Don’t Look at MakerDAO for Signs of Next Ether Rally

Also, SNX whales pushing dump, and green shoots in unsecured DeFi lending.

Hello defiers! Here’s what’s going on in decentralized finance,

ETH in MakerDAO jumps amid rally, but it’s a lagging indicator

Whales trigger SNX plunge

Developers give undercollateralized DeFi loans a shot

Don’t Look at MakerDAO for Signs of Next Rally

It might seem safe to assume ether locked in MakerDAO could be a reliable way to predict when the next ether pump will come, but it’s actually the other way around. ETH locked in MakerDAO increases faster after* an ether rally.

Ether is up 13 percent in the past three days to $144, the highest in about three weeks, amid a broader cryptocurrency rally. In that time, ether locked in MakerDAO, rose by more than 24k to a record 2.4 million. Previous ether rallies have also been followed by a faster increase in ETH locked in Maker.

It makes sense that both metrics would be somewhat related as traders lock in ETH in MakerDAO to take out loans in the DAI stablecoin, which they use to buy more ETH. Putting up ETH as collateral also indicated some confidence that it won’t quickly lose value and force the borrower to put up more ETH to maintain the mandated collateral ratio or get liquidated.

But it’s interesting that DeFi traders are locking up ETH after the market already rallied, meaning, the Maker charts won’t be a great indicator to predict the next increase in ETH price.

DeFi Darling Synthetix is Hitting a Snag

Synthetix had a spectacular 2019, overtaking Compound as the decentralized finance platform with the most assets locked after MakerDAO, while its token SNX soared by many times over. But for some traders, the time has come to cash out.

SNX is down more than 40 percent since Nov. 28 and more than 20 percent just today to $0.88, the lowest since Nov. 16.

There was no fundamental change in the project to trigger such a sell off. More likely, traders are taking the opportunity to cash out on an enormous rally, amid a bullish crypto market.

Specifically, it seems that a big sellers triggered a cascade of profit taking. Independent SNX investor who goes by the name @DegenSpartan on Twitter told me,

1 big guy wanted to quickly exit through Uniswap, and the short-term traders that have been riding the price up also decided to exit, and since they can see his large size moving on chain and his choice route of exiting was Uniswap which is also all on-chain, so it seemed to me like people were trying to front run his exit.

The “big guy” mentioned can be found in this Ethereum address, who together with a second big seller, has helped sell about 250,000 SNX in less than one day.

