DeFi Traders Pour +$400M Into a 1-Day-Old Project Just to Get YAM Meme Coins

Also, a dive into YFI & BAL holders

Hello Defiers! Another crazy day in decentralized finance,

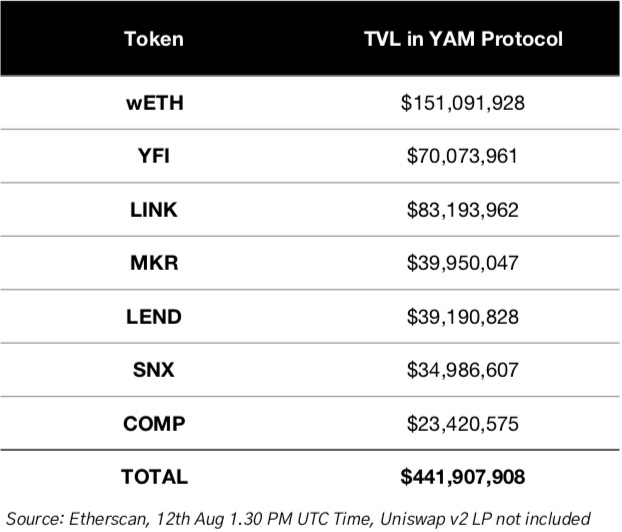

Yam Finance, the unaudited DeFi platform which didn’t exist before yesterday, is now holding over $400M in its smart contracts

YFI & BAL tokens’ holders and whales surged after Binance listing

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for 70 Dai/yr vs $100/yr).

🎙Listen to this week’s podcast episode with Andre Cronje here:

📺 Also, The Defiant’s YouTube Channel Launched! Subscribe!

🙌 Together with DeversiFi, a professional-grade, self-custodial exchange.

🍠YAM: The Emoji That Drew $400M in Less Than a Day

No one knew Yam Finance before yesterday at 5pm UTC when the team tweeted their first and only Medium article explaining the “project” they launched two hours later.

The token was born with “zero value” and without an audit, as the Medium post specified. Still, yield farmers couldn’t get enough YAMs and according to Etherscan $90M USD was deposited in the protocol within the first 90 mins, while YAM price jumped to ~50 DAI –– which sounds a lot more impressive when you take into account it was supposed to be pegged to $1.

Less than 24hrs later, more than $400M has been deposited in Yam’s smart contracts, and YAM has climbed to ~$95. The only purpose of these pools of tokens is to get YAM rewards, which are producing double-digit weekly returns.

What’s more, part of these tokens have been borrowed, which means that if the price goes the wrong way and/or there’s smart contract failure, some of these traders would be on the line to lose their collateral.

According to Aave founder Stani Kulechov, $22M worth of LINK, $2.9M of MKR, and $4.2 MM of SNX were borrowed on Aave to farm YAM.

Farmers Cycling Crypto

As hundreds of millions of dollars in crypto flooded into Yam Finance overnight, total value locked from recent yield-farming darlings slumped. Assets in Balancer, Curve and Yearn fell by 16%, 24% and 38% respectively, according to DeFi Pulse.

Yam Finance now has more assets locked than any of the DeFi protocols mentioned above as farmers are apparently cycling their crypto into the highest-yielding crops.

AMPL + YFI = YAM

The protocol crafted by Dan Elitzer of IDEO, Will Price of Flipside Crypto and a few other DeFi investors and developers wants to be a meme-based version of AMPL, combining the 1 USD target elastic supply (supply contracts when token is below $1, and expands when it’s above $1) with the most hyped-up DeFi features such as a total distribution since day 1 (YFI model, no founders, VC or premine), decentralized governance based on Compound Finance’s module, and a governable treasury.

The cherry on top of course is an aggressive farming program, which has become almost a prerequisite in the space.

