The State of Ethereum Dexes: Open and Trustless Wins the Race

Hello Defiers! Decentralized exchanges are the driving force behind DeFi and Ethereum itself, powering the most basic building block, the starting point needed for all other more complicated actions: facilitating the buying and selling of tokens. Dexes have made the cypherpunk dream of a censorless, parallel financial network, actually possible, by enabling people, all over the world, to exchange value, instantly, with minimum fees, across borders. All thats’ needed is a blockchain address and internet connection. In the past two years, Ethereum Dexes have had explosive growth, as innovations such as liquidity pools and simplified interfaces have made them more accessible and easier to use than most centralized exchanges.

Still, Defiant contributor Lucas Campbell, shows there’s a long road ahead for Dexes overtake Cexes, but he makes the case for why that’s bound to happen. The numbers he has crunched on climbing earnings and volume point to a bright future, and will give you a detailed overview on the state of the most important sector in Ethereum.

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for 70 Dai/yr vs $100/yr).

🎙Listen to this week’s podcast episode here:

🙌 Together with Status, a secure messaging app, crypto wallet, and Web3 browser.

Open and Trustless Wins the Exchange Race

Dexes are taking on more and more volume and quickly gaining ground versus centralized counterparts. This means earnings are rising too, and while the numbers are small compared to Cexes, in the decentralized world, anyone can benefit.

It may be a slow, long battle to supersede our centralized overlords. But in the end, it will be a no-brainer for people to trust an open, decentralized protocol over a closed, centralized bank. Since January 2019, Ethereum’s liquidity protocols and applications have increased their market share relative to CEX volumes by 5x, up to 0.6% from 0.12%, according to The Block’s Larry Cermack.

With rising volumes, come rising earnings. Annualized revenues for major DEXs are on track to reach new highs this year as forecasted sector earnings approach $12M, according to Token Terminal data. Because of their permissionless nature, many protocols allow anyone with an Ethereum address to become a liquidity provider and earn a piece of the fees.

DEX Volume Surges

Ethereum’s DEXs have traded over $3B in total volume in the first six months of 2020, compared to the $2.4B in all of 2019. Moreover, DEX volumes have seen a massive spike upwards since the beginning of the year. In January, cumulative weekly volumes averaged around $61M across major DEXs. Only three months later, average volumes increased by 213% to reach ~$193M in March. The biggest increase came from Black Thursday - a day where crypto asset prices were cut in half in response to the COVID19 pandemic - as major DEXs aggregated over $400M in trading volume that week alone. Since then, trading activity has remained steady as Ethereum DEXs average around $184M in weekly volume as of May 2020.

(Above) 2020 DEX weekly volumes by project

Uniswap is the dominant force in the DEX sector. Since the beginning of the year, the liquidity protocol has seen nearly $755M in trading volume, beating out the rest of the field. Kyber and dYdX took second and third as they experienced similar volumes of $562M and $538M, respectively. The other major player includes 0x, which launched its v3 upgrade in late 2019, as the protocol facilitated over $400M in cumulative volume this year. The two lowest in cumulative volumes in 2020 include AirSwap, which was acquired last week by ConsenSys, and Bancor - the tokenized liquidity protocol which raised $153M in the midst of the 2017 ICO Bubble, one of the largest sales at the time. Kyber, IDEX and 0x also did multi-million ––though sub $100M–– ICOs between 2018 and 2017.

While Ethereum’s DEXs are growing, they aren’t even close to competing with its centralized counterparts. According to Messari’s ‘Real Volume’, major centralized exchanges trade for a total of $5.83B. In a single day. Yes, that’s correct. Centralized exchanges facilitate nearly 2x more trading volume in a single day than Ethereum’s DEXs have done all year. We’re not even close to adoption yet, even when limiting our perspective to just the crypto space.

(Above) Total DEX volumes in 2020

The positive sign is that the DEX landscape has evolved drastically since 2019. The space is becoming more diverse, as a greater number of players capture bigger slices of the volume pie.

According to Dune Analytics, IDEX dominated the sector in 2019 as it aggregated over $853M in annualized volume last year. The next closest competitor was Maker’s Oasis which reached just shy of $500M in total volume. Ranks three, four, and five went to Kyber, Uniswap, and 0x, respectively, as the liquidity protocols generated $200-$400M each in total volume over the course of last year.

