Exclusive: DeFi Year in Review by DappRadar

2020 was the year of DeFi and DappRadar covers all the major developments and milestones in an exclusive report.

Hello Defiers! Hoping you all had very happy holidays and are enjoying the very last days of 2020.

This year has been intense — wildfires in Australia and the US West Coast, an economic downturn of historical magnitude and unprecedented money printing by central banks to overcome it, Black Lives Matters protests, the US election, a deadly explosion in Beirut, royals leaving the UK royal family, even “murder hornets” made an appearance. All of this of course under the over-riding theme of a global pandemic forcing us to rethink the very foundations of how we have so far carried our lives.

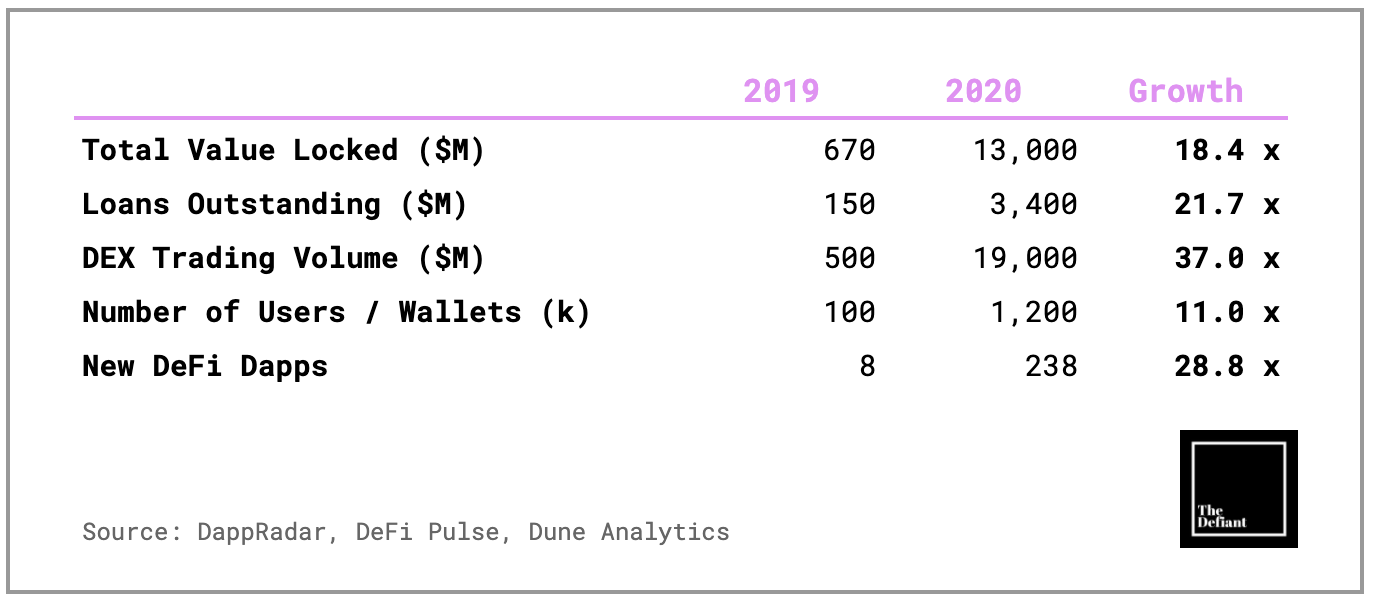

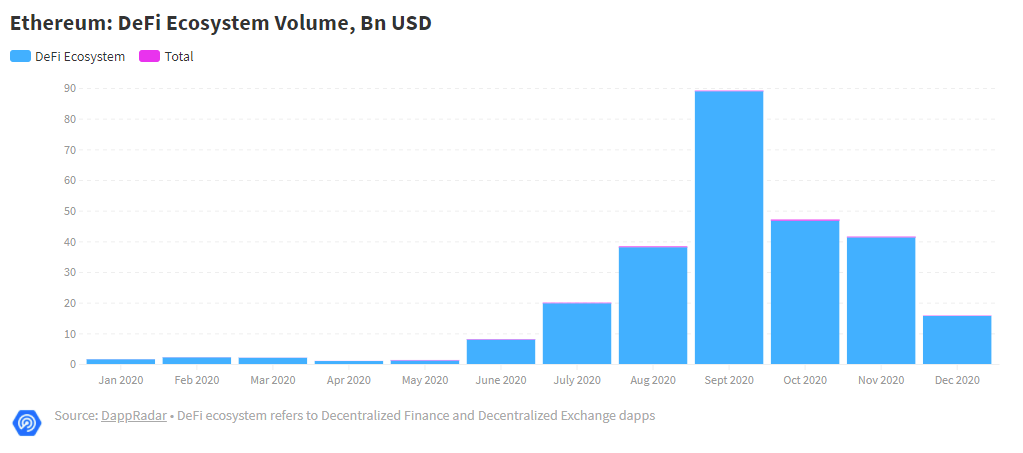

Amid all this chaos, DeFi has thrived. Look at any metric; from assets in the ecosystem, to volume traded, to number of users and new applications, they have all multiplied many times over. It’s the result of thousands of developers freely building and innovating on top of open-source, distributed networks —particularly, on top of Ethereum in the past five years. That innovation resulted in money applications being rebuilt from the ground up creating a global, open, financial system that doesn’t care who you are or where you’re based; anyone can be a user, or builder, or both.

2020 was the year where the basic infrastructure built years before met an explosion of volume and users. This explosion also pushed the space to its limits, with rising gas costs and a multitude of hacks and attacks.

Today we’re reviewing the past year in DeFi, together with DappRadar, which has created a report exclusively for Defiant readers.

Both paid and free subscribers receive the full report, but paid subscribers got it early. Paid subscribers also get complete access to The Defiant content and archive, and access to The Defiant Discord chat. Join the club! Pay with Dai on this link or in fiat at the link below.

🎁 Merry DeFi! Get The Defiant’s $100 annual subscription for $80. Offer expires Dec. 31s. Get full access to Defiant content and community as a gift for yourself or for others.🎄

🙌 Together with Zerion, a simple interface to access and use decentralized finance, Neutrino, an algorithmic price-stable protocol that enables the creation of stablecoins tied to real-world assets, and Value DeFi Protocol, a suite of DeFi products including the Value Liquid AMM, which allows anyone to create trading pools with flexible ratio pairs.

