Yield Farmers' Latest Obsession: CRV's Imminent Launch

Also 1inch raises $2.8M and launches AMM, Nexus Mutual assets soaring, YFI jumps on Binance listing, APY wants to democratize yield farming

Hello Defiers! here’s what’s going on in DeFi:

All you need to know about Curve’s CRV token launch

Nexus Mutual assets climb to record

1inch raises $2.8M and launches new AMM Mooniswap

YFI soars on Binance listing

APY.finance wants to democratize yield farming

and more :)

[UPDATED @1:30pm EST to add quote by APY CEO Will Shahda]

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for 70 Dai/yr vs $100/yr).

🎙Listen to this week’s podcast episode with Andre Cronje here:

📺 Also, The Defiant’s YouTube Channel Launched! Subscribe!

CRV Distribution is Near - Everything You Need to Know

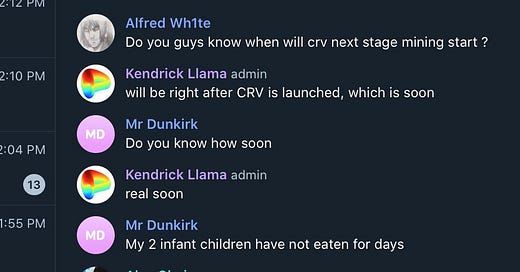

There’s one thing on yield farmers’ minds this week: The CRV token launch.

Curve, the third-largest DEX with nearly $2B in cumulative volume and the center of much of the yield farming frenzy, is gearing up to distribute its own CRV governance token this week ––possibly as soon as today–– and yield farmers just can’t wait.

“Let's talk after the launch.” Curve contributor Michael Egorov told the Defiant “If I start answering everyone now, the launch gets delayed.”

After COMP, BAL and YFI prompted traders to pour hundreds of millions of dollars into lending protocols including Curve, while the tokens’ price skyrocketed, speculation is mounting that CRV will be the next hot DeFi token.

As the yield farming frenzy heated up, Curve has been quietly keeping track of liquidity providers in the now-closed CRV pre-launch program. Liquidity providers, who will retroactively get CRV in proportion to the assets they deposited on Curve, can check how many tokens they earned from the pre-launch program here.

Curve Design

Curve leverages a unique AMM curve design (hence the name Curve) which mitigates slippage for trading pairs like USDC<>DAI and wBTC<>renBTC that are pegged to the same value. More on the project and it’s growth here.

Curve collects yield by lending collateral across Compound, Aave and dYdX —offering LPs an attractive hybrid of 0.04% trading fees plus interest.

Many projects have turned to Curve as a means of stabilizing their native tokens. One of the best examples of this is Synthetix and its sUSD and sBTC pools, which offer SNX, REN and BAL rewards on top of lending APYs.

The recent YFI rush, which began with traders providing liquidity to Curve’s Y pool in exchange for YFI, highlighted these incentives. As a result, total assets locked in Curve has increased by 1,600% in the past two months, bringing the DEX to $200M in TVL today and $450M at its peak.

Retroactive Distribution

In total, 151.5M CRV, or 5% of the total supply, will be claimable by LPs subject to a one year vesting period. Only 990 addresses earned more than 10,000 CRV with one whale taking the lion’s share with 21% of the earlyCRV rewards.

The pre-launch period will unlock in real-time, meaning that after the first 24 hours, early LPs will be able to claim 1/365th of their rewards. Here’s a look at how the initial 1.3B (representing 43% of the total supply) is set to break down:

30% to shareholders with 2-4 years vesting

5% to pre-CRV liquidity providers with 1 year vesting

5% to the CurveDAO community reserve

3% to employees with 2 years vesting

The remaining 1.73B Curve is set to be distributed at a diminishing rate of 2¼ each year, meaning the entirety of the supply will not be issued for over 300 years. Upon launch, 2M CRV (or 0.067% of the total supply) will be distributed each day, until 62% has been distributed through liquidity mining.

CurveDAO

CRV tokens will be used to participate in the CurveDAO, a time-weighted voting system which grants early participants higher voting weight as the project evolves. It’s been suggested that all system fees will accrue to the DAO and be used to burn CRV at a later date. Liquidity providers are also likely to benefit from CRV rewards and a locking mechanism to favor long-term liquidity with added incentives.

