DeFi10 Part 1: Lessons in Building a DeFi Portfolio

It was crazy fast and easy, but still for insiders.

Hello Defiers and happy Friday! As some of you know, I’m embarking on a DeFi experiment :) I’m putting an equal amount of money into 10 different decentralized finance protocols and tracking their performance throughout the year. I have the final list of projects I’m trying out, and the insights I got after my first batch of investments. (thanks to your feedback on Twitter! @camirusso).

But before I dig in, I have an update to tell you about. I’m changing up the publishing format for The Defiant to increase the value to paid (and free) subscribers. In short: Paid subscribers will get additional, exclusive content.

Update to publishing schedule:

Paid subscribers will receive two or three News Briefings -with the latest developments, curated and explained- and a weekly recap with link to content. Subscribers also get full access to one weekly exclusive interview and early access to op-eds. Membership also includes access to The Defiant’s archive and the subscriber-only Telegram group chat (coming this month).

Free sign ups will receive only a subset of the News Briefings, i.e. Paid subscribers will always get an extra, exclusive issue each week. Free signups have partial/delayed access to interviews & op-eds, archive and recaps. This is a significant upgrade vs. today as fewer articles will have blurred out sections. For all the details, check out my About Page.

Now, let me tell you about my DeFi10!

Crazy Cheap, Super Fast —But Still For Insiders

Here’s what it’s like to become an armchair investor. Except with programmable money.

The rules of the game are:

I’m putting in 100 Dai into 10 different decentralized finance platforms, plus DSR as a benchmark (so roughly $1,100), to generate passive income

It has to be an open finance platform. In this case, this will mean: Non-custodial (I have full control of my funds), open source code, and anyone can have access (light to no KYC)

If there’s a number of options within a platform to choose from, I’ll go with either the most popular, or the one with the highest estimated returns

The project can’t require any additional action from me after making the initial investment, so things like putting up collateral or taking on margin trades, are off

I can’t move the money until Dec. 31, unless the platform is being upgraded and funds are going into a same type of contract

In the case of a black swan event where funds go to zero or the project shuts down, that’s a loss to the portfolio and I can’t reinvest those funds

My goals are to document: The experience of using DeFi platforms, the experience of tracking my investments’ performance, the risk incurred and how it was disclosed, investments’ volatility, and returns. At the end of the year I’ll rank the projects I used based on these factors, and see how DeFi returns compare with traditional finance benchmarks such as the S&P 500.

I asked Crypto Twitter Monday its opinion on which investments I should do. Here’s a link so you can take a look at the great answers:

Finally, I have the full list: Here’s my DeFi10 fund!

MakerDAO’s DSR (fund benchmark)

Fulcrum’s iToken

Aave’s aToken

Uniswap pool via DeFiZap

Staked’s Robo Advisor for Yield

TokenSets’ ETH 20DMA Crossover Set

Synthetix’s SNX staking

PoolTogether pool

Melon Network fund

Chai’s wrapped DSR

Compound’s cDai

*UPDATED to add Compound’s cDai. I hadn’t done so because Ive been using it for months and wanted to try out different interest bearing tokens. Still, it’s responsible for a large part of the interest earned in DeFi, so it deserves to be on the list.*

My reasoning behind choosing these investments was: I wanted to have a diversity in the type projects to get a taste of the different tools DeFi offers right now. So I tried to include different interest-bearing tokens, automatically rebalancing investment tools, and innovative interfaces.

