The Internet of Money Was Built This Year

Thanks to decentralized finance. A 2019 recap.

Dear defiers, in my last post for 2019, sending you my yearly review of the decentralized finance space.

2019 was the year of DeFi, with an entire movement springing to life from the seeds that were planted in 2018. Open source platforms, accessible by anyone and driven mainly by automated computer programs and less and less by centralized entities and humans, are giving rise to a whole new financial system. This was the year when an increasing number of people paying attention realized, these platforms aren’t waiting for anyone or asking for permission; they’re actually working. Developers are coming up with new solutions to make money freer, faster, better — and more fun— almost every day.

Growth was explosive by almost any metric. To be sure, most of those metrics are also small in absolute terms when compared with traditional finance and even with centralized cryptocurrency platforms — only a few hundred people use DeFi per day, and while total value locked soared, it has yet to crack $1 billion. Still, progress has been remarkable so far, considering it’s only been two years since this system started in earnest.

DeFi growth was steady throughout the year, with collateral, volume and loans outstanding increasing almost month to month. All this even amid a very volatile broader cryptocurrency market, with ETH diving from a high of over $300 to ~$130 by the end of the year. Of course, this just shows that DeFi goes beyond a single-use case and speculation, in other words #defidontcare.

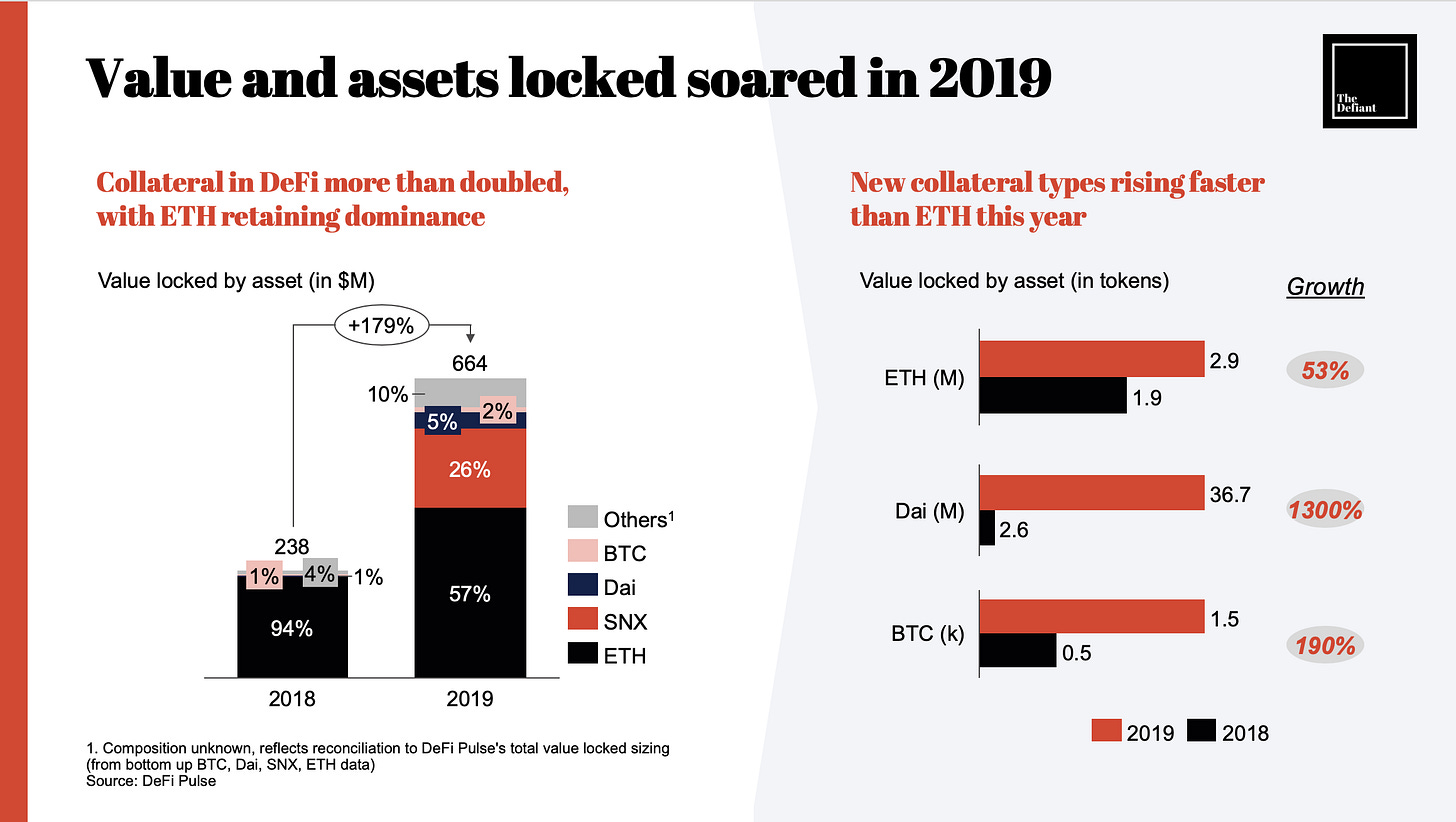

Total value locked in decentralized finance more than doubled in 2019 from a year earlier, and the number of assets used as collateral also increased.

Fast growth in the amount of value secured in DeFi points to increased use of these platforms. Greater diversity of assets used as collateral signals,

Increased use cases and user bases

Ability to scale beyond ether

Potential for Ethereum to become a financial settlement platform for all cryptocurrencies

Total value locked refers to collateral stored in DeFi platforms’ smart contracts, which is used to back mostly loans and margin trading, but also other use-cases like derivatives issuance and exchanges’ liquidity pools. It’s become the main reference to gauge the ecosystem’s activity as platforms use collateral to secure assets against borrower default when there is still no way to verify users’ identity, credit history or other financial data in a decentralized way (without trusting third parties).

