No, DeFi is Not Dead

A video retrospective on the year so far; greatest hits and lessons learned.

Hello, Defiers! So much has happened in DeFi these past few months, that it’s time for a 2020 retrospective, even if the year isn’t over yet.

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI.

🎙Listen to this week’s podcast episode w/ Gavin McDermott of IDEO:

🙌 Together with Zerion, a simple interface to access and use decentralized finance, Perpetual Protocol, which provides decentralized perpetual contracts for any asset, and HackAtom V, a two-week virtual hackathon organized by Cosmos.

DeFi Token Crash Doesn’t Show the Full Picture

The DeFi bubble might have popped but DeFi itself is stronger than ever.

After an absolute DeFi explosion this (northern hemisphere) summer, with food-themed coins popping up everywhere, hundreds of millions in digital assets flowing into untested and unaudited protocols, anonymous founders based off cartoon characters hailed as heroes, and “million-percent yields” flashed across colorful UIs, it was inevitable that the froth would start to subside.

Hottest tokens crash

And sure enough, then came the code bugs, hacker attacks, scams and rug pulls. Outside of crypto Donald Trump got Coronavirus and approval of a US stimulus package was questioned. Soon those impossible yields were nowhere to be found, and tokens which only seemed capable of going up started crashing.

The DeFi hype is subsiding. Just this past week alone, the hottest tokens of the summer, SUSHI, SWRV, CRV, YFI and UNI are down by more than 20%. In the past month, the DeFi market lost 15% in total market cap, according to Santiment.

Hindsight is 2020

As builders and investors pick up the pieces, it’s a good time to reflect on the major developments so far this year, and on the lessons we can learn from them.

For that, take a look at the video produced by Robin Schmidt and Alp Gasimov of Harmony Protocol, and relive the greatest hits showcased on The Defiant channel.

Bullish Metrics

Still, while the DeFi hype is deflating, decentralized finance is stronger than ever. It’s through these boom and bust cycles that protocols can learn to build better and safer products. As token prices slump, DeFi keeps rising by other metrics:

1. Total value locked in DeFi is up 15% in the past 30 days to $10.5B, according to DeFi Pulse.

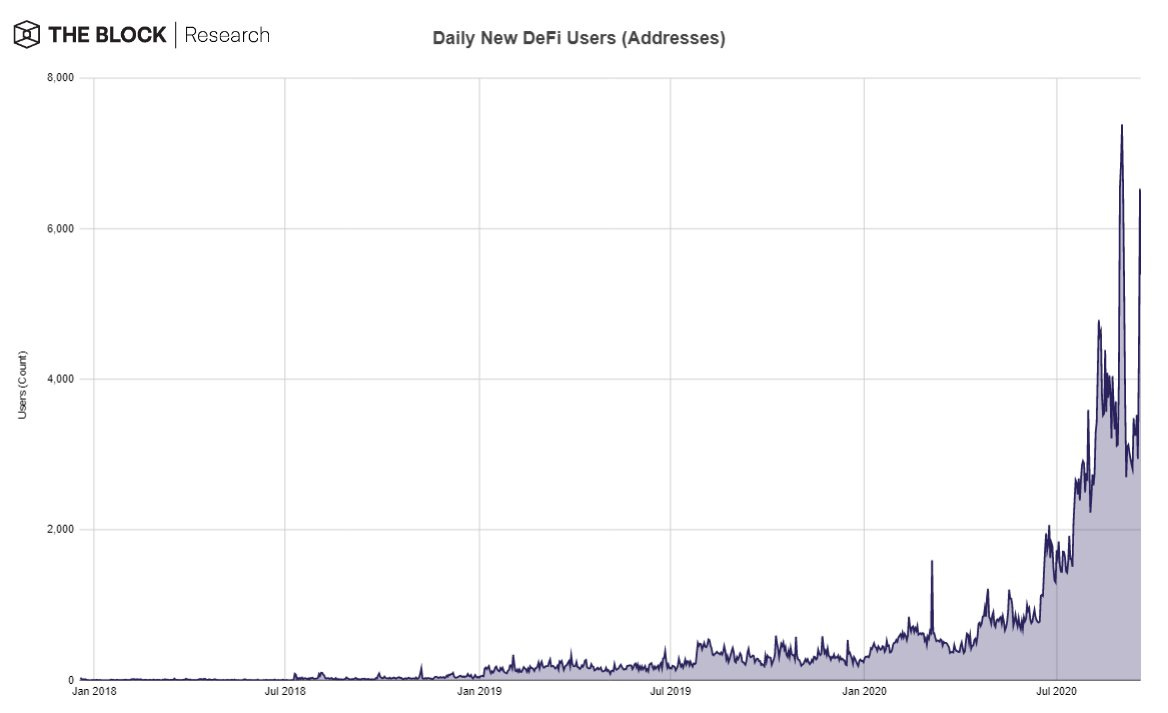

2. Daily new DeFi addresses continue to climb, spiking past 6k for the first time ever, according to Dune Analytics data compiled by Richard Chen of 1confirmation and Mika Honkasalo of The Block.

3. Outstanding loans issued by DeFi protocols soared by over 40% to $2.3B over the past 30 days, according to DeFi Pulse.

While many only heard of DeFi amid the yield farming craze, this cypherpunk financial system has been around since at least 2017 with MakerDAO. The ecosystem we see today was built in a bear market.

The recent slump isn’t a sign of the death of DeFi. If anything, it will prompt developers and teams to put their focus back into building a more open, accessible transparent, and fun financial system.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

About the founder: Camila Russo is the author of The Infinite Machine, the first book on the history of Ethereum, and was previously a Bloomberg News markets reporter based in New York, Madrid and Buenos Aires. She has extensively covered crypto and finance, and now is diving into DeFi, the intersection of the two.