Open Gardens are Reshaping Business and the Internet: Spencer Noon

Hello defiers and happy Friday! Today Spencer Noon, who leads investment for cryptocurrency fund DTC Capital, is taking over The Defiant. He writes about the shift in business models from walled gardens, which are good for businesses and bad for users, to open gardens, brought on by public blockchains like Ethereum. Open gardens are showing promise in being good for users, but it remains to be seen how they can be good for business. Read on to understand what the future of applications and the internet will look like in a permissionless, transparent and modular world.

Open Gardens

By Spencer Noon, lead investor of DTC Capital

The Internet is filled with Walled Gardens—closed ecosystems controlled by centralized operators who extract as much value as possible. History has shown us that as platforms grow, Walled Gardens become increasingly parasitic to their own users and 3rd parties. Chris Dixon captures this relationship perfectly in his 2018 essay, Why Decentralization Matters:

“As platforms move up the adoption S-curve, their power over users and 3rd parties steadily grows. When they hit the top of the S-curve, their relationships with network participants change from positive-sum to zero-sum.”

Source: Why Decentralization Matters

Walled Gardens: Good for Business, Bad for Users

I’ve observed the effects of closed ecosystems first-hand as an early employee at event ticketing company SeatGeek. When I joined in 2014, we were a fast-growing startup building the Kayak for event tickets — a thin, user-friendly aggregation layer that collated inventory from all over the web and made comparison shopping easy.

The mission to aggregate all of the tickets on the internet resonated with investors like Accel Partners, who led our Series B, and even Kayak’s CEO, Steve Hafner, who joined our company board.

To achieve this, SeatGeek needed to partner with all of the websites that sold event tickets using a relatively simple API integration. Ticket providers would provision SeatGeek a partner API containing their ticket listings, which SeatGeek used to populate its own website. When users attempted to buy tickets, SeatGeek would simply redirect them to the provider’s website for checkout and take a small referral fee.

Convincing most ticket providers to partner with SeatGeek was easy. Websites needed help selling tickets and were eager to grant permission to a new sales distribution channel. Because SeatGeek wasn’t selling tickets directly, it wasn’t viewed as competitive.

However, one company didn’t want to give their tickets to an industry upstart. It was Ticketmaster, the largest provider in the industry, which tickets most of the major professional sports teams and touring artists in the United States.

Already the market leader and sitting at the top of the S-curve for almost 43 years, Ticketmaster viewed SeatGeek as a potential competitor down the line. While syndicating Ticketmaster inventory on other websites could offer a sales lift and make clients and fans happier, it also meant empowering the competition. Collaboration was off the table.

For SeatGeek to realize its vision and unlock an open ticketing ecosystem for fans, it would need to directly compete with Ticketmaster, the industry’s biggest Walled Garden, and open the industry up from the inside. In the years that followed, it did exactly that. The company is now perhaps the fastest-growing ticket provider in the world, working with major clients such as the Dallas Cowboys and Manchester City FC, and the event ticketing industry has made promising strides to become more open.

If this type of story sounds familiar, that’s because it happens regularly between fast-growing technology startups and entrenched incumbents. For companies like Ticketmaster, who already benefit handsomely from the status quo, there is often limited upside in opening up their platforms to 3rd parties.

When it does happen, usually through the provisioning of partner APIs, companies heavily consider business risk. This results in APIs that are limited in functionality and scope and with rules that can be unilaterally changed by the provider on a whim—hardly a solid foundation for new companies to build businesses on.

Open Gardens: The Product of a Permissionless Internet

Recently, however, a major assumption that software is Closed by Default has been challenged by public blockchains like Ethereum.

