Regulatory Clampdown as DeFi Heats Up Means $1 Trillion in Transactions Could be at Risk

Also, The Graph Network launches, Aave releases V2 governance, Zerion enables trading.

Hello Defiers! Here’s what we’re covering today:

The potential implications of the Stable Act for DeFi, by IntoTheBlock

The Graph launches its decentralized network for DeFi APIs, together with its GRT token

Aave further decentralizes its governance

Zerion enables trading

Polkadot DEX Polkastarter launched a fixed-price IDO mechanism

And more :)

💗 Contribute to The Defiant’s Gitcoin Grant Here: Today is the last day to contribute! Huge thanks to the 237 contributors so far. Right now 1 Dai is being matched by 22 Dai, and 10 is being matched by 57! Your support for DeFi-focused journalism makes a huge difference.

📺 Watch the latest drop of The Defiant’s DeFi 101 Series on YouTube!

🎙Listen to this week’s podcast episode with Bloq’s Jeff Garzik here:

🎁 Merry DeFi! Get The Defiant’s $100 annual subscription for $80. Offer expires Dec. 31s. Get full access to Defiant content and community as a gift for yourself or for others.🎄

🙌 Together with Zerion, a simple interface to access and use decentralized finance, Neutrino, an algorithmic price-stable protocol that enables the creation of stablecoins tied to real-world assets, and DeversiFi's Nectar Beehive V1, which allows traders to provide liquidity & earn Nectar ($NEC) tokens.

On-Chain Markets Update by IntoTheBlock

Potential Implications of the Stable Act for DeFi

Stablecoins have recently been under scrutiny as a new bill from the American congress dubbed the Stable Act proposes strict regulations for stablecoin issuers. Most notably, the proposal suggests that all stablecoin providers must require a banking charter. As readers may have guessed, no stablecoin provider currently has a bank license, meaning that if the bill passes they may be in jeopardy.

The Stable Act also intends to have stablecoin providers notify and obtain approval from the federal reserve at least six months prior to issuance, and maintain ongoing auditing regarding any systemic risks. Finally, it also proposes stablecoin issuers either obtain insurance for their funds or keep their reserves directly at the Federal Reserve, facilitating on-demand conversion into USD.

While these measures are intended to protect consumers, they have strong implications extending beyond stablecoins. Due to their increasing reliance on stablecoins, both cryptocurrency markets and decentralized applications are likely to experience a short-term downfall if the Stable Act passes. In this piece, we explore crypto’s reliance on stablecoins, and the magnitude of the potential implications associated with the Stable Act:

Over $1 Trillion Worth of Transactions Would Be at Risk

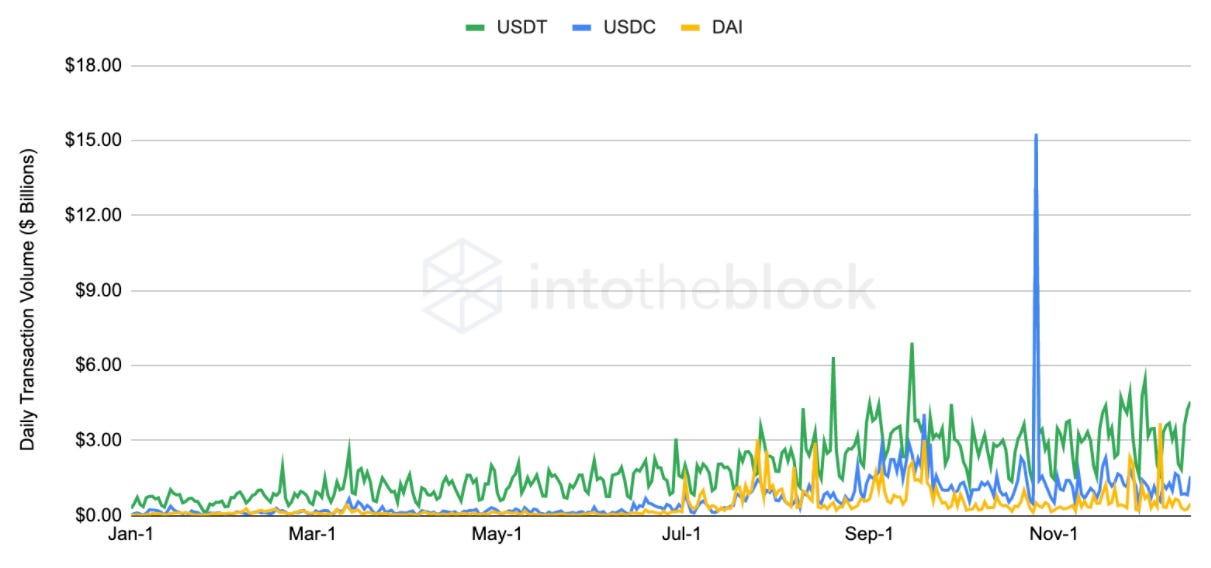

Stablecoins record billions in daily transactions on the Ethereum blockchain. In 2020, the cumulative amount transacted thus far among USDT, USDC and DAI is over $1.04 trillion, all which would be deemed unlawful were the Stable Act to pass at this moment.

Source: IntoTheBlock

The aggregate volume transacted between the top three stablecoins is over double the total ETH volume in 2020. Furthermore, while centrally managed stablecoins such as Tether and USDC could potentially apply for a bank charter, decentralized stablecoins like DAI have a more troublesome path. Though it is unclear how the government would enforce this for a decentralized stablecoin, Rohan Grey — a proponent for the Stable Act — insisted that the regulation would also apply to decentralized stablecoins in an interview with The Block.

Making the matter worse, the bill suggests that software validating unregistered stablecoins would also be violating the law unless they too are registered as a chartered bank. This implies that people running nodes on Ethereum could potentially be charged would the Stable Act pass in its current form.

