💥Outdated Node Clients Cause Blockchain Reorg on Eth2 Beacon Chain

Hello Defiers! Here’s what we’re covering today:

News

Outdated Node Clients Cause Blockchain Reorg on Eth2 Beacon Chain

Ethereum Rollup Startup StarkWare Closes Series D At $8B Valuation

Podcast

🎙Listen To The Exclusive Interview With Yoni Assia:

Video

Elsewhere

Circle Asks US Fed Not to Step on Its Toes by Launching a Digital Dollar: CoinDesk

Portugal’s Parliament rejects Bitcoin and crypto tax proposals: Finbold

Nvidia shares plunge after Q1 figures, crypto mining card revenue ‘nominal’: Cointelegraph

Trending in The Defiant

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Eden Rocket RPC, providing the fastest private transactions on Ethereum (90%+ hashrate). Trade better anywhere on Ethereum with Eden Rocket RPC.

ZetaChain is the first public L1 blockchain that natively connects with any chain and layer including Bitcoin and Dogecoin without wrapping or bridging assets. Dive into the docs to start building the future of multichain.

dYdX Grants is powering the future of dYdX through community grants. Join us to build on top of the largest decentralized perpetuals exchange!

Bancor, the only DeFi trading and yield protocol with Single-Sided Liquidity & 100% Impermanent Loss Protection. A safer, more sustainable way to earn DeFi yields on your favorite tokens - start earning now!

Beacon Chain Blocks Scrambled

💥 Outdated Node Clients Cause Blockchain Reorg on Eth2 Beacon Chain

By Samuel Haig

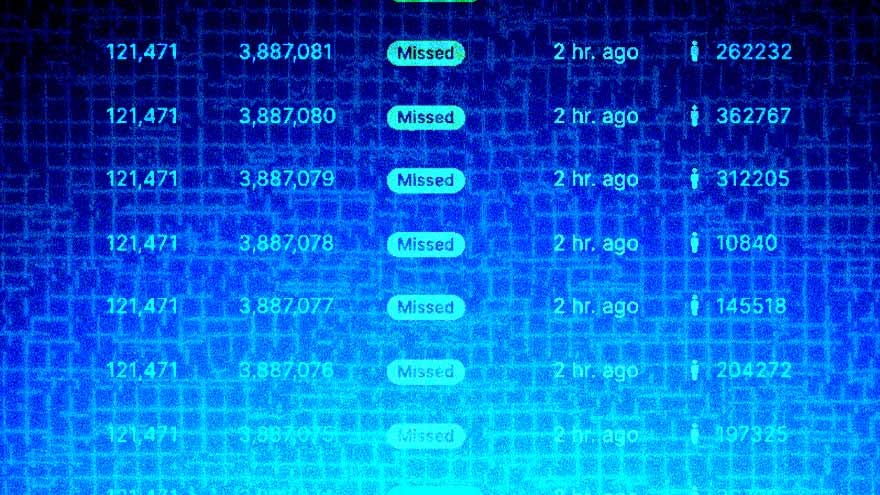

The Eth2 Beacon Chain’s validators fell out of step on May 25 after a client update boosted some clients but caused confusion among validators who hadn’t bothered to upgrade.

The incident, called a blockchain reorganization, happens when nodes disagree on the order of the most recent block. Blockchains order blocks – batches of transactions – chronologically.

If some nodes are faster than others, they can’t agree which block should come first. If that happens, they’ll keep adding blocks to their own version of the blockchain, then discard the shorter chain when the next block gets produced.

That’s exactly what happened yesterday.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Andreessen Horowitz Doubles Down on Web3

💸 a16z Raises $4.5 Billion For Its Largest-Ever Crypto Fund

Venture capital firm a16z has raised $4.5 billion for its fourth crypto fund, the firm announced Wednesday morning.

The new fund dwarfs a16z’s previous fundraising efforts and brings the total amount of money the firm has raised for crypto ventures to $7.6 billion.

“We think we are now entering the golden era of web3,” Chris Dixon, a general partner at the firm, wrote in a blog post announcing the fund. “A massive wave of world-class talent has entered web3 over the last year. They are brilliant and passionate and want to build a better internet. That’s why we decided to go big.”

Crypto Fund 4 will provide nascent crypto companies with $1.5 billion in seed financing and $3 billion in venture financing, according to the firm. Web3 gaming, DeFi, zero-knowledge proofs, decentralized social media, self-sovereign identity and layer 1 and 2 infrastructure are among the fund’s areas of focus.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Disgraced WeWork Founder Enters Crypto

👀 WeWork’s Adam Neumann Raises $70M for Crypto Startup

By Jason Levin

Adam Neumann, the disgraced founder of WeWork, has ventured into crypto. His new company, Flowcarbon, just raised $70M for a private token sale led by a16z crypto. It wants to provide crypto-based carbon credits to offset pollution from the companies that are slowly killing us all.

When companies harm the environment, they can buy carbon credits to reduce their net emissions. These credits are sold by companies that work to reduce greenhouse gasses from the atmosphere. McKinsey predicts that the $3B carbon credit market could grow to $50B by 2030.

Neumann’s company wants to put this market on the (proof-of-stake) Celo blockchain. Its “Goddess Nature Token” (GNT) is backed by carbon credits certified by Verra, one of the four market-recognized registries. GNT is a carbon credits stablecoin, essentially.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

No time for DYOR? There is now a Service DAO for just that

Still rely on biased anon shills when looking for the real gems? With PrimeDAO’s new Research on Demand (RoD) service, you can now hire your own research A-team to get cutting-edge insights on a protocol of your choice.

In a world where DYOR is critical, yet time-consuming and cumbersome, RoD provides in-depth analysis from an entire community of expert analysts with on-chain reputation. Choose from among three offerings: protocol ratings, pre-launch due-diligence and custom research.

You can also customize your request with add-ons, such as hiring only a top-5 rater, making the report confidential and non-public.

What’s more, as a Defiant reader, you get 50% off on all research requests made before June 10th (enter code: ALPHANOTALFALFA). Get started here or by clicking the image above.

Prime Rating has authored 100+ reports on DeFi and Metaverse projects. Check out our rating app to give you a feel for the research muscle and objective expertise in our DAO.

So, are you ready to get up-to-date research pieces you need for your next big decision? We’re here to help.

Mint Essays As NFT Collections on L2

✒️Mirror Taps Optimism for New Writing NFTs

By Samuel Haig

Web3 blog platform Mirror now lets writers sell their essays as NFTs.

Mirror, a kind of Medium meets Web3, lets bloggers publish essays on the Ethereum blockchain, then vote on the best ones with the platform’s governance token.

Upstart writers could already sell NFTs on the platform and hold crowdsales – they’ve raised $15.36M since Mirror launched in 2020.

Now they can create NFTs of their posts, many of which ebulliently describe the future of Web3.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Airdrop Opportunists Punished

💪🏼 Optimism Foundation Cracks Down On Airdrop Farmers

The Optimism Foundation, the entity behind the eponymous Layer-2 scaling solution for Ethereum, is cracking down on sybil attackers.

To maximize influence or profit, some individuals or organizations create multiple online accounts — or, in the world of crypto, wallets — posing as independent or unaffiliated. These so-called Sybil attackers hoard value created by airdrops, the crypto giveaways meant to generate interest in a nascent project, as well as power over a project whose tokens confer governance rights.

“Optimism is for the people, not the sybils,” the Foundation said in a Monday post announcing the identification and removal of more than 17,000 alleged sybil attackers.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Layer 2s Defy Downtrend

🚀 Ethereum Rollup Startup StarkWare Closes Series D At $8B Valuation

By Samuel Haig

Even though the price of ETH has fallen by about 50% since early April, Ethereum scaling solutions continue to secure huge amounts of funding to address the bottlenecks that slow down the blockchain and make it expensive to use.

On May 25, StarkWare, an Israeli startup building Layer 2 scaling solutions for Ethereum, announced the completion of a $100M Series D funding round at an $8B valuation. The funding round was led by FTX and Compound backer Greenoaks Capital, and Moonpay and Alchemy investor Coatue. Other investors in the Series D include Tiger Global.

Rivals have also secured huge backing from major VC firms. In February, Polygon scored $450m in a round led by Sequoia Capital India, which lifted its valuation to $20B. Optimism raised $150M at a $1.65B valuation in a Series B round led by Paradigm and Andreessen Horowitz in March.

All these companies build rollups: a data compression technique that grabs batches of Ethereum transactions, rolls them up into a single transaction, then feeds the lone transaction back to Ethereum’s mainnet.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

The Tube

📺 Hot Stuff: Catalog is the Deadpool of DEX's

🎙️ Podcast: Yoni Assia on the Rise of Active Trading in a Blockchain-Based World

Elsewhere

🔗 Circle Asks US Fed Not to Step on Its Toes by Launching a Digital Dollar: CoinDesk

Circle Internet Financial is arguing the U.S. Federal Reserve should pass on launching a digital dollar, arguing that could strangle private-sector efforts such as Circle’s to manage their own dollar-based tokens. “A host of companies, including Circle, have leveraged blockchain technology to support trillions of dollars of economic activity with fiat-referenced stablecoins,” the company told the Fed in a letter released Wednesday. “The introduction of a CBDC by the Federal Reserve could have a chilling effect on new innovations.”

🔗 Portugal’s Parliament rejects Bitcoin and crypto tax proposals: Finbold

The Portuguese Parliament, Assembleia da República, rejected not one but two different proposals to tax Bitcoin and other cryptocurrencies, both of which came from political groups in the minority. At the start of this month, the country’s Minister of Finance Fernando Medina said that the government would begin taxing cryptocurrencies. He also stated that the government would work on the regulatory framework, but he did not provide a time frame for when this would occur.

🔗 Nvidia shares plunge after Q1 figures, crypto mining card revenue ‘nominal’: Cointelegraph

American graphics card manufacturer Nvidia’s stock price tumbled in after-hours trading on Thursday because the revenue outlook for Q2 has fallen short of expectations. The tech firm saw a drop in sales of its Cryptocurrency Mining Processor (CMP) in Q1 to “nominal” levels compared to $155 million a year ago. The filing does not specify exact revenues on CMPs, but revenues have been falling since last year.

Trending in The Defiant

Vitalik Proposes Soulbound Tokens as Web3 Credentials of the Future Ethereum creator Vitalik Buterin recently proposed a new kind of token standard that will help users gain insights into others’ real-world activities, accomplishments, likes and dislikes – something like a glimpse into their soul. Buterin’s soulbound tokens (SBTs) are non-transferrable NFTs held by unique crypto wallets called Souls. In the paper Buterin co-authored to introduce the concept, he described multiple ways SBTs could be used – as university degrees, education credentials, and as web3 credit scores.

OpenSea Drops New Marketplace Protocol for NFTs NFT developers just got a new tool to build with as the bear market rages on. OpenSea, the leading NFT marketplace, has launched what the company bills as a “web3 marketplace protocol for safely and efficiently buying and selling NFTs.” The protocol, called Seaport, will allow for a more varied, but also more specific, NFT trading experience — users will be able to post offers for NFTs including ERC20, ERC721, and ETH, instead of just ETH trading like OpenSea facilitates currently.

Milady NFTs Plummet As Founder Comes Clean Charlotte Fang had a confession to make on Saturday morning. “I was Miya,” the Twitter user once called the mastermind behind the Milady NFT collection, said. For a brief period in mid-April, the cheapest of the 10,000 generative, doe-eyed, anime avatars “inspired by 00’s Tokyo street fashion” was selling for a little more than $6,000. But the price began to drop, and fell even further after a May 5 story from CoinDesk exploring the Milady founder’s sordid history.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Samuel Haig, Jason Levin, DeFiDad, Aleksandar Gilbert, and yyctrader, and edited by Edward Robinson, yyctrader, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Subscribers get full access, while free signups get only part of the content.

Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr).