🦄 Recap: DeFi Week of March 29

Hello Defiers! Hope you’re having a great weekend.

Summing up: 2021’s first quarter came to an end and we gave DeFi a report card; it turns out that while NFTs were grabbing all the headlines, decentralized finance doubled or tripled its key metrics. The biggest news of the week for crypto was that Visa will be using Ethereum to settle USDC transactions for its partnership with Crypto.com, a huge step towards traditional finance using open finance for its rails. We dove into NFT decentralization — it turns out most NFT platforms rely on centralized services to store the data, so while you may own your NFT token, the actual art still relies on a centralized party. In major DeFi projects’ updates, Aave announced it will be expanding into scaling network Polygon and Dharma announced on-tap access from banks to DeFi.

We got the full backstory of how artist pplpleasr sold the animation she made for the Uniswap v3 launch to a DAO and plans to donate the half a million dollars she got to an NFT to charity —interviewed the artist, the DAO members, and the runner up bidder. DeFi drama this week was between Uniswap and Delta Finance, as Uniswap scrubbed Delta’s trading volume from its chart, and Delta started a fake volume attack on Uniswap in retaliation. Cooper Turley wrote about how he sold the NFT of a blog post for 3.33 ETH to 3LAU on the Mirror platform, which enables writers to monetize their work. Pat White, a crypto expert and cofounder of Bitwave, wrote about how to pay your DeFi taxes this year.

And there was more! There’s a lot going on, but we’ve got you covered :)

Subscribe to get the latest DeFi news and analysis straight to your inbox. Free-signups get partial content, paid subscribers get everything. Click here to pay with DAI (for $100/yr) or click on the button below to subscribe with fiat ($100/yr, $10/mo). Price is increasing to $15/mo tomorrow!

🙌 Together with:

Zerion, a simple interface to access and use decentralized finance

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at https://balancer.finance/!

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Casper, an enterprise-focused blockchain which aims to introduce unprecedented security, speed and scale for businesses

Video

📺 Defiant Weekly: WTF is Bitclout!!?? Your questions answered (mostly)

📺 Tuesday Tutorial: The beginner's guide to being a Liquidity Provider

📺 Quick Take: zkSync 2.0 is on its way. What's coming?

Interview

"Collector DAOs Are Going to be a Game-Changer for the NFT Space:" pplpleasr

In this week’s episode we talk with the DeFi artist of the moment. Pplpleasr got into DeFi drawn in by the crazy yields but really stayed when she resonated with the community —the gaming-like, niche subculture of memes and internet-native humor. She started making videos for many DeFi teams, from Yeran to Pickle Finance. Her latest and best-known work though is the video she made for the highly anticipated v3 of Uniswap.

The clip of a unicorn in an otherworldly oasis, Ethereum dapp symbols floating about, gained her universal praise. But it’s what happened later when it gets really interesting. Pplpleasr decided, like many other artists these days, to sell the video as an NFT. But unlike most artists fetching big chunks of cash, she was set on donating the proceeds to charity. Also unlike other auctions, it was a decentralized autonomous organization, or DAO, created just for the occasion, what ended up winning the piece.

🎙Listen to the interview in this week’s podcast episode here:

Op-eds

A Handy Guide to DeFi Taxes

That not so joyful time of the year is here for US residents —the tax man is coming to collect. As if this wasn’t enough of a pain to do the paperwork without crypto, actively trading in DeFi makes it even harder: How to treat LP tokens earned from adding liquidity in an AMM? What about interest from deposits in a lending protocol that’s accruing by block? Or token rewards from yield farming? And have you even considered what to do about NFTs? Crypto tax expert Pat White has got us covered in today’s guest post.

How I Sold a Blog Post for $6k to 3LAU

A new web3 media platform called Mirror offers a new way for journalists to monetize their work. Cooper Turley set out to explore the NFT value-stack, leveraging Mirror to make the essay into an NFT. The post, titled “NFT Value Capture Equation” was broken down using a fractional token called $VALUE, which hit its crowdfund target of 2 ETH in under five minutes. The NFT of the post sold for 3.33 ETH to 3LAU earlier this week. Cooper shares what he learned from the experience.

