Scale-apalooza: Coinbase on Ethereum's Layer 2 is Only the Latest in Scaling Boom

Also, Bancor releases upgrade to fight impermanent loss.

Hello Defiers! Here’s what’s happening,

Coinbase Wallet is testing an Ethereum Layer 2 network as an increasing number of dapps and exchanges use scaling solutions

Bancor aims to eliminate impermanent loss with upgrade

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI.

📺 Watch the latest video on The Defiant’s YouTube Channel:

🎙Listen to this week’s podcast episode with Simon Taylor of 11:FS:

🙌 Together with Zerion, a simple interface to access and use decentralized finance, Perpetual Protocol, which provides decentralized perpetual contracts for any asset, and HackAtom V, a two-week virtual hackathon organized by Cosmos.

Coinbase on Layer 2 is Latest in Ethereum’s Scaling Boom

There’s been an explosion of Ethereum scaling developments this past week, with the latest and arguably biggest one announced yesterday: Coinbase Wallet is integrating with Optimism’s Optimistic Rollup testnet.

Coinbase Wallet is the US exchange’s non-custodial wallet and dapp browser (not the exchange itself) and the integration will allow users to view their balances and send transactions on Optimism’s Layer 2 testnet, according to the post.

💡 Layer 2 scaling solutions are technologies that remove some of the computation that’s on-chain (Layer 1) and take it off-chain, so that the network can be faster. Optimism uses Optimistic Rollups, one of these Layer 2 solutions. 💡

Image source: Optimism’s Medium

Exchanges and dapps moving into Layer 2 solutions that enable increased throughput and reduce congestion on the Ethereum network, will be key for Ethereum’s long-term growth. Even with today’s niche user base, gas fees and confirmation times skyrocketed at the height of the yield farming craze, to the point of pricing out anyone transacting with smaller amounts.

Coinbase is the second major centralized exchange after Bitfinex to announce plans to take part of their transactions off the Ethereum main chain. Bitfinex is in the process of integrating with OMG’s off-chain scaling solution called More Viable Plasma.

Synthetix on Optimism

Synthetix, which had announced the first phase of its integration with Optimistic Ethereum in May, yesterday said it’s moving to phase two of its integration, which will trial the migration from Layer 1 to Layer 2.

And while Optimism’s announcements are for its testnet, there are live scaling solutions supporting Ethereum dapps right now. Value transacted on them is booming, though still relatively low.

Scaling is Live

Value deposited in Loopring, a DEX built using zkRollup scaling tech, is up by 70% to $17M in the past 90 days. Funds in the xDai sidechain have jumped from less than $500k to over $2.5M in that time as an increasing number of applications, from POAP to Foundation are using the network.

In addition to Coinbase and Synthetix announcements, here’s a Run Down of Past Week’s Scaling Developments:

Aztec Releases Privacy-Focused zkRollup L2

Aztec 2.0 is a zkRollup-based Layer 2 network, that’s live on Ropsten. ERC20 transactions are private by default and validated on-chain.

Matter Labs and Curve Announce zkSync L2 Testnet

Matter Labs released a Layer 2 smart contracts testnet based on zkSync technology, with Curve Finance as the first resident dapp.

QuickSwap DEX Launches on the Matic Network

Quickswap, a permission-less DEX based on Ethereum, launched on Matic Network’s Layer 2, an adapted version of Plasma with PoS based side chains.

Bancor Aims to Eliminate Impermanent Loss With Upgrade

Bancor has unveiled the next step in their new AMM design.

The 2.1 release introduces an elastic BNT supply, used to cover impermanent loss for LPs through a mechanism called Liquidity Protection. The update builds on the ability to add single-sided liquidity, or using one token to pool liquidity instead of two like Uniswap.

💡 Impermanent loss happens when returns gained from providing liquidity to decentralized exchanges are less than returns of holding an asset. This relative lower performance happens because liquidity providers often have to deposit tokens in a certain ratio, even when one token is gaining faster than others in the pool. 💡

LPs are encouraged to keep their liquidity inside a Bancor pool to recoup the losses they would have incurred through impermanent loss, in addition to receiving swap fees. The longer they stay in the pool, the more protection they get.

