Recap: DeFi Week of Dec. 16 🦄

Hello defiers! Hope you’re having a great pre-holiday weekend.

Summing up: It’s been all about the DAO, with Kyber Network and Synthetix announcing plans to migrate at least part of their governance into a decentralized organization, Parity Technologies offloading their Ethereum client into a DAO and the MetaCartel community planing to create a for-profit DAO. Also, lots of updates re: tokenized assets: Fulcrum is leveraging interest-bearing Chai, tokenized coffee started trading on Uniswap, RealT’s tokenized home traded on DeFi sold out, and social money started gaining traction (including with my own CAMI COINS). Maker raised $27.5 million from venture funds and OKEx started offering Maker’s DSR rate.

Also, don’t forget to tune in to this tomorrow:

Guest Post

The Future of DeFi is Undercollateralized: By Alex Masmejean

Alex Masmejean, a founding member of MarketingDAO, and part of MetaCartel and Stake DAO, wrote a post outlining the main alternatives decentralized finance could take to in its path towards under-collaterization. So far, DeFi has been dominated with over-collateralization to protect against asset volatility and loan default, in a space with no identity or credit checks. To Alex, and to many others in the space, for DeFi to continue to grow, it will be key for platforms to be able to issue loans without requiring so much capital up front.

Friday

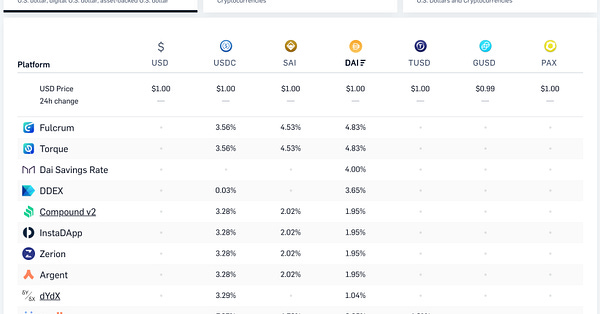

Money Legos Maximize Profit But May Add Systemic Risk: Trading platform Fulcrum put DeFi’s money legos together in such a way that its users can use the same asset to collect interest from two sources.

SEC Wants to Broaden Accredited Investor Definition: The U.S. Securities and Exchange Commission is proposing amendments to the definition of accredited investor, which highlights exactly how DeFi can lower barriers of entry to finance.

Maker Raises $27.5 Million in MKR from Venture Funds: The Maker Foundation raised $27.5 million in MakerDAO’s governance token MKR from venture capital funds Dragonfly Capital Partners and Paradigm.

Tokenized Coffee Added to List of Items Sold On Uniswap: A 200 pound lot of coffee from the Honduran region of El Paraiso lot was tokenized into CAFE tokens using DAI as collateral and then added to a liquidity pool on Uniswap

Wednesday

Synthetix and Kyber Are Latest to Join DAO Wave: DeFi projects are increasingly migrating to decentralized autonomous organizations, or DAOs. The latest to plan this shift are Synthetix and Kyber Network.

OKEx Integrates Dai Savings Rate: Centralized finance will increasingly want to offer DeFi products. The latest example is OKEx becoming the first exchange to offer MakerDAO’s Dai Savings Rate.

Tuesday

Parity is Offloading its Ethereum Client Into a DAO: Parity Technologies is planning to move the Parity Ethereum codebase to a DAO.

Ethereum Devs Betting a For-Profit DAO is Now Possible: A group of Ethereum community members released the whitepaper for MetaCartel Ventures, which would be the first for-profit decentralized autonomous organization since The DAO, arguably Ethereum’s most traumatic event ever.

Monday

Abundance Without Money: I minted my own CAMI COINS over the weekend. We live in a time when anyone can have their own coins, and trade them over the internet, for other digital coins, money, or in exchange for other things one may value.

First Tokenized Home on Ethereum is Now Sold Out: The first tokenized home tradeable in DeFi is now sold out and token holders should now start receiving their share of rent.

💜Community Love💜

Thanking all the amazing defiers for the support and love this week (and always)!

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.

Click here to pay with DAI.There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the author: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.