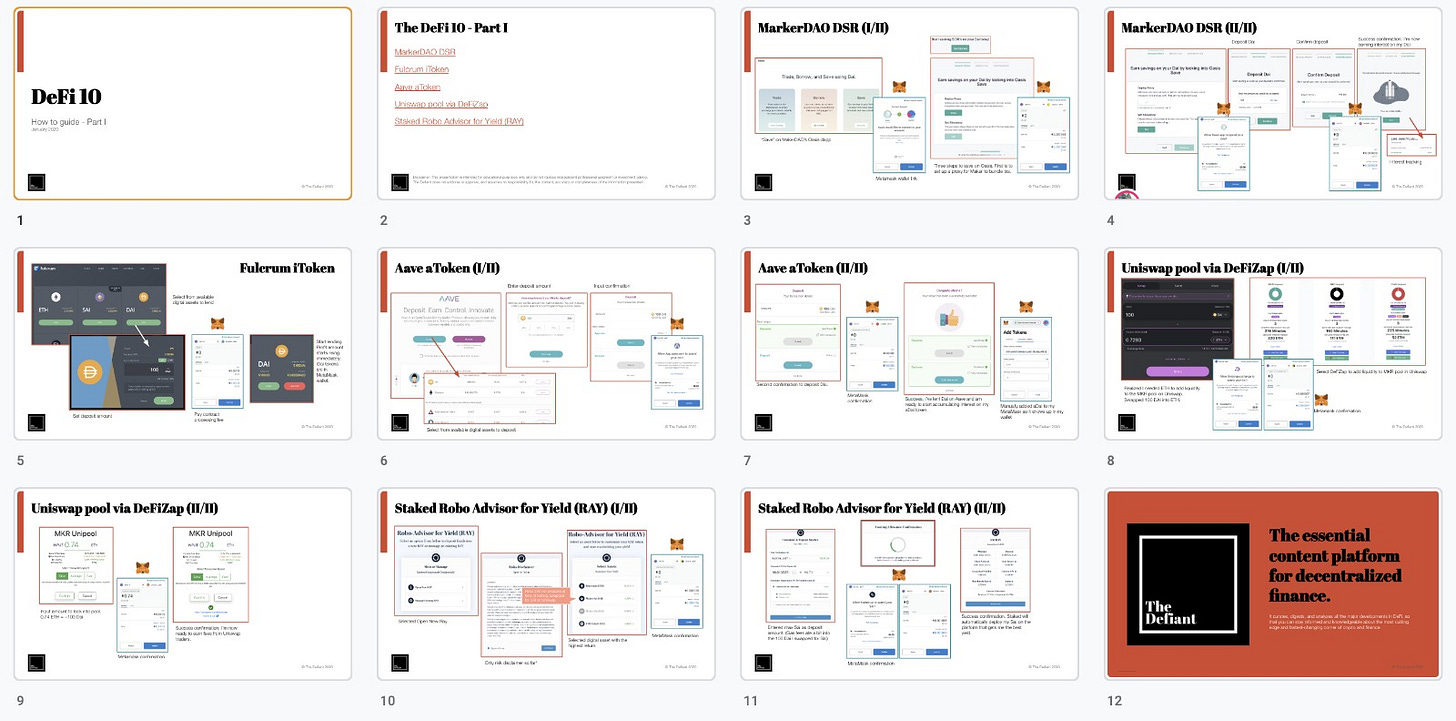

Yesterday, I went through the first five investments in one go. First, I’ll give you my five main takeaways, after which there’s a link to a PDF where I have screen grabs for every step of the process with my comments, in a How to guide of sorts.

1. The Process Was Crazy Fast, Cheap and Easy

From the moment when I moved 1,000 Dai, and a couple of bucks of ETH, to a MetaMask account I’m using just for this, to the very last transaction, it took me one hour and 15 minutes (this includes stopping to order food and answer a short phone call in between investments). That’s about 15 minutes per dapp, with about three to four steps involved in each one.

Think about this: I’m talking about using five different investment platforms. And not just creating an account with each of them, but locking up money and having it be put to work right away. This all took me about the same time it takes to stream an episode of The Crown on Netflix.

I also loved not giving up my personal info. Nobody asked for my name, credit card card number, address or phone number. I never had to upload a picture of my ID. Only one of the five platforms asked for my email. It was all done through the automatic connection to my MetaMask account (which is also created without giving up any personal info).

Remarkably for the speed, the 16 transactions in the whole process cost me a grand total of $1.4 in gas fees — that’s the fees I had to pay the Ethereum network to process computation required for each transaction, and they’re priced and paid in ETH. Each transaction cost a couple of cents.

This is unthinkable in traditional finance.

Caveat 1: I didn’t have to stop and read much documentation about what each platform does, because I already knew at least the basics about them, what they do and how they work. I just went and executed the transactions. That would not necessarily be the case with an average user. To be safe, we can double the time it would take for someone without much DeFi knowledge, some crypto experience. and two hours would still be amazing.

Caveat 2: Fees per transactions aren’t higher in part because platforms themselves aren’t taking a margin at this point. I imagine this may change for some of them when their goals change from gaining traction and volume, to becoming profitable

2. Biggest Pain Was Confirming Txs and Paying Gas Fees

While the process was fast and cheap, it was annoying to have the MetaMask dialogue to confirm transactions come up at every single step, taking me from the dapp website to a blank page with the pop up. It would be great if this could be somehow abstracted away, or if at least the pop up would let you stay on the same page. I’d imagine being taken out of a website, with everything suddenly turning white, while you’re doing stuff with your money, will be scary for anyone not used to Ethereum.

