DeFiZap Takes Financial Engineering to Another Level

The system can potentially increase profits, but there's no free lunch.

Hello Defiers and happy new year! May this new decade be truly roaring for all of you. Here’s what’s going on in decentralized finance,

New DeFiZap combines liquidity pool fees and long ETH exposure

More people are streaming their salaries with Sablier

Re-Tweets are trading on Uniswap

Have Your Cake and Eat it Too With New DeFiZap

One of the most interesting projects to close out the year in decentralized finance was DeFiZap, which combines different protocols under one platform, reducing the number of steps and applications users need to visit so that they’re just a couple of clicks away from executing complex financial strategies. It epitomizes the money legos concept; DeFi’s extreme composability.

The latest of such strategies is the Leveraged Liquidity Pool (LLP) Zap, which lets traders have their cake and eat it too. What do I mean?

💡First, a reminder that Uniswap is a decentralized exchange, which enables the automated swapping of tokens by holding pools of liquidity of those tokens in smart contracts. These pools are supplied by market makers in exchange for fees paid by traders. Note that it’s pretty remarkable that, thanks to DeFi, anyone with an ETH address and some tokens can be a market maker, compared with huge capital requirements on traditional exchanges, for example $100,000 in the case of NYSE.

For some liquidity providers who are long ETH, one problem of this set up was having to give up some of their ether to match their contribution to a pool with the corresponding pair. For example, if you wanted to provide to an ETH/DAI pool, you’d have to give up 50 percent of your ETH to provide the equivalent amount in DAI. That meant losing out on a percentage of the upside if ETH gained in USD terms.