As if yield farming wasn’t hot enough, the launch of CRV in tandem with a new YFI inflation schedule is set to drive DeFi TVL to new all-time highs.

Sponsored

With Great Yield, Comes Great Responsibility 👩🌾 🌾

Yield Farming is the latest trend in DeFi, but high yields are not guaranteed. If you are interested in yield farming, please consider the following:

Most yield farming apps interact with several DeFi protocols within a single transaction: this increases smart contract security risk.

Using leverage might get you liquidated.

Farming yield costs a lot in gas. Check the fees before finalizing your transaction!

These safety recommendations were brought to you by Quantstamp 🛡, the blockchain security company auditing the leading ETH 2.0 client, Prysm. Check out the shoutout we got for our work on ETH 2.0.

Assets in DeFi Insurer Nexus Mutual Soar by 4X to Record

Nexus Mutual’s active coverage plans and ETH capital pool are soaring to record highs. Demand for protection against smart contract failure is growing as total value locked (TVL) in DeFi soared by almost 80% in the last month to a record of +$4.6B.

As a p2p alternative to legacy insurance built with smart contracts on Ethereum, Nexus provides DeFi users Smart Contract Cover totaling 46,250 ETH (~$18M) today. This is significant as Nexus helps to address the #1 risk for all DeFi users: protection against smart contract bugs.

Nexus has provided protection for all major DeFi apps including Compound, Maker, Synthetix, Aave, dYdX, Curve, Balancer, Uniswap. Growth in its ETH Capital Pool has outpaced growth of DeFi TVL in the last 30 days, climbing from 21k ETH to over 84k ETH since July 9.

Image source: Richard Chen of 1confirmation at nexustracker.io

Part of Nexus Mutual's success is tied to its ability to extend more of its insurance-like protection against smart contract bugs. The amount of active cover that can be sold for a premium is dependent on the continued growth of the Capital Pool in ETH, and the mutual's continually increasing Minimum Capital Required (MCR), which now increases by 1% every 4 hours as long as the mutual has over 130% of the capital required to pay all active cover.

Tough Love

In a bold move that can be likened to "tough love," Mutual members made a short-term sacrifice to suppress the NXM bonding curve price, by voting to modify the continually increasing Minimum Capital Required (MCR), from 1% daily to 1% every 4 hours (=6% daily) as long as the mutual has over 130% of the capital required to pay all active cover (MCR% = 130%).

Unless the Capital Pool in ETH can increase faster than 6% daily (faster than the Minimum Capital Required floor), NXM price falls, which helps to attract more ETH into the pool. NXM is priced in ETH so placing ETH into NXM leaves one exposed to the price movements, which is ideal for anyone wishing to accumulate and grow ETH holdings. You'll notice the effect of faster rising MCR on MCR% since mid-July, which leads to the conclusion NXM/ETH price becomes mainly dependent upon the rate of growth of the ETH in the Capital Pool.

Image source: Richard Chen of 1confirmation at nexustracker.io

If you're interested to learn more about the bonding curve behind the NXM token used to capitalize and align incentives within Nexus Mutual, watch my new tutorial, where I help explain how these incentives work with the NXM bonding curve and more importantly, how to protect your assets in DeFi by buying Smart Contract Cover from Nexus.

For more DeFi video tutorials and insights, follow @DeFi_Dad on Twitter and subscribe to DeFi Tutorials with DeFi Dad on YouTube at defidad.com (https://www.youtube.com/channel/UCatItl6C7wJp9txFMbXbSTg).

Disclaimer & Risks: This is not financial advice and you should approach all DeFi applications, wallets, protocols, and tools with caution. Please be aware there is always risk in using DeFi, including technical risks (ie smart contracts hacks), financial risks (ie liquidity crises), and potentially admin risk (admin key compromise, governance 1vulnerabilities). Also, there's risk of any pegged asset like a stablecoin de-pegging.

1inch Raises $2.8M in Funding Round Led By Binance

1inch raised $2.8M on its first funding round, which was led by Binance Labs. Other investors included Galaxy Digital, Greenfield One, Libertus Capital, Dragonfly Capital, FTX, IOSG, LAUNCHub Ventures, Divergence Ventures, Loi Luu, the Founder of Kyber Network, and Illia Polosukhin, the Co-Founder of NEAR Protocol. The raise comes after the DEX aggregator surpassed $1B in overall trading volume.