Thursday

Dives

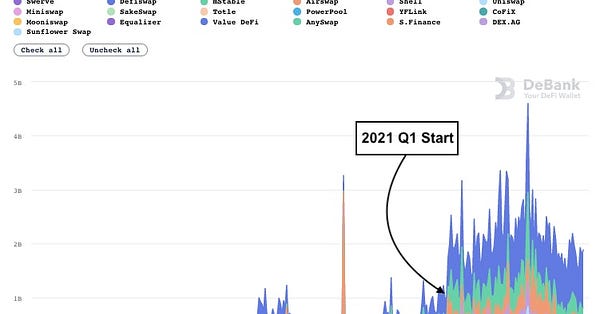

DeFi Quietly Doubled By Most Metrics in Q1: While searches for “NFTs” have outpaced those for “DeFi” by seven to one at the close of 2021’s first quarter, DeFi has quietly doubled or tripled by most key metrics.

Bytes

Aave Sets Sights on Scalability with Polygon: Aave, DeFi’s third-largest protocol by assets in its smart contracts, will be expanding onto the Polygon network as it aims to improve scalability.

Filecoin Rallying The Most Among Largest Crypto Tokens: Filecoin’s token is soaring by the most in all of crypto. FIL has jumped 168% to $231 in the last week, the most among the top 100 tokens listed on CoinGecko.

Enjin Introduces NFT-Focused Blockchain: Enjin has revealed more details about their NFT-focused blockchain, Efinity Network, which was announced earlier this month alongside their “high-speed bridge network” scaling solution, JumpNet.

Links

Wednesday

Dives

Do You Really Own Your NFT? Chances Are, You Don’t: NFTs have been pitched as a radical, new form of digital ownership detached from the whims of centralized overlords. Unfortunately, the truth isn’t that simple. Many NFTs are more centralized than collectors realize, which means that true “ownership” is not necessarily a given.

Delta Financial Takes on Uniswap Tracker: Delta Financial, a new on-chain options layer, is already making a big splash in DeFi—by waging war against Uniswap. Shortly after Delta launched its DELTA token was making up for ~85% of Uniswap volume. Shortly thereafter, Uniswap released a hotfix removing Delta’s data from their tracker, and Delta quickly shot back.

Bytes

Dharma Enables One-Tap Bank-to-DeFi Access: Dharma just made getting started in DeFi easier. Users can now move funds from their bank account into the Compound Finance, Aave and Yearn Finance protocols with one tap.

Element Raises $4.4M to Boost Fixed Rate DeFi Markets: Element Finance raised $4.4M in a seed round led by Andreessen Horowitz and Placeholder accompanied by SV Angel, A.Capital, Scalar Capital, and Robot Ventures.

CME Group to Launch Bitcoin Mini Futures: CME Group, the world’s largest financial derivatives exchange, is set to launch Micro Bitcoin futures, at one-tenth of a Bitcoin, on May 3.

Tuesday

Dives

“I Thought I Was Living in a Simulation.” The Story Behind the ~$500k Uniswap Video: A DAO bought the artist pplpleasr’s Uniswap V3 teaser video for $525K and she has committed to donating all proceeds to charity. Here’s how what’s probably this year’s most inspiring DeFi story went down.

Visa Transacting on Ethereum Signals Stronger TradFi-Crypto Link: Visa is now settling transactions via stablecoins on the Ethereum network. The first such transaction in USDC, a USD-backed stablecoin, was settled over Ethereum, Visa said in a March 29 blog post.

Bytes

MOB Short Squeeze Has Traders Reminiscing GME Days: MobileCoin (MOB) is up more than five times in the last 48 hours after a trader was borrowing what was at one point $120k worth of the token per hour to short it, according to crypto influencer who goes by Donny Crypto on Twitter.

Delta Exchange Completes $5M Token Raise: Delta Exchange a cryptocurrency derivatives exchange, announced today that it has raised $5M in a private sale for DETO, the platform's native token.

Links

💜Community Love💜

Thanking all the amazing Defiers for the support and love this week (and always)!

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($10/mo, $100/yr). Price is increasing to $15/mo tomorrow!