🎯Terra’s Do Kwon Takes Aim at DAI With Pool of Four Stablecoins

Hello Defiers! Here’s what we’re covering today:

News

Terra’s Do Kwon Takes Aim at DAI With Pool of Four Stablecoins

Ethereum Layer 2 Networks Hit ‘Critical Mass’ as The Merge Approaches

Yellen: No Evidence Russia is Bypassing Sanctions with Crypto

DeFi Primers

Podcast

🎙Listen to this week’s podcast episode with Cosmos’ Ethan Buchman:

Video

Elsewhere

Sky Mavis Raises $150M Led By Binance, Funds to be Restored on the Ronin Bridge: The Lunacian

UST: New Paradigm or Ticking Time Bomb? | Terra Bear vs Bull: Bankless

Binance.US raises over $200 million at a $4.5 billion pre-money valuation: The Block

NEW BLOG POST! Read about our first official vote for Government Toucan holders: Shell Protocol

Trending in The Defiant

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

SynFutures is a DeFi derivatives exchange that enables permissionless futures trading, allowing anyone to list and trade any asset with a price feed. Learn more!

Nexo is a wallet where you can easily exchange between 300+ unique market pairs, receive up to 0.5% cashback or get instant liquidity against your crypto assets with flexible credit lines. Get started!

Sperax has created $USDs, the stablecoin that generates passive income for holders. Thanks to the Auto-Yield feature, it pays to hold $USDs. Try it yourself here!

APWine is a pioneering yield tokenisation protocol, allowing users to get their future yield in advance. Hedge your risk on APY volatility or speculate on yield with their native AMM.

Stablecoins

🎯Terra’s Do Kwon Takes Aim at DAI With Pool of Four Stablecoins

Will 4pool Muster the Liquidity to Maintain Stability?

By Owen Fernau

“By my hand DAI will die.” So tweeted Do Kwon, the co-founder of the Terra ecosystem on March 22.

DOOM Kwon‘s vow of doom for DAI, the U.S. dollar-pegged stablecoin supported by MakerDAO, is a rare case of unalloyed competitiveness in DeFi. True to his word, the Terra co-founder on April 1 introduced “4pool,” an amalgam of four stablecoins on an automated market maker (AMM), Curve Finance.

POOL This four-headed beast will include Terra’s UST, Frax Finance’s FXS, USDT (Tether), and USDC. Users will be able to deposit one of the four stablecoins into the pool to earn a yield as other users trade between the pooled assets.

INCENTIVES The key to making this pool function: Terra and Frax will work together to incentivize users to deposit into the forthcoming 4pool. The bigger the incentives, the more users deposit any of the four stablecoins in the pool. Or more succinctly, the bigger the incentives, the deeper the liquidity.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Layer 2s

📈 Ethereum Layer 2 Networks Hit ‘Critical Mass’ as The Merge Approaches

Investors Prep for New Proof of Stake Ecosystem

By Samuel Haig

NEW PERIOD All eyes are on The Merge. When Ethereum’s mainnet joins with the beacon chain Proof of Stake system everything will change — the Proof of Work era will draw to a close and a new period will dawn for the most important blockchain network in DeFi.

