Recap: DeFi Week of March 30 🦄

Hello Defiers, hope you’re having a great weekend!

Summing last week up: MakerDAO survived its biggest test yet and has raised enough funds in its MKR auctions to cover underwater loans and has laid out plans to reach fully decentralized governance. Assets locked in DeFi protocols are rebounding and DeFi activity is up more than 3x in February versus a year ago. Tron launched a MakerDAO copycat and EOS block producer partnered with Bancor to launch a platform to boost its DeFi ecosystem. Open source is helping increase supply of urgently needed medical equipment to fight COVID-19. Keep Project raises $7.7m to build tBTC and Coinbase invested $1.1m in Uniswap and PoolTogether. In the third installment of The Flippening That Matters, Ganesh Swami of Covalent compares monthly transfer volumes of fiat-backed and trustless stablecoins. And there’s more!

That was just one week. Subscribe to get the latest DeFi news and analysis straight to your inbox and you don’t miss a thing. Free-signups get partial content, paid subscribers (only $10/month, $100/year) get everything. Click here to pay with DAI ($70/year).

📢 Two Days Left to Contribute to The Defiant Gitcoin Grant!

Help me scale up The Defiant team by donating to my Gitcoin Grant or recommending that friends do! This funding round ends Tuesday so now is your chance. 1 Dai is currently being matched by 70 Dai, so it doesn’t take much to make a big contribution :)

If you’re a free subscriber and enjoy the content, this is a great way to help The Defiant grow.

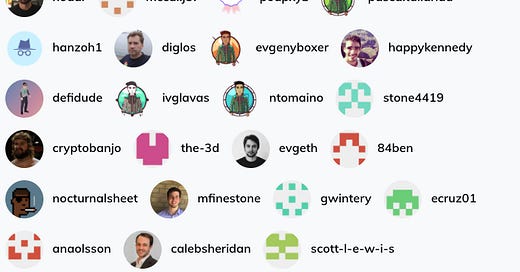

Incredibly grateful to my +60 contributors so far! <3

Tuesday

Dives

Trust in a Trustless Financial System is Returning: Assets held in decentralized finance are ticking up for the first time since the market meltdown two weeks ago with ETH locked in DeFi gaining 18% in the past seven days. The biggest contributor to the increase in value locked is MakerDAO, followed by Aave and Uniswap.

Sums

Celsius to Use Chainlink Oracles in Decentralization Push: Lending platform Celsius Network plans to use blockchain data company Chainlink’s price feeds to calculate interest payment amounts, according to an emailed press release.

MakerDAO Likely to Shut Down Sai Next Month: The MakerDAO community is participating in a poll on whether to shutdown the Single Collateral Dai system through an executive vote on April 24. So far, 95% of participants have voted to shutdown SCD, with 2% of MKR holders voting.

Money Printer Meme Spurs Deep Fake Video of Vitalik: The latest installment of Money Printer Go Brrr is a deep fake video of Vitalik Buterin singing Money by Pink Floyd. It was created by a project called MemePool, which allows users to stake Dai into a smart contract so that the interest generated goes to support content creators.

Bytes

CoinGecko Launches ‘Earn’ Section, Releases ‘How to DeFi’ Book: The Daily Hodl

DeFi Activity Up 294% as Ethereum Dominance Grows: DappRadar

Tron Launches Dai Copycat

Wednesday

Dives

Open Source Saving Lives in COVID-19 Pandemic: While the COVID-19 pandemic highlights the faults of centralized institutions, the tech industry is stepping up, warning about the gravity of the situation early on and working to increase supply of urgently needed medical equipment. Open source has been key in this effort.

Thursday

Dives

Do Pure, Trustless Stablecoins Stand a Chance?: In the third installment of The Flippening That Matters, Ganesh Swami of Covalent compares monthly transfer volumes of fiat-backed stablecoins like Tether, USDC, TrueUSD, Paxos with trustless stablecoin DAI/SAI. In a stable market like 2019, trustless crypto-backed stablecoins see adoption. When markets go haywire, users retreat to more centralized alternatives.

Sums

MakerDAO Lays Out Roadmap for a Self-Governed System: MakerDAO co-founder Rune Christensen laid out plans for the decentralized lender to become increasingly governed by its community, until the point where the Foundation will be completely redundant and able to dissolve itself.

Keep Raises $7.7 Million to Build Bitcoin/Ethereum Bridge: Keep Project raised $7.7 million to build Bitcoin/Ethereum bridge tBTC. Paradigm Capital led the round, while Fenbushi Capital, Collaborative Fund and others also participated, by buying the Keep token. Read overview of major ETH/BTC bridges.

Coinbase Invests $1.1 Million in Uniswap and PoolTogether: Coinbase, through its USDC Bootstrap Fund, provided $1 million of liquidity to Uniswap’s USDC/ETH pool, and $100K USDC as a pool sponsor on PoolTogether, to increase rewards for lottery players who deposit USDC.

Friday

Dives

MKR Whale Emerging from Auction Adds Urgency to Delegated Voting: The issuer of Dai and biggest lender in DeFi, this week raised about $5.3 million in Dai in its MKR auction, enough money to cover underwater loans. With venture fund Paradigm buying 68% of MKR at the auction, while the Maker Foundation and other venture funds also hold large stakes, there’s increased urgency to implement delegated voting, which would empower smaller token holders.

Sums

DeFi10 Fund Recovering from March Bloodbath: With the March 12 crash, the DeFi portfolio went from being up 4.5% since Jan.9, to slumping 3.9%. It has been gradually recovering and is down 1.1%, compared with the S&P 500’s 23% plunge year-to-date.

EOS Launches Platform to Boost its DeFi Ecosystem: EOS block producer EOS Nation, has partnered with automated liquidity provider Bancor to launch a platform to boost the network’s DeFi ecosystem.

Bytes

💜Community Love💜

Thanking all the amazing Defiers for the support and love this week (and always)!

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

Click here to pay with DAI.There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the author: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.