I Made Monetary Policy (So Can You), Get-Stuff-Free Business Model

Hello defiers, here’s what’s going on in decentralized finance:

MakerDAO stability fee vote

New business model debate

I Can’t Vote Where I Live But I Can Vote on MakerDAO

Yesterday, on July 8th (my birthday), I participated in monetary policy.

It took me less than five minutes to cast a vote to raise MakerDAO’s stability fee to 18.5 percent from 17.5 percent.

I had recently written about how MakerDAO’s stable coin DAI was slipping from its 1-to-1 peg with the U.S. dollar, and that a rate hike would likely be necessary, just like in my past life as a Bloomberg markets blogger I had commented about the Fed and different Latin American central banks. The difference is that in this brave new DeFi world, I can make my opinion count –literally.

It’s pretty remarkable considering I can vote in this parallel banking system, but I can’t vote in the place I actually live, the U.S.

Also, it didn’t require a million steps and copying and pasting complicated lines of code I can’t understand (like when I tried to run an Ethereum node). I’ve found that once you buy ether and transfer it to MetaMask, a browser-based wallet, playing with Ethereum apps is not that hard. So, with ETH already in my MetaMask wallet, this is what I did:

I went to Uniswap to swap my ETH for Maker (MKR), MakerDAO’s token required to participate in governance decisions. I typed in 0.04 ETH where it says input, selected MKR where it says output, then pressed “swap.” A MetaMask pop-up asked me to confirm the transaction and in about 10 seconds 0.0158 MKR appeared in my MetaMask wallet. The transaction cost, or gas fee, was $0.06.

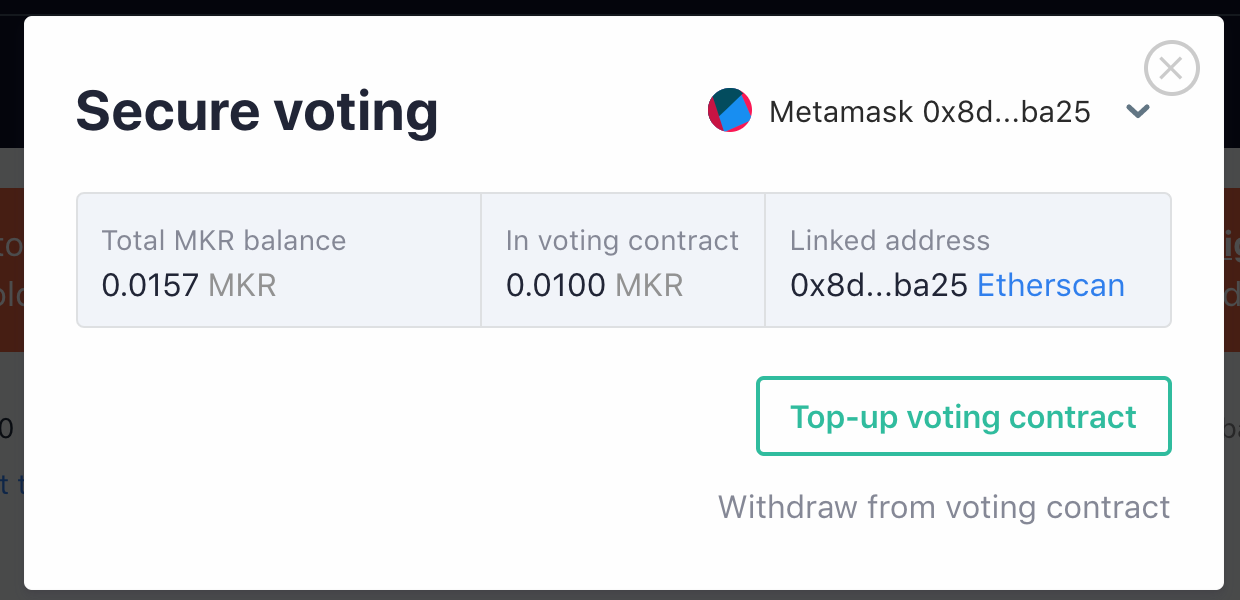

I went to the MakerDAO voting system where there was the option to vote towards a stability fee within a range between 13.5 percent to 21.5 percent. I clicked on “voting contract” and it connected with my MetaMask wallet, so it showed the amount of MKR I had available to put towards a vote. I put 0.01 MKR in the voting contract, confirmed the transaction on MetaMask, and after about 10 seconds, there was MKR in the contract.