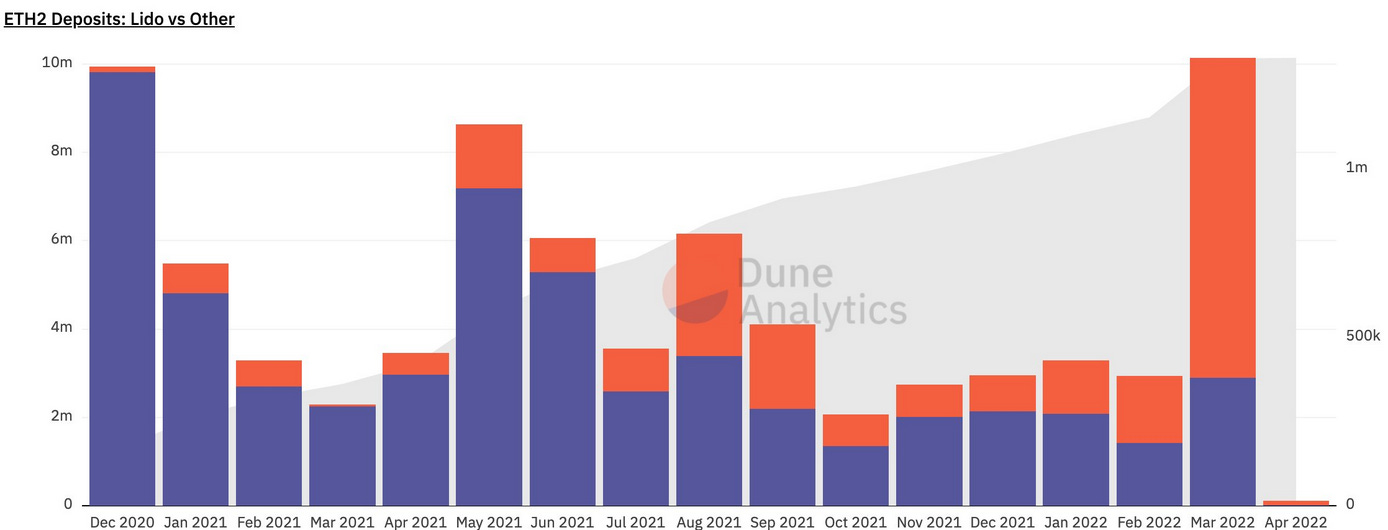

ALL-TIME HIGH Ethereum’s next generation Layer 2 networks are pumping, with their total value locked (TVL) hitting $7B several days after posting a record high of $7.4B on April 2, according to L2beat.

SIMPLE TRANSFERS Layer 2s such as Arbitrum and Loopring offer reduced transaction fees and high-speed transactions compared to Ethereum’s Layer 1 mainnet. While fees on Ethereum’s mainnet are notoriously high, simple transfers on L2s tend to cost less than $0.2 to execute and complex smart contracts are priced below $2, according to L2Fees.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Ukraine

🏛 Yellen: No Evidence Russia is Bypassing Sanctions with Crypto

By Samuel Haig

SANCTIONS U.S. Treasury Secretary Janet Yellen said Wednesday there is no evidence that Russian government officials or oligarchs are using digital assets to skirt sanctions imposed by Washington in response to the invasion of Ukraine.

FOREIGN RESERVES Yellen’s testimony before the U.S. House Committee on Financial Services comes roughly six weeks after the U.S. and its allies froze Russia’s $400B in foreign reserves and barred its banking system from using the Swift cross- border payments messaging system. The severe actions are meant to pressure Russian President Vladimir Putin to end his unprovoked war on Ukraine.

LARGE TRANSACTIONS Speculation has been rife that Russian officials and oligarchs may tap blockchain-based assets to get around the sanctions. “We are aware of the possibility clearly that crypto could be used as a tool to evade sanctions and we are carefully monitoring to make sure that doesn’t occur,” Yellen told the committee. “Large-scale transactions would become apparent… we would see that there were large transactions taking place.”

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi 101

🌊 How to Connect OpenSea to MetaMask

A Step-by-Step Guide to Using an Ethereum Wallet and NFT Marketplace

By Arya Ghobadi

MARKETPLACE OpenSea NFT is the largest non-fungible token (NFT) marketplace in the world that supports Ethereum and Polygon blockchains. Often called the eBay of NFTs, OpenSea allows you to create and sell your own NFTs on their decentralized platform as well as discover new ones to add to your collection.

AVATARS Founded in 2017, OpenSea typically handles between $30M to $100M a day in volume. You may be confused about what exactly an NFT is in the first place. NFTs are digitally unique files that memorialize art, video, objects, documents, and other things. Perhaps the most popular form of NFTs are avatars such as CryptoPunks, Bored Apes and SpaceDoodles.

METAMASK ACCOUNT In this tutorial, we walk through how to connect MetaMask to OpenSea. Before we start you need to know that in this tutorial we assume that you have read What is MetaMask and How to Use MetaMask guides and you have a MetaMask account!

Go to the OpenSea official website and click on the profile icon:

Select MetaMask:

👉READ THE FULL STORY IN THE DEFIANT.IO👈

☑️Five Tips To Elevate Your DeFi Research

By river0x

WILD PLACE DeFi has the potential to be a wild place at times. Seemingly bulletproof protocols can rug in an instant or suffer exploits that token prices will never recover from.

