You Can Have Your Own Personal Token and Stream it Too

Also, private blockchain transactions are here, Maple Finance launches community-backed loans and more.

Hello Defiers! So much going on in decentralized finance,

Social money can now be streamed

Aztec protocol launched, enabling private Ethereum transactions

Maple Finance launches platform for community-backed loans

PoolTogether raises $1 million

and more :)

Streaming Social Money is the Future of Work

Just in the past couple of months developers created an easy way for anyone to issue their own personal tokens, while a different team created a way for anyone to create payments streams —think an employee paying employers by the second.

Today, both concepts were combined so that anyone can streams those personal tokens, also known as social money.

This is possible thanks to the high composability of an open economy. Tokens traded over public networks and applications being built with open source and accessible to everyone, means builders are able to easily combine each others’ applications like legos. This accelerates growth and innovation.

For the first time ever, anyone can issue a money-like instrument that they can link to their own work and trade it with anyone in the world over the internet. And not just that, but there are also tools that allow them (or anyone using their tokens) to turn payments on and off like a faucet.

Image source: Sablier

Issuing Social Money

First you would mint your own personal token. This can be done by coding up an Ethereum token, but an application called Roll makes it easy for non-developers to do that, and created an interface to facilitate transactions and a market for these tokens. Users can set a name for their token —I have my own token called CAMI, for example— and the monetary policy for it, such as total supply, issuance schedule etc. Tokens are minted in a few minutes.

Next, social money issuers would define products and services to exchange for their tokens. Social tokens is they create abundance without “real” money. These tokens facilitate the exchange of mutually beneficial actions without there being traditional money used between parties.

As an example, I can reward readers who share The Defiant with CAMI coins, I could issue them as an extra thank you to subscribers or I could send over a few for whoever gives me a shoutout on Twitter. Conversely, someone who wants my advise in say, writing a book or creating a newsletter, can pay me with CAMI for an hour of my time. I could also price a newsletter subscription in CAMI.

Once personal tokens are minted and the issuer defined the products and services they’re willing to exchange for them, they can start trading and a market would start to emerge. Social coins could potentially also be listed on an exchange; these platforms can make it easier for anyone to sell or buy these tokens, and improve price discovery for the tokens. Eventually, a liquid market could help issuers see how the value of work tied to the token is being priced.

Streaming Social Money

The issuer or token holder can send a pre-determined amount of tokens into someone’s Ethereum wallet in exchange for goods/services, or even just another digital asset. But if what’s being exchanged is someone’s time then it could make more sense to create a payments stream that can be turned off once the task is completed.

To create a payments stream, the token holder would go to pay.sablier.finance, and fill in the token they’d want to use, the amount, the recipient, and the length of the stream. Following the example above, when I accept CAMI in exchange for giving out advise on writing a book, the holder of CAMI coins could create a stream for the call. The stream starts when the call starts, so if they’re late, I would get compensated and if the call lasts for 40 minutes, the’ll cut the stream early. This has already been done:

Social tokens can be used to better put a price on people’s time, which means it’s also easier to sell it.

Currency for a New Economy

Social money can be used to incentivize actions where using “real” money doesn’t make much sense, like sharing a newsletter or hopping on a call. But if they’re tied to specific goods/services produced by the issuer, they can also help put a better price on those good/services. A price chart on a personal token, if the market is liquid enough, can be a more helpful indicator than any client satisfaction survey.

These tokens can be exchanged for work that’s already been executed, but they could also potentially be exchanged for future work too. I wrote in this newsletter about Spencer Dinwiddie’s tokenized bonds, and the potential for crypto to enable more people to issue their own Income Share Agreements, so supporters of someone’s work can invest in them by buying their tokens. The NBA star did this by issuing bonds to accredited investors, but social tokens offer a more accessible avenue to achieve the same thing.

This technology is coming at a time when entrepreneurs working remotely are booming. The self-employed population with an incorporated businesses, grew by 48 percent for home-based businesses from 2005 to 2019, while the employee population (not including work-at-home or the self-employed) grew by 15 percent in that time, according to a report by GlobalWorkplaceAnalytics.com

A tokenized way to value and exchange services can be a major enabler for more people to do the same.

Private Transactions on Ethereum are Live

One big barrier for adoption of public blockchains is that they’re public; once an address is connected with a person, their whole transaction history is visible. Same thing goes for corporations and banks. That’s a deal breaker.

Aztec protocol is making strides in solving this problem. They’ve recently launched their privacy network in Ethereum, enabling applications to integrate zkDai, a private version of Dai, which conceals the amount transacted. Other private tokens will be released in the coming weeks, and eventually, Aztec will remove restrictions so users will be able to “make completely private custom assets from scratch.”

The next steps will be to also conceal the sender and the recipient, and finally, smart contract code will be private too. Presumably, the first dapps to integrate this should be decentralized exchanges.

