MakerDAO Weighs Strengthening Ties With Legacy Finance

Good morning defiers! I dedicated today’s Defiant to an important debate in decentralized finance: Should MakerDAO strengthen its ties with traditional finance.

MakerDAO Weighs Whether to Remain Fully Trust-less

The MakerDAO community is debating the risks and merits of the system accepting non-trustless assets as collateral for Dai.

Backtracking a bit. MakerDAO, which holds more than half the assets in DeFi, currently only takes ether as collateral to back its Dai stablecoin. Each Dai is backed by 150 percent of ether, and that’s why it can maintain its peg at $1, even as ether fluctuates. From the very beginning of the project the plan was to have many different assets backing Dai to make the system stronger and more scalable. This new version of the system, called Multi-Collateral Dai, or MCD, is finally close.

So the question is, should assets that depend on traditional finance for custody and security, and are designed to limit token holders with know-your-customer procedures, be included as part of MakerDAO, the backbone of trustless, no KYC, no intermediaries, open finance.

The question raised by MakerDAO founder Rune Christensen on Sept. 14, originally focused on whether other stablecoins should be added as collateral. He argued yes. In that scheme, “Dai starts behaving like a fiat backed stablecoin itself, in that it will be so easy to exchange it 1:1 with very low spreads to USD and fiat,” he said.

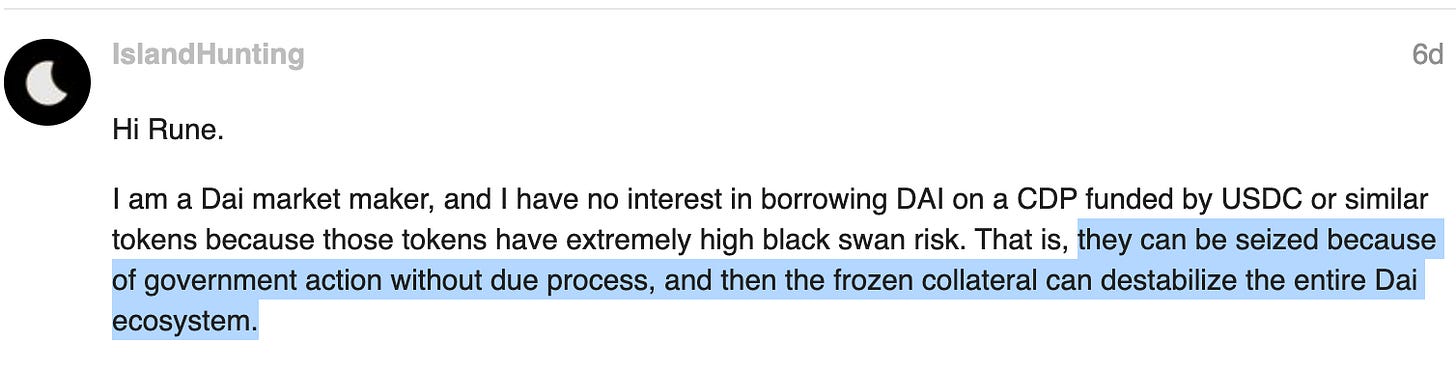

But then the discussion turned to the risks involved in adding centralized coins to a system that’s supposed to be decentralized. The main concern is that stablecoins like Circle/Coinbase’s USDC, and Tether’s USDT can ultimately be shut down by regulators. They’re not censorship resistant like bitcoin and ether.

Of note, it seems that the MakerDAO foundation is already leaning towards the non-trustless asset option. This is from one of the replies in the Maker forum:

Right now we are more or less headed in the “love-KYC” direction unless external events force a change. It is however very valuable to have participants with opposing views so please continue sharing your doubts.

My opinion is that MakerDAO should stay fully permissionless. I’ll list the reasons for non-trustless assets in MCD and then I’ll present the counterarguments.

Reasons for non-trustless assets in MCD:

Dai will need more liquidity and stability to keep growing while keeping its peg than what trustless assets can offer.

Dai holders won’t be exposed solely to the highly-correlated risk of crypto, and as a result it will be more liquid and stable.

Users will be able to choose between trustless assets as collateral, or regulated assets that require KYC.

There’s a risk that non-trustless assets are shut down by regulators and they lose their value, but there’s also the risk that crypto exchanges get hacked or banned and crypto loses its value.

The Maker protocol won’t become centralized regardless of what collateral it uses.

Reasons against non-trustless assets in MCD:

Dai will grow as the cryptocurrency ecosystem grows. Remaining fully trustless is a bet that cryptocurrencies will continue gaining liquidity and be able provide exposure to assets that are not correlated with crypto.

Rather than strengthening Dai by using permissioned collateral, the system becomes vulnerable to centralized parties. It opens the possibility of a black-swan event where regulators ban, seize or interfere on one of the non-trustless assets, causing its value to quickly drop to zero/near zero, and destabilizing Dai and Maker.

Dai becomes less attractive for users seeking an alternative to the traditional financial system. MKR tokens and Dai could lose value if market participants believe the "love-KYC" strategy undermines the project's central value proposition.

Users will be able to choose trustless assets as their collateral, but they will still be exposed to the risks that permissioned assets bring to the system.

While the value of bitcoin and ether can plunge after attacks to centralized exchanges, their underlying and fundamental value remains the same. If Dai is backed by permissioned assets, and plunges because they become compromised, its underlying and fundamental value changes.

Maker the protocol itself won’t become centralized, but the protocol was made to create a fully decentralized stablecoin. What’s the point of a decentralized protocol that’s minting assets that are vulnerable to censorship?

MakerDAO’s MKR token holders will decide the path the system takes. Foundation members obviously own a large portion of tokens, but not all members necessarily feel the same way.

In the case one part of the community disagrees with the outcome of the vote, there’s always the possibility of a fork. And maybe it’s not a bad idea to have a KYC-version of Maker and a fully trustless Maker. If this were the case, I think it’s clear which would continue to be at the center of DeFi.

Sign up to get the best and only daily newsletter focusing on decentralized finance news, complete with analysis, exclusive interviews, scoops, and a weekly recap. All content is free for now. Those who become paid subscribers now, before the paywall goes up, get a big discount :)

About the author: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.