Uniswap Liquidity Plunges After UNI Rewards End

and now holders can opt to extend the program. Also, DeFi protocols have lost ~$16M in flash loan attacks.

Hello Defiers! Here’s what’s going on in DeFi,

Uniswap liquidity plunges after UNI rewards end

DeFi protocols have lost ~$16M in flash loan attacks just in the past week

Bitcoin climbs to record market cap

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($10/mo, $100/yr).

📺 Watch The Defiant’s New YouTube Video on Social Tokens

Video producer Robin Schmidt dives into social tokens in the latest Defiant video, produced in partnership with Harmony Protocol.

🎙Listen to the interview in this week’s podcast episode here:

🙌 Together with Zerion, a simple interface to access and use decentralized finance, and1inch.exchange v2, which aims to provide the best rates by discovering the most efficient swapping routes across all leading DEXes.

Uniswap Liquidity Plunges After UNI Rewards End

Uniswap’s total liquidity has almost halved after the decentralized exchange ended its token rewards program on Monday afternoon.

Down to $1.8B from a peak of $3.3B just 24 hours earlier, the drop in liquidity goes to show how powerful UNI rewards were for attracting capital, good for the #1 spot on DeFi Pulse’s TVL leaderboard since rewards started on September 18th.

Volume Rises

Despite the drop in liquidity, the DeFi exchange’s volume is up by more than $370M, or 47%, over the past 24 hours as yield farmers shift capital around to new opportunities.

New Menu of the Week

Other projects are now looking to siphon off yield-hungry traders by offering incentives of their own, best highlighted by SushiSwap boosting SUSHI rewards and Bancor’s BNT liquidity mining released yesterday.

SushiSwap modified its Menu of the Week, or the rotating SUSHI rewards in exchange for providing assets to different liquidity pools across DeFi, to increase incentives on the four pools Uniswap was incentivizing.

The project tweeted the following table:

BNT Rewards

With Bancor, 100k-200k worth of BNT is now allocated to 6 ‘high-cap’ pools on the protocol, including WBTC, DAI, USDT and USDC - the same pools incentivized by Uniswap on its own platform prior to UNI rewards ending.

While 70% of the rewards are allocated to the BNT side of the pool, Bancor is encouraging LPs to stick around by offering a Bonus Reward Multiplier for up to 2x rewards to those who keep liquidity locked for longer periods of time.

TVL Surges

At the time of writing, SushiSwap’s TVL is up 62% while Bancor’s is up 41% according to DeFi Pulse, many times higher than increases on Curve and Balancer.

Not the End

But this may not be the end for UNI rewards. Community governance is now discussing a plan to continue UNI rewards at a reduced rate of 5M in monthly UNI rewards as opposed to 10M per month from the genesis program.

UNI holders can now vote on a Temperature Check Snapshot proposal to signal whether or not they would like to see the plan pushed to a Consensus Check.

Over-Incentivized

The release of UNI solidified Uniswap’s dominance in the DEX landscape, with TVL spiking from $518M following the SushiSwap vampire attack to a peak of $3.3B over the course of two months. The increased liquidity improved pricing even when compared with centralized exchanges.

Still, even Uniswap CEO Hayden Adams commented that “while it was cool seeing Uniswap have lower slippage on ETH/USD than Binance and Coinbase, $3B was (probably) a bit excessive over-incentivized at this stage.”

Sponsored Post

Inclusive Pool to Launch on Wing Platform

The Inclusive Pool, to be launched on the Wing Platform, is the first DeFi project of its kind due to the integration of credit-based digital lending. With decentralized finance (DeFi) erupting recently in the blockchain industry, Wing has taken advantage of the tailwind by implementing Ontology’s OScore feature into its lending platform.

Through its Inclusive Pool, users will be able to receive real-time adjustments to interest rates or collateral requirements based on a digital credit score known as an OScore. This credit score is a combination of a user’s historical transactions, as well as their current asset list within their digital wallets. In short, users will be rewarded with lower interest rates and be able to under collateralize assets if they have an overall positive OScore. A user’s score will increase with actions resulting in positive externalities to the overall community such as promptly paying back loans.

