Wall Street is Paying a +500% Premium to Own Ether

Also, smart contract wallets are still tiny compared with total Ethereum accounts, dPiggy launched no-loss investment, Ethereum-based Sila raised $7.7m to replace ACH.

Hello Defiers! Lots going on in DeFi:

Smart contract wallets’ usability represent the road to mass adoption, yet they’re only a tiny fraction of total Ethereum accounts, Ganesh Swami says in part 4 of The Flippening series

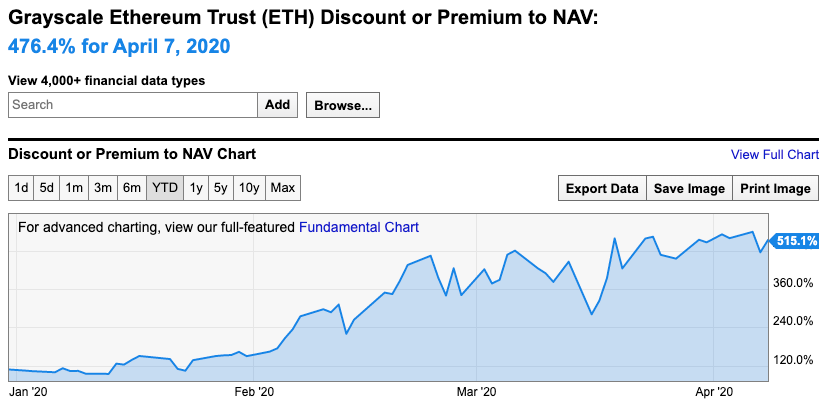

Shares in Grayscale’s Ethereum Trust are trading at a 515% premium to net asset value as institutional investors are left with few options to get ether exposure

dPiggy launches a no-loss crypto investment platform

Ethereum-based Sila raises $7.7m in seed round to replace ACH

Bitcoin-backed token launched on Tezos

and more!

🎙Also, in case you missed from yesterday, The Defiant’s first podcast episode is live! Click here to listen to the interview with MakerDAO founder Rune Christensen.

📢 And Gitcoin grants are still going! Tomorrow is the last day so now is your chance to contribute if you still haven’t. Help me scale up The Defiant team by donating or recommending that friends do. Just 1 Dai goes a long way —it’s being matched by 57 Dai right now!

The Flippening – Part 4

Ethereum’s Road to Mass Adoption -Smart Contract Wallets

By Ganesh Swami, co-founder of Covalent

Exclusive for The Defiant

Recap

In previous op-eds of my series “The Flippening”, we looked at 1) Ethereum maturing beyond simple token transfers and 2) crypto-backed stablecoins trying to hold their ground against more centralized, fiat-backed stablecoins.

In this part, we will look at smart contract wallets – a unique feature that’s only possible because of the power of smart contracts on Ethereum.

Why Smart Contract Wallets

Everything on Ethereum revolves around the concept of an account, which is quite different from blockchains likeUTXO-based Bitcoin.

From the Genesis block, there were 90 million addresses seen on Ethereum, growing at roughly 90,000 new addresses per day. Ethereum accounts are of two kinds: 1) regular, externally owned and 2) smart contract-based.

Regular accounts are secured by a private key and the user is then responsible for the security of that private key. If they were to lose the private key or a malicious person got hold of their key, the user would have lost their funds forever.

Beyond regular accounts, it’s possible to “install” a smart contract at an account address, enabling a wide array of functionality. These functions substantially improve the security and usability of Ethereum —opening up the route to mass-adoption.

Over the last two years, lots of smart contract wallets have come to market. These wallets boast gasless transactions, social recovery, native DeFi integrations, etc. – exciting features that are substantial improvements over the status quo.

The Smart Contract Wallet Flippening

Smart contract wallets are crucial for the mass adoption and acceptance of Ethereum by main-stream users. Thus, it’s important to understand the traction of these wallets.

