The Nifty Ways That NFTs Become DeFi

From liquidity mining to interest-gaining tokens, non-fungible tokens are increasingly integrating with decentralized finance, shows DappRadar report

Hello Defiers! Today DappRadar has an in-depth report on the fast-moving non-fungible tokens space. NFTs are tokens that have unique characteristics and aren’t interchangeable with each other; they’re meant to represent things and not currencies, and as trading volume and prices show, they’re taking off.

DappRadar dives into new token standards gaining adoption beyond ERC721, and new Layer 1s beyond Ethereum that are supporting trading. They also explore how the use of liquidity mining strategies found in DeFi are being used by NFT platforms; how some of these strategies have resulted in low quality art and which have resulted in more genuine engagement. The report also highlights the different ways that NFTs and DeFi are starting to interact, from NFTs to insure financial assets, to interest-bearing tokens. It’s clear we’re just starting to realize what the full potential of these unique digital assets can be. Read below to see how.

📺 Watch The Defiant’s New YouTube Video on Social Tokens

Video producer Robin Schmidt dives into social tokens in the latest Defiant video, produced in partnership with Harmony Protocol.

🎙Listen to this week’s podcast episode with SBF & Solana’s Anatoly:

The open economy is taking over the old one.Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($10/mo, $100/yr).

🙌 Together with Zerion, a simple interface to access and use decentralized finance, Sorare, a fantasy football game with officially licensed cards on Ethereum, and Near, a high-performance proof-of-stake blockchain that interoperates with Ethereum.

NFTs Blossom Below DeFi Canopy in One Big Forest

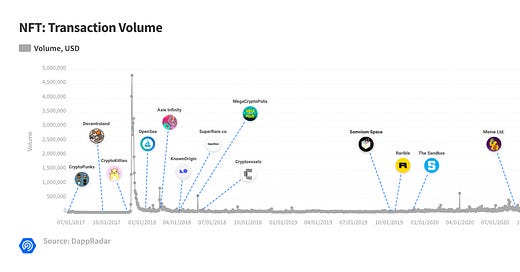

Blockchain technology goes far beyond the digital currency use case. Over the past six months, headlines have been dominated by cryptocurrencies and related projects as they spiked in value. But these assets were fungible meaning that one ETH token is identical to another ETH token. In the shadow of the DeFi canopy blossomed NFTs, and it’s all one thriving forest.

NFTs or non-fungible tokens are tokens with a unique property. If you consider popular projects that leverage NFTs: Crypto Punks or CryptoKitties, you will notice that each Crypto Punk and each CryptoKittie is its own unique entity.

Just like fungible tokens, NFTs have their own standards, the most common being ERC-721 on Ethereum. However, as experimentation and adoption grow, new standards are developing and more blockchains are incorporating.

ERC-1155 may be the next most popular standard for NFT projects. Its main advantages are that it is a multi-token standard (projects can mint booth fungible and non-fungible tokens), smart contracts can be reused for multiple issuances, and it supports batch transfers.

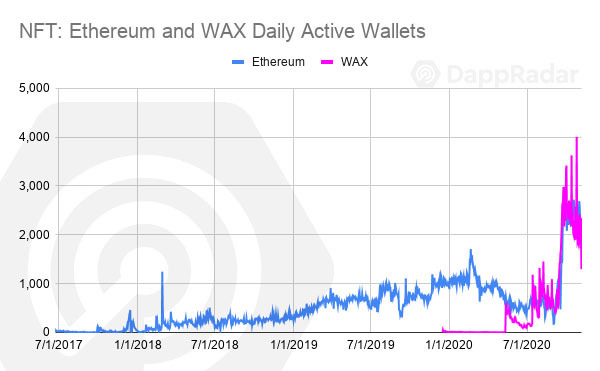

Outside of Ethereum, WAX has been making progress utilizing the technology, as has Flow. A number of other ecosystems have also been experimenting with NFTs.

Image Source: DappRadar

Image Source: BSC dapp Battle Pets

The number of use cases for NFTs is growing and given the nascent state of the technology we are likely to see many more in the coming future. The key ones so far are art, collectibles and in-game items, virtual worlds, tokenized real-world items, permissions gateways.

Image Source: Boson Protocol infrastructure for automating commercial exchanges

The sector is growing and looks to be primed to integrate with the DeFi space. As that occurs we may see a number of new asset classes enter the decentralized financial sector.

Minting and Trading

While there are many interesting use cases developing around NFTs, the ones gathering the most hype right now are in gaming, collectibles, and art. The dynamics in these ecosystems revolve around minting and trading entities.

In games and collectibles, the minting of NFTs is defined by the publisher or the development team. The team also defines the distribution of the items. These can be “claimed” as in the case of Crypto Punks, purchased at an auction, discovered in packs or crates, and so on. There is often an element of randomness involved.

Image Source: DappRadar NFT marketplaces TOP 5 dapps

However, the value of these items is determined by the market, and as such, it is critical for users to be able to buy and sell them. This has given rise to NFT marketplaces. These are in a lot of ways similar to Decentralized Exchanges (DEXs) in that they enable users to transact with their token assets.

Image Source: CryptoDiffer visualization based on nonfungible.com data

Two major types of marketplaces can be identified: native and aggregator. Native marketplaces are set up by the publisher or the project community for the purposes of transacting the items of a specific dapp and/or ecosystem.

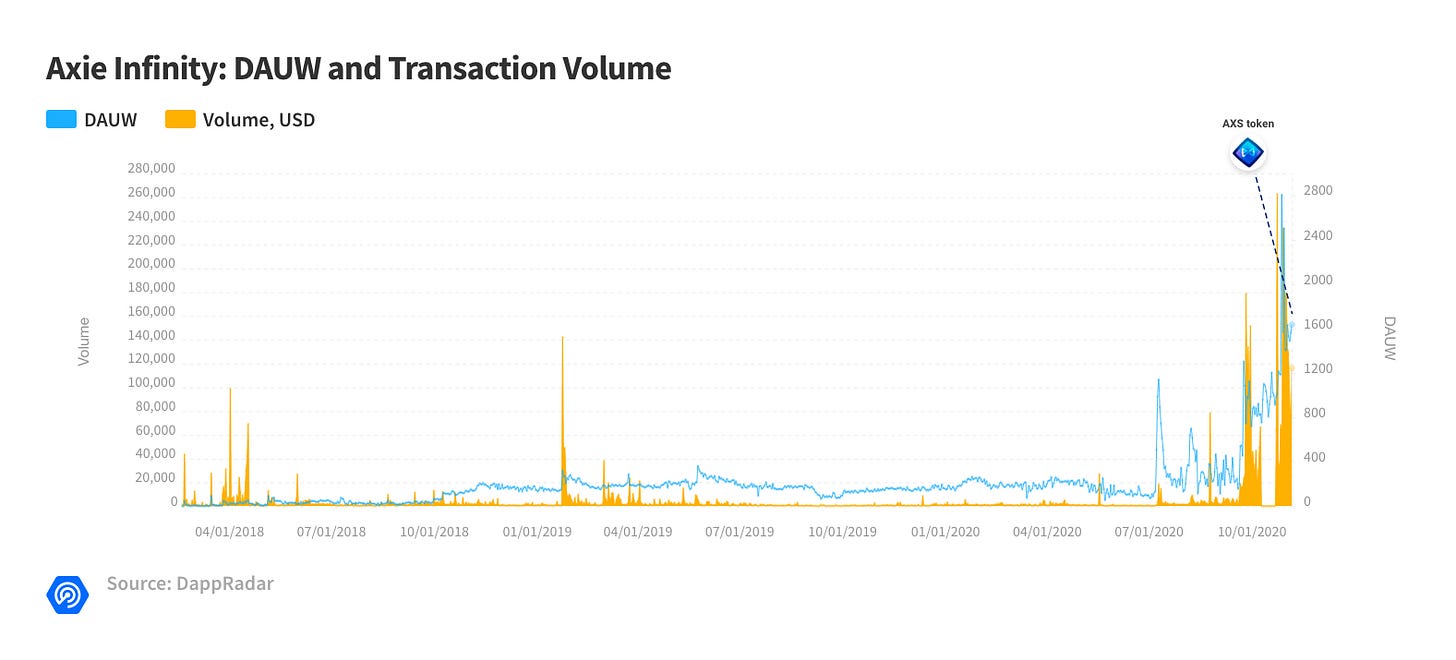

For instance, Crypto Punks have their own marketplace as does Axie Infinity. For some projects, native marketplaces may serve as the primary source of trading activity.

Alternatively aggregate marketplaces, like OpenSea and Rarible offer collectors and artists the ability to buy and sell their NFT tokens from different dapp origins under the same roof. NFT assets are relatively illiquid, so it is not surprising that volumes on NFT marketplaces are much lower than on DEXs.

The gaming space took a big hit this year because of high gas fees on Ethereum, so it is also not unexpected that the AUW numbers are considerably lower. As the sector grows the number of NFT originators and exchanges should increase, as should the activity figures.

Image Source: OpenSea top NFTs (7 days volume)

Bridging the gap to adoption

Over the past six months, DeFi has shown a kind of blueprint for quick growth to the rest of the crypto community. It remains to be seen how long-lasting the effect will be, but it looks like collectibles and art projects are starting to take note.

For instance, Rarible implemented the governance token mining model made so popular by DeFi applications. Rarible has decided to implement a distribution model that rewarded platform usage: minting and trading. This in turn created a lot of excitement around the marketplace and catalyzed activity.