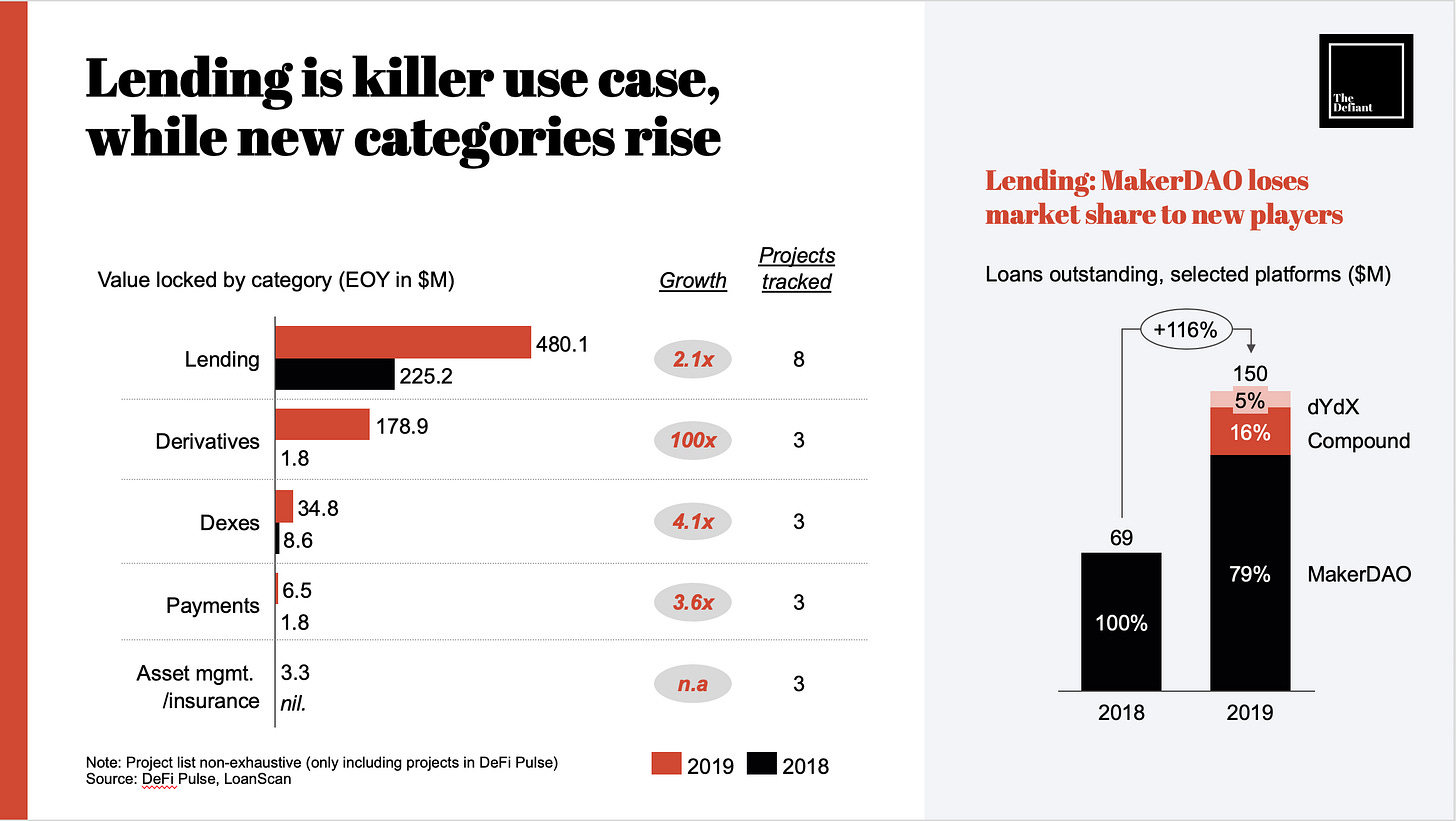

Lending continued to be decentralized finance’s dominant use case in 2019, as total loans outstanding more than doubled. MakerDAO has spearheaded decentralized lending, and was largely the sole player in that space until this year. Maker is still the main loan issuer, but new players have taken some of its market share, highlighting a maturing market. Increased competition has benefited users with improved interfaces across the board, and lower borrowing costs, pushing rates from as high as +16 percent for Dai loans in mid 2019 to around 4 percent by December.

After lending, derivatives had the biggest growth this year in terms of value locked, with Synthetix leading in the category. Derivatives are showing huge potential to lower entry barriers, allowing anyone to trade proxies of global financial assets. Synthetix offers the ability to get long or short exposure to different fiat and crypto currencies, commodities, stocks and basket of assets.

Besides lending and derivatives, there was growth in value locked and number of projects across all categories, as developers continue building a new financial system from scratch. Use-cases seen in traditional finance are being done in a decentralized way, while new functions, which just weren’t possible in the old system, also emerge. Social currencies, streaming payments, tokenized savings accounts, are only some examples. Asset management and insurance was one DeFi category which was practically invented this year, as all projects in that sector tracked by DeFi Pulse went live in 2019.

Dexes had the least number of new entrants, but improved UX caused volume to soar in Uniswap and Kyber Network. Still at $2.3 billion for Dex volume in 2019, according to Dune Analytics, they’re still processing a fraction of centralized exchanges’ volume. Development in Zero-Knowledge based scaling technology, and increased functionality in recent platform updates, should boost usage going forward.