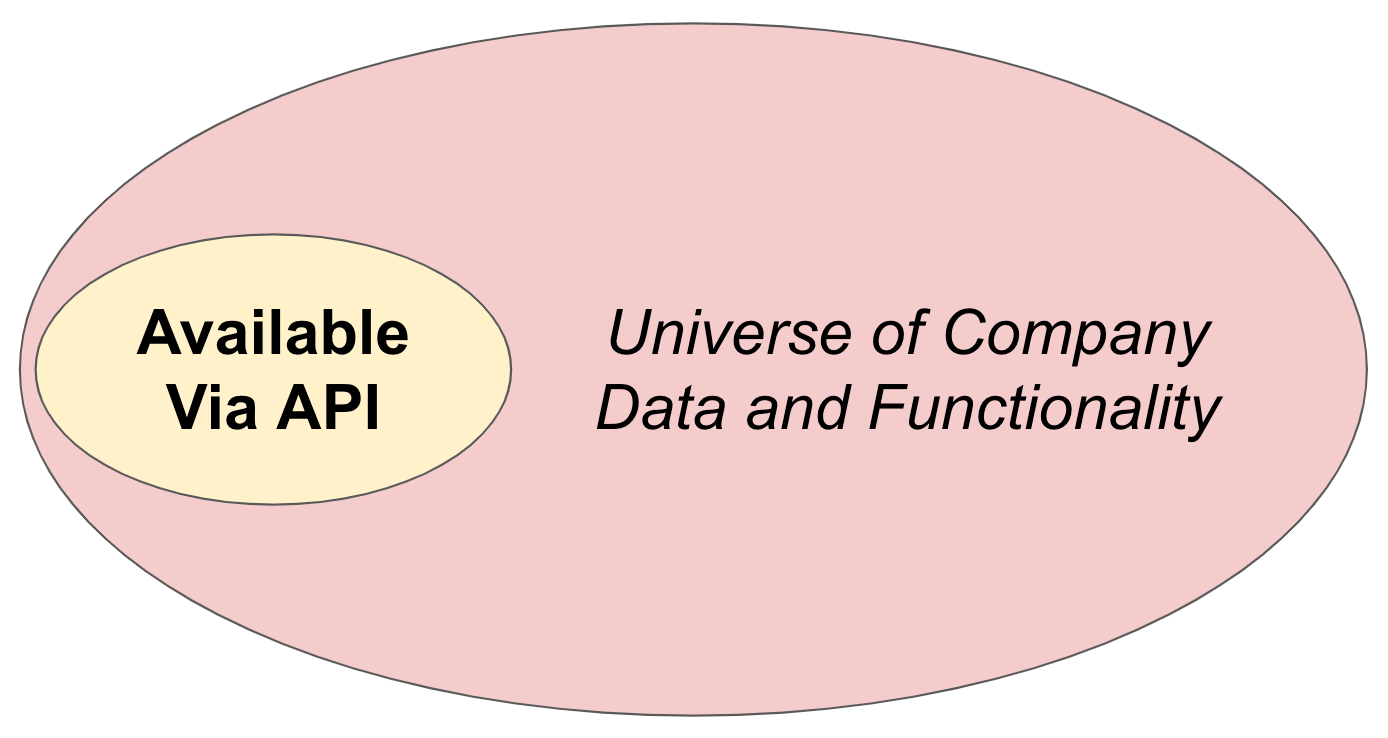

Blockchains are Open by Default. When someone deploys a smart contract on Ethereum, they have opted into a version of the internet in which technology is available to anyone in the world without restrictions. No permission is needed to interact with an application, nor is there any possibility of your access becoming restricted or revoked.

This new paradigm inhibits Walled Gardens and enables Open Gardens—open ecosystems that cannot be controlled by centralized operators. It has never existed on a global scale before, and it has profound consequences for platforms and their relationships with users.

From Open Gardens to Open Apps

With a foundation of game-theoretical, cryptographic, and community-driven guarantees, applications built on the permissionless internet are deserving of a new classification: Open Applications.

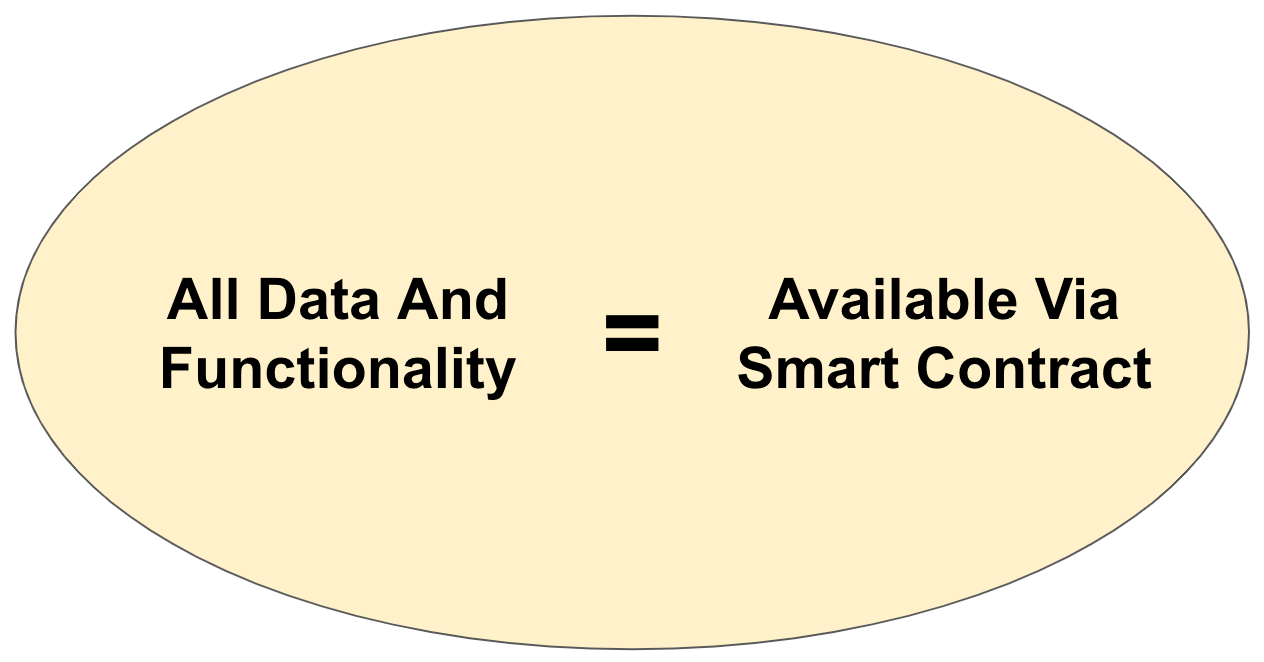

Open Apps are the product of smart contracts being deployed to public blockchains. They are not necessarily decentralized, although they can be, and they have the following core properties:

Permissionless — anyone can access an Open App’s smart contracts and data. No permission is required.

Transparent & Auditable—all data and code are publicly available for anyone to view.

Modular & Composable— Open Apps are themselves building blocks, called primitives, that can be easily combined and stacked on top of one another.

