Instant $500k Profits on BZRX Raises Questions on DEX Offerings

Also, no one is shorting COMP, and The Infinite Machine launch!

Hello Defiers! Here’s what’s going on in DeFi

BZRX token sale sparks debate on open versus fair

COMP bears are hibernating

and a bunch of book stuff :)

🌈🌈: Countdown is Over! The Infinite Machine Launches Today!

🙌 Together with Status, a secure messaging app, crypto wallet, and Web3 browser, Kyber Network, the on-chain liquidity protocol for the tokenized world, and Keycard, the secure, contactless hardwallet & open source API.

In DEX Offerings, Open Doesn’t Mean Fair

bZx’s token listing is raising questions on the latest fundraising mechanism on Ethereum.

Lending platform bZx listed its BZRX tokens, and like other Etehruem projects, it did so via the fan-favorite decentralized exchange Uniswap, adding to a wave of so-called Initial DEX Offerings, or IDOs. The bZx team seeded the listing with $500k in capital and included a bridge for presale investors to claim liquid BZRX tokens.

Different Animal

IDOs on Uniswap are unlike ICOs where investors sent funds directly into teams’ wallets at predetermined price bands, as an automated pricing model means the token price can start climbing as soon as the sale starts. Also, the liquidity pool at the core of DEXs like Uniswap, means that traders can instantly cash out.

DEX offerings are also different from listings on centralized exchanges, such as Binance, as anyone is able to list their tokens on the open Uniswap platform. In theory, just as IDOs allow anyone to list tokens, they also allow anyone to buy them. In practice though, it doesn’t always work out that way.

12x Jump

Less than 60 seconds after the Uniswap liquidity pool was seeded, BZRX price jumped 12x from it’s listing price of 0.0002 ETH to 0.0024 ETH. You’d think this was a sure win for early investors. However, when looking under the hood of what happened, the main “winners” were those running scripts to purchase BZRX in the same block it became available.

The very first purchase of 650ETH was completed in the same block liquidity was added.

“At block 10451767, the Uniswap pool is created with 1k ETH and 1M BZRX which implies $0.04 as expected,” wrote Dex.Blue co-founder Angelo Min. “BUT in the same block, 3 addresses managed to buy ~$187k worth of BZRX driving the price to $0.15 right off the gate”

Not only were the bots able to get in and scoop the tokens up early, but they may have spammed the network to prevent others from getting in, according to Roman Storm, Peppersec founder.

Less than 5 min later, when the team officially announced the Uniswap pool on Discord and Twitter, the price was already hovering at around $0.60. At that point, other traders piled in to buy the token, and the initial traders were able to sell, with one of the “snipers” making almost $500k of profits.

BZRX has since slumped from its high of $0.6 to $0.2.

Bots’ Advantage

The bZx team clearly communicated the token address, the listing time and made precautionary warnings about scam addresses that popped up minutes after the sale.

But there’s only so much that can be done to give less technical and experienced investors a fair chance against their automated counterparts. As highlighted by CoinFund founder Jake Brukhman following UMA’s initial listing, it’s clear small fish may get fried when using Uniswap offerings.

The listing has sparked debate over openness versus fairness: do open protocols effectively generate an equal playing ground when technical traders can front-run less experienced participants?

bZx said that the bot was doing nothing more than a trader buying low and selling high.

Moving forward, it’ll be interesting to see how teams prepare for pushback from DeFi users after seeing what happened when a sale didn’t work out in their favor. This certainly won’t be the last IDO, and it’s clear other protocols - like Mesa - are putting their hat in the ring to start the discussion on a more fair distribution model.

No One Is Shorting COMP in DeFi

By Rachel Rose O’Leary

Compound Finance’s COMP token is currently trading at $160 —up about 10x its listing price and with a market cap of $1.6 billion, it’s DeFi’s most valuable token.

While COMP’s surge may prompt speculation that it’s rallied too far, the reality is that there are no signs of anyone shorting the token that spurred the yield farming craze in decentralized platforms.

Zero Volume

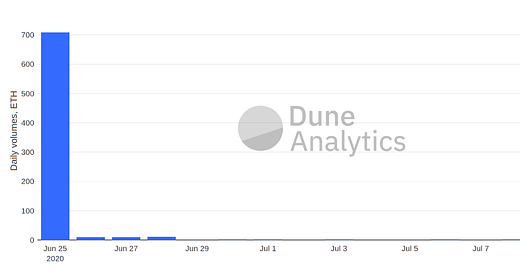

yCOMP-AUG20, an ERC-20 token expiring August 20 that allows holders to short COMP, has had zero trading volume in the past 4 days, compared with 708 ETH ($170,000) on June 25, when it launched. The token, which was created by synthetic assets issuing and trading platform UMA Protocol, was widely heralded as a mark of DeFi’s growing maturity when it launched.

