Yield Farmers Dreaming of 1,000% APY Pour Millions to Get Latest DeFi Token YFI

DeFi breaches $3B milestone, mStable lists MTA, DeFiDollar adds token rewards.

Hello Defiers! Tons going on in decentralized finance:

Keep track of everything going on with YFI, the latest DeFi token, from 1,000% yields, to admin key risk, to 30k supply cap

There’s now $3B locked in DeFi

mStable lists MTA on Gnosis-based Mesa DEX to thwart front runners

DeFiDollar stablecoin adds token rewards

Balancer token holders participate in governance for the first time

and more!

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for 70 Dai/yr vs $100/yr).

🎙Listen to this week’s podcast episode with 1kx’s Lasse Clausen:

🙌 Together with DeversiFi, a professional-grade, self-custodial exchange.

Farmers Scramble to Get Latest DeFi Token’s 1,000% Yield

This is the state of DeFi right now: a token called “valueless” by its issuers drove $150M of deposits, while the token itself soared by more than 80x to as high as $2,500 practically overnight, as “farming it” has yielded annual returns of 1,000% for some traders.

We’re talking about yEarn’s YFI token. yEarn (previously called iEarn) is a yield aggregator which redirects users’ deposits to lending markets offering the best rates. Four days ago, yEarn founder Andre Cronje launched YFI, its governance token, to cede control over their many products to users “mostly because we are lazy,” the team said in a blog post.

Community Governance

Whatever the reason, in practice, the token distribution puts the entirety of the protocol in the hands of the community right out of the gate, unlike other projects where teams keep the majority of voting power. And like any token rewards system, it incentivizes users to add liquidity to the platform.

YFI is distributed among those who deposit funds to yEarn pools. Three days after the token distribution started, this is exactly what they did: deposits soared by more than $150M to over $280M.

Admin Key Risk

While governance is ruled by token holders, until a few hours ago, control over YFI was not. After millions flowed into yEarn pools, Ethereum community members were quick to point out that the admin keys in control of YFI issuance rest in the hands of Cronje, meaning he *could* have minted infinite tokens and drain the DAI/YFI pool containing over $60M in value.

This was fixed last night by putting control of YFI in a multi-signature wallet, which requires 6 out of 9 participants to agree on changes. Cronje is not a member of the multisig. (Disclosure: I am one of the signatories).

Image source: yearn.finance

Value of “Valueless” Token

So what’s so great about YFI that traders are pouring over their crypto to get it? The yEarn team said it’s worthless:

“We have released YFI, a completely valueless 0 supply token. We re-iterate, it has 0 financial value. There is no pre-mine, there is no sale, no you cannot buy it, no, it won’t be on uniswap, no, there won’t be an auction. We don’t have any of it”

That statement is a tongue-in-cheek way to highlight that the token can only be earned by using the yEarn platform. It has a total supply of 30,000 which will be distributed to stakers in the platform’s liquidity pools. There is no separate stash for investors in the project, and it wasn’t sold in an “initial dex offering” like many other DeFi tokens.

Here’s a quick look at the first two Pools which went live when YFI was announced:

yEarn - Stake yCurve LP tokens to earn YFI

Balancer - Stake Balancer LP tokens for this DAI/YFI pool to earn YFI

Since then, two new pools have been announced, pushing composability to its limits:

Meta Governance - Stake Balancer LP tokens for this yCurve/YFI pool to earn YFI and governance rights

Fee Rewards - Vote on a governance proposal and stake at least 1000 BPT tokens in the Governance pool to have a claim on yEarn’s ~$50k/wk trading fees.

1,000% APY

For anyone wondering why the hell anyone would be interested in these convoluted positions, look no further than the outrageous APYs currently being offered. At its peak price of just over $2000/YFI, LP’s were looking at APYs north of 1,000% on any of the aforementioned pools.

These returns are the short-term result of the rapid spike in demand. Still, yEarn has consistently delivered annual returns of about 10% for it’s yearn.finance lending pool - a contract which autonomously shifts between Compound, Aave and dYdX based on which has the highest return.

Now, so much money is flowing into the platform’s liquidity pool on the Curve DEX (called yCurve), that the stablecoin aggregator is now the second-largest DEX by trading volume, with volume peaking at $87M on Sunday.

Supply Cap

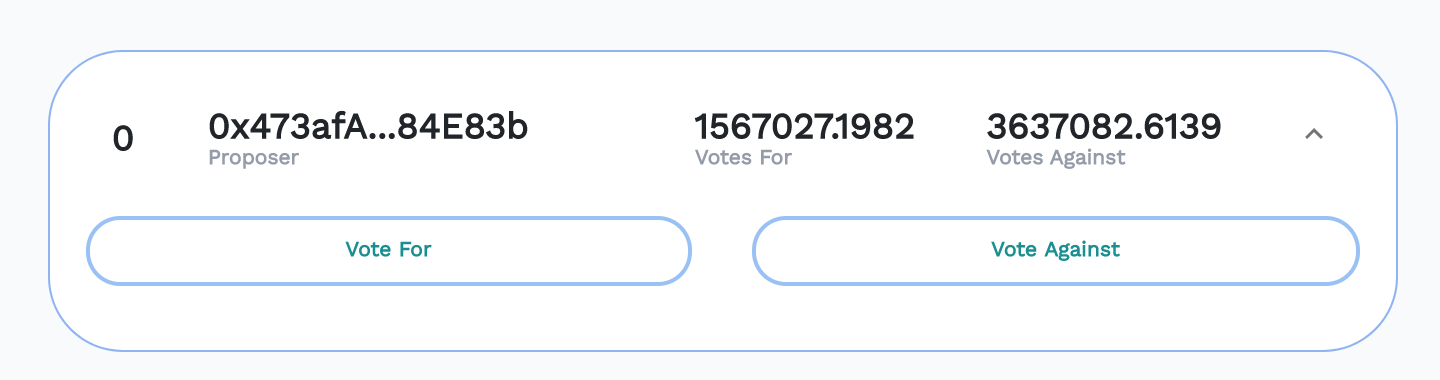

As if 1,000% APY wasn’t exciting enough, YFI’s first governance poll has also intrigued yield farmers.

Proposal 0 decides whether the YFI supply should be capped at 30,000 in perpetuity or if the protocol should retain the ability to mint additional YFI tokens in the future as new pools come into play.

With 3x more votes in favor of “Against” it looks like YFI will in fact be capped, opening a pandora’s box regarding sustainability for DeFi’s hottest new governance token.

To corral the discussion around governance, the community has launched both an official governance forum and a Discord channel to discuss all things yEarn.

Risks

While the contracts used for YFI staking were forked directly from Synethix’s audited contracts, the YFI ones have not been audited after they were adapted to suit the needs of yEarn governance. Cronje is known for deploying code which hasn’t been audited —he even says so on his Twitter bio which reads “I test in prod.”

These contracts are now in review by a group of security auditors who form the group Audit DAO.

The premise of a truly community-owned yield farming token is as exciting as it is scary. This experiment around truly decentralized governance is one which has us at the edge of our seat.

Sponsored Post

With Great Yield, Comes Great Responsibility 👩🌾 🌾

Yield Farming is the latest trend in DeFi, but high yields are not guaranteed. If you are interested in yield farming, please consider the following:

Most yield farming apps interact with several DeFi protocols within a single transaction: this increases smart contract security risk.

Using leverage might get you liquidated.

Farming yield costs a lot in gas. Check the fees before finalizing your transaction!

These safety recommendations were brought to you by Quantstamp 🛡, the blockchain security company auditing the leading ETH 2.0 client, Prysm. 👉 Check out the shoutout we got for our work on ETH 2.0

There is Now $3 Billion Held in DeFi

Value held in DeFi reached a record of $3 billion today, highlighting decentralized finance is growing at breakneck speed.

If we count the launch of Dai in December 2017 as the birth of DeFi, it took over two years for the space to reach its first billion at the end of February this year. The second billion came five months later at the start of July, and the third billion took just three weeks.

Image source: DeFi Pulse

Token incentives, or yield farming, have fueled the recent inflow of funds, as traders pour million in assets for a chance to get DeFi platform’s tokens. Frenzy around these tokens have caused them to spike in price, adding to the interest traders would already make for lending their crypto.

The trend has also reduced MakerDAO’s dominance to just over 20% of total value locked, as assets in Compound, Aave, and Curve Finance shot up with users flocking to take advantage of liquidity incentives.