The Year of DeFi

By DappRadar, for The Defiant

2020 was a big year for DeFi. The sector became the engine behind the crypto renaissance that saw BTC break through $24K and the industry’s market cap push past $680B. Decentralized applications finally started to see sustained usage and the industry took a giant step forward in realizing its macro vision for a web3 economy.

Source: CoinGecko

Once again Ethereum led the charge, and while spiking gas prices hurt the gaming sector, DeFi became the cornerstone of its ecosystem. Nevertheless, over the course of the year, rival blockchains have started to make their presence known. With the market at stake becoming more lucrative every day, and composability unlocking new frontiers, the competition between public blockchains may only intensify.

2020 was a foundational year for the crypto proving, to both institutional and retail players, that the blockchain vision is not a pipe dream.

Liquidity is King

Prior to 2020, DeFi was stuck in a negative feedback loop: dapps needed liquidity to provide low slippage/deep market services, but without it to begin with, it could not attract enough users (and capital), who instead opted for centralized alternatives.

However, this year, teams figured out ways to incentivize users to bring over their capital, giving rise to the liquidity mining boom. Participants would effectively be paid by the protocols to provide liquidity and use their services. Synthetix was arguably the first to successfully implement it, but unlike many of its peers the dapp had a native token.

This in-turn incentivized other protocols to consider launching their own tokens in order to benefit from the model. Compound set off a chain reaction, when it started distributing its COMP token. Teams with existing projects and those building on the sidelines, saw how quickly Compound was able to capture the market’s attention and grow its user base and liquidity, and wanted in.

From then on it felt like every other day, there would be a new project popping up, with a token reward from bringing liquidity and usage to its platform. The DeFi sector began to grow, quickly, and attracted both attention and capital from the industry.

https://public.flourish.studio/visualisation/4740965/

With liquidity present, users were now able to enjoy the benefits of DeFi such as: wallet control, accessibility (no KYC), wider listing options and composability. By removing the key roadblock, projects were able to replace a negative feedback loop with a positive one: liquidity begets liquidity.

The DAO Model

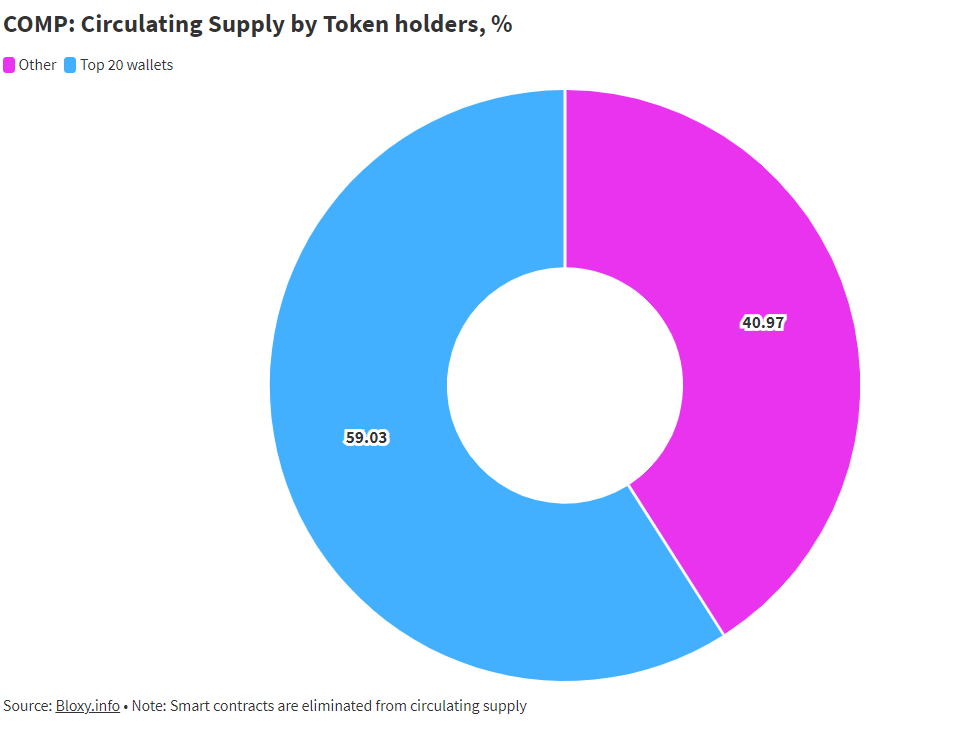

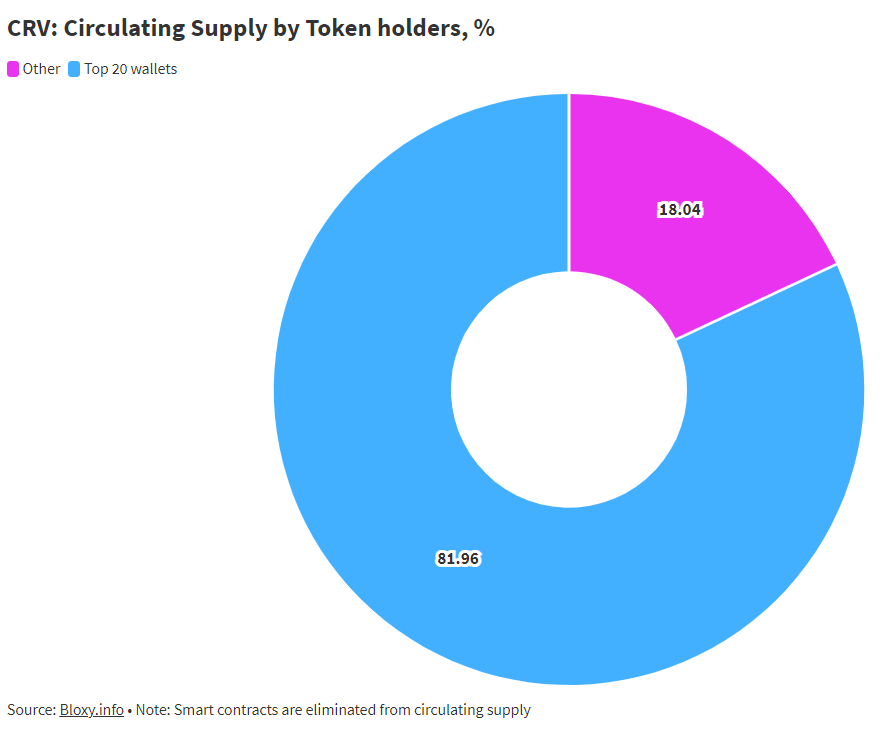

Teams introducing native assets needed to find a way for their tokens to have value. At the same time, with the regulatory landscape still undefined, there remained a need for greater decentralization.

In this context issuing a governance token, one that would allow the token holders to control the project through voting, made a lot of sense. Teams would decentralize the platforms by giving up control to the community, and token owners would benefit from ownership of the protocols.

While initially, some teams tried to focus on the governance utility of the token, the market quickly realized that tokens have at least a potential revenue stream. Since many of the DeFi projects charge a fee, protocols generate revenue that could potentially be distributed to its users. This could give the tokens some quantifiable value. Curve became one of the first projects to do that.

Source: Token Terminal

Problems with governance token centralization have taken some of the shine off of the initiative. However, both the governance models, distribution mechanics and incentive models continue to evolve.