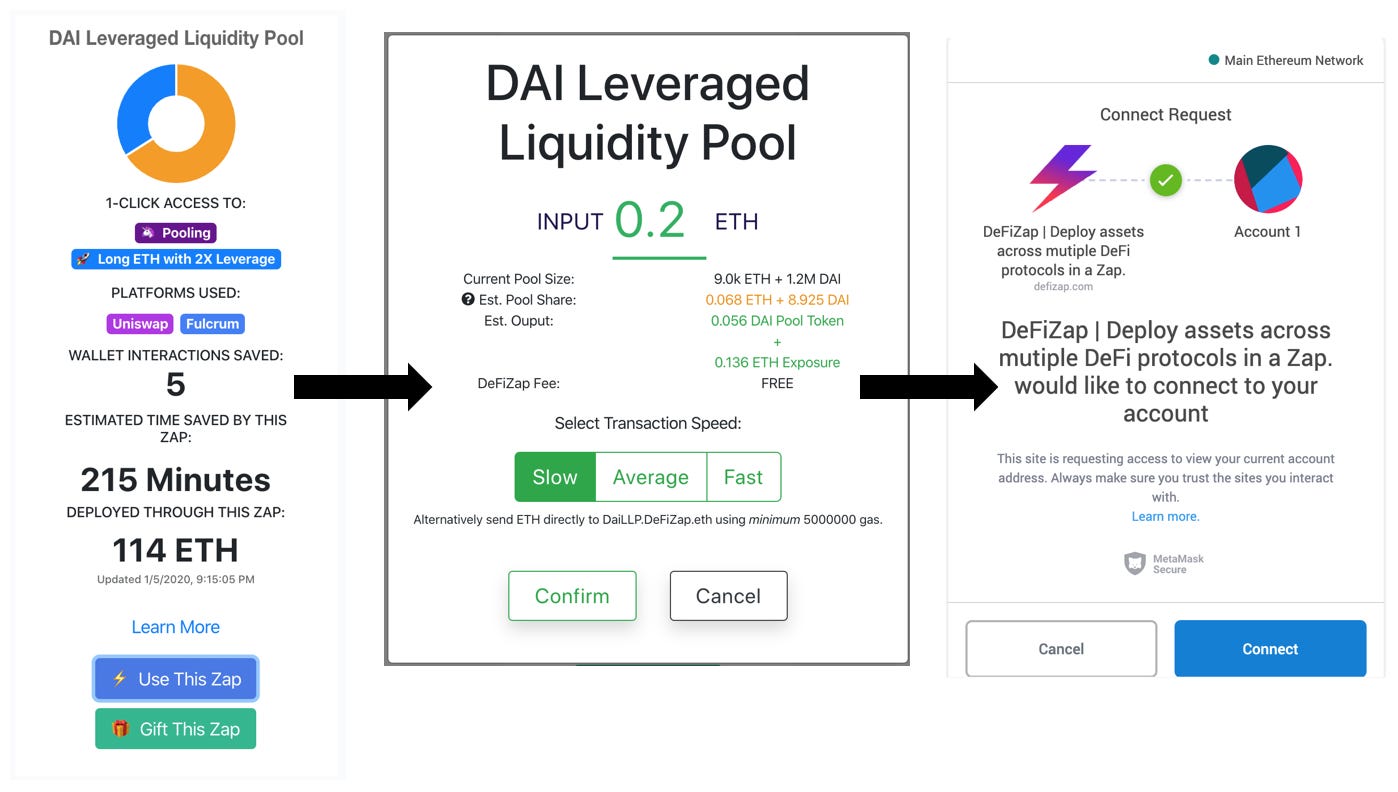

Enters DeFiZap, which creates a system that automatically enters a 2x leveraged long position on ether via the Fulcrum platform, so that the trader providing liquidity to the ETH/DAI pool doesn’t loose any of their ETH/USD exposure, while still earning fees from the Uniswap liquidity pool.

Image source: DeFiZap

The system is using both Uniswap and Fulcrum, and according to DeFiZap is saving each user five wallet interactions. 114 ETH have been deployed to this Zap since its launch on Jan. 4.

Zaps are impressive, but they’re also risky. Decentralized finance already involves a high level of risk, as you’re dealing with mostly untested platforms and technologies. Zaps, because of their very nature, layer risk on top of risk — you’re now taking on the potential failures of all the platforms involved. And the “one-tap” nature of the system, while convenient, may also dissuade users from researching the the pros and cons involved in each specific project they’re using.

In the case of Leveraged Liquidity Pool Zap, it may be easy to overlook —even if it’s right there in the name— that you’re actually making a leveraged trade. That means traders get twice the upside if ETH goes up, but they’ll get liquidated, meaning their position will be wiped out, if the price goes down.

With ether at ~$130, liquidation price would be around $70. The current interest rate on the margin trade on Fulcrum is ~6.4 percent, which means the Zap makes sense if the price of ETH plus the liquidity pool fees exceed 6.4 percent, according to a DeFiZap blog post.

I tested this out and this is what it looks like:

The whole operation; taking my ETH, making the leveraged trade on Fulcrum, putting the rest on the Uniswap liquidity pool, took about three minutes and cost $0.72 in gas fees. Again, impressive. But maybe it wouldn’t hurt to have some warnings and disclaimers along the way.

People Are Increasingly Streaming Their Salaries

The latest to use Sablier, a DeFi protocol which lets users withdraw their salary by the time worked without having to wait to the end of the month, is Pascal Tallarida of Jarvis exchange. He went all in on DeFi last year (I chronicled his dive into the space here), and is deepening his experiment, (and I covered Sablier in this post).

Tweets are Now Being Traded on Uniswap

Ameen Soleimani of SpankChain and MolochDAO tokenized 100 RTs and added 5 to a Uniswap pool under the token name PEW. Only 100 will ever exist. “20 have been rewarded to @pet3rpan_ for underwriting my ITO (Initial Tweet Offering),” Ameen said. In this hypercapitalism experiment, Ameen is basically selling retweets. He’s willing to RT almost any content as long as it doesn’t violate Twitter’s terms of service or puts his account at risk.

The Most Interesting Developments of 2019 Belong to Ethereum: Gavin Andresen

Gavin Andresen, the leading maintainer of the Bitcoin software, claims that over the past two years, the most interesting developments in the cryptocurrency ecosystem have been carried out on the Ethereum blockchain.

‘DeFi’ Movement Promises High Interest But High Risk

The FT’s high level take on DeFi: DeFi start-ups are trying to build an interlocking financial system denominated in cryptocurrencies, offering a wide array of lending and derivatives products available globally, peer-to-peer and without any middlemen.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.

Click here to pay with DAI.There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the author: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.