Recap: DeFi Week of June 29 🦄

Hello Defiers! Hope you’re having a great weekend and happy 4th to those in the United States 🇺🇸

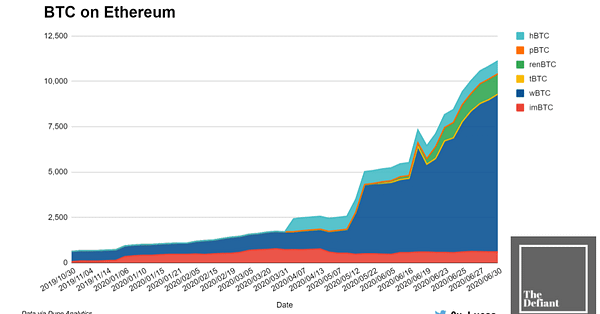

Summing up this past week: DeFi platforms’ token incentives, which come on top of the yield they were already generating with lending and borrowing, are causing ripples. There’s now over $100M in BTC circulating the Ethereum economy, driven mainly by WBTC used to farm yield. Stablecoin-focused DEX Curve Finance has shot up to the second-largest decentralized trading platform by volume as traders seek USTD and other stable assets to maximize yield on other platforms. An attacker was able to withdraw $500K from Balancer, which has been at the center of the yield farming frenzy with its BAL token, and hackers have found a way to take unclaimed COMP tokens for the platform.

MCDEX introduced the first ETH perpetual futures contract, Synthetix launched binary options, and 0x released DEX aggregator Matcha. The prediction markets space just got a little more crowded with Omen and Polymarket, and The Graph Raised $5M. Corey Petty of Status writes about security in a self-sovereign world.

That was just one week. Subscribe to get the latest DeFi news and analysis straight to your inbox and you don’t miss a thing. Free-signups get partial content, paid subscribers (only $10/month, $100/year) get everything. Click here to pay with DAI ($70/year).

🌈🌈: Also: We’re Only 9 days away from The Infinite Machine launch!

Pre-Order my book on the history of Ethereum and I’ll send you a personalized Proof of Pre-Order NFT. Click here for how to get a POP.

🙌 Together with Quantstamp, a leading blockchain security firm keeping your money legos safe, Kyber Network, the on-chain liquidity protocol for the tokenized world, and Keycard, the secure, contactless hardwallet & open source API.

Op-ed

Will a Self-Sovereign World Make Users Pick Between Security and Convenience?

We’ve become used to relying on others for security. We’ve traded ownership, freedom and privacy, for convenience. As we step into this new world, made possible by distributed technology and cryptocurrencies, we need to relearn what the best practices are so that our funds and personal information are kept secure. The question is, can this be done in a way that’s as convenient as trusting others? Does DeFi stand a chance at mass adoption if the answer is no? Corey Petty, security lead at Status, answers these questions in this week’s guest column.

Thursday

Dives

Stablecoin DEX Curve Surges Amid Yield Farming Boom: As yield farming continues to push demand for stablecoins, one platform is taking the cake.

Bytes

COMP Users Vote to Change Token Incentives: Markets that lend more value will receive more rewards, which will continue to be evenly distributed among lenders and borrowers.

Matcha is The Hot New DEX in DeFi: Think of Matcha like an Expedia or Kayak for finding the best rates when you want to trade ETH or ERC20 tokens on Ethereum.

Bet on This: Prediction Markets Space Heating Up: Ethereans have been pushing for decentralized prediction markets since before Ethereum itself launched. The latest attempts to crack this use case are Omen and Polymarket.

Wednesday

Dives

Bitcoin is Buckling Under Ethereum’s Gravitational Pull: There’s now over $100M in BTC circulating the Ethereum economy. Ethereum acts as a gravity well for global financial assets. And Bitcoin is the first victim.

Key Analytics Behind the Rise of WBTC: IntoTheBlock finds WBTC daily active addresses and transactions of more than $100k surge after the token was added to yield farming. The average balance of a WBTC holder has also increased as a result of the potential to profit from DeFi integrations.

Tuesday

Dives

bZx About to Jump on Yield Farming Bandwagon: bZx is seeking to jump on the yield farming bandwagon with its BZRX token in search of increasing the total value locked in its protocol.

Bytes

Kyber Announces KNC Makeover Launch Date: Kyber’s Katalyst upgrade, which is going live on July 7, aims to bolster the DEX’s depth and ecosystem integrations by introducing voting incentives, rebates for liquidity and the ability for partners to set their own spreads.

Synthetix Launches Binary Options: Synthetix, which offers long and short exposure to crypto, fiat currencies and indexes through synthetic tokens, is adding binary options to its exchange.

The Graph Raises $5M to Build the Web3 Query Layer: The Graph raised $5M from crypto funds including Framework, ParaFi Capital, Coinbase Ventures, and Digital Currency Group, with continued participation from Multicoin Capital and DTC Capital.

Careful Out There Farmers; Balancer Exploited Again: Shortly after a hacker was able to withdraw $500k from Balancer pools exploiting deflationary tokens (which Balancer reimbursed), another trader drained unclaimed COMP tokens in several Balancer pools.

Monday

Dives

Hacker Drains $500k from Balancer Pools: A hacker yesterday drained $500k in tokens from two Balancer Labs liquidity pools in the latest of at least five DeFi attacks this year.

MCDEX Launches First ETH Perpetual Contract in DeFi: MCDEX today is launching DeFi’s first ETH/USD perpetual futures contract today. DeFi traders will now be able to go up to 10x long ETH in a permissionless way.

Bytes

MakerDAO Adds Poll to Raise WBTC Debt Limit: MakerDAO’s MKR holders will now be able to signal their support to raise WBTC debt ceiling to 20m from 10m.

The DeFinancial Farming Toolbox: TokenBrice: Monolith’s Brice Berdah published “a hitchhiker’s guide to liquidity mining curating tips & tools to help you make the most of DeFi’s agrarian revolution.”

💜Community Love💜

Thanking all the amazing Defiers for the support and love this week (and always)!

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

Click here to pay with DAI.There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the founder: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.