MetaMask's Mobile Wallet is a Big Deal, DEX Volume Triples

Hello defiers! This is what’s going on in decentralized finance:

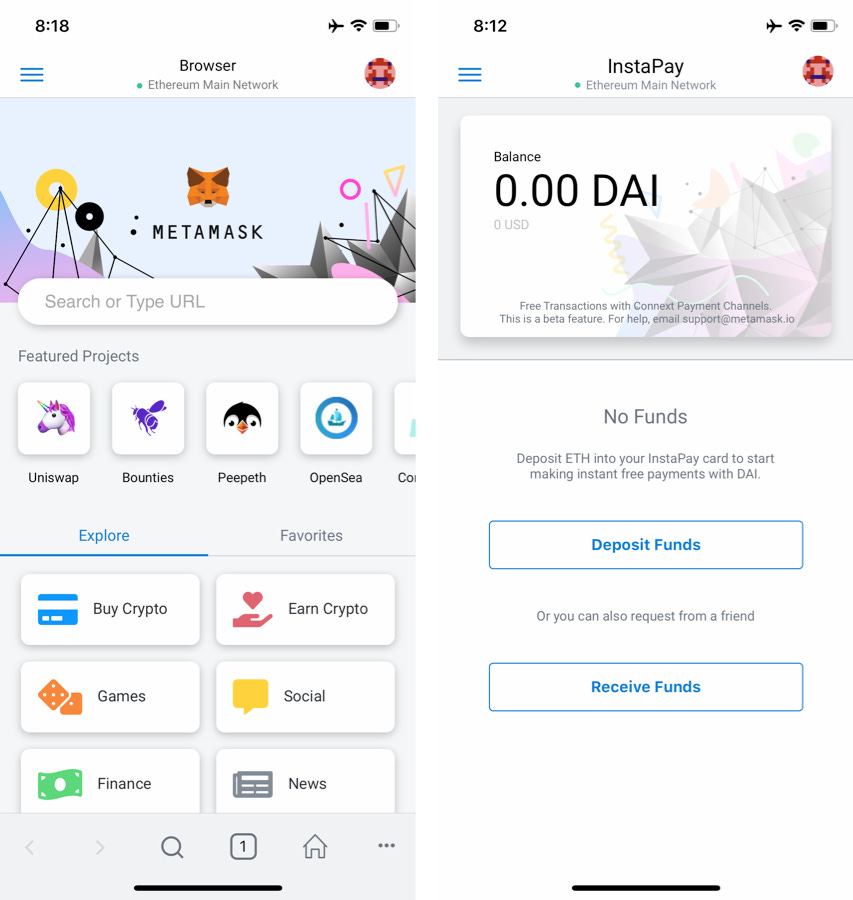

MetaMask’s launches the beta version of its mobile wallet

Decentralized exchange volume has tripled this year

MetaMask’s Mobile Wallet Gives a Glimpse Into How the Internet Should Work

Ethereum browser wallet MetaMask launched its mobile app yesterday and it has the potential to change how we use the internet.

The iOS and Android app, which is in beta, will make using decentralized apps easier but more importantly, has the potential to open the door to micropayments. The technology for the free, borderless transfer of very small amounts of money online isn’t what’s new. What changes is that it will now be at the fingertips of MetaMask’s almost 300,000 monthly active users.

Another difference with existing systems is that it’s Ethereum-based, which means it payments are done with decentralized stabelcoin DAI, which is pegged at 1-to-1 to the dollar and removes the risk of using volatile cryptos.

The wallet has the option of enabling payments interface InstaPay, which is done by depositing a minimum of 0.03 ETH, or about $6. It took me about 5 minutes to get the confirmation and the ETH instantly showed up as DAI in my wallet. There’s the option to send, deposit more funds, or withdraw, pretty much like Venmo, except you only pay a fee when you deposit funds and when you withdraw to your account, not every time you make a transfer or payment.

Source: MetaMask mobile app screenshot

This is key, because it means that making payments of a couple of cents, which is unfeasible because of card network fees, can make sense. Online micropayments have the potential of spurring entire new business models. One example I’m close to is news sites that could allow users to pay per article, like streaming news.

Also unlike Venmo, users will be able to transfer money with people from all over the world, not just in their own country. Facebook is proposing to do this but unlike with Libra, you won’t have to worry about a big corporation spying on you. MetaMask doesn’t own your funds or data.

State channels, similar to what the Lightning Network uses on Bitcoin, is what makes this possible. MetaMask partnered with Ethereum infrastructure company Connext, which provides this technology. It’s a Layer 2 solution which means transactions can be instant because their balance is recorded to the blockchain only when the parts close the channels. Payment channels on Ethereum are still nascent. There are 904 open channels, about 2,200 transfers processed in total (a bit over 100 / week), according to Connext.

Connext has partnered with other wallets before, but the significance of the latest announcement comes down to MetaMask’s reach.

The rest of the wallet works pretty seamlessly. It connects with MetaMask’s browser wallet through a QR code or seed phrase and the user’s tokens including ERC 721 non-fungible tokens, and transaction history get instantly synched. For those who don’t have a browser wallet installed, creating it will take a couple of minutes. As always, the challenge will be to get ETH, which can take a few days.

Another piece of the wallet is a browser, which has a search bar and it also takes the user by the hand suggesting six dapps categories, each leading to a short list of apps. Finance will lead to DeFi apps including Uniswap, Compound and MakerDAO. It’s a clean and organized window into the blockchain-based internet known as Web3 aimed at encouraging people to start trying out these apps.

From here, it’s pretty easy to imagine an online experience that won’t require endless logins, subscriptions and filling out forms with your credit card info. Hopefully soon it will just take one click.

DEX Volume Tripled Since January

More than $300 million was traded on Ethereum-based decentralized exchanges in June, up from $86 million in January, according to a report commissioned by D5 — The Data Science DAO, an organization of data-scientists specializing in the decentralized technology. Growth was largely driven by transaction size, as total number of transactions only grown by about 74 percent in that period.