Image Source: Rarible

Image Source: CoinGecko

However, this also introduced the problem of wash trading. Marketplaces are not exactly like DEXs, and the NFT space is full of nuances, so introducing DeFi strategies may result in unexpected consequences. The marketplace saw an increase in “low-quality art” being minted on its platform, as some users were simply trying to earn token rewards.

The community responded by instituting fees, but it remains to be seen if incentives become properly aligned in the long-term.

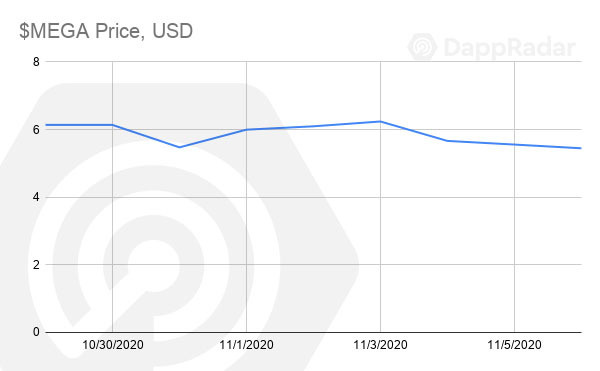

The MEME token is another example of the space adopting a DeFi strategy, and taking something that started out as satire and turning it into a functional model.

Image Source: DappRadar

Image Source: Rarible Meme Ltd. items on Sale

Additionally, the sector has started to take advantage of wrapping and fractionalization. Liquidity remains a key subject in the space and in order to bridge the gap to more liquid markets these tools can be used.

Similarly to how the Bitcoin and now Dash and Zcash communities have used wrapped tokens to enter the Ethereum DeFi ecosystem, Crypto Punks have been able to do something similar. This has resulted in a meaningful increase in activity around the project and may serve as a blueprint for other collectibles projects.

Axie Infinity has seen its collectibles sharded, allowing users to invest in expensive rare collectibles. This may generate increased interest from retail consumers as an investment in these items has become more affordable to them.

Image Source: DappRadar Shardmarketcap.io

New horizons

NFTs are starting to integrate with other financial concepts. For instance, yInsure NFTs on Rarible enables users to buy and sell insurance for certain DeFi projects. The insurance is limited, but the concept shows how NFTs can be used to create a liquid market for such an asset.

There has been some experimentation with NFTs in the Aave ecosystem. The Aavegotchi may become an interesting implementation of NFTs in DeFi. These assets are simultaneously collectibles and revenue-bearing entities. It will be interesting to see how the market ends up valuing them.

The concept of using NFT art to increase the value of memorabilia of certain items may gain more interest. Items like concert tickets can be implemented using NFTs and instilling them with art properties will make them more valued after they have been used as tickets.

Revenue bearing NFTs are also slowly making their way into the sector. First of all, NFTs enable artists to profit from secondary sales in an automatic way. This may help revitalize the music industry as well as give digital artists a way to monetize their efforts.

Furthermore, NFT tokens can theoretically carry rights to real-world sales revenue. For example, MetaFactory is implementing a concept where token holders maintain a right to a portion of the revenue from merchandise sales that use the image associated with the token.

It will be interesting to see if and how regulators evaluate these assets. NFTs add a number of different capabilities to the crypto space, and as revenue streams become attached to assets their classification may vary.

Tokenizing the real world

There are a number of initiatives that are looking to tokenize real-world assets. In these instances, NFTs can be used as ownership certificates that give the user the right to exchange these tokens for the underlying goods.

It would not be surprising to see these assets become accepted as collateral in DeFi applications. Already, we are seeing the concept of NFTs as collateral tested by NFTfi, and this may only be the beginning.

Image Source: https://nftfi.com/

Virtual worlds

The rise of NFTs has opened up prospects for virtual worlds. Projects like Decentraland and Cryptovoxells have enabled the creation of entire universes on the blockchain. The universes have properties, items, events, and more. They give users the ability to interact and own things in this virtual environment.

Ownership through NFTs has given monetization value to everything from land parcels to digital clothes. In fact, digital clothes have been a concept that has started to see monetization outside of the blockchain space, but NFTs may enrich their ownership properties.