All of these instruments and platforms are able to build on top of each other, and use each others’ infrastructure, like “money legos.” This helps to fuel growth, collaboration and and innovation, but may also increase systemic risk.

“Token” had become a bad word after the ICO craze. This year, while the narrative that “most projects shouldn’t have a token” remained, with Uniswap as the poster-child for the token-less model, they became somewhat more accepted as projects worked to find the right incentives for holders and increase their utility. Synthetix is again the standout in this aspect, as its token soared more than 2,000 percent, thanks to its staking model.

But other than SNX, increased value locked and activity didn’t always correspond to the projects’ token performance, with MakerDAO’s MKR mostly sidelining even as it continued to act as the backbone of DeFi. On the other hand, value in Augur dwindled, while its REP token gained more than 20 percent.

Decentralized finance grew by almost any metric in 2019. Thanks to open finance, crypto is more than peer-to-peer money— it’s becoming the entire bank, enabling a true internet of value. This groundbreaking innovation and the value it’s bringing users, drove the spectacular growth seen this year.

The next milestones the sector should tackle to continue growing and reaching mainstream adoption are:

Easier crypto-to-fiat on-ramps

Undercollateralized loans

Decentralized identity

Regulatory clarity

With just about two years in existence, and the almost daily progress (recorded in this newsletter) this is bound to be just the beginning.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.

Click here to pay with DAI.There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the author: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.