POINTERS In line with The Defiant’s security awareness mission, I will outline a few pointers on how to identify a potential disaster before it unfolds. I spend my days identifying how projects conduct development and measuring how they end up deploying their code. After assessing over 200 protocols, we’ve picked up a few insights to identify poor development practices in DeFi.

EXPLOITS and Axie Infinity recently suffered exploits resulting in significant losses of funds. Katana, the only decentralised exchange on Axie’s Ronin chain that was developed by the same team (with the same development practices), scored 5% in our appraisal. Inverse scored much better but still lagged in some critical areas. Both were unaudited, had no bug bounties and provided extremely limited proof of testing or none at all. Katana was especially opaque when it came to explaining how it worked. Despite identifying these issues, these exploits still happened and users still lost their life savings.

CHECKLIST With this checklist, I want to arm you – the humble ape/farmer/degen – with a few tips and tricks that are personalised to your risk profile as you navigate the DeFi minefield.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

Do you want to manage SOL tokens in one place? Have you ever used bridges? Want to see them all?

DeCommas App is a platform which offers toolkits that simplify user interaction with various blockchain-based ecosystems. Data-driven automation solutions empower users and enable more efficient workflows. Let’s take a quick look at it in a nutshell.

Bridges: a platform for finding crosschain bridges. All existing bridges are collected into one place and are updated regularly. There is also a plan in a few weeks to finish integrating Wormhole and Hop internal swaps - so that sounds comfortable.

Are U a Bounty Hunter? All the faucets you need in one place.

Do you know where your most desired NFT is listed? Check out our NFT-Gallery! Using NFT-Gallery to conveniently display unique tokens, users can also obtain detailed information about each NFT available in the wallet. Not to mention it looks cool ;)

Earn automated basis strategies (testnet). The idea of the basis strategies is to follow the approach where profits do not depend on the direction of the price movement.

Join us in our way of reDeFining automation and creating a better experience for trading and investing in DeFi.

The Tube

📺 First Look: Move2Earn - is Stepn the future of crypto powered fitness?

Job Board

⚙️ prePo: Smart Contract Engineer (Solidity)

prePO is looking for a Smart Contract Engineer to take ownership over the development of novel DeFi-related smart contracts.

For more info, click here.

✒️ pre:Po Executive Assistant

prePO is looking for an exceptional Executive Assistant to work with the founder to perform a wide variety of operational, administrative and strategic tasks.

For more info, click here.

🚀 Liquity Head of Growth (Crypto)

Liquity is seeking an experienced Head of Growth that can help grow its user base, boost LUSD adoption and overall stablecoin market share.

For more info, click here.

Elsewhere

🔗 Sky Mavis Raises $150M Led By Binance, Funds to be Restored on the Ronin Bridge: The Lunacian

Today we announced a 150 million USD funding round led by Binance with participation from Animoca Brands, a16z, Dialectic, and Paradigm.

🔗 UST: New Paradigm or Ticking Time Bomb? | Terra Bear vs Bull: Bankless

Terra is exploding. Do Kwon and the Terra ecosystem are turning Bitcoin into their collateral asset of choice to backstop LUNA and the UST stablecoin.

🔗 Binance.US raises over $200 million at a $4.5 billion pre-money valuation: The Block

Binance.US, the American affiliate of global crypto exchange Binance, has closed its inaugural funding round after months of seeking it.

Trending in The Defiant

Pudgy Penguins Fly as Floor Price Triples It’s been quite the roller-coaster ride for Pudgy Penguins. This week the collection’s floor price has tripled, briefly surpassing its peak in September 2021 with a high of 3.73 ETH ($12,000) yesterday, according to data from niftyprice.io

0xsplits – Power Is Nothing Without Control 0xSplits is an open-source, audited, and non-upgradeable protocol for efficiently splitting onchain income. Whenever a Split receives funds, each recipient gets their share. Simple enough for friends, secure enough for anons.

MetaMask Update Allows Apple Pay Users to Buy Crypto Mainstream adoption of cryptocurrencies just got a boost. MetaMask has announced that the popular crypto wallet will now support direct digital asset purchases with debit and credit cards by way of Apple Pay.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Samuel Haig, DeFiDad, and yyctrader, and edited by Edward Robinson, yyctrader, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Signest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr)