Real-World Assets Are Coming to DeFi; Here's Centrifuge on How it Will Make it Happen

Also, a dive on the spike of bitcoin on Ethereum following the yield farming boom

Hello Defiers and happy Friday! We have two deep dives for you today:

A Q&A with Centrifuge on how they plan to bring real-world assets to DeFi

IntoTheBlock digs into the spike of tokenized bitcoin on Ethereum following the yield farming boom. Here’s one insight: Bitcoin deposits on Curve surged faster than stablecoins deposits

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for 70 Dai/yr vs $100/yr).

🎙Listen to this week’s podcast episode with Santiago Roel here:

📺 Watch New Video on The Defiant’s YouTube Channel and Subscribe

Check out the just-released video on The Defiant’s YouTUbe channel, covering the latest on this week’s governance wars involving Yearn Finance, Curve and 1inch. The video was produced in partnership with Robin Schmidt of Harmony Protocol.

🙌 Together with Zapper, the ultimate hub for managing DeFi assets & liabilities.

Centrifuge Wants to Bring Real-World Assets to DeFi

DeFi is living in its own, separate digital bubble. And, though there certainly are exceptions, it’s largely used for speculation. To become more useful and reach a wider user-base, bridging real-world assets, such as real estate, cars and invoices, into this tokenized world will be key. The goal is that eventually, individuals will be able to take out loans against their house, while companies will be able to borrow against their invoices, using tokens in permissionless protocols.

Centrifuge, which wants to do just that, today published its design proposal, which you can read here. It’s a highly ambitious and complex process. To break it down, we did a Q&A with Cassidy Daly, who leads token design and research for the project.

Explain Centrifuge like I'm five.

Centrifuge lets businesses get the money that they need to run, without using a bank. We created an open place that anyone can use to lock up assets (ex. a house or an invoice) to get a loan.

How are assets tokenized?

Centrifuge Chain enables users to bring their assets on-chain as non-fungible tokens (NFTs). NFTs are easily bridged to Ethereum from day one. This enables businesses to put up these NFTs as collateral in Tinlake pools, our asset-backed financing Dapp on Ethereum.

How to make sure there aren't many tokens for the same asset and that tokens represent assets they're supposed to represent?

Underwriters are responsible for ensuring the asset is not fraudulent. They are responsible to check that the asset exists and that this NFT is a legal claim on that asset.

How are underwriters incentivized to make sure NFTs correspond to the right asset?

In the case of default, the underwriter loses the TIN that they staked toward the asset.

How are tokens of real-world assets priced?

In traditional finance, assets are usually priced by banks with little incentive to be efficient or fair, because they have no competition. With our underwriter token design proposal, many different underwriters will compete and collaborate to find the optimum price for assets to be financed.

There are two different tokens used in Centrifuge Tinlake; TIN and DROP. Can you explain the difference?

TIN and DROP are Tinlake's two investment tokens. These two tokens behave very similarly to how tranches are modeled in the traditional finance world. The TIN token is the higher yield junior tranche which takes the first loss, and DROP is the fixed interest, lower yield senior tranche.

How are TIN and DROP different from the Centrifuge Radial token?

The Radial (RAD) token directly empowers users to operate, control, and gain value from the system. RAD functions differently and is used for both standard network functions such as chain security and transaction fees, as well as Centrifuge-specific utility, including on-chain governance and rewards to incentivize users to provide liquidity to Tinlake pools.

How is the system different in traditional finance?

Traditionally, a business would try to access financing from a bank, who will only give them a loan if there is enough of an incentive (profit) for them. This leaves many businesses unserved or results in excessive fees for those that do get covered.

What is the benefit of having an on-chain system?

With Centrifuge, any Asset Originators can launch a Tinlake pool and make them available to anyone to invest. Investors can browse through a list of pools to finance based on asset type and risk. All of this happens without any third party; transactions are settled trustlessly on-chain. As a result, this system can lower the costs of financing to businesses through greater transparency and efficiency.

How do borrowers benefit?

Businesses around the world can tap into this new source of capital, without using a bank.