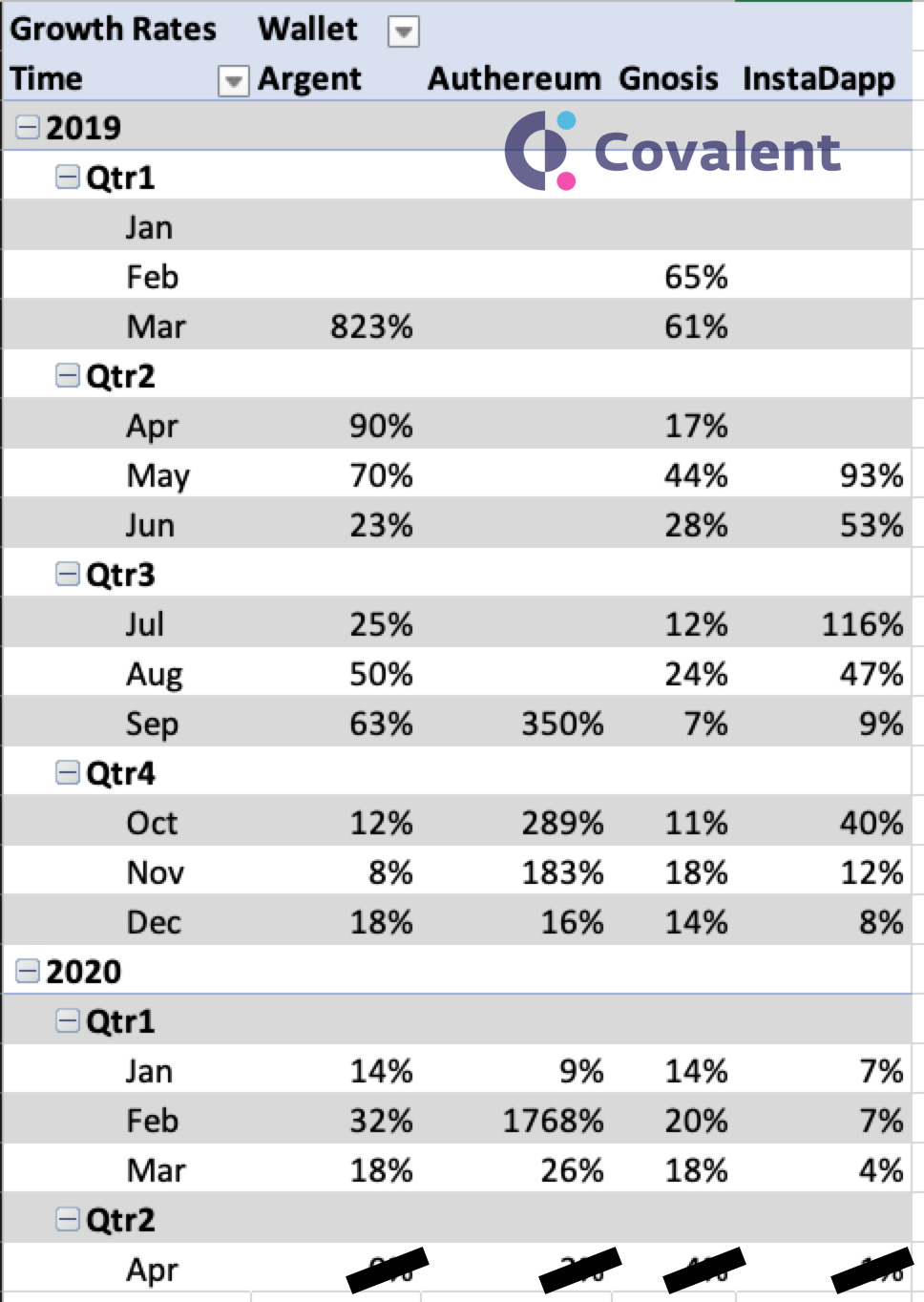

There are many smart contract wallets on the market – Argent, Dapper, InstaDApp, Gnosis Safe, Authereum, Dharma, Maker’s Vat, etc. We’ll focus on four wallets that are general purpose and multi-protocol: Argent, InstaDApp, Gnosis Safe and Authereum.

With our knowledge that 90,000 new addresses are being added everyday, here’s a total count of the number of smart contract wallets added over the last 15 months.