In the grander scheme of things, utilizing a credit-based system is imperative to the development of the overall DeFi market because it drastically increases the liquidity of assets, in addition to further strengthening trust amongst the community. With more liquidity, users are free to lend and borrow more frequently based on individual needs, in addition to being no longer tied to traditional collateral rates which can hinder growth or investments.

The Inclusive Pool is scheduled to be launched towards the end of this month. For further details, you can follow Wing’s Twitter or join the Wing DAO Telegram discussion for real-time updates.

Attackers Drain $16M+ From DeFi Protocols in One Week

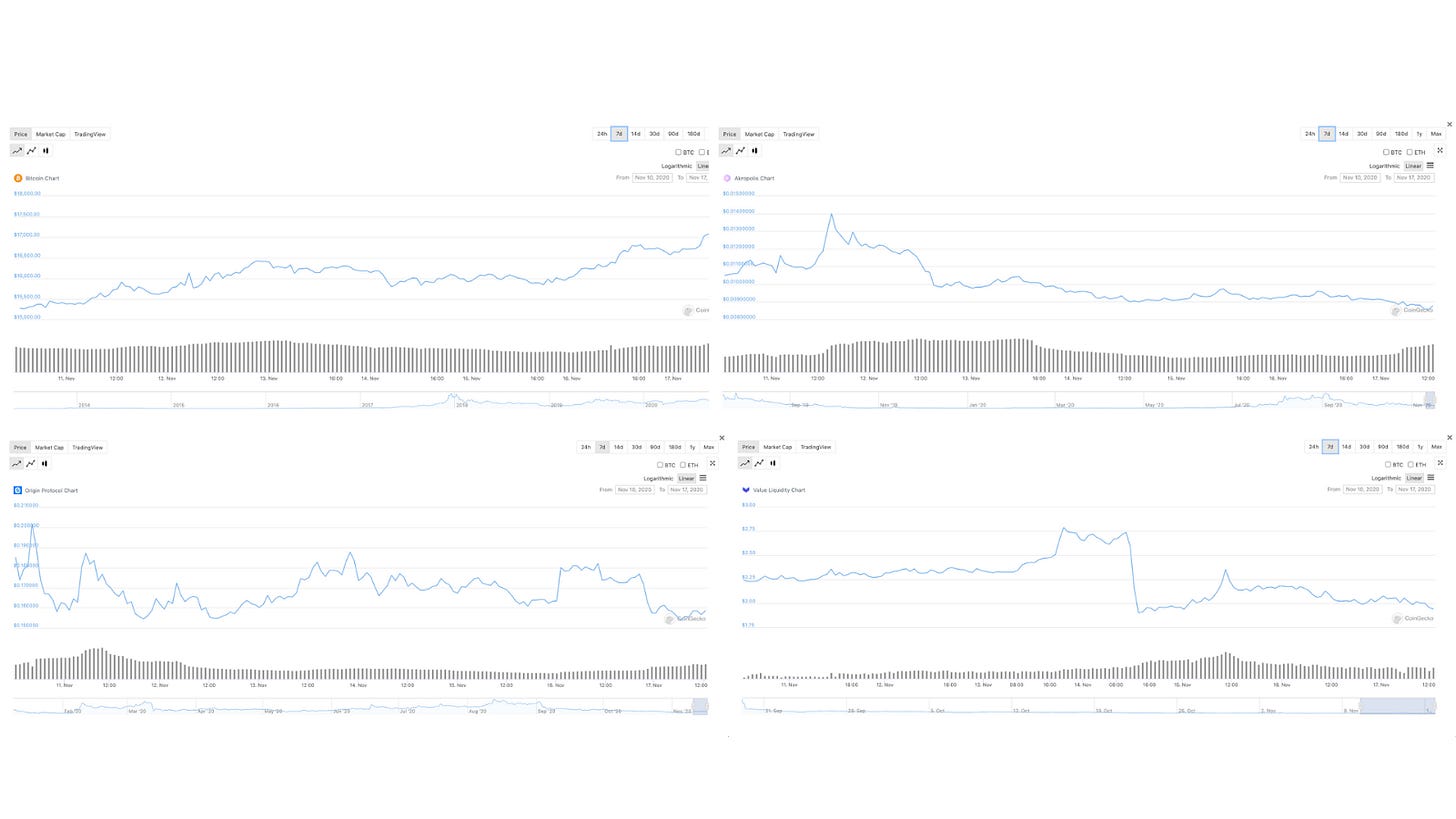

Hackers were able to drain $16.4 million in ETH and Dai from DeFi projects Akropolis, Value DeFi Protocol, and Origin Protocol using flash loans, just in the past week.

Value DeFi Attack

An attacker on Value DeFi swapped flash-loaned ETH for DAI and USDT, deposited part of the flash-loaned DAI into Value DeFi's multi-stablecoin vault. They then conducted a series of stablecoin swaps between USDT, USDC, and DAI designed to exploit the pricing used by the Value DeFi vault's withdrawal method, resulting in a loss of $7.4M, before the hacker returned $2M, according to the team’s post-mortem.

Value DeFi has halted vaults as every depositor’s balance is captured before the time of the attack to calculate exact compensation amounts.

Origin & Akropolis Attacks

For Origin Protocol, which was hacked for $7M, this method continues with washing and rinsing the flash loans on liquidity platforms such as Uniswap. Meanwhile, deposits to vaults are disabled as the company warns not to buy any OUSDs as current prices do not reflect its underlying assets. The team anticipates a plan to compensate users if Origin is unable to recoup user deposits.

For Akropolis the incident, resulting in $2M drained, was due to an exploitation of pooltokens minted without being backed by assets. Akropolis has added checks for deposit tokens and re-entrancy guards for deposits and withdrawals. Next week the team plans to do additional contract testing and gradually re-open AKRO & ADEL staking pool for deposits.

Flash Loans