How do investors benefit?

Once onboarded in Tinlake, investors can immediately start investing in asset pools. Tinlake is built to eliminate bureaucracy and mitigate risk with better data and trustless technology.

Where should readers go to find out more?

We just published our token model for underwriters to minimize trust in real-world assets. We look forward to feedback from the community!

Also head to centrifuge.io to learn more.

On-Chain Markets Update by IntoTheBlock

This Week: BTC on Ethereum Gets Yield Farming Boost and It’s Just Getting Started

The amount of tokenized Bitcoin on Ethereum has more than doubled in August. While Bitcoin-pegged ERC20s like wrapped Bitcoin (WBTC) have been around since January 2019, it wasn’t until this summer that they started to get momentum. This growth has been largely a result of DeFi protocols adopting tokenized versions of Bitcoin and providing users services on top of it.

Maker Led, Yield Farming Followed

In May, MakerDAO led the way with the integration of WBTC as collateral, allowing users to mint DAI loans in return for locking their tokenized Bitcoin on their Oasis portal.

In mid-June, BTC was introduced to yield farming via Synthetix, Ren and Curve. Through this initiative, users providing liquidity to tokenized Bitcoin pools (in the form of WBTC, renBTC or sBTC) were rewarded with SNX and REN tokens, while the Curve team rewarded liquidity providers with their native CRV token.

This brings us to Curve’s unexpected CRV release by an anonymous “chad”. Following confirmation from the Curve team that they adopted the CRV deployed, capital rushed into the Curve protocol. As a result, BTC tokens on Ethereum saw a spike in demand as users rushed to farm CRV with it. In turn, the total supply of Bitcoin locked and tokenized through Ethereum reached new highs approaching the 50k Bitcoin mark (over $500 million).

CRV Mining Boosts renBTC

While WBTC is still the tokenized version of Bitcoin with the most BTC locked, renBTC has benefited disproportionately from Curve and CRV yield farming. This has allowed renBTC to capture a greater market share of the total amount of Bitcoin on Ethereum, growing to over 20% from 10% in June based on data from DeFi Market Cap. This may have to do with Ren’s trustless method of tokenizing Bitcoin, which better aligns with the ethos of decentralization in the community.

Using on-chain data we can observe the remarkable increase in the amount of Bitcoin tokenized on Ethereum. Leveraging IntoTheBlock’s indicators we are able to dive deeper and determine that this growth has been largely driven by institutional players moving their Bitcoin into DeFi. Here are three key insights highlighting this trend, and why it may just be getting started:

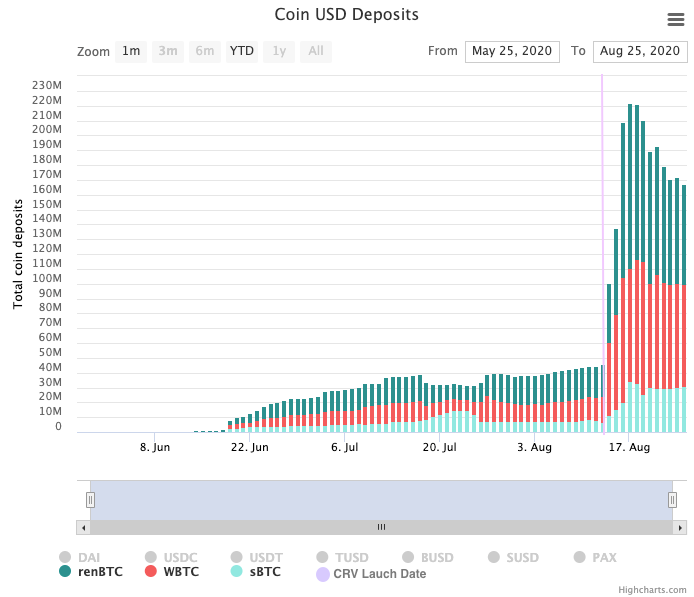

1. Tokenized BTC on Curve Quadruples in Four Days

Following the anticipated, yet unexpected release of CRV, liquidity quickly flowed into Curve as yield farmers sought to receive liquidity mining rewards. Within a few days the TVL in Curve surpassed the $1 billion mark, making it only the third protocol to achieve this milestone. While much of this was fueled by stablecoin deposits, tokenized Bitcoin deposits actually grew at a faster rate following the launch.

