🖼 The Impermanence of NFTs: What Do You Really* Own?

Hello Defiers! Here’ what we’re covering today,

The impermanence of centralized NFTs

Delta Financial takes on Uniswap tracker

Dharma enables one-tap bank-to-DeFi access

Bitcoin mini futures (may signal what’s next for ETH futures)

Element raises $4.4M from a16z

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($10/mo, $100/yr). We will be raising the price to $15/month next week!

🙌 Together with:

Zerion, a simple interface to access and use decentralized finance

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at https://balancer.finance/!

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Casper, an enterprise-focused blockchain which aims to introduce unprecedented security, speed and scale for businesses

📺 Quick Take: zkSync 2.0 is on its way

📺 Tuesday Tutorials: Beginner's guide to being a Liquidity Provider

📺 Podcast: "I Try to Tell People About DeFi; It Will Come Here and Completely Flatten You:" Jim Bianco

NFTS

🖼 Do You Really Own Your NFT? Chances Are, You Don’t

TLDR NFTs have been pitched as a radical, new form of digital ownership detached from the whims of centralized overlords. In other words, as long as you own the token, you own the art. Unfortunately, the truth isn’t that simple. Many NFTs are more centralized than collectors realize, which means that true “ownership” is not necessarily a given. Some projects are seeking to change that.

OFF-CHAIN DATA When you buy an NFT, the token itself is stored on the blockchain, but because on-chain storage of large files is very expensive, the art or media that the token correlates to is usually stored off-chain. Typically, the token will point off-chain to either an HTTP URL metadata file or an IPFS hash.

YES, EVEN BEEPLE NFTs that hinge on HTTP URL metadata files can never be truly “ownable” in a complete form as they will always rely on the issuing organization continuing to operate their server. Using the example of Beeple’s “Crossroad” minted on Nifty Gateway, the token points to an HTTP URL hosted on Nifty’s servers that contains Crossroad’s metadata. The metadata text points further to another HTTP URL that contains Crossroad’s actual visual media, which is hosted on a cloud-based media service, but still served by Nifty’s servers.

NUANCE WITH IPFS IPFS, or InterPlanetary File System, is a protocol for sharing and storing data centered around a decentralized peer-to-peer network. This allows for content-addressable storage (CAS), which means that content itself can be hashed (cryptographically encoded) and referenced. Theoretically, media stored using CAS via a protocol like IPFS can be completely decentralized while still being verifiable and inalterable. But reality isn’t that simple.

Files hosted on IPFS must be hosted intentionally by a node in the IPFS network. Major, centralized NFT markets utilizing IPFS for storage currently act as the node intentionally hosting those files through their own private gateways. This means that even if an NFT references directly to media stored on IPFS, that media still might be reliant on a specific centralized marketplace’s IPFS node staying online.

ON-CHAIN WAY A number of high-profile NFT projects, including Avastars and Art Blocks, have been designed to live entirely on-chain, meaning that storage of both the metadata and visual media aspects are completely decentralized. In short, NFT projects that live entirely on-chain allow for the purest form of digital “ownership” that NFTs have always promised.

NFT42, the team behind Avastars, has even launched a new NFT minting platform, InfiNFT, capable of minting completely decentralized NFTs with on-chain metadata and image storage. Unfortunately, full on-chain media storage isn’t cost-effective.

NEW WAVE Arweave is building upon IPFS with the aim of sustaining long-term data storage. Other players include Filecoin, which essentially allows users to rent or lease decentralized storage space, and Pinata, which provides accessible UX for anyone interested in opening an IPFS node and managing their own data storage.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

DEFI DRAMA

🥷 Delta Financial Takes on Uniswap Tracker

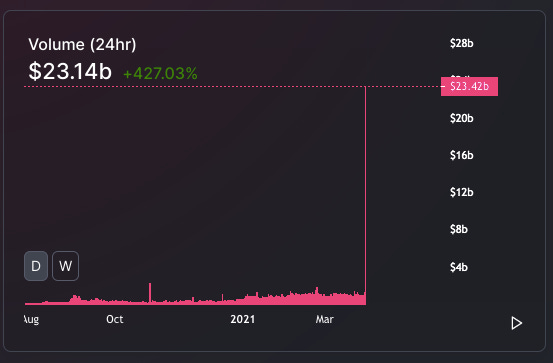

TLDR Delta Financial, a new on-chain options layer, is already making a big splash in DeFi—by waging war against Uniswap. Shortly after Delta launched its DELTA token, Uniswap’s 24-hour trading volume shot up from $1.2B to $7.2B, with $DELTA accounting for ~85%, despite only having $16.4M in liquidity. Shortly thereafter, Uniswap released a hotfix removing Delta’s data from their tracker, or as a Uniswap engineer put it: “fix for scammy tokens.”