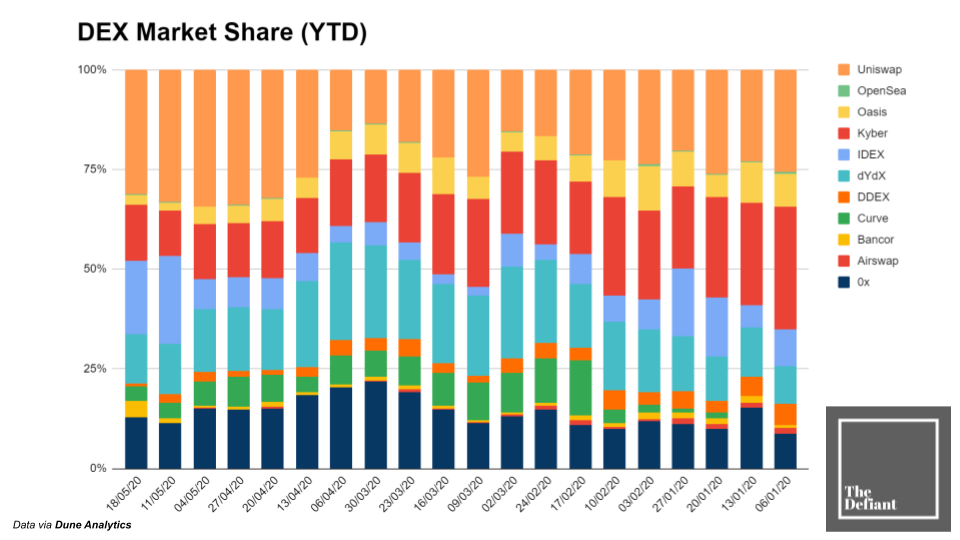

In terms of market share, Uniswap is king in 2020. Despite only bootstrapping the protocol with a $100K grant from the Ethereum Foundation in 2018, Uniswap is responsible for nearly 25% of all DEX volumes year-to-date, though the next closest player, Kyber Network, has been gaining ground, with 18.5% of the market. dYdX follows with 17.76% The only other liquidity protocol with a double-digit market share is 0x with ~13.8%.

The remaining liquidity protocols and DEXs - Airswap, Bancor, Curve, DDEX, Oasis, and OpenSea - combine for the remaining ~25% of the DEX market share as they culminate for over $750M in volumes this year alone.

(Above) Volume market share by project in 2020

Earnings Near Record

Projected annualized earnings for major DEXs tracked by Token Terminal ––Bancor, IDEX, Uniswap, dYdX, 0x, and Kyber–– are on track to touch a new high this year at $12M. For DEXs, earnings are primarily driven by trading volumes, as the platform will usually take all or part of the fees paid by traders. The previous high was almost $12.5 million in March, when volumes spiked due to Black Thursday and uncertainty in financial markets.

Earnings snapshot 05/31 via Token Terminal

Looking at specifics, Kyber is punching above its weight. While it’s second in cumulative volume in 2020, the platform is leading with $2.5M in estimated earnings. dYdX is second with $1.9M, and Uniswap is third, averaging $1.5M in annualized revenues to liquidity providers. 0x is also on the board with seven-figure average revenues of $1.3M. The two remaining DEXs - Bancor and IDEX - are on track to accumulate roughly $415K and $182K in earnings based on the data so far.

Still, if you took a snapshot today, Uniswap is the highest projected earner as the protocol is forecasted to generate $4.5M in revenue, according to Token Terminal.

(Above) 30-day average annualized earnings for major Ethereum DEXs

In terms of market share for DEX earnings, Kyber is leading the field as it represents 32% of all liquidity protocol revenues in 2020. This is followed by dYdX holding a 24.4% share. Uniswap and 0x have similar rates as they account for 19.29% and 16.66% of revenues, respectively. That said, Uniswap has made a major move in recent weeks as the liquidity protocol’s average weekly volumes surged to ~$61M, up from ~$14M at the beginning of the year.

When it comes to earnings, the comparison with CEXs is also bleak. Binance alone burned over $52M last quarter - nearly 5x higher than what DEXs are projected to earn in the entire year - and that’s allegedly only a fraction of Binance’s total earnings.

(Above) Market share for 30 day average earnings by project.

Bright Long Road

While DEXs have slimmer earnings than CEXs, they also have a secret weapon: Open, permissionless, transparent operations. Anyone in the world with an internet connection can access Uniswap or Kyber as a trader or a liquidity provider. No KYC required either. The cherry on-top is that everyone can know what the protocol is earning (updated every ~15 seconds) and look at what’s going on under the hood. At this point, it’s nearly impossible to know what Binance is earning as they’ve changed the literature in their documentation over the years.

Uniswap’s forecasted earnings? $4.98M. Kyber’s? $2.28M.

That’s the benefit of open, permissionless liquidity protocols. Anyone knows what’s happening and anyone can easily opt-out. In the long run, we may even see the Protocol Sink Thesis take into effect as CEXs elect to adopt permissionless liquidity protocols to facilitate their trading and minimize overhead.

While we’re only at the tip of the iceberg for DEX adoption and DeFi at large, there’s a bright (but long) road ahead.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

Click here to pay with DAI.There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the founder: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.