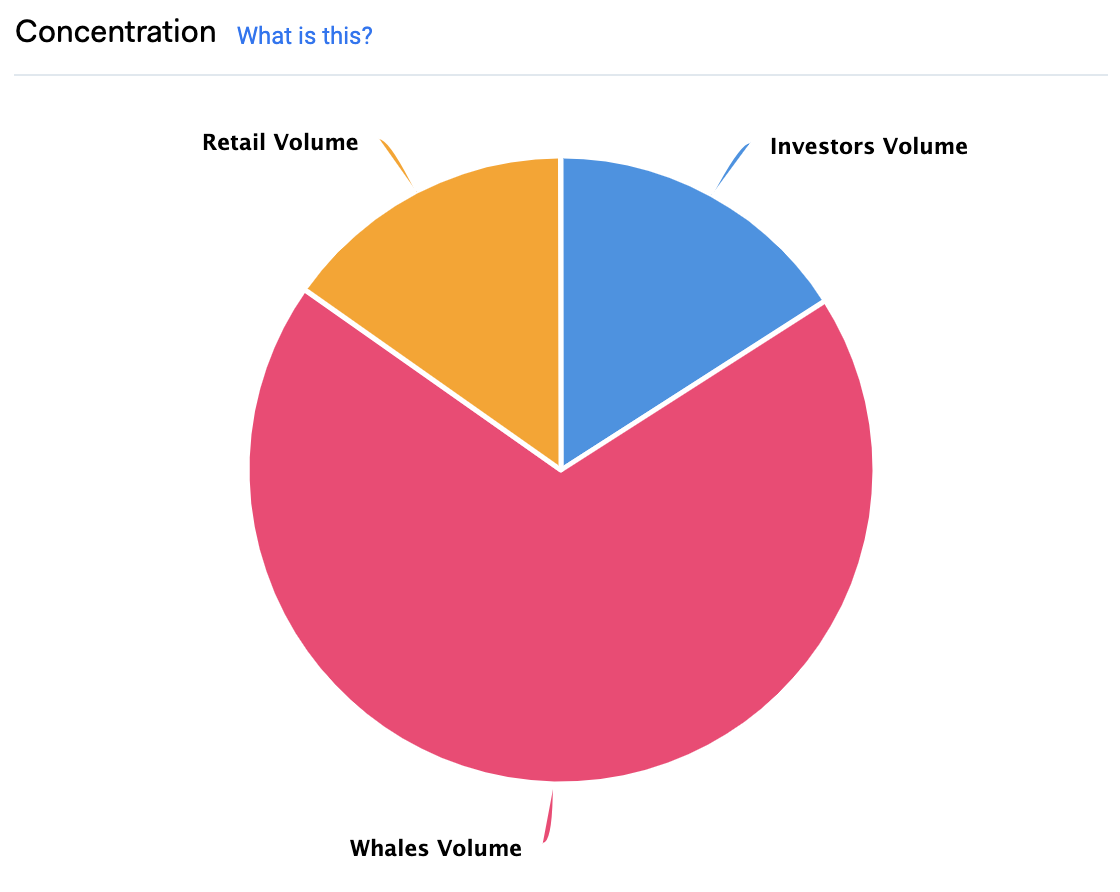

It shows the risk of owning a token that’s still concentrated in the hands of a few whales. More than half of SNX tokens are concentrated in just 12 holders of more than 1 percent of the total supply, according to IntoTheBlock. Sometimes they’ll push prices up, but eventually they’ll want to profit.

Image source: IntoTheBlock

Green Shoots in Zero Collateral Loans

We’ll finally see under-collateralized lending in decentralized finance — that was my prediction for DeFi this year on Nathaniel Whittemore’s The Breakdown podcast. We’re barely one week into the year and there’s already encouraging progress on that front.

Global debt is at $215 trillion and 80 percent of that is unsecured, says the Zero Collateral team, concluding that for DeFi to really grow, it will have to find a way to offer loans without requiring borrowers to put up more capital upfront than what they’re borrowing. The question is, how to do this without trusting a centralized third party to provide information about the borrowers’ credit-worthiness.

Zero Collateral Protocol is an undercollateralized lending market, currently on Ethereum’s Ropsten testnet. The first time a borrowers uses the platform, they’ll have to back their loan with the same amount in collateral (compared with 130 percent in the case of MakerDAO). The amount of total interest paid from that loan will be discounted from the collateral needed on the next loan, until eventually, collateral needed will drop to zero.

Image source: Zero Collateral

In its first version, the protocol is offering 30-day Dai loans at 20 percent interest rate. Each wallet can open one loan at a time, and the maximum amount it can borrow increases with every repaid loan, so borrowers with no track record, won’t be able to take out large loans. If the borrower runs off with the money, the collateral added and interest on previous loans (if any) is distributed to lenders.

It’s far from perfect, as 20 percent monthly rate by far exceeds current rates on DeFi which are under 10 percent. The 100 percent initial collateral, while lower than other DeFi platforms, probably isn’t low enough to compensate for the high interest rate. Usually, only those really strapped for cash would pay such high rates, but those users probably won’t have enough money to put up as collateral.

Still, it’s a start and the fact that it’s a permissionless system , which doesn’t require giving up personal information, may compensate the drawbacks. It will be interesting to see what kind of demand it gets.

The next step, Zero Collateral says, will be to integrate with identity and risk management credit platforms, like Credit Karma and Experian, via Stratosphere, a distributed network of cloud nodes which enables DeFi protocols to interoperate with the centralized finance ecosystem.

It’s too early to say I told you so on my 2020 DeFi prediction, but we’re getting closer.

A Beginner’s Guide to Decentralized Finance (DeFi): Coinbase

Cryptocurrency’s promise is to make money and payments universally accessible– to anyone, no matter where they are in the world. The Decentralized Finance (DeFi) or Open Finance movement takes that promise a step further.

Credible Neutrality As A Guiding Principle: Vitalik Buterin for Nakamoto

There is a very important principle that is at play, and one that is likely to become key to the discourse of how to build efficient, pro-freedom, fair and inclusive institutions that influence and govern different spheres of our lives. And that principle is this: when building mechanisms that decide high-stakes outcomes, it’s very important for those mechanisms to be credibly neutral.

Ernst & Young Doubles Down On Its Bet With Ethereum: Forbes

On December 19th 2019, the audit and consulting giant Ernst & Young announced the release of their “third-generation zero-knowledge proof blockchain technology” to the public domain as part of the firm’s effort to make public networks ready for enterprise adoption.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.

Click here to pay with DAI.There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the author: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.