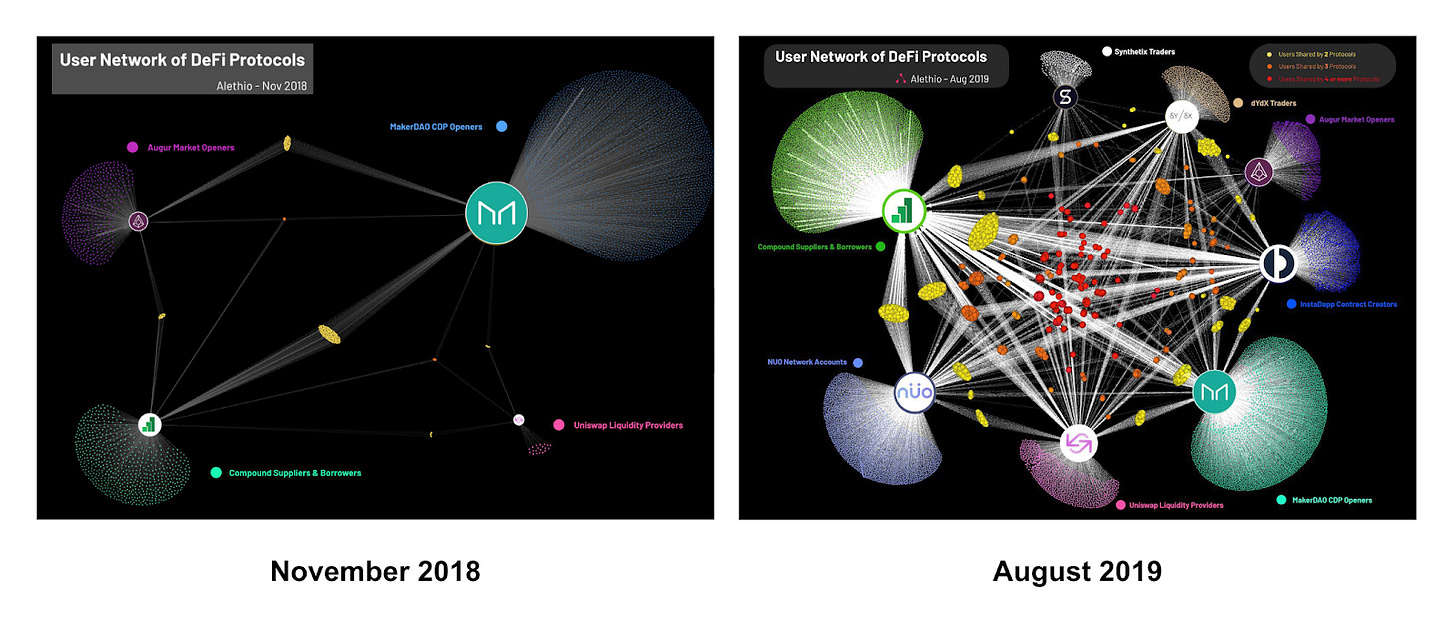

Today, Ethereum’s Open Finance ecosystem (aka DeFi) contains the most Open Applications. The total number of DeFi users is modest, but there are hundreds of millions of dollars worth of crypto assets locked in DeFi smart contracts, which indicates user confidence and skin in the game. In less than a year, a vibrant ecosystem has already emerged:

Source: Alethio

Open Finance has also produced a fertile ground for early insights about Open Applications:

#1: The barriers to creating an application have the potential to be greatly reduced someday. Infrastructure is publicly available, modular, and composable, which means anyone can easily combine or stack different primitives on top of one another to create their own application. It’s not hard to imagine a world someday in which development feels a lot like playing with LEGOs.

Source: Building with Money Legos

#2: It’s harder to create a defensible business model on the permissionless Internet. Web2 companies like Apple, Amazon, Facebook and Google leveraged multi-sided network effects to build massive Walled Gardens and proprietary data silos, which allowed them to extract handsome profits from users and 3rd parties. This business model is simply not possible in an Open by Default software paradigm.

#3: Users have an unprecedented amount of agency. Open App users can verify for themselves if the rules of a system are being followed, and they can also fork away from a system if it is being abused. This naturally extends to pricing—if companies are charging too much for services, they should expect others to step in, fork their service, and start offering it for a more reasonable price.