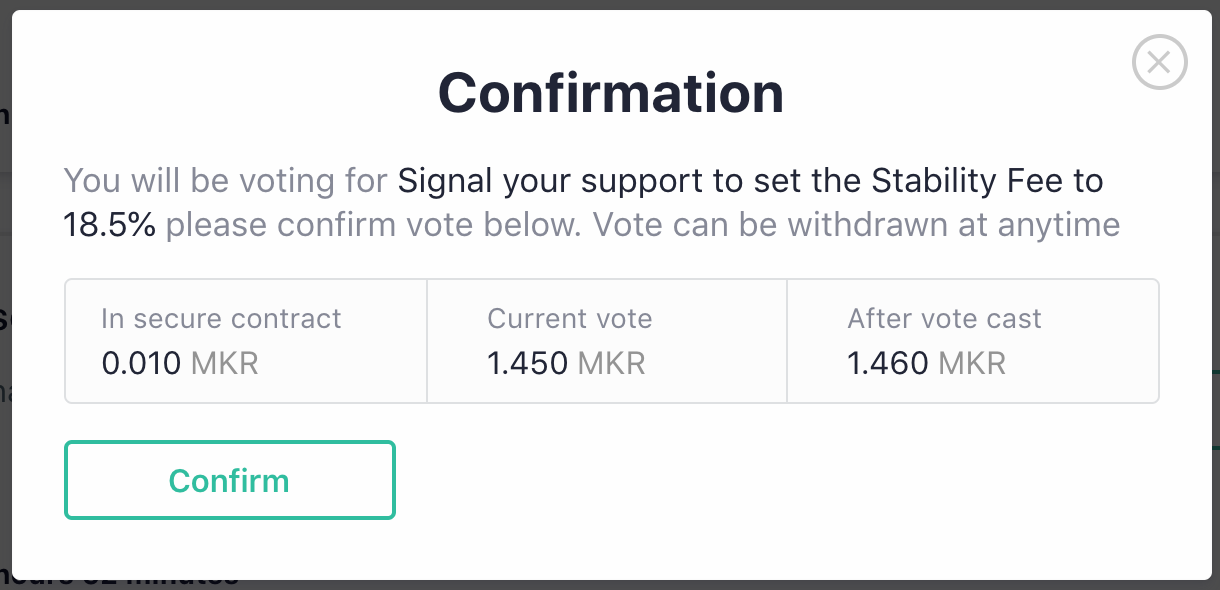

I clicked on the option to signal support to raise the stability fee by 1 percentage point to 18.5 percent, confirmed the transaction on Maker and MetaMask, and after about 10 seconds, my vote was cast. The 1.45 MKR in that option increased by 0.01 MKR.

What happens next: Holders of MKR tokens can continue to signal their support for different stability fee levels until Friday. On Friday, there will be an executive vote asking token holders if they support or reject the change proposed by the poll.

My conclusions from the voting process:

I was surprised to see the option supported by the most MKR (8.35) was to raise the fee to 21.5 percent. That would make borrowing on MakerDAO more expensive than most DeFi platforms, but it’s still early in the process.

It was pretty easy (if i can do it, anyone can do it), but there’s still room to cut steps, for example, all the MetaMask pop-ups.

It would be great top get cliff notes from the latest governance call, something like Fed minutes. It may sound lazy, but I assume most people won’t have time to listen to the entire call. It could raise participation.

More than 70 percent of the $650 million locked in decentralized finance is in MakerDAO. It’s very cool to be able to influence the largest part of this decentralized financial system, with less than $10. It shows how blockchain technology can be a tool to democratize from monetary policy, to shareholder votes, to even one day national decisions.

A New Get-Stuff-for-“Free” Business Model

Imagine depositing $250 into Netflix to watch the latest Stranger Things season, binge on all the 80’s nostalgia, and then take your money back. You feel like you got to stream a show for free, Netflix got the interest on that money.

What would go on backstage is that the service provider would take the DAI you deposited, lend it on Compound to get cDAI tokens in return and put the money in a pool on Uniswap Exchange, which would earn 0.3 percent plus base-level APR for DAI, which has been between 5 percent and 10 percent, wrote Paul Berg, founder of Sablier, an app to enable earning your salary real-time.

“Basically, companies have a new way of monetising their products and services,” he tweeted. “Instead of capturing value, they can SHARE the value they create.”

This sparked an interesting debate, where Gitcoin’s Kevin Owocki touted this as a new model for Web3, Ethereum developer Nick Johnson questioned why someone who can afford to lock up $250 indefinitely can’t just pay a $3/month subscription fee, and Ethereum Foundation consultant Jamie JeMeng said firms would likely be tempted to take excessive risk with the pool of money.

The Defiant will become a paid newsletter in the next couple of months. As a way to say thank you to the first ones joining me in building this platform, anyone who signs up before the paid period will pay just $8/month and $80/year for the best (and only) daily, in-depth DeFi content out there, compared with the full price of $10/month and $100/year.

Subscribe now! You’ll be supporting independent journalism and allowing me to continue illuminating this fascinating corner of the world for you.