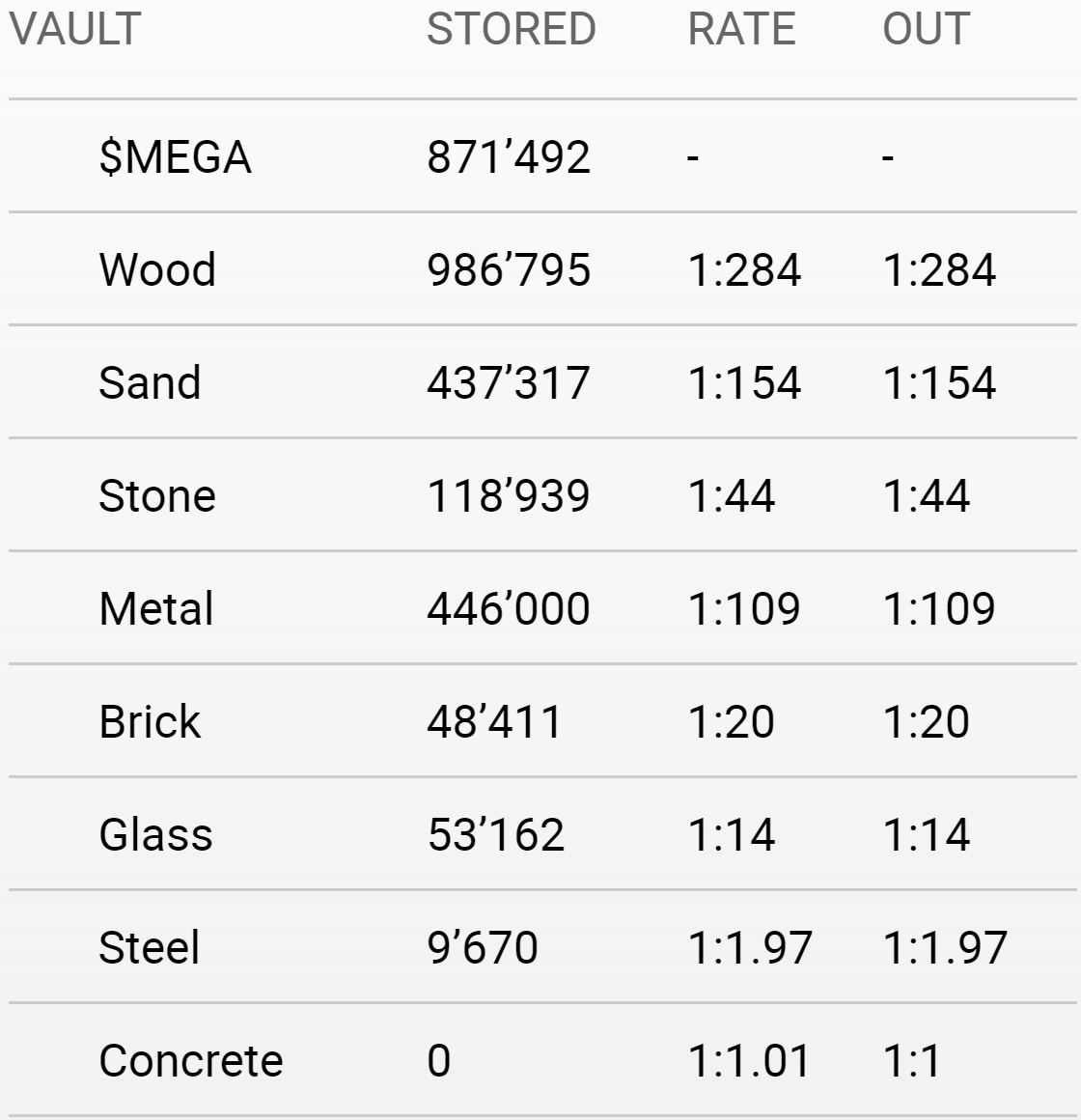

Furthermore, Megacryptopolis is trying to show that a virtual world may have its own economy. If and when games like these become more popular, their internal economies may become an important component of the broader crypto economy. Moreover, it wouldn’t be surprising to see virtual world economies link creating new opportunities for users.

Source: CoinGecko

Image Source: MegaCryptoPolis resources swap rates

Conclusions

Non-fungible tokens are an exciting instrument within the crypto industry. By guaranteeing unique properties, they open the door to a number of different assets. Everything from asset tokenization to content distribution can be enriched with NFTs.

While NFT based assets and marketplaces have limited use and scope, for now, there is growth around experimentation and implementation of this technology. This is true for both Ethereum and its competitors.

For now, most of the adoption is centered around the games, collectibles, and art segments. While these sectors have not attracted the same level of capital as DeFi, they may hold greater retail appeal. As the use of NFTs expands, the industry may see the rise of new asset classes.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

About the founder and editor: Camila Russo is the author of The Infinite Machine, the first book on the history of Ethereum, and was previously a Bloomberg News markets reporter based in New York, Madrid and Buenos Aires. She has extensively covered crypto and finance, and now is diving into DeFi, the intersection of the two.

Hello from Daniel at NFTBank.ai :)

I enjoy reading your post! For the future post, it would be great if NFTBank.ai is also covered :)

If you have time, please give it a try, NFTBank.ai (https://nftbank.ai)

If you are interested, please come to our Discord channel! https://discord.gg/3wjgKmspda