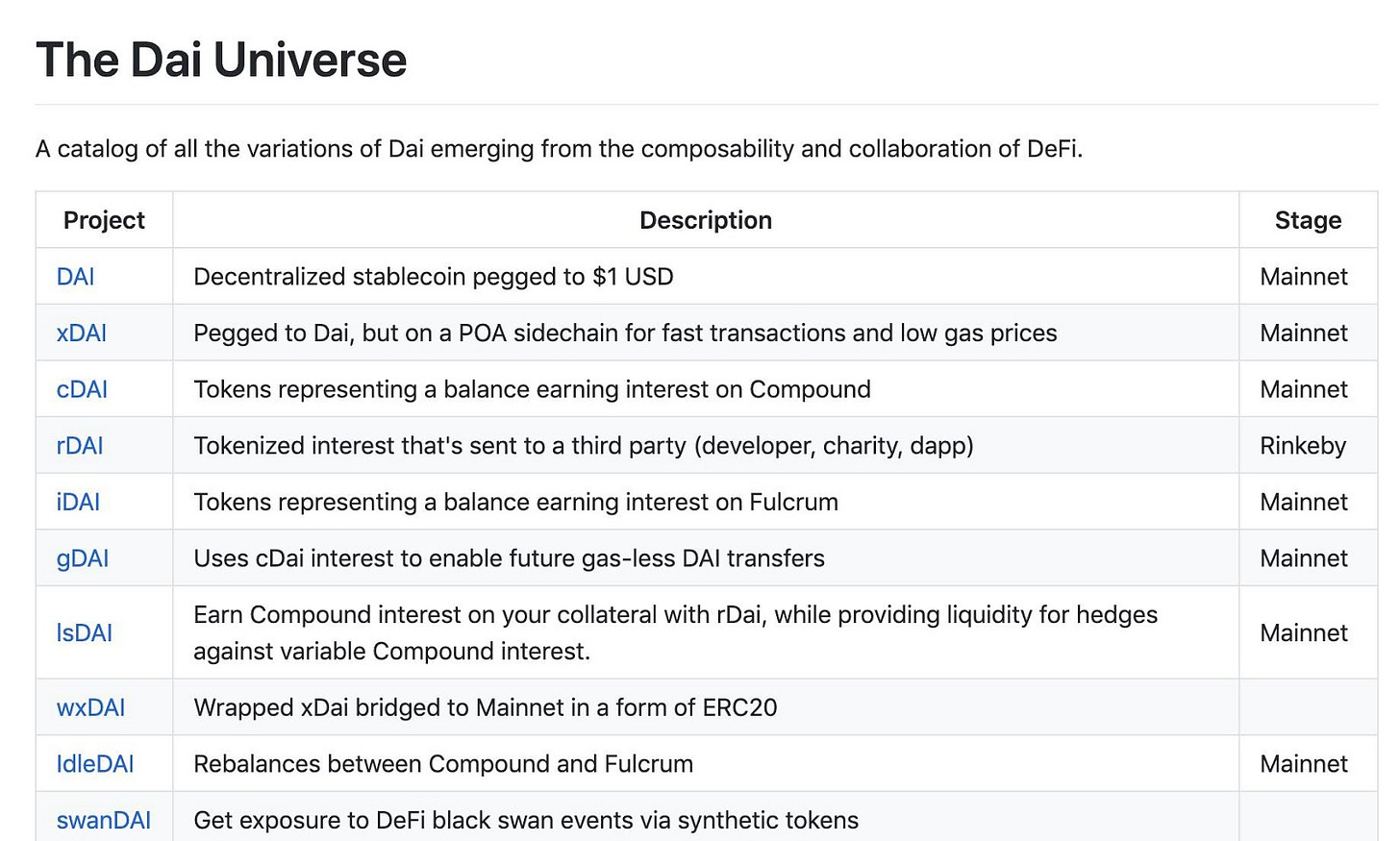

#4: Open Apps support rapid experimentation and iteration. Anyone can interact with a smart contract once it’s been deployed, which includes forking the code or taking it in a different direction. A great example of this phenomenon happened recently with Dai, which has seen an entire universe of variations built on top of it emerge over the past few months.

Source: The Dai Universe

It’s important to remember that today’s Internet, which is dominated by Walled Gardens, isn’t going anywhere. But with the advent of public blockchains, a new paradigm has emerged that provides developers with a permissionless foundation for building Open Applications. It will take years for Open Gardens to bloom, but when they do, there might be no turning back.

Spencer Noon, leads investments for Doggie Tail Crypto Capital, a crypto-native fund based in the Greater Miami Area. Click here to follow him on Twitter.

Thanks to Tony Sheng, Cyrus Younessi, and Jacob Arluck for reviewing this post.

Sign up to get the best and only daily newsletter focusing on decentralized finance news, complete with analysis, exclusive interviews, scoops, and a weekly recap. All content is free for now. Those who become paid subscribers now, before the paywall goes up, get a big discount :)