REBASE While Delta’s massive trading volume may look similar to wash trading (ie: manipulating the market by trading the same asset back and forth), it appears to be a result of Delta’s “liquidity rebasing system,” wherein Delta algorithmically raises their token minting prices over time to create a limited supply.

“Not wash trading but not ‘real’ volume either,” said Uniswap inventor Hayden Adams on Twitter in response to the news of the exchange’s record-breaking daily trading volume. “Soon will be considered untracked volume on uniswap.info.”

DELTA ATTACK On March 30, a Twitter user posting under the handle “0xRevert” and claiming to be a developer for Delta’s parent company CORE Vault, wrote: “Everyone can now create $20b volume on a custom token! Attack will continue until DELTA trading history is reinstated, and we get [sic] a apology from uniswap for abusing centralized power.”

DELTA’s tokens are still accessible to exchange on Uniswap. Their data, however, is blacklisted from Uniswap’s tracker.

CENTRALIZATION FLAG Regardless of whether or not Delta’s algorithm is messing up Uniswap’s tracker, some DeFi community members say that a decentralized exchange like Uniswap should not be picking and choosing which tokens to blacklist, even if it's just from their trackers.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

DEFI/TRADFI

🏦 Dharma Enables One-Tap Bank-to-DeFi Access

TLDR Dharma just made getting started in DeFi easier. Users can now move funds from their bank account into the Compound Finance, Aave and Yearn Finance protocols with one tap and begin earning interest of at least 7.7% currently, more than 100 times the United States’ average savings rate of .07% according to Bankrate. It’s the first time Dharma has integrated Aave and Yearn into its app.

$25k/WEEK Whereas previous iterations of Dharma limited users to $250 a day in deposits, the cap is now $25K a week. As the median American has $5,300 dollars in their savings accounts according to data collected by the Federal Reserve, this means that the majority of Americans can go “all in” on earning interest in DeFi in the time it takes to download the app, attach a bank account, and supply their assets.

DHARMAOS “The ‘real magic’” of the release, Dharma co-founder Brendan Forster told The Defiant, lies in something called dharmaOS which the product’s docs define as “an open SDK that allows developers to connect any EVM protocol action to Dharma's high-grade fiat on and off-ramps.”

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

FIXED-RATE MARKET

💰 Element Raises $4.4M to Boost Fixed Rate DeFi Markets

FUNDING ROUND Element Finance raised $4.4M in a seed round led by Andreessen Horowitz and Placeholder accompanied by SV Angel, A.Capital, Scalar Capital, and Robot Ventures. Angels included Joseph Lubin, Fernando Martinelli, Stani Kulechov, Mariano Conti, Robert Leshner and Tarun Chitra. The project aims to bring liquidity to the fixed-rate income and interest markets

DISCOUNTED CRYPTO Users will be able to purchase BTC, ETH, and USDC at a discount without being locked into a fixed-rate term, allowing easy swapping between the discounted asset and any other base asset at any time. The Element Protocol splits the base asset positions (ETH, BTC, USDC) into two tokens: the principal token, and the interest token. This allows users to sell their principal as a fixed-rate income position, “further leveraging or increasing exposure to interest without any liquidation risk,” the team said in a blog post.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

MINI FUTURES

📈 CME Group to Launch Bitcoin Mini Futures

TLDR CME Group, the world’s largest financial derivatives exchange, is set to launch Micro Bitcoin futures, at one-tenth of a Bitcoin, on May 3rd. CME Group already offers standard Bitcoin futures, which have traded at an average volume of 13,800 contracts (roughly 69,000 BTC) daily throughout 2021. Micro Bitcoin futures will offer institutional traders and investors more cost-effective trading strategies for Bitcoin exposure.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

✊ Head to THEDEFIANT.IO for more DeFi news 📰

🧑💻 ✍️ Stories in this newsletter were written by Owen Fernau and Dan Kahan, and edited by Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($10/mo, $100/yr). We will be raising the price to $15/month next week!