Needing ETH to pay for transactions is another pain. Not everyone will always have ETH, and if they do, maybe they won’t have enough. This happened to me. I was told I didn’t have enough funds, which was odd because, like I said, Txs only cost me $1.4 and I had already deposited just under $3 at the start of the process to prevent this —I still don’t know why I was told I didn’t have enough funds. The solution for this is already here with Meta Transactions, and I know projects like Argent have enabled payment of fees using Dai. This should be so much more widespread.

3. Can You Not Ask Me to Buy a Different Token?

At the risk of sounding like a spoiled brat, I would love it if I could just come up to any DeFi app, feed it any token, and have it automatically convert it to the actual token I need for whatever action I’m doing. Taking the example to traditional finance, it would be as if a Chilean only needed Chilean pesos to buy Apple stock in the U.S. and trade oil futures in the London market, and she could do it all from the same account. This is impossible to do in traditional finance — but it can be done in DeFi.

One of the investments I wanted to make was to add liquidity into a Uniswap pool. I went to pools.fyi to choose the pool with the highest return and decided on the MKR pool. I thought, this is a great opportunity to try DeFiZap, which bundles up many different steps into one click. So I went to the Zap designed to add liquidity to the MKR pool, and saw that while DeFiZap would buy MKR for me, I still needed ETH. I went back to Uniswap to swap 100 Dai for ETH, and then back to DeFiZap. The actual process of doing the Zap was easy, but it took longer because I had to buy more ETH.

Same thing with RAY. I wanted to try Staked’s robo-advisor, which chooses the platform that gets you the highest yield for an asset. I wanted to have a Ray for Dai, but that will be implemented next week, so had to do one for Sai (will upgrade to Dai next week). That meant I had to go and buy Sai.

4. Would Love to See All My Investments in One Place

Part of the factors I want to measure is to experience how hard or easy it is to track DeFi investments. Right now, there are many different platforms to earn money, but not many interfaces to see them all in one clean and neat place. MetaMask stores my tokens, but doesn’t offer a good way to see their performance over time, and doesn’t document other types of investments, for example, my deposit in DSR, my ETH/MKR position in the Uniswap pool, and my Sai RAY, don’t show up.

Zerion does a relatively good job at solving this, but still, RAY and DSR don’t show up either. As of today, I’m still not sure how I’m going to easily track all of this.

Another point on this, it would be great if all tokens automatically came up in MetaMask. When I deposited Dai in Fulcrum, I was fairly certain I would get iDai in return, but when I went to MetaMask, it wasn’t there. I thought maybe I had gone through the wrong process and hadn’t actually bought iDai, but after reading up on some of Fulcrum’s FAQs, realized I must have the tokens and they’re not showing up on MetaMask. So went to Etherscan, looked at the contract address, and manually added them to MetaMask. Had to do the same thing for Aave’s aTokens.

5. DeFi Needs Better Disclosures

This is risky business people! And it doesn’t say so anywhere. There were no warnings along the way, except for one screen from Staked. It should be easy for anyone to understand exactly what they’re getting into. Has the platform been audited? If so, what were the main vulnerabilities found? Are oracles centralized? Can management unilaterally take control of smart contracts? Are funds insured in any way? Has the platform ever been hacked? Etc. If there were half as many risk disclosure pop ups as MetaMask pop ups, maybe we’d be on track :)

Stay tuned for the next five. Will make the investments in the next couple of days and plan to share the process and insights here, likely next Friday. I’ll continue tracking the portfolio’s performance on a weekly or semi-weekly basis on The Defiant.

🛠How to Guide🛠

Click here for a 10-page PDF HOW TO on each of the five platforms. This will give you a one-glance look at each of these Dapps’ UX/UI. Here’s a peak:

Happy to hear your feedback; so excited for this experiment! Stay tuned for Part II!

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.

Click here to pay with DAI.There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the author: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.

looking forward to the summary of 1Y results in a few weeks Cami :)

‘Part of the factors I want to measure is to experience how hard or easy it is to track DeFi investments. Right now, there are many different platforms to earn money, but not many interfaces to see them all in one clean and neat place.‘

I use an iOS app MyDefi, thats tracks a lot of DeFi products, but not all.