After high volume on the day of its launch, trading has dried out, with an average of 2.7 ETH ($644 daily) exchanging hands daily.

Holders and Sponsors

To short COMP using UMA’s method, users can either hold yCOMP or become a sponsor. As a sponsor, users can mint yCOMP with Dai as collateral before selling it on Uniswap. As the price of COMP falls, that collateral can be unlocked for cheaper than the price the yCOMP was sold for.

A total of 8 sponsors have engaged with the short method since launch, while the number of distinct addresses that bought yCOMP is 31.

No Borrowing

Prior to the launch of yCOMP, COMP was difficult to short in DeFi. Borrowing COMP, the basis of short selling, isn’t currently supported by any major platform, which led the UMA protocol to release a token to automate the short-selling process.

According to UMA co-founder Hart Lambur, in this way, yCOMP was successful. But there are many reasons for its low usage.

For one, at the time of launch UMA protocol lacked a front end interface to mint the token. To short COMP, yCOMP users would have to mint the token manually- making it hard for non-technical users to engage with.

A front end has now been built by community members which may in time increase the token’s traction.

Fairly Priced

yCOMP trades at a slightly cheaper price to COMP token itself, giving its holders a discount: what UMA calls the yCOMP yield. While annually, this yield was up to 350% at the day of launch, it has now dropped to 225%.

According to Lambur, this is another indicator that the market has stabilized.

“You could interpret this as saying that the market thinks COMP is "fairly priced,” Lambur said.

COMP Put Options

While yCOMP failed to gain traction, COMP options show comparatively high activity, signaling that while there’s no demand to profit from the decline of COMP, holders are seeking to protect against the token’s volatility.

On June 26, DeFi options trading platform Opyn launched a COMP put option, which allowed users to sell COMP if for $150 it reached that price or lower before June 03.

The option is now closed, but had daily volume highs of $425,000. A total of 2714 put options were bought.

On July 10, Opyn launched a second COMP put option, allowing holders to sell COMP for $150 before August 07. So far, 20unique addresses have bought this contract, which is currently selling for $8.70.

Bears in CeFi

While DeFi traders aren’t using UMA’s synthetic token to short COMP, some traders are using CeFi platforms are betting against Compound Finance’s token. But they’re not lining up to short the token either.

Margin trading platform FTX offers the ability to short COMP by 3x, meaning if the price of the token drops, traders profit by three times the size of the drop. FTX’s COMPBEAR token has had only $8k of trading volume in the past 24hrs, that’s lower than most tokens on the exchange, with LINKBEAR volume at 100x higher and DOGEBEAR at 10x higher.

Still, others are betting against COMP in a more straightforward way: selling the token. COMP has slumped more than 50% since highs of $373 on June 21. Just yesterday it dropped 7.5%.

🚀Book Stuff! The Infinite Machine Launches Today

My book on the history of Ethereum, The Infinite Machine, is out today! It’s the culmination of more than two years of work, following the Ethereum crowd around the world, and hundreds of hours of interviews; I couldn’t be more excited! I’m so happy I was able to tell this fascinating story, and really hope you enjoy it too. Here are a few articles and podcasts on the book out today:

Five Years On, Ethereum Really Is the ‘Minecraft of Crypto-Finance’

I wrote an opinion piece for CoinDesk for Ethereum’s five year anniversary, stating that the network is achieving everything it set out to do.

The incredible story of Ethereum, “The Infinite Machine”

Decrypt reviews The Infinite Machine, comparing it to Nathaniel Popper’s Digital Gold and saying I “straddled the tightrope of meticulous technical fact (…) interlaced with salacious detail worthy of a Hollywood biopic.”

Hidden Forced Podcast: The Rise of Ethereum the Future of DeFi, and the Transformation of Crypto Media

“In Episode 145 of Hidden Forces, Demetri Kofinas speaks with Camila Russo, the host of the Defiant podcast and author of “The Infinite Machine,” the first official account of the rise of the Ethereum blockchain.”

Keen On Podcast: Camila Russo on Ethereum and the Future of the Internet

“The coronavirus pandemic is dramatically disrupting not only our daily lives but society itself. This show features conversations with some of the world’s leading thinkers and writers about the deeper economic, political, and technological consequences of the pandemic. It’s our new daily podcast trying to make longterm sense out of the chaos of today’s global crisis.”

Lit Hub’s Most Anticipated Book of 2020

The Infinite Machine made this list! “Don’t let the techno-verbosity of her title mislead you, however. Russo—the ex-Bloomberg tech journalist who describes herself on Twitter as “Chieftess at the Defiant”—has written a fast-paced, Michael Lewis-style history of crypto-currency which help us sort out our Bitcoins from our Ethereums.”

Don’t like touting my own tweets, but I did break news with this one: ERC20 market capitalization surpassed ETH’s market cap for the first time.

Hope you’re enjoying The Defiant. If you are, spread the word!

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money.

About the founder: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.