😬 ‘Massive Dumping’ by Ethereum Miners Punishes ETH

Hello Defiers! Here’s what we’re covering today:

News

Markets

The Merge

👀 Defiant Premium Story for Paid Subscribers (📜Scroll to the end!)

Podcast

🎙 Listen to the Exclusive Interview with Robert Lauko

Video

DeFi Explainers

Elsewhere

Ethereum Fork ETHPoW Suffers Bridge Replay Exploit, Token Tanks 37%: Decrypt

On Nov 15-16, we’ll host our inaugural DC Policy Summit: Blockchain Association

Trending in The Defiant

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Nexo’s fundamentals-first model helps you secure your assets and grow your wealth. The company now provides an increased insurance on custodial assets of $775 million. Learn More!

ZetaChain is the first public L1 blockchain that natively connects with any chain and layer including Bitcoin and Dogecoin without wrapping or bridging assets. Dive into the docs to start building the future of multichain.

Thales is your way into OP Summer! Simple, novel, and easy-to-understand markets: UP or DOWN? IN or OUT? The choice is yours. Try it now. No registration needed.

Ref Finance: Where your DeFi Journey starts on NEAR. First AMM and DEX on NEAR. A DEX offering easy to use liquidity mining programs and access to many networks.

Market Action

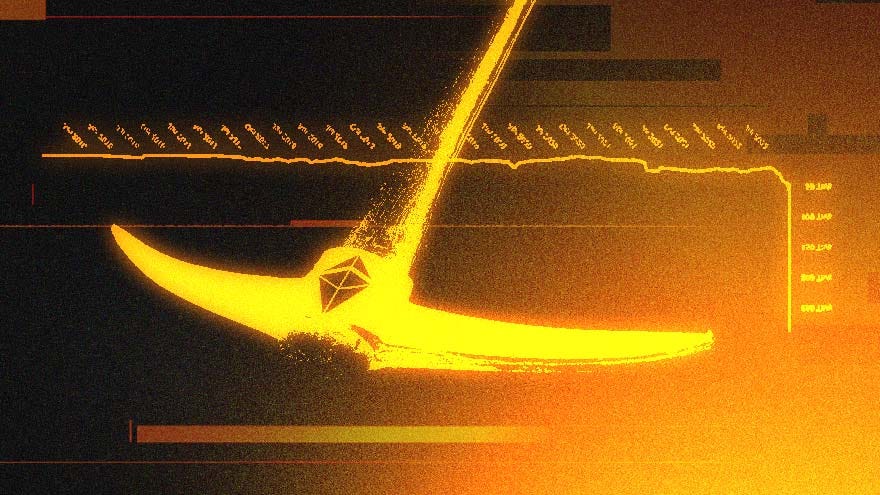

😬 ‘Massive Dumping’ by Ethereum Miners Punishes ETH

Shift to Proof of Stake Roils ETH Market But Perhaps Only for the Short Term

By Samuel Haig

DISMAY Ever since The Merge took place on Sept. 15 investors have looked on in dismay as Ether lost a fifth of its value over the next four days. What was going on? Many traders expected some profittaking and sell-the-news market action, but the historic upgrade was supposed to usher in a vibrant new era for Ethereum, not a spasm of bearish selling.

MINERS Now, one of the causes for the selloff may be emerging — Ethereum miners are dumping ETH at record levels, according to data from OKLink.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Crypto Regulation

🏛 Gensler Rattles DeFi With Suggestion PoS Coins are Securities

Crypto Supporters Decry Move to Treat Ethereum Same as Stocks and Bonds

BATTLE The Merge may be complete, but the battle for legally defining Ethereum 2.0 is just beginning. Hours after Ethereum completed its historic transition to Proof of Stake technology, a top U.S. regulator said cryptocurrencies that use this approach should probably be defined as securities.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

Nested is the ideal place for your crypto journey combining portfolio management and social trading - all at the touch of a button.

On Nested, you can build, share, and copy strategies. Earn 50% of the platform’s fees whenever someone copies your strategy - our royalties scheme will become your favorite passive income!

When you create or copy a strategy, your NFT comes to life and represents your portfolio: Here you can see what our disruptive solution looks like.

Nested raised more than $8 million from the most renowned investors including Jump and Alan Howard. More than 40,000 strategies have already been created and thousands of dollars have already been shared with our community.

It’s your time to make your mark and appear on the top of our leaderboard!

DeFi Domains

🕹 ENS Regains Control Of eth.link Domain

Manifold Finance Purchased The Domain For $850K Two Weeks Ago

By Owen Fernau

CONTROL Ethereum Name Service (ENS) has regained control of the eth.link domain, according to the project’s Twitter account. Nick Johnson, the founder of ENS, describes eth.link as a decentralized application (dapp) built on top of ENS which allows the internet’s Domain Name System (DNS) to access information stored in ENS.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Blockchain Interoperability

⚛ Cosmos’ ATOM Bucks Broader Bearish Trend

Ecosystem Of Blockchains Unveils Interchain Security

By:Owen Fernau

ON THE RISE Even as the price of Ether has sunk this week despite a successful Merge, another blockchain ecosystem is on the rise.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Post-Merge

👀 Ether Not Quite ‘Ultrasound’ Money As Inflation Persists

ETH Issuance Has Dropped By 97%

By Owen Fernau

MONEY Proponents hoping to immediately proclaim Ether to be an “ultra sound” form of money can’t celebrate just yet.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Podcast

🎙 Building The Forefront of Decentralization

Defiant Video

📺 Quick Take: Merge Completed - What's Next?

📺 The Open Metaverse Show: Josie Bellini is the queen of the Metaverse

Shoutout

ZetaChain is the first public L1 blockchain that natively connects with any chain and layer including Bitcoin and Dogecoin without wrapping or bridging assets.

Enter ZetaChain’s ZetaLabs testnet dApp now to experience the 1st native asset cross-chain swap and contribute to the development of omnichain dApps.

DeFi Explainers

🧐 What Is Synthetix?

A Step-by-Step Primer on the DeFi Derivatives Platform

RISKY MARKET Synthetix operates in one of the riskiest markets in finance — crypto derivatives. These are financial instruments that even professionals find difficult to manage and may punish ill-prepared retail investors. In some nations such as the U.K., regulators have prohibited the sale of crypto derivatives to retail investors.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Elsewhere

🔗 What kind of layer 3s make sense?: Vitalik Buterin

One topic that often re-emerges in layer-2 scaling discussions is the concept of "layer 3s".

🔗 Ethereum Fork ETHPoW Suffers Bridge Replay Exploit, Token Tanks 37%: Decrypt

ETHPoW, the proof-of-work blockchain forked from Ethereum that went live shortly after Ethereum’s transition to proof-of-stake (PoS) last week, has fallen victim to a replay exploit that resulted in an extra 200 ETHW tokens being siphoned by the attacker.

Trending in The Defiant

New PoW Ethereum Fork Plunges 75% Amid Flurry of Problems The Merge may have launched without a hitch but ETHPoW, the Proof of Work fork of Ethereum aimed at die-hard miners, is off to a troubled start.

Exchanges Resume ETH Transfers After Successful Merge Centralized crypto exchanges have re-enabled withdrawals and deposits of Ether and related tokens on Thursday, after a brief pause due to uncertainty surrounding the Merge, Ethereum’s biggest upgrade in its seven-year history.

ETH Plummets Post-Merge as DeFi Chugs Along Maybe the Merge was a sell-the-news event after all. ETH has fallen just under 10% in the past 24 hours, while Bitcoin, the world’s largest cryptocurrency, has only dropped 2%. The DeFi Pulse Index (DPI), the largest index focused on DeFi, is down 6%.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Aleksandar Gilbert, Samuel Haig, and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

Free subscribers to the newsletter get:

Daily news briefings

Sunday Weekly recap

General chat on The Defiant’s Discord server

👑Prime defiers get:

Full transcript of exclusive podcast interviews

DeFi Alpha weekly newsletter on how to put your money to work in DeFi by yyctrader and DeFi Dad

Weekly live DeFi Alpha call with yyctrader

Inbox Dump edition of The Defiant newsletter every Saturday with all the PR that didn’t make it to our content channels

Exclusive community calls with the team

Subscriber-only chats on The Defiant Discord server

Full access to The Defiant’s content archive

Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

You can start a prime membership for free right now with this link. You’ll get full access for 7 days. It’s 100% risk-free.

👀 Defiant Premium Story for Paid Subscribers

⛏ Proof of Work Mining Craters After Ethereum’s Merge

Ethereum Miners Struggle to Find Their Footing After The Merge

By Samuel Haig

FALLOUT The fallout from The Merge for Proof of Work mining outfits has been swift and profound. As expected, many former Ethereum miners appear to be shutting down their hardware following the execution of its historic upgrade last Thursday.

To read the full story subscribe to The Defiant newsletter.

Keep reading with a 7-day free trial

Subscribe to WE'VE MOVED TO thedefiant.io to keep reading this post and get 7 days of free access to the full post archives.