Funding will help 1inch continue to expand its products, according to a blog post. Among its plans is a new algorithm to help find the best trading paths, and its own token, which will include liquidity mining on specific Mooniswap pools.

1inch Launches AMM Mooniswap

Arbitrageurs have been eating liquidity providers’ lunch. Now, 1inch says they can all get a piece of the pie.

DEX aggregator 1inch yesterday launched Mooniswap, an automated market maker, which aims to let liquidity providers capture part of arbitrageurs’ profits.

AMMs revolutionized decentralized exchanges by enabling traders to seamlessly swap between tokens, no matter how little volume they have, by providing pools of liquidity which basically pre-fund trades and get rid of order books. The pricing formula for these systems can create wide spreads between the bid and ask, which market makers could potentially profit from, but this isn’t always the case, 1inch wrote.

“Traders that conduct front-running, literally steal from liquidity providers by trading on the price swings. The problem of front-running is undeniably important,” accordging to the 1inch blog post.

1inch’s solution to this problem is that when a swap happens, a market maker does not automatically display the new prices for upcoming trades. Instead, it reflects the exchange rates over a ~5-minute time period. As a result, arbitrageurs will be able to collect only a portion of slippage, while the rest will remain in the pool and shared among liquidity providers.

“On average we expect Mooniswap to generate from 50% to 200% more income for liquidity providers than Uniswap V2 due to redirection of price slippage profits,” the blog post said.

APY.Finance Wants to Democratize Yield Farming

As gas prices continue to skyrocket, the average yield farmer is getting boxed out. APY.finance aims to change that.

Touting itself as the Wealthfront for DeFi, APY offers a global liquidity pool to farm top strategies from protocols like Compound and Balancer with plans to expand into Synthetix and Curve shortly after launch.

September Alpha

Teasing its September alpha, APY will launch with a liquidity mining program for a native governance token - APY - accompanied by an Initial DEX Offering to incentive early participation.

Similar to how liquidity providers receive Balancer Pool Tokens (BPTs) and Uniswap Liquidity Tokens (UNI), APY distributes APY Pool Tokens (APTs) for those who deposit capital to the protocol.

Risk-Adjusted Allocation

APY scans top yield farming strategies and allocates capital using risk-adjusted analysis to limit potential downside by prioritizing user safety.

When asked about how the protocol differs from robo farmers like Rari Capital, APY’s CEO Will Shahda told The Defiant, “Rari Capital operates as a black-box fund with carry. We envision more of an open protocol where the community can self-govern its own farming strategies.”

At inception, APY will feature only one capital pool, with ambitions to gradually add different strategies for collaborative yield farming which saves on gas by only requiring users to deposit and withdraw at their convenience.

As automated yield farming heats up, passive farmers can rejoice that protocols like APY, Rari Capital and Akropolis Delphi will handle the crop rotations for them. To Shahda, it’s inevitable that “ as long as we have decentralized assets, we will have permissionless yield.”

“Compound has democratized lending markets, Uniswap has decentralized market making, but when it comes to high APY yield farming strategies, we are just not there yet,” Shahda said. “I believe we have yet to cross the chasm even for crypto natives and when we do... it will be a stampede.”

Valueless Token Now Worth $6,000 after Binance Launch

Yearn.finance’s YFI token soared by 45% to over $6,400 after Binance, the largest exchange by trading volume, announced it’s listing the token. Smaller crypto tokens often jump after large exchanges list it on their platforms on speculation demand will increase as they will now be available for a larger group of buyers.

Image source: CoinGecko

The token incentives for liquidity providers, the fact that it’s community-owned and at the center of one of a popular DeFi protocol, pushed YFI to cross $1,000 on its first day of trading, and keep climbing. At $184M market cap, it’s now the 13th most valuable DeFi token, according to defimarketcap.io.

YFI was made to be earned by Yearn’s liquidity providers in its primary listing, rather than bought on an exchange offering, on a pre-sale to investors or distributed to early team members. Before its launch, yearn creator Andre Cronje said YFI was only meant to allow users to govern the protocol, and that it was “valueless.”

Uniswap generated more fees than the entire Bitcoin network yesterday.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

About the founder: I’m Camila Russo, author of The Infinite Machine, the first book on the history of Ethereum. I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.