Source: Curve.fi Stats

As can be seen in the graph above, the dollar amount of tokenized Bitcoin locked in Curve quickly grew from $45 million to over $200 million within four days. In other words, the total amount of Bitcoin locked in Ethereum more than quadrupled within four days.

While such parabolic growth may lead one to believe that a large crowd of people is rushing to tokenize their Bitcoin to farm CRV, IntoTheBlock’s data shows that most likely it is only a few whales and institutional investors leading this trend.

2. renBTC Attracts Whales & Institutional Users

IntoTheBlock’s Large Transactions Volume indicator aggregates the total dollar amount transferred in transactions of over $100,000 within a 24 hour period. By filtering out smaller transactions, the Large Transactions Volume metric acts as a proxy to the total amount transacted by whales and large players.

As can be seen in the graph below, throughout most of June the total amount of large transaction volume per day in renBTC was near-zero. This quickly changed following the release of the CRV token.

Source: IntoTheBlock’s renBTC Financial Indicators

The large transaction volume seen in renBTC grew from $2.5 million to over $140 million within 3 days of the CRV launch. While certainly not all of this volume ended up locked in Curve, its native token release evidently acted as a catalyst spurring large players to get into renBTC. This trend can be corroborated by looking at the average balance of a renBTC holder.

Source: IntoTheBlock’s renBTC Financial Indicators

With this indicator reaching over $300,000 on August 17, it is safe to say that it wasn’t average crypto traders that led the growth into renBTC. Instead, it is likely that institutional players stepped into DeFi as yield farming expands beyond ‘traditional’ Ethereum tokens and attracts a new wave of whales.

3. renBTC Will be Available on Maker and Likely on Yearn.Finance Soon

With DeFi and yield farming continuously growing, community participants are eager to keep the trend going. This is apparent in governance forums of some of the top DeFi protocols. Given the industry’s permissionless nature, there are multiple proposals of integrating one protocol with another and benefitting from these ‘money legos’.

Earlier this month, the community voting in MakerDAO’s governance portal demonstrated this by approving renBTC as a collateral within the Maker ecosystem. With the approval of this proposal, Maker users will soon be able to use renBTC to obtain DAI loans from Oasis, just like they are able to do so with wBTC at the moment.

Taking this a step further, the yearn.finance community proposed a yRenBTC delegated vault to be launched as soon as renBTC is available on Maker. As specified in the proposal, the yRenBTC vault would allow users to deposit BTC (or renBTC if they already have it). This capital would then be pooled and yield-optimization strategies proposed by yearn.finance’s contributors would then be applied, growing the size of the renBTC pool.

As with other yVaults, these returns would later be redistributed to depositors, subject to a 0.5% withdrawal fee and 5% performance fee (part of which goes to the users providing the strategy). So far the yearn.finance community forum has shown overwhelming support for this proposal, with 99% of voters in a poll in favor of implementing yRenBTC vaults. This would only be the first step, though, as the proposal has to proceed to on-chain voting for 3 days, be codified by Andre Cronje and community contributors, and approved by multi-sig owners before being implemented.

Source: Meme provided by yearn.finance community

Overall, while $500 million in Bitcoin locked in Ethereum seems like a very high amount considering it was at under $10 million at the beginning of the year, this trend may just be getting started. Currently just over 0.25% of Bitcoin’s circulating supply is represented by a tokenized version on Ethereum. As yield farming and other incentive schemes offer a decentralized way for BTC holders to earn on top of their holdings, it is likely that Bitcoin’s journey into DeFi is just getting started.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year or 70 Dai/year, while free signups get only part of the content.

About the founder: I’m Camila Russo, author of The Infinite Machine, the first book on the history of Ethereum. I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.

Geocash