Ether continues to represent the majority of the value in DeFi, with a record 3.8M of locked ETH. While ETH price is climbing, the $3 billion milestone was reached because the net amount of ETH in DeFi increased, not just because the dollar value of ETH rose. There is now a record 3.8M ETH in DeFi, up from 3.6M seven days ago.

DeFiDollar Stablecoin Adds Token Rewards

The team behind DeFiDollar will now use Curve Finance pools to collateralize its stablecoin, enabling liquidity providers to earn token rewards.

DeFi Dollar (DUSD) is a stablecoin that leverages DeFi protocols to maintain the peg to the US dollar. Users deposit stable coins such as DAI and TUSD and mint DUSD in exchange. The stable coins are then deposited to Curve Finance pools in exchange for LP tokens and start generating income from the pools' trading fees. Some liquidity pools also earn interest from lending to Compound

Users are also able to stake their DUSD in the system to add additional collateral and, in exchange, get rewarded with the pools' trading and lending fees. The team is currently gathering community feedback to decide how to allocate the farming rewards that will be obtained. The exact launch wasn't announced yet, as the code still needs to be audited.

DUSD system has four components that are called Streams, Peaks, Base, and Valley. Streams are the price reference data, which is sourced via Chainlink oracles. Peaks are the yield generating protocols that are supported by the system. Initially, the system will support Curve's susdV2 pool and y pool (other protocols like Aave and Uniswap might be added in the future). Base is the system's core contract, which is in charge of the mint/redeem operations and distributes protocol income. Valley is the DUSD staking system that allows users to stake their DUSD in exchange for receiving the protocol income.

Recapping mStable’s MTA Distribution

mStable launched its MTA governance token using a batched auction on the Gnosis Protocol-based DEX, Mesa on Saturday, after delaying the listing by 4 days.

mStable, a protocol for collateralized mASSETS like the basketed mUSD stablecoin, listed $4.7M of MTA on Mesa instead of on Balancer, as previosuly planned.

To highlight the difference between Mesa and Balancer, users could submit buy orders on the mUSD/MTA trading pair leading up to the sale. Once the sale started, Mesa leveraged Gnosis’s ring trades to essentially sell the 2.6M MTA in batches to the highest bidders. This design prevented front-running and was aimed at offering a more equitable means to price discovery.

Despite some slight hiccups regarding Mesa resolvers, the auction settled at roughly $1.77/MTA - over 10x above the initial seed price of $0.15 per token.

MTA is live on Balancer, currently trading at just under $4 per token at the time of writing. With 75,000 fueling MTA/mUSD incentives for the first week, the primary liquidity pool for MTA has jumped to over $4.5M in liquidity in less than 72 hours of being live.

Balancer Launches First Governance Polls

Balancer’s BAL token holders were able to participate in the platform’s governance for the first time.

Using a snapshot of user’s BAL holdings, the voting interface offered three polls for tokeholders to decide on different liquidity mining incentives.

balFactor - BAL liquidity now enjoys a 1.5x multiplier and a capFactor of $50M (5x more than other assets at $10M)

feeFactor - The fee curve was adjusted to make BAL rewards more equitable to pools with higher swap fees.

softpegFactor - Pools with soft-pegs (WETH/sETH, USDC/mUSD) receive a 0.7x multiplier as to further incentivize useful liquidity.

All three polls passed with an average of 95% consensus, a sign that BAL-based voting had the desired intention of siphoning off counter opinions from farmers who were voting on Discord polls and had no vested interest other than to dump BAL the second it was received.

Given the 7 day MVP-like nature of the voting interface, we expect BAL governance tooling to ramp up in tandem with new proposals in the coming weeks.

Mastercard Announces Expansion of Cryptocurrency Efforts, Inks Card Deal With Wirex: The Block

Mastercard announced Monday an expansive bid for bringing more cryptocurrency and fintech companies into its card-issuance network, The Block reported. The payments giant said in a press statement that it was unveiling "the expansion of its cryptocurrency program, making it simpler and faster for partners to bring secure, compliant payment cards to market."

Hope you’re enjoying The Defiant. If you are, spread the word!

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

Click here to pay with DAI. There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the founder: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.