Flash loans allow users to borrow from a DeFi protocol without putting up collateral as long as the loan is paid back on the same block. This has enabled speculators to exploit protocol vulnerabilities without the need of massive amounts of initial capital. These attacks have been on the rise as 2020 has lured in new users with generous APYs (annual percentage yield) that surpass traditional banking accounts.

Sentiment in the DeFi community is split among those who see flash loans as dangerous tools, which jeopardize users’ funds, while others believe they simply allow protocol flaws to be exposed sooner. If one thing is clear, they’re helping weed out weaknesses in the space, albeit at a high cost for some users.

As we approach the end of 2020, $346 million has been stolen across DeFi protocols to date, according to Crypto Briefing. What is next for these protocols is working with security firms to retrace and retrieve the lost funds.

Bitcoin Market Cap Climbs to Record High

Bitcoin’s market capitalization is at a record, crossing $330B for the first time ever, according to CoinGecko.

Bitcoin has rallied in the past two months, gaining more than 50%, as less uncertainty around the US election and a potential COVID-19 vaccine is luring investors to risker assets. The BTC price at almost $17,700 is the highest since January 2018, but still 13% below the December 2017 record of almost $20,000.

The discrepancy between BTC price and market cap is because of the increased circulating supply, which at 18.5M BTC compares with 16.8M on the previous market peak, or about 10% higher, according to CoinMetrics.

ETH Market Cap

Meanwhile, Ethereum’s market cap of $54.7B is at the highest since June 2018. The ETH price of $482 is at the highest since July 2018, and 65% below its all-time high. ETH supply of 113M is 17% higher than supply at the January 2018 market peak.

Eth in smart contracts is rising, while ETH on centralized exchanges slides, meaning more people are putting the cryptocurrency to work in DeFi.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

About the founder and editor: Camila Russo is the author of The Infinite Machine, the first book on the history of Ethereum, and was previously a Bloomberg News markets reporter based in New York, Madrid and Buenos Aires. She has extensively covered crypto and finance, and now is diving into DeFi, the intersection of the two.