Moving onto DeFi specifically, protocols have also become reliant on stablecoins for their day to day operations and would be hindered by the proposed regulation.

Lending Protocols Heavily Rely on Stablecoins

The decentralized lending protocol Compound offers users the ability to borrow money and earn interest on funds deposited. Since its launch in the fall of 2018, Compound has grown to $3.62 billion in supply deposited by users and $1.9 billion in loans currently outstanding. Stablecoins account for a whopping 65% and 96% of the total amount supplied and borrowed to Compound respectively.

As of December 15 using IntoTheBlock’s DeFi Insights

Needless to say, lending markets are likely to collapse in the event of stablecoins becoming unlawful in their current state. Since most of the supply locked in Compound and other lending protocols consists of stablecoins, their TVL would drop drastically. This could lead to forced liquidations of loans if protocol withdrawals cause the utilization ratio of collateral to increase past 100%.

DEX and CEX Volume Also Depend on Stablecoins

As of December 15 using IntoTheBlock’s DeFi Insights

Seven out of the top ten most traded pairs in decentralized exchanges are denominated in stablecoin terms. In terms of liquidity provided six of the ten most liquid pools have stablecoins in them. It is unclear if the volume and liquidity would shift right away to ETH and WBTC if the Stable Act passes, but there is likely to be a liquidity shock at least in the short-term.

Similarly, centralized exchanges have been increasingly adopting stablecoins; so much that in fact Tether has replaced Bitcoin as the main asset used to buy into and sell out of most crypto-assets in the top ten. This transition in market structure has taken place over the last three years and there is uncertainty about the ease of shifting back to Bitcoin-denominated pairs.

While we can all agree that stablecoins are far from perfect in their current state, they have facilitated the growth of crypto globally and in a relatively censorship-resistant way (with a few exceptions). USDC’s Jeremy Allaire described the Stable Act as “a huge step backward for digital currency innovation in the United States.” Paxos - the whitelabel stablecoin solution partnered with Binance USD and Huobi USD - reacted by applying for a bank charter. It is still unclear if the Stable Act will pass but even as just a proposal it already has had severe implications in stablecoin issuers.

Protecting consumers should always be kept in mind by regulators, but there are legitimate concerns behind the Stable Act hindering innovation in the blockchain space. Regulation is expected to come as crypto grows in adoption and liquidity, but users and the broader crypto community certainly hope the path is not this prohibitive. Ultimately it is in both regulators’ and stablecoin providers’ best interests to craft regulations that provide safety to users without slowing down progress.

The Graph Launches Open Blockchain API Network

The Graph today launched its decentralized network of searchable, public data for the top decentralized finance applications.

“The Graph Network is the world’s first network of open, global APIs that is free from the hands of big tech, to help evolve the web from a centralized beast to a platform where anyone can contribute and be rewarded for their work,” the project said in an emailed press release.

The project also launched its GRT token with the goal of incentivizing participants to index, curate data and secure the network.

The network is made up of Indexers, Curators, Delegators and Consumers. Indexers are node operators who stake GRT. Curators are developers of so-called subgraphs, or APIs, data consumers or community members who indicate to the Indexers what should be indexed. Curators earn a portion of the query fees. Delegators contribute to the network by giving GRT to Indexers, earning a portion of the query fees in return. Consumers query subgraphs and pay query fees.

There are subgraphs for 21 of the top 25 DeFi dApps. There are now over 3,800, up from 1,000 at the beginning of 2020.

Aave Holders Vote to Further Decentralized Governance

Aave’s governance will be increasingly controlled by its community after token holders approved a proposal to activate the project’s so-called “V2 governance.”

The move means that now any Aave token holder that meets the requirements can create Aave Improvement Proposals. AIPs are binding on-chain governance proposals that require some technical knowledge and automatically execute once the votes are in and validated.

Holders of AAVE and stkAAVE —derivatives representing staked AAVE tokens— can also delegate their ability to create proposals. This means that AAVE holders can separately delegate their proposal power and voting power. In V2 governance, both AAVE and stkAAVE holders have voting rights, so staking will not be a hurdle for participating in the governance.

The Aave Protocol V2 launched just over a week ago and has rapidly grown in market size, now reaching over $98M.

“The V1 → V2 migration tool has not even been released yet (Soon™), so this growth is particularly Aavesome,” Aave said in a blog post.

Zerion Enables Trading Within Protocol Tracker

Zerion, a DeFi portfolio tracker, today launched the ability for its users to trade tokens, and LP shares — or tokens representing liquidity in DeFi protocols. The platform will also track trading costs and fees, and enable push notifications.

Polkadot DEX Polkastarter Launches Fixed-Price IDO

Polkastarter, a decentralized exchange based on the Polkadot network, launched a mechanism for crowdfunding that allows projects to list their tokens with a fixed price per token. The product launched on Dec. 15 with three projects lined up to use its initial DEX offering mechanism; SpiderDAO, MahaDAO, and Royale Finance.

The first two fixed pools with SpiderDAO sold out in less than 30 seconds, raising 340 ETH, or over $200k. Still, some users were able to go directly to the smart contract and bypass the price limit. Polkastarter said the team has now implemented a simple fix so that the contribution limits are now set on-chain.

Total value locked in DeFi has already surpassed $20B, according to DeBank.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Get The Defiant’s $100 annual subscription for $80. Offer expires Dec. 31s.

About the founder and editor: Camila Russo is the author of The Infinite Machine, the first book on the history of Ethereum, and was previously a Bloomberg News markets reporter based in New York, Madrid and Buenos Aires. She has extensively covered crypto and finance, and now is diving into DeFi, the intersection of the two.