Governance Token Wars; The Exit Scam that Wasn't; YFI Worth More than Bitcoin

Also, Aragon's plans for a DAO, and the NEAR-Ethereum bridge

Hello Defiers! So much going on in DeFi,

Governance token wars are erupting

YFI is now worth more than Bitcoin

Exit scam false alarm

Aragon’s plans to decentralize protocol

Near’s bridge to Ethereum

[UPDATED on Aug. 21 to clarify Aragon’s Phoenix phase]

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for 70 Dai/yr vs $100/yr).

📺 Also, The Defiant’s YouTube Channel Launched! Subscribe!

🎙Listen to this week’s podcast episode with Alex Masmej here:

🙌 Together with Zapper, the ultimate hub for managing DeFi assets & liabilities.

Governance Token Wars Ensue

Communities are clashing to farm CRV.

Yesterday, Curve Finance’s pool of tokens which are deposited in Compound Finance saw a $60M spike after its CRV reward APY jumped to over 300% , the highest of any pool at the time of writing.

💡A reminder that Curve rewards liquidity providers with its CRV token, which they receive on top of interest rates from lending protocols such as Compound.

Users can lock CRV governance tokens and “vote” on the weighting of different pools, a feature called ‘Gauge Weight Vote’ . The higher the weight, the more CRV the pool earns.

A 40% increase in CRV’s price earlier this week, the highest 24h change since launch, is spurring speculation that traders are buying the token to lock it in the DAO and increase rewards for their pool of choice by voting to increase the Gauge weight.

Given the fundamental role yCRV plays in the yEarn ecosystem, many are memeing that “this means war” for COMP and YFI holders.

While there is no direct mechanism for CRV to increase COMP price, yEarn yVaults harvest CRV rewards to increase APY’s —a big reason why the token has seen such a strong runup this week. The higher weight for Compound’s pool means fewer rewards for the yCRV pool, and lower returns for yVault LPs.

Yearn Fights Back

yEarn passed a vote to lock its ~$2M early-LP CRV treasury in the DAO for a 2.5x multiplier on all future rewards and to participate in governance weighting. This means that yEarn is looking to take a competitive stance on being the Curve pool with the highest CRV APY at any given time.

This is the first time we’ve seen competing parties use governance token to their advantage, and one which may give CRV inherent value as the yield farming rush continues.

Sponsored Post

The #SmartCon virtual Smart Contract Summit is packed with content and even more keynotes

Here are a few highlights:

Spencer Dinwiddie 🏀 The Brooklyn Nets star tokenized his NBA contract, making new models of sports finance possible. He’ll explain how and why blockchain finance is coming to disrupt professional sports.

Ed Felten ⏩ Former Deputy CTO of the U.S., Princeton Professor, & Co-Founder of Arbitrum’s Offchain Labs share the latest research advances in L2s for high transaction throughput to scale smart contracts.

Justin J Moses 🧪 Fast iteration on Ethereum is critical for DeFi to keep up with the ever-changing landscape. Synthetix’s CTO presents several methodologies for testing.

Andreas Dittrich ️☎️ brings perspective from T-Systems MMS, a Deutsche Telekom subsidiary, on how enterprises will bring value to blockchain and defi through infrastructure.

Join these keynotes and many more panels, tech talks, and AMAs at #SmartCon on August 28 & 29.

Register here today >> ️🎟

YFI is Now The Most Valuable Token in All of Crypto

Yearn Finance’s YFI last night became the first token with non-negligible volume to surpass the price of Bitcoin. And it did so after being live for a month.

YFI’s price soared above $12k last night, while Bitcoin still hovered below that milestone, and has kept rallying. It’s trading at over $15k today.

DeFi Darling

YFI quickly became the darling of DeFi when Yearn’s creator Andre Cronje decided to distribute it only among those who supply liquidity to the Yearn protocol and yToken pools. There was no pre-sale to investors, there was no allocation for the Yearn team, and it wasn’t sold through an exchange. Cronje called it “valueless.”\

It was truly the token for the people, and YFI holders would have full control of Yearn. One of the first decisions was to cap YFI supply at 30,000, of which most have already been issued, and is one reason some holders use to justify the price.

DeFi traders pounced as soon as it was issued and made YFI jump to $1,000 from around $30 on its first day of trading. From there, it just kept climbing.

Exit Scam or Good Night’s Sleep?

With DeFi token launches starting to feel like 2017 ICOs, it’s inevitable that scammers will be lurking.

Yesterday afternoon, some suspected ProxiDeFi of being one of the first to exit scam by removing all liquidity against their CREDIT-ETH Uniswap pool.

The cross-chain derivatives lending protocol shared details of their Mesa offering, with roughly 15,751 trying to land an allocation in the batch-order based sale.

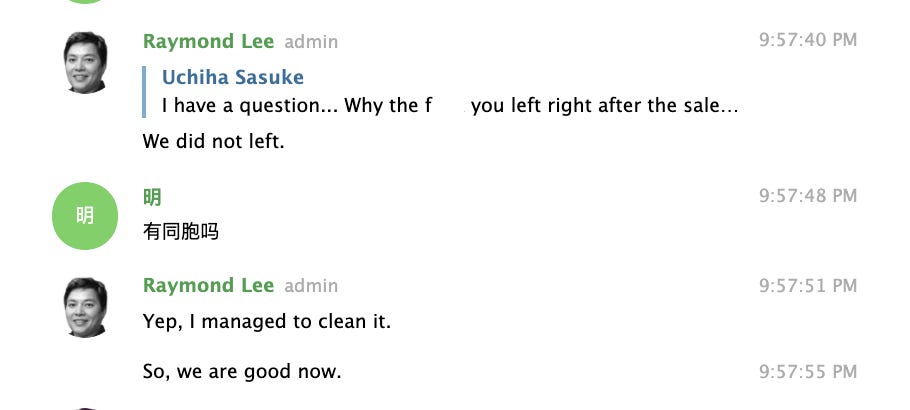

It was at this time that the core team went to bed and chaos ensued. The Telegram group was quickly overrun with profane images due to a lack of admins being present to moderate.

While team members have resurfaced to say all is well, the project's image was temporarily tainted by so-called moonboys (crypto traders waiting for tokens to rally) suspecting the team of exit scamming for trying to get a good night's sleep.

No Evidence of Scam

When looking at the CREDIT-ETH pool, it appears that 400 of the original 550 ETH provided by a liquidity provider is still present at the time of writing. There is no evidence of a large liquidity removal which would signal the ‘rug pulling’ community members were rallying around.

If anything, this goes to show that DeFi is a 24/7 game, and that things are quickly snowballing out of control for teams fundraising through unregulated, decentralized platforms like Mesa and Uniswap for their initial offerings.

A DAO for the DAO Protocol

Aragon plans to decentralize its protocol for DAOs through the advent of its own DAO in a two-phase rollout.

The newly announced Aragon Network DAO allows ANT holders to:

Enact and amend the Aragon Network Agreement

Amend the DAO and its parameters

Govern key Aragon Court parameters

Govern a common funding pool

Rather than release control today, Aragon will transition through two phases; Phoenix and Firebird.

With Phoenix, Aragon will pass executive control from the Interim Governance Council featuring the project’s CEO Luis Cuende and community-stars like Griff Green and Jesse Pollak to ANT token holders.

At some point in the near future, the Firebird Phase will kick off following the ratification of the Aragon Network Agreement - or the project’s manifesto on how future governance is handled, and control of the Aragon Network is transitioned from the Governor Council to ANT holders.

With the promise to make Aragon ‘financially sustainable’ it will be interesting to see how ANT token holders rally around what the project is touting as ‘the end of its original roadmap’ into new, uncharted territory.

Near is Building Bridge to Ethereum

Near is building a bridge to Ethereum which aims to make the two blockchains interoperable. The bridge is currently in testnet.

NEAR’s Rainbow bridge is aiming for users to be able to move assets and data between the two blockchains and for apps that seamlessly communicate across the two networks. Developers who build on NEAR will have access to all the assets on Ethereum, and developers who build on Ethereum can move gas-fee critical parts to NEAR, while keeping their Ethereum user base, near co-founder Alex Skidanov wrote.

The Rainbow bridge does not require the users to trust anything but the blockchains themselves, and doesn’t require any special permissions to deploy, maintain, or use, according to a blog post by Near. Latency for NEAR->ETH interactions is 4 hours, and will be about 14 seconds once EIP665 is accepted, the post said.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

About the founder: I’m Camila Russo, author of The Infinite Machine, the first book on the history of Ethereum. I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.

Crypto currency is not exactly a newfangled contraction; the idea of a decentralized digital asset was coined in the late 80’s by David Chaum, but cryptocurrency fraud is one of the looming dangers of this new digital opportunity. Here’s how you can make sure you don’t fall for it. As a rule of of thumb, you should never accept crypto trading with companies or startups that are not blockchain-powered. before committing to a company or another, you may want to review their credentials look for status quo indicators such as adherence to initial coin offerings rules and digital currency liquidity. If you are in this kind of situation you have nothing to worry about have got a trusted and a reliable recovery company which will get you out of this and get you all your lost back , Mr. Darnell at darnellsean592@yahoo.com will surely get you back your lost bitcoin