The Defiant's YouTube! | YFI Becoming DeFi's Token for the People

Also, UMA launches new token, Gemini custodies Unstoppable domains.

Hello Defiers! I have an announcement to make: The Defiant’s YouTube channel just launched!

📺 Check out the first of a series of videos which I teamed up with video wizard Robin Schmidt of Harmony Protocol to produce; it’s on this week’s hottest topic, YFI. You know the drill: like, comment, subscribe and hit that bell icon :)

Now, here's what’s going on in DeFi:

YFI governance is on overdrive

UMA launches fixed rate token

Gemini to custody .crypto domains

and more :)

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for 70 Dai/yr vs $100/yr).

🙌 Together with DeversiFi, a professional-grade, self-custodial exchange.

YFI Surges +70x Pushing Governance Limits

This is what radical community governance looks like.

yEarn Finance’s YFI token is one of the most interesting projects on Ethereum right now. In one week since it launched, it’s gone through a parabolic price increase, eye-popping returns for yield farmers, hundreds of millions deposited into the platform’s liquidity pools and —this is likely the most unique aspect— seven on-chain votes.

yEarn Finance is the first project on Ethereum, whose governance is entirely in the hands of token holders. While other teams like MakerDAO and Compound Finance give users the power to participate in major decisions via token-based voting, yEarn is different in that there is no foundation, early venture investors or management holding large stakes.

Earn It

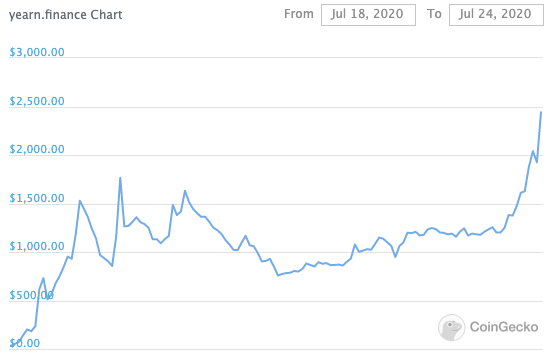

YFI is distributed among those who supply liquidity for the yEarn platform and that’s the only primary market — there was no pre-sale or initial DEX offering. The system has worked out, with YFI up more than 70x in one week, climbing to almost $2,500, a record.

Image source: CoinGecko

The “token for the people,” narrative coupled with yields of over 1,000% annually resulting from its program to incentivize liquidity (aka yield farming), have fostered an especially active community. Token holders have become so engaged in the platform, they’ve been proposing improvements and holding on-chain votes literally all week.

Proposal 0

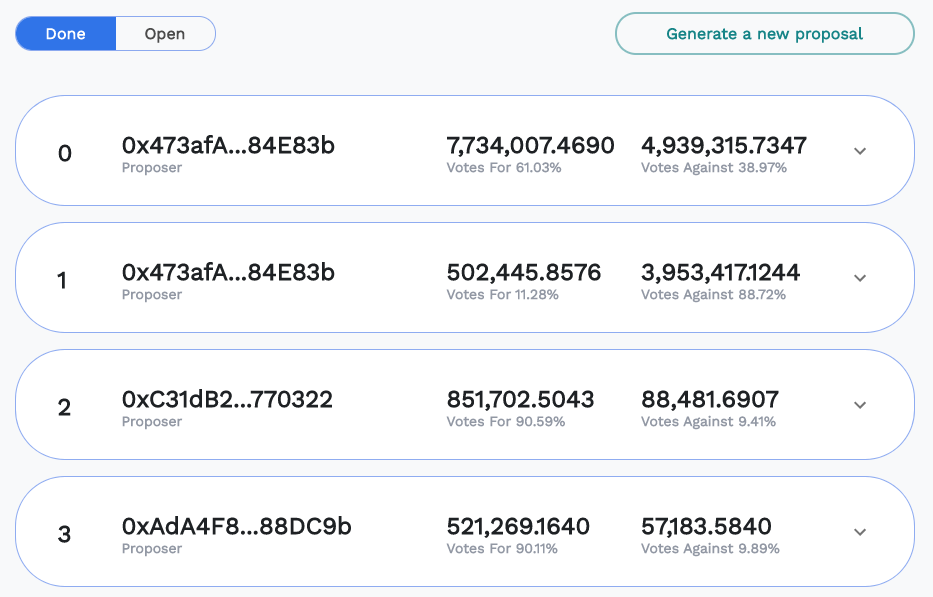

Of the seven on-chain votes held so far, the first one, called Proposal 0, passed. This proposal was to decide whether YFI supply should be capped at its current total supply of 30,000 in perpetuity or if the protocol should retain the ability to mint additional tokens in the future. 61% of participants voted to allow for YFI minting beyond the 30,000 supply.

While 63% of token holders voted in Proposal 0, the next six on-chain votes didn’t meet the required 33% quorum, so they were declined.

Image source: ygov.finance/vote

Ongoing Votes

There are six ongoing votes, with Proposal 10 attracting the most attention from token holders. Proposal 10 was made by Andrew Kang, an active crypto investor, who argues that only YFI token holders should be able to vote in yEarn’s governance. The current yEarn voting contract accepts BPT tokens, which are issued from depositing liquidity to yEarn’s Balancer Pool, of which YFI tokens represent just 2%. That means stablecoin holders’ are receiving a larger amount of voting shares than YFI holders.

“Governance should be dictated by those with the most vested long term interest of the protocol - YFI holders - irrespective of their portfolio composition,” Kang said in the proposal. “More importantly, the protocol is currently vulnerable to a hostile takeover of governance by stablecoin whales who could potentially pass a proposal to mint a large supply of YFI and disproportionately reward themselves (via favoring large stablecoin holders).”

The large majority of participants, or 99.6%, have voted in favor of the proposal. Still, with 21% of token voters participating, it’s below the quorum 22 hours before the vote ends.

DeFi Hero

yEarn’s governance left entirely in the hands of the community has elevated founder Andre Cronje to something close to a hero in the DeFi community. Cronje also gave up control over YFI issuance —which it solely held after launch to the concern of many— and put it in a multi-signature wallet, which requires 6 out of 9 participants to agree on changes. Cronje isn’t one of the signatories in the multisig.

It’s early to say whether this experiment works out. One question to look out for is whether YFI’s token holders’ interests will match the sustainability of yEarn platform, or will they privilege short term profits over long-term health.

UMA Launches Fixed Rate Stablecoin

UMA is starting to ramp up its permissionless synthetic asset platform with the release of its third token yUSD.

Leveraging the Yield Protocol, yUSD offers a fixed rate, fixed term stablecoin which expires on September 1st. This “yield dollar” allows anyone to mint tokens similar to the way DAI is minted in Maker.

Using UMA’s EMP tools, users lock collateral in the form of WETH to mint yUSD. These positions are overcollateralized to the tune of 125% and can be closed at expiry for $1/yUSD.

Image Source: UMA Project

What’s different about yUSD from DAI is that interest rates change relative to the time in which the tokens are minted, and are fixed throughout the life of the position. This is unlike Maker’s Stability Fee for borrowing and Dai Savings Rate for lending in which rates are variable and subject to change. Instead, minters create yUSD at different prices above or below its peg, with all positions rounding out to $1 at the time of expiry.

Liquidity Mining

To kickstart this initiative, UMA has alluded to a liquidity mining program - granting users who provide yUSD liquidity to a soon-to-be announced AMM with UMA rewards. Given the resources which point to this 50/50 yUSD/USDC Balancer pool, we can assume this will be one the first pair eligible for liquidity mining when the details are announced this week.

While UMA’s tooling is not for the faint of heart, the premise of issuing interest-earning stablecoins with fixed expiry dates is one of the more novel approaches to automated yield farming. In tandem with the ETHBTC and yCOMP tokens, UMA’s token price has jumped over 40% since the announcement, which mentioned a “liquidity mining pilot.”

Winklevoss’s Gemini Will Now Keep Your ‘Unstoppable’ Web Domains Safe: Decrypt

Unstoppable Domains has announced that you can entrust your .crypto domain names with Gemini Custody, the custodial service run by Cameron and Tyler Winklevoss.

KR1 sells tokens from blockchain insurance firm Nexus Mutual: Proactive Investors

KR1 PLC said it has sold 35,128 tokens in the Nexus Mutual project at an average price of US$14.03 each, netting the company US$492,991. The digital asset investment firm said it had acquired the tokens at an average price of US$2.24 each during a seed round for the project.

🎙Listen to this week’s podcast episode with 1kx’s Lasse Clausen:

Hope you’re enjoying The Defiant. If you are, spread the word!

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

Click here to pay with DAI. There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the founder: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.