Because of its elastic supply, YAM is not a standard ERC-20 token and it could be risky to use it as collateral in pools or other protocols. We already saw how experimenting with token standards led to a Balancer Labs pool getting drained.

YAM Distribution

There will be two phases for a total initial supply of 5 million tokens.

First, 2 million tokens will be distributed to farmers. Yam Finance enabled farming via eight different tokens and each pool will be rewarded with 250K YAM distributed over 7 days.

Second, 3 million tokens will be used to reward the liquidity providers of the YAM / yCRV pool on Uniswap, which is used as an oracle for the supply rebase and to provide liquidity to purchase yCRV for the treasury after the rebase. 10% of the tokens issued as part of the supply rebase will be used to buy yCRV.

Once the tokens are distributed, YAM holders will entirely govern the protocol.

Potential Selling Pressure

The first supply rebase happens 1-2 hours after the beginning of Wave 2 Distribution, and Wave 2 starts today at 7pm UTC / 3pm EST. With YAM way above its $1 peg, the market is bound to get flooded with tokens.

Keep in mind that following AMPL’s system, token holders’ stash of YAM increases directly in their wallets, meaning there will be whales with suddenly even more YAM tokens, which they got from farming and paid $0 for. That could potentially generate selling pressure. Since they didn’t pay anything for those tokens, the bar for selling is very low.

I don’t think it’s too cynical to say that it’s likely the eye-popping returns farmers are hoping to get is what's driving the frenzy for these governance tokens, rather than the chance to actually participate in on-chain governance. Whatever the case, YAM is another example of token incentives being extremely effective in driving liquidity to DeFi platforms. The challenge will be to make it stick.

Sponsored

DeversiFi Gives Serious Traders a Decentralized Edge

That's right, this edition is sponsored by DeversiFi. DeversiFi is a professional-grade, self-custodial exchange built with Layer 2 scaling technology. DeversiFi provides serious invetsors (quant/day/algo/arb traders) with the cornerstones of profitable trades: high-speeds (9,000+ tps), deep liquidity, privacy-by-default, and low-fees, resulting from rapid off-chain execution and batched on-chain settlement. Adding to this is the advantage of withdrawal-time-certainty, enabling them to move in and out of trades reliably.

Underpinning the DeversiFi ecosystem is their deflationary utility token Nectar (NEC) which is burnt on a perpetual basis through weekly necBURN auctions (50% of trading fee revenue is used to burn NEC from the market). Holders are also entitled to voting power in necDAO (with 17,000 ETH pledged) as well as trading fee discounts up to 20%. There are a number of initiatives going on as well as necDAO proposals designed to increase the utility, liquidity and volume of NEC. Connect DeversiFi on their telegram to stay in the loop.

On-Chain Markets Update by IntoTheBlock

This Week: DeFi Tokens & the Binance Effect

As DeFi keeps growing in popularity and adoption, investors have been increasingly favoring DeFi protocols’ tokens. The rally in DeFi tokens is becoming a defining trend of the current bull market, with crypto traders’ risk appetite reaching levels reminiscent of ICOs in 2017.

While the products being shipped by DeFi protocols differentiate them from the vaporware pitched by ICO teams, in both cases, investors’ expectations appear to be getting ahead of themselves. This is evident when looking at the recent listings of the Balancer (BAL) and Yearn.Finance (YFI) governance tokens in Binance.

In 2017 the term ‘Coinbase Effect’ was coined after Litecoin and Bitcoin Cash managed to increase by over 50% within days of being listed on the San Francisco-based crypto exchange. In 2020 we have seen the same happen with the listings of OMG and MKR in Coinbase in late May and early June respectively. More recently, the hyped YFI and BAL tokens have experienced similar price run-ups after getting listed in Binance as traders have been eager to get their hands on DeFi tokens.

Leveraging on-chain indicators from IntoTheBlock, we can assess the impact in key metrics for these protocols’ tokens following their listing in a major exchange. Here are three key insights we observe from the listings of BAL and YFI in Binance, besides the price action:

1. BAL Large Transactions Hit All-Time Highs

Balancer’s governance token BAL was listed in Binance on August 6. Not only did BAL’s price rise by over 35% on the same day, it also managed to attract significant interest from larger investors.

IntoTheBlock’s large transactions indicator, which measures the number of on-chain transactions of over $100,000, can act as a proxy of trading/investing activity from whales and crypto funds. As can be seen in the graph below, the number of large transactions for BAL hit a record on the same day it got listed in Binance.

As BAL’s price continued to increase in the following days, the number of large transactions hit a new all-time high of 121 transactions of over $100,000 within 24 hours. This growth is particularly impressive when compared to the mere 3 large transactions BAL had had the day prior to its Binance listing, implying a 40x increase within less than a week.

While certainly not all of the large transactions were from institutional investors buying, it is likely that many opted to gain some exposure into the automated market maker’s token. Overall, this increase in large transactions highlights that in general institutions and whales are still more comfortable buying DeFi tokens once they are listed in predominant crypto exchanges than in decentralized exchanges (DEXs). This could be due to large investors associating higher liquidity with Binance despite growing DEX volumes.

2. YFI Holders Spike Following Binance Listing

Within a couple of days of the BAL listing, Binance proceeded to add Yearn Finance’s YFI token to its platform on August 10. Despite Yearn Finance’s Andre Cronje repeatedly stating that YFI was meant to be earned and that it would be a valueless token, Binance traders begged to differ as YFI’s price blew up by over 50% within 24 hours.

As Binance users rushed to buy YFI, the total number of holders increased along with it. Currently, the number of YFI addresses with a balance is approaching 5,000, growing by over 10% on the day it got listed on Binance.

While a 10% increase in the number of addresses with a balance may not seem as significant, it is important to note that centralized exchanges hold users’ private keys. By doing so, they often aggregate multiple users’ tokens within one or a few addresses. This points to the likelihood that the number of YFI holders increased by more than 10%.

On the other hand, in DEXs users do hold their own keys so the assumption of one address being equal to one user is more accurate in this case. In YFI’s case, the growth in total addresses with a balance may be linked to users buying YFI in Binance and transferring their tokens to the YFI protocol.

3. YFI Western Transactions Outpace Eastern Counterparts

There had been rumors of YFI being one of the most hyped tokens in the Eastern hemisphere. This led to the Chinese forked version YFII and the Korean fork Asuka token, the latter which concluded in an exit scam.

Using IntoTheBlock’s East vs West metric we can track an on-chain heuristic classifying transactions that occur during Eastern market hours versus those happening in Western trading times.

As shown in the graph above, Eastern transactions had dominated on August 8 and by an even larger ratio of 3-to-1 on August 7. This trend reversed the day prior to the Binance listing with 60% of transactions occurring in the West. On August 10 as YFI got listed on Binance and Western transactions consisted of 66% of the total of 3,800 transactions.

While this has consolidated YFI’s appeal as a global token, sudden increases like these in particular time zones are relevant for traders following YFI when there is volatility like the one seen on August 10.

DeFi tokens have become the most recent benefactor of listings in large exchanges. While in 2017 Coinbase was the culprit, the Binance effect is appearing to gain some steam with the listings of BAL and YFI.

Asides from the evident price increases and growing speculation in DeFi tokens, on-chain data suggests that listings in large exchanges benefit the tokens with a broader reach of institutional and retail investors, as well as further liquidity. Ultimately, this should contribute positively to these tokens and their respective protocols, but it is important to proceed with caution as these price spikes signal that expectations may be getting ahead of themselves.

Aave’s Emilio Frangella reviewed one of Yam’s contracts, which is based off a Synthetix contract, and found that changes don’t introduce security risks.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

About the founder: I’m Camila Russo, author of The Infinite Machine, the first book on the history of Ethereum. I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.