A lifetime count of 30,000 smart contract wallets.

These are tiny numbers. For comparison, Facebook added a million users in its first year of operations. We still have a long way to go.

Still, I crunched some more numbers with account balances, cohort retention rates and growth rates.

Here’s a pivot chart with month over month growth rates of these wallets. Some observations:

Growth outliers come from funding announcements (InstaDApp in Oct 2019, Authereum in Feb 2020)

Gnosis has the longest history and has consistent double digit monthly growth. Really impressive.

Conclusions

Smart contract wallets are a cornerstone of Ethereum’s future. The next one billion users will be onboarded using these wallets, but we are not there yet. We’ll see what these numbers show six months from now.

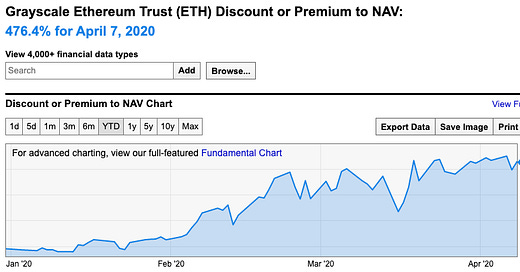

Ether Trust Premium Surges to +500%

Wall Street is paying a near record premium to have exposure to ether.

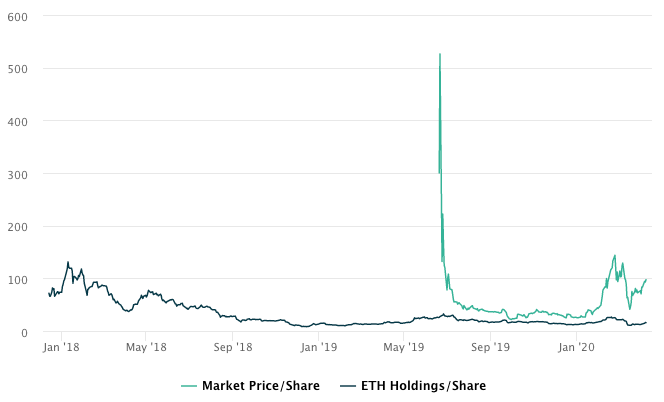

Shares in Grayscale’s Ethereum Trust, ticker ETHE, are trading at a 515% premium to the fund’s net asset value. Ether holdings per share in the fund were worth $15.85, while market price per share was $97.5 as of yesterday’s close. That gap is near the widest since ETHE first started trading in OTC markets at a crazy 1,150% premium in June, probably because of lack of liquidity.

Image source: grayscale.co

This time the widening premium likely reflects investor appetite to own ether, except they’d rather hold shares of a trust than the actual cryptocurrency to avoid any regulatory and tax uncertainty, or have to deal with digital wallets and custody of private keys.

The premium, which started to pick up in February, continued to rise even after the March 12 crash, when ether plunged more than 40% in one day to $112, probably on speculation the selloff had gone too far.

Image source: ycharts.com

This gap would normally be a juicy opportunity to arbitrage, but shares are subject to a one-year holding period after they’re created, making it hard to trade them.

Investor “Protection”

The main reason for this gap to exist in the first place is that ETHE is one of the few ways investors can get regulated securities linked to ether. Demand for the fund pushes the share price above its actual ether holdings. The same happens with Grayscale’s Bitcoin Trust, GBTC.

Crypto ETFs, which would open the doors for retail investors and more closely track the actual price of the cryptocurrency, have been long heralded as a solution, but don’t have the green light from US regulators. ETHE is only open to accredited investors, and has a minimum investment requirement of $25,000.

But by shutting off crypto ETFs trying to protect investors against what they deem opaque and illiquid markets vulnerable to manipulation, regulators are leaving traders with no choice but to buy ether and bitcoin at many times its actual value, if they want to stay within the confines of traditional markets.

GBTC Premium at Just 12%

While GBTC has had premiums of over 100% at the peak of the 2017 bubble, the current spread is merely at 12%. The lower premium for GBTC might be explained because the fund is more liquid with $2.2 billion AUM and 316 million shares outstanding, versus $189 AUM and 12 million shares for ETHE.