“We view this as liquidity mining 2.0,” Bancor’s head of growth Nate Hindman told The Defiant. “instead of arbitrarily paying LPs to provide liquidity on our protocol, we are compensating based exactly on their individual impermanent loss incurred. “

Those who stake BNT earn a governance-enabled wrapper called vBNT, granting voting power and a claim on protocol fees. vBNT is used to usher in protocol changes, including the 2.1 upgrade currently live for voting in the new governance dashboard.

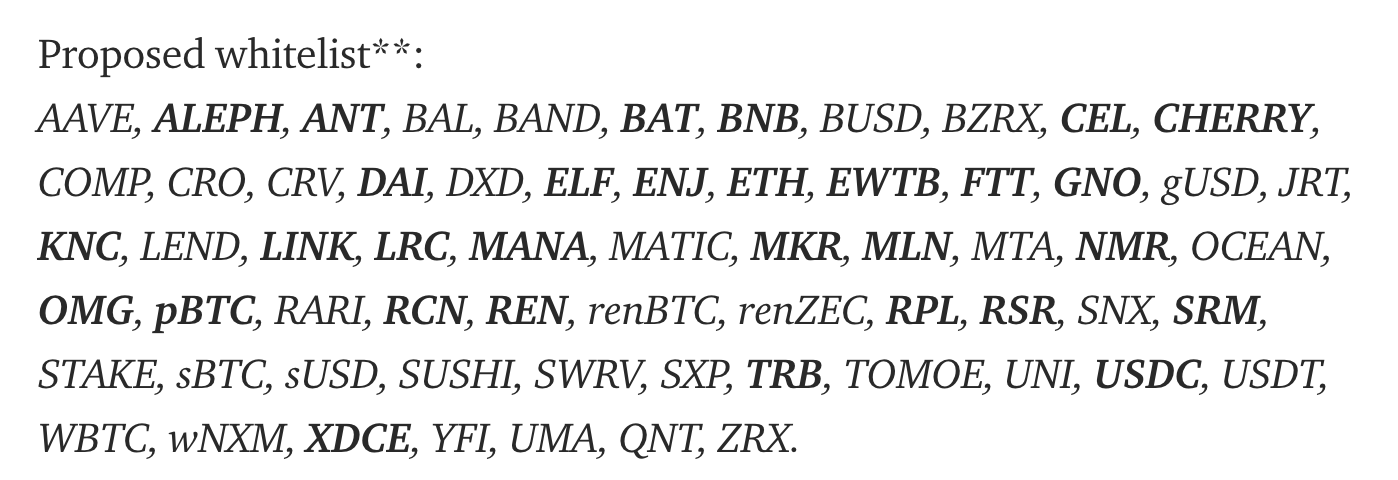

60 different pools are currently being considered for the Bancor whitelist, half of which (illustrated in bold below) are eligible for Liquidity Protection today.

With the first Bancor V2 LINK pool reaching its cap of $300k in under 24 hours, it seems that many have been anticipating the next steps of AMM promising to eliminate impermanent loss while offering single-sided liquidity.

While the team seems to think they’ve found the answer, the community will now decide whether or not all checks out thanks to the first BNT governance poll.

Boardroom Raises $2.2M for Blockchain Governance Toolset: CoinDesk

Blockchain governance suite Boardroom has announced a $2.2 million funding round led by Standard Crypto, with additional participation from Variant, CoinFund, Framework and Slow Ventures. Boardroom, which has vote delegation built in, is designed to be a solution for blockchain participation that can scale with the growth of crypto communities.

Messari’s Jack Purdy provides a great thread on the best tools for analyzing crypto.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

About the founder and editor: Camila Russo is the author of The Infinite Machine, the first book on the history of Ethereum, and was previously a Bloomberg News markets reporter based in New York, Madrid and Buenos Aires. She has extensively covered crypto and finance, and now is diving into DeFi, the intersection of the two.