Source: https://public.flourish.studio/visualisation/4748078/

Source: https://public.flourish.studio/visualisation/4748171/

Gastronomical Delight

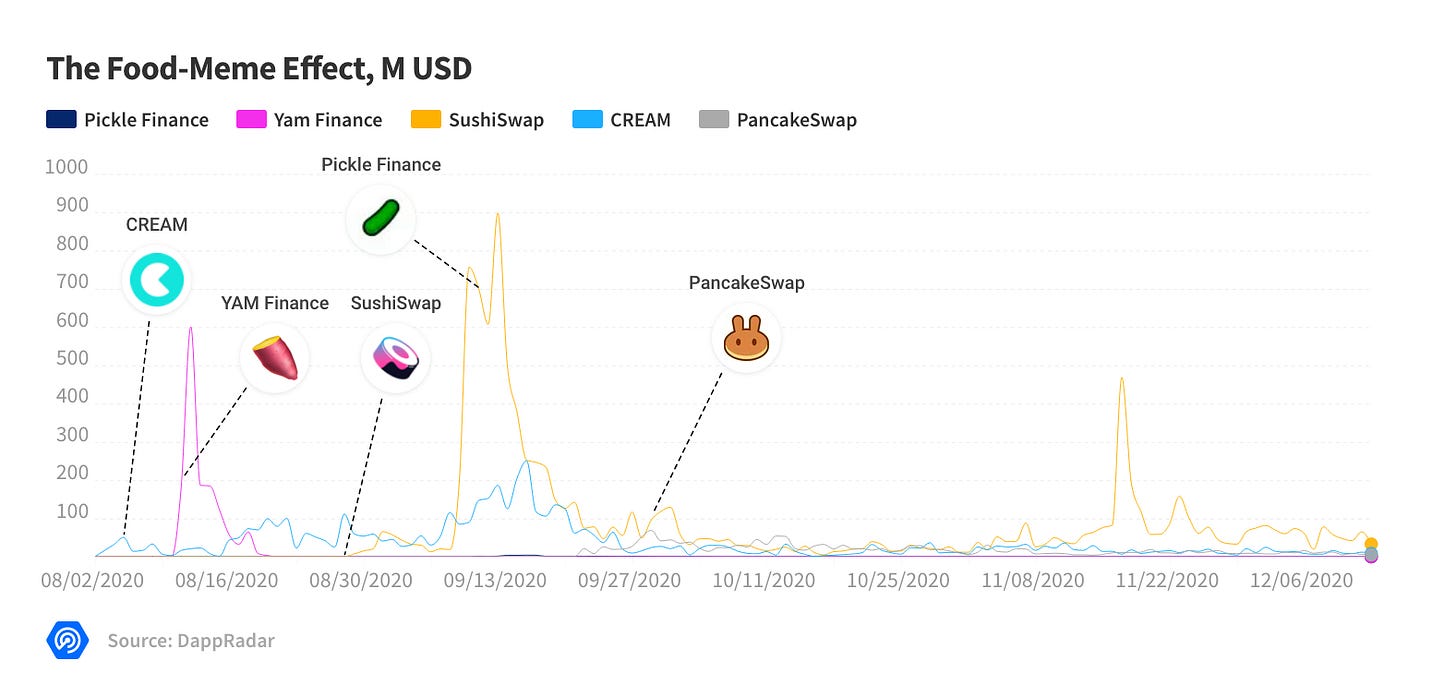

One of the core tenants of the blockchain industry is that everything should open-sourced. That in turn means that everything can be forked. When the market realized that the key driver for liquidity may not necessarily be utility or brand power, but mining incentives, forks of established projects began popping up left and right offering the promise of quick riches from the yield.

Instead of waiting for listings on centralized exchanges, teams opted for Initial DEX Offerings (IDOs), on platforms such as Uniswap and Balancer, meaning that they could deploy quickly, at little cost, and allow anyone brave enough to participate.

In order to draw attention to themselves, they choose food-related names, which after YAM and PASTA quickly materialized into a food-meme frenzy. The DeFi buffet offered everything from fruits and vegetables to sushi.

Source: https://public.flourish.studio/visualisation/4740971/

A number of these projects did not last very long, but for farmers who were active across the ecosystem, the offered yields were often high enough to compensate them for the risk of things going wrong in a few of them.

Still others became prominent enough to battle for dominance with the old core. For instance, SushiSwap famously “vamped” liquidity from Uniswap, prior to the latter’s release of its own governance token UNI. However, when Uniswap’s mining program expired SushiSwap once again attracted away a significant amount of liquidity.

Source: https://public.flourish.studio/visualisation/4662726/

For now, the industry maintains its friendly community feel, but the events may be foreshadowing the liquidity wars yet to come.

One Metric to Rule Them All

With liquidity being the key driver of growth, Total Value Locked (TVL) became the chief metric in the industry. The statistic measures the amount of capital (typically in USD) locked in a given dapp.

As