🪜Steps to Mainstream: Binance's CeFi to Polygon Bridge & DeBank's User-Friendly Wallet

Hello Defiers! Here’s what we covered yesterday,

News

Video

Links

Podcast

🎙Listen to this week’s podcast episode with Chris Blec here:

📆 REMINDER: Jam Session #3 is TODAY 7/29 at 2pm EST on our YouTube channel. We will be speaking with the biggest names in synthetic assets.

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at https://balancer.finance/!

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Aave, an open-source and non-custodial liquidity protocol where users can earn interest on deposits and borrow assets.

The DeFi Pulse Index, by Index Coop - DPI is the easiest way to capture the upside of DeFi with the benefit of diversification. Buy DPI today on your favorite DEX.

Layer 2

Binance Now Supports Direct Polygon Withdrawals and Deposits

CEFI LINK DeFi is getting easier for CeFi users. Crypto’s largest centralized exchange, Binance, now allows users to withdraw and deposit Polygon’s MATIC token directly from and onto the protocol’s proof-of-stake mainnet.

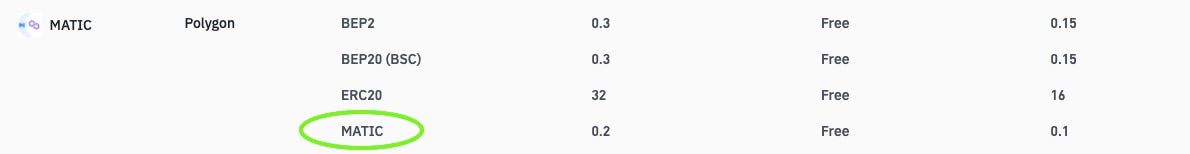

CHEAPER Previously users needed to go through a multi-step process, either utilizing one of Binance’s two blockchains or swapping for Ethereum-based versions of MATIC when withdrawing or depositing. These options accrued fees. But with a direct route now, the fees are less, especially compared with a withdrawal to the Ethereum network.

Supporting Polygon’s mainnet is also symbolically significant — it recognizes the project as legitimate and distinct from Ethereum.

“It’s going to be a huge boost for the already burgeoning Polygon ecosystem,” Polygon co-founder, Sandeep Nailwal, told The Defiant. Nailwal continued, saying Polygon is second only to Ethereum in terms of adoption, and that the integration will help developers provide superior experiences to their users.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Sponsored Post

DeFi is changing the world and Fintech Meetup is helping make it happen!

From Blockchain to Smart Contracts, Crypto to CBDCs, Digital Assets to Dapps, Payments to Protocols, Trading to Tokens (and everything else DeFi), Fintech Meetup is bringing together the players, solutions and organizations at the intersection of crypto and finance.

If you’re in DeFi, join Fintech Meetup to meet with 4,000 individuals from 2,000 organizations, including fintech startups, financial institutions, banking tech providers and payment networks! We’re facilitating 30,000 meetings so you can forge new partnerships, create opportunities and fill your pipelines. Fintech Meetup is held online, so there’s no wasted travel time or expense. And, there are no speakers or webinars. Just high-value 15-minute video meetings with the people you want to meet and who want to meet you.

"Fintech Meetup 2021 was a great event and the team loved the format. The event was super efficient and opened the gates to a really diverse crowd!". Ripple

Fintech Meetup will be held online, March 8-10, 2022. Get Fintech Meetup into your 2022 budget now--discounted early bird tickets are available for a limited time only. GET TICKET

AMMs

Paradigm Team Outline Efficient AMM Design for Large Trades

NEW AMM Paradigm researcher partners Dave White, Dan Robinson and Uniswap founder Hayden Adams have cooked up another trading protocol.

LARGE ORDERS The decentralized exchange, called TWAMM, which stands for time-weighted average market maker, aims to help traders execute large orders, quickly, at low gas prices and without negatively affecting price.

TWAP In traditional finance, traders will often employ brokers to execute large orders algorithmically over a set period of time to get the best price, often using a Time-Weighted Average Price, or TWAP order.

The TWAMM protocol aims to replicate TWAP orders on-chain by breaking them up as a long-term order into “many infinitely small virtual sub-orders,” the Paradigm post says.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Staking

ETH Staking Service Lido Aims To Be More Decentralized

NON-CUSTODIAL The Ethereum staking-as-a-service company Lido is aiming to become more decentralized. The project has implemented a skeleton upgradable smart contract for making new withdrawals and new deposits fully non-custodial, according to a blog post. Lido is still seeking an optimal solution to become a trustless node operator.

Centralized exchanges offer a significant portion of the ETH2 staking services today. Because of the amount of ETH they stake for their customers, they’re likely to also be the biggest block producers once ETH2 goes live. Lido believes that could “harm Ethereum’s decentralization.”

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Wallets

DeBank Launches DeFi Browser Extension Wallet With “Human-Readable” Features

BROWSER WALLET Competition is heating up in the DeFi browser extension wallet category. DeBank, previously known primarily as a data provider, is the latest to announce a browser extension wallet geared especially for DeFi users.

USER FRIENDLY The wallet, called Rabby, will automatically switch between chains, according to the launch post. Rabby also promises to display more details regarding the contracts users are signing and a pre-transaction risk-scanning feature, which will alert users if it finds potential vulnerabilities in the contracts the user is interacting with.

COINBASE AND METAMASK Rabby follows the May 17 announcement by Coinbase to build a browser extension wallet., meanwhile, market leader MetaMask had 5M monthly users as of April 21. Metamask makes well over $100K a day in fees based on the 0.875% cut it takes on trades that happen within its browser extension. So Rabby’s in-wallet trading feature could be lucrative indeed.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Video

First Look: Sushiswap’s Trident

Links

🔗 Zuckerberg is turning trillion-dollar Facebook into a ‘metaverse’ company, he tells investors: TechCrunch

Following the quarterly release of Facebook’s earnings numbers where the company’s CFO takes time to walk analysts through the nitty gritty of the company’s financials, CEO Mark Zuckerberg took a moment to zoom out and wax on the company’s future goals, specifically calling out his ambitions to turn Facebook into “a metaverse company.”

🔗 Migrate or Die: @iearnfinance

🔗 dAMM (decentralized AMM: StarkWare

AMMs on L2 face a liquidity fragmentation problem

dAMM, a cross-L2 AMM that shares liquidity across layers, solves this

dAMM enables ZK-based L2s (e.g., DeversiFi, Loopring …) to asynchronously share liquidity — exposing LPs to more trades

dAMM enables LPs to serve L1 AMM such as Uniswap while partaking in L2 trading => scaling without compromise

dAMM harnesses the permissionless nature of L1, mitigating against liquidity fragmentation due to disparate L2s

This is a public version of the newsletter and both paid and free subscribers are receiving it.

Free subscribers get:

Daily news briefings

Weekly Recap

Paid subscribers get:

Full transcript of the weekly podcast interview

Early access to opinion columns and research pieces

Exclusive access to Inbox Dump where we send all the press releases that didn’t make it to the newsletter (Saturday)

Exclusive access to subscribers-only Discord chat

✊ Head to THEDEFIANT.IO for more DeFi news 📰

🧑💻 ✍️ Stories in this newsletter were written by Dan Kahan and Owen Fernau, and edited by Bailey Reutzel and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr).