Hello Defiers! Hope everyone’s having a great weekend.

Summing last week up: I got started in my DeFi passive investment experiment, where I’m putting an equal amount of money in 10 DeFi projects, plus Maker’s DSR as a benchmark. MakerDAO raised its Dai Savings Rate 2 ppts to 6 percent. Aave launched on mainnet with features including uncollateralized flash loans. A project called Zero Collateral also made progress with unsecured borrowing. DeFiZap introduced a new one-click strategy to its collection. And more!

Friday

DeFi10 Part 1: Lessons in Building a DeFi Portfolio

I’m putting an equal amount of money into 10 different decentralized finance protocols, plus a benchmark, enabling passive income and tracking their performance throughout the year. Check out the post to see the the final list of projects I’m trying out, the insights I got after my first batch of five investments, and the PDF going through all the steps involved in each investment.

Thursday

Dives

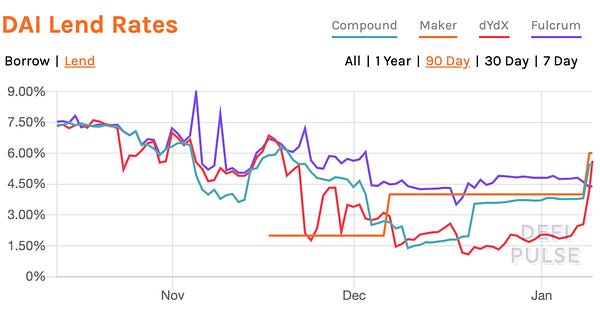

Earn 3x the Interest on a Dollar-Pegged Asset With DeFi: MakerDAO’s MKR holders voted to raise the Dai Savings Rate by two percentage points to 6 percent, meaning you can now earn 3 times the interest on Dai than what traditional banking apps offer for USD deposits.

Aave Launch Raises the DeFi Bar in a Flash: Aave is an open source, non-custodial lending platform that launched on mainnet with a series of groundbreaking innovations for decentralized finance, including uncollateralized flash loans and fixed-rate, short-term loans.

Bytes

Wednesday

Dives

Don’t Look at MakerDAO for Signs of Next Rally: It might seem safe to assume ether locked in MakerDAO could be a reliable way to predict when the next ether pump will come, but it’s actually the other way around.

DeFi Darling Synthetix is Hitting a Snag: Large holders are taking the opportunity to cash out on an enormous rally, amid a bullish crypto market.

Green Shoots in Zero Collateral Loans: Zero Collateral Protocol is an undercollateralized lending market, currently on Ethereum’s Ropsten testnet. The amount of total interest paid from that loan will be discounted from the collateral needed on the next loan, until eventually, collateral needed will drop to zero.

Bytes

A Beginner’s Guide to Decentralized Finance (DeFi): Coinbase

Credible Neutrality As A Guiding Principle: Vitalik Buterin for Nakamoto

Monday

Dives

DeFiZap Takes Financial Engineering to Another Level: DeFiZap’s latest one-click strategy is the Leveraged Liquidity Pool (LLP) Zap, which lets traders earn fees from liquidity pools, while keeping full ETH exposure.

Sums

People Are Increasingly Streaming Their Salaries: The latest to use Sablier, a DeFi protocol which lets users withdraw their salary by the time worked without having to wait to the end of the month, is Pascal Tallarida of Jarvis exchange.

Tweets are Now Being Traded on Uniswap: Ameen Soleimani of SpankChain and MolochDAO tokenized 100 RTs and added 5 to a Uniswap pool under the token name PEW. In this hypercapitalism experiment, Ameen is basically selling retweets.

Bytes

💜Community Love💜

Thanking all the amazing defiers for the support and love this week (and always)!

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.

Click here to pay with DAI.There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the author: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.

LOVE this newsletter!!! Really interesting, well written and fun to read :) TKS