Beyond liquidity, US investors who want to get exposure to Bitcoin at least also have CFTC approved bitcoin futures. Ether, which is the only crypto other than bitcoin classified as a commodity by regulators, still doesn’t have its own regulated futures. Right now, ETHE is the only avenue for Wall Street.

There’s Now a “No Loss Investment” Platform on DeFi

Decentralized finance has enabled a no-loss lottery with PoolTogether, no-spend charity with rTrees, and now there’s dPiggy, a platform which enables no-loss crypto investing.

As with PoolTogether, rTrees and other similar projects, dPiggy is based on redirecting interest gained on crypto deposits. Dai deposits on dPiggy are sent to Compound Finance, where they start gaining interest. Users choose where they want to invest that interest and at the end of the month, it will be automatically used to buy their chosen crypto on Uniswap.

Image source: dpiggy.com

Auctus Project, the company behind dPiggy, charges 0.1% annual fees of the amount invested, which are used to buy and burn AUC tokens. Auctus issued AUC tokens in an April 2018 ICO. dPiggy is a departure from the company’s original idea to make a smart-contract powered retirement planning platform.

Bitcoin-Backed tzBTC Launches on Tezos

The Bitcoin Association Switzerland together with a group of crypto firms launched a token that’s backed 1-to-1 with Bitcoin to be traded on the Tezos blockchain. tzBTC, as the token is called, would allow Bitcoin holders to use Tezos applications without relinquishing their BTC, bringing liquidity to the network.

This is the latest effort to bring Bitcoin to other chains. Ren Project, Keep Protocol and others are working to bring Bitcoin to DeFi on Ethereum. While these projects are trying to enable cross-chain transactions in a trustless way, tzBTC relies on third parties. Four companies known as Keyholders are the only ones able to mint and burn tzBTC, while five organizations known as Gatekeepers are in charge of doing KYC and AML checks on investors who want to buy the token. An independent third party is meant to issue quarterly audits to confirm that the amount of BTC in custody by Keyholders equals the amount of tzBTC in circulation.

Tezos Founders Drama

Separately on Tezos, there’s growing concern in the community that founders Arthur and Kathleen Breitman are distancing themselves from the project. Arthur’s name was removed from Tezos’s Technical Steering Committee, and Kathleen said on Reddit her blockchain game Emergents may not launch on Tezos: “Candidly, I have a lot of concerns about the platform,” she wrote.

Programmable Fintech Payments Startup Sila Raises $7.7M Seed to Wipe Out ACH: TechCrunch

Sila, a payments and banking API infrastructure company designed to supplant ACH, raised a $7.7 million seed funding round led by Hope Cochran of Madrona Venture Group and Rick Holt of Oregon Venture Fund. Sila follows the ERC-20 token protocol and is built on top of the Ethereum blockchain. Shamir Karkal, one of the co-founders, founded Portland-based Simple in 2009, one of the first “neobanks,” which was sold to BBVA for $117 million in 2014. Karkal spent several years integrating Simple’s systems into BBVA’s and building the company’s API products, until he got tied of the bureaucracy of large banks.

Codefi Launches Inspect to Boost DeFi Transparency

ConsenSys-backed Codefi launched Inspect, an open source platform with the goal of helping disclose critical security information about decentralize finance projects, including audits and teams’ control over the protocol.

Image source: inspect.codefi.network

Risk/Reward of liquidity provision in AMMs: AlfaBlok

This AlfaBlok report compares returns of holding ETH versus depositing it to a liquidity pool in an automatic market maker, such as Uniswap. It concludes that pooling outperforms when 1) there’s lateral or slightly decreasing movement of the underlying asset. If the price increases or decreases dramatically, the strategy starts under-performing 2) when transaction volume outpaces liquidity added to the pool.

“Combined with the experience during Black-Thursday, the analysis suggests that this is in the whole, a defensive strategy, that can heavily outperform in times of turbulence, and provide an interesting hedge during mild price decreases.”

Image source: alfablok.substack.com

Jack Purdy of Messari says DeFi activity is soaring this year.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

Click here to pay with DAI.There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the author: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.