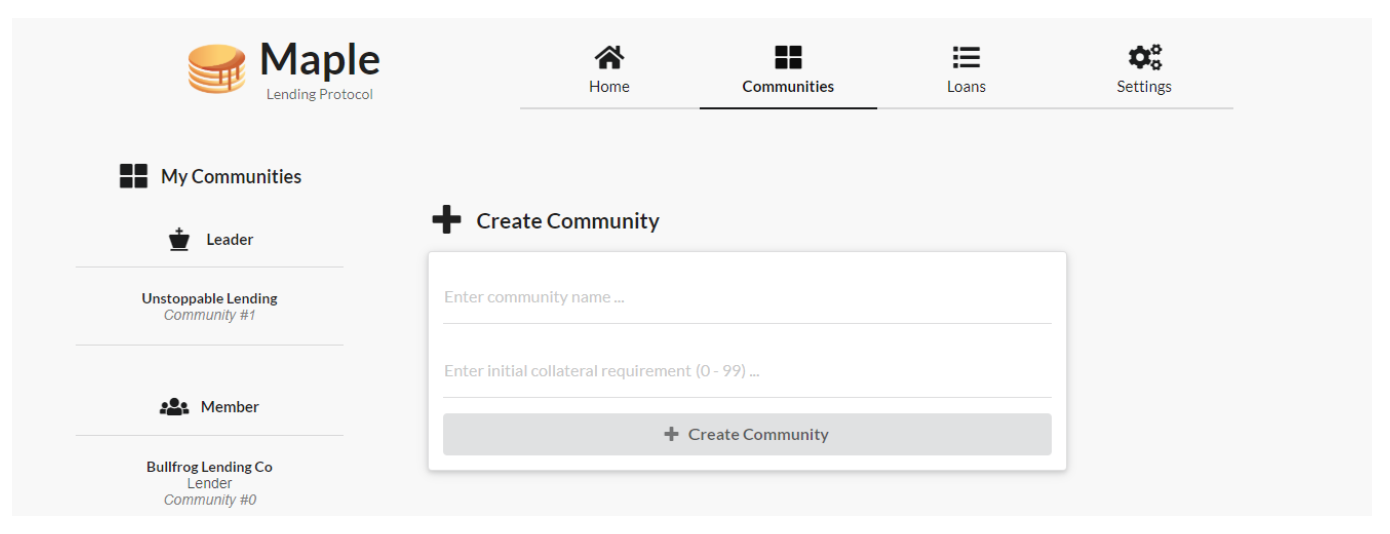

Maple Finance Launches Community-Backed Loans

Most DeFi platforms have solved the challenge of issuing loans without trusted third parties with collateral. Maple Finance wants to solve this challenge with community.

The startup launched Maple Loans, which enables users to create groups of lenders and borrowers, who are connected with each other by some degree of separation. The members of these communities set the terms of the loan —from the rate, to the documentation the borrowers need to present, to the duration and the level of collateral.

Image source: Maple Finance

After rules are set, borrowers can start making loan requests, and lenders can fund as much as they want. Payments and interets are made in stablecoins Dai and USDC through the protocol, and collateral is held in these coins too. If the borrower misses three payments, lenders can claim any collateral deposited by the borrower. Otherwise, theres no other enforcement mechanism.

This approach isn’t as automated as some solutions offered by other DeFi platforms, where borrowers put up collateral that’s worth more than the assets they’re withdrawing. Maple Loans require more coordination between parties and some degree of trust. Still, unlike the more automated and trustless alternatives, which are more similar to leveraged trading, it has the potential to spur actual peer-to-peer loans.

Pool Together Raises $1 Million from IDEO

PoolTogether, the no-loss lottery, has raised $1 million in a funding round led by IDEO CoLab Ventures with participation from ConsenSys Labs and DTC Capital. It builds upon earlier funding from the MakerDAO Grant Program, the company said in a blog post.

Funds raised will be used to hire security audits and increase payouts for developers who find bugs. The round will also be used to improve the lottery prize, as a portion of the funds will be added to “Sponsored Dai” in the PoolTogether Protocol, which contributes interest to the prize but isn’t eligible to win. It will also allow PoolTogether to continue growing without charging fees for longer.

Idle Finance Updates Automated Investment Protocol

Idle Finance, which allocates users’ tokens into the highest-yielding platforms, released its v2. The updated version’s audited smart contracts dynamically allocate funds across lending protocols, powered by a decentralized rebalancing mechanism, “which means that smart contracts and allocation strategy do not rely on any specific pair of human hands,” Idle Finance said in the post. The system’s new architecture also makes it easier for the team to introduce new tokens and platforms.

DeFiZap Makes it Easier to Un-Zap

DeFiZap, which lets users implement multi-step decentralized strategies in one click, introduced Zap Out, to make it just as easy to undo those strategies. The first Zap Out helps users remove liquidity from Uniswap pools. The feature also gives traders the option to withdraw funds in a single token, instead of the two assets required to participate in liquidity pools.

CFTC chairman reiterates belief that ether futures will be launched: The Block

Commodity Futures Trading Commission (CFTC) chairman Heath Tarbert remarked Thursday that the crypto market could see the launch of ether (ETH)-based futures contracts, The Block reported.

No-Code Is the Next Big Step for Crypto And It’s Here: Jack Knutson

Jack Knutson of Wyre says crypto will enable more non-devs to build decentralized applications. “No-code allows anyone to be a dreamer and a builder. The more people we enable to build, the quicker we’ll find crypto’s first viral application. And once we have that, we can begin the next chapter of finance.”

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

Click here to pay with DAI.There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the author: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.