Multi-Collateral Getting Close, Instant 10% Rates

Happy Friday defiers! here’s what’s going on in decentralized finance,

MakerDAO gets closer to releasing multi-collater Dai

Dharma started offering instant 8-10 percent annual rates on deposits

Dex volume creeping up as centralized exchanges keep getting hacked

Non-Ether Collateral at MakerDAO is Closer to Reality

Ether is about to get some competition as the reigning backbone for decentralized finance.

MakerDAO, the most used decentralized protocol, only accepts ether as collateral for loans but, from the start of the project, the plan has been to transition to mutli-collateral Dai loans from only ether-backed Dai loans. That means borrowers will eventually be able to use other tokens too.

When? There’s still no set date but yesterday Maker signalled it’s getting close after it released a list of tokens up for consideration to be included alongside ETH.

On the week of July 29, holders of MakerDAO’s governance token MKR will be able to vote on which assets should enter the platform’s governance system for additional review and potential approval –so tokens have to pass at least two filters. MKR holders will be able to propose additional tokens to the ones listed by Maker on July 9. –By the way, anyone can be a MKR holder and vote, even if you have a tiny bit of MKR.

The tokens proposed by Maker after months of analysis by its risk team are Augur (REP), Basic Attention Token (BAT), DigixDAO (DGD), Ether (ETH), Golem (GNT), OmiseGo (OMG) and 0x (ZRX). Ether was included so its risk parameters, which define loan terms, can be re-evaluated.

This is kind of a big deal. The first thing that will happen is that there will be different loan parameters. Right now, ether-backed loans require 150 percent collateral and have interest rates of 16.5 percent. Those terms will change according to each specific token. It will enable blockchain-based projects who have a large stash of their own tokens and don’t want to sell it, to get Dai loans on those assets that they can spend on working capital.

But the next thing that can happen is that this initial step opens up the system for many different types of collateral. For example, digital tokens backed by real-life assets, like property, or security tokens that represent company debt or equity.

Borrowing against your home or investment portfolio isn’t new in the traditional financial world, but it’s done through investment banks and brokers that make the process slower and more expensive. Having the collateral and loans on-chain and executed through smart contracts is faster and more transparent, but borrowers run the same risk of getting liquidated if their collateral suddenly drops in value and they can’t make up for it. (That risk is high with volatile assets like crypto, but then, that’s why there’s 150 percent collateral).

Having different types of assets as collateral reduces the risk of the system as a whole. Right now most of DeFi is backed by ether. When Maker enables these tokens, the whole system will still be backed by highly correlated crypto assets. Stocks, bonds and property are uncorrelated to crypto, which will help make the system safer if they come into play down the line. In a crisis, hopefully not everything will crash together.

There’s a New Way of Earning Interest With Crypto

Dharma is offering to start paying savers annual rates of 10 percent on Dai deposits and 8 percent on USDC, instantly. No need to wait around for a borrower. People can send their tokens into a contract and start accumulating interest right away.

Dharma is the counterparty there, making sure those rates get paid. They can do that because they charge borrowers the same rates. It can be argued they’re effectively an intermediary, but at least they’re not taking a huge cut for it.

The interface shows the user is gaining interest in real time, but they can only make withdrawals after a 90-day period. For deposits of over $5,000 Dai or USDC, lenders have to wait to be matched with borrowers.

Still, it’s pretty cool from an ease-of-use perspective and 10 percent compared with about 2 percent APR at a traditional U.S. bank isn’t bad. The catch? As with any of these protocols, you have to trust hackers won’t steal your funds and that smart contracts will work like they’re supposed to.

Another Day Another Centralized Exchange Gets Hacked

Hackers stole $4.2 million from Singapore-based cryptocurrency exchange Bitrue. They were able to steal money because the exchange was holding it in the first place. This is is why decentralized exchanges matter. Users hold their own money so there’s no big, crypto-filled coffer to entice the bad guys.

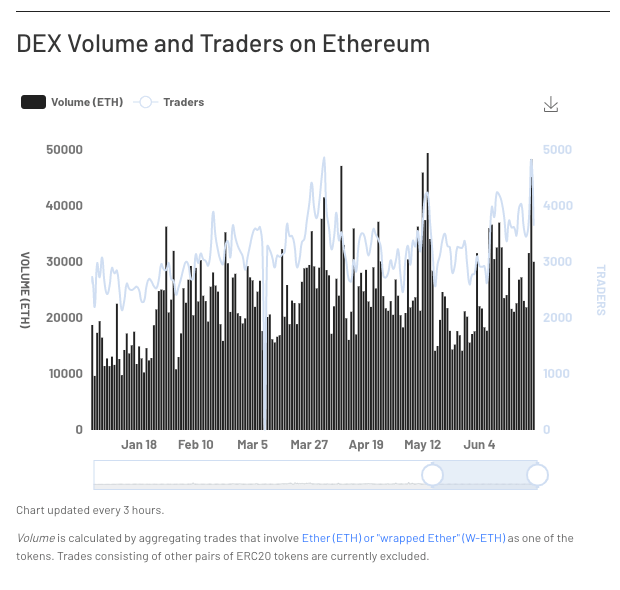

Volume for Dexes is still a fraction of centralized exchanges, but it has been very slowly trending up this year, according to DEXWatch.

The Defiant will become a paid newsletter in the next couple of months. As a way to say thank you to the first ones joining me in building this platform, anyone who signs up before the paid period will pay just $8/month and $80/year for the best (and only) daily, in-depth DeFi content out there, compared with the full price of $10/month and $100/year.

Subscribe now! You’ll be supporting independent journalism and allowing me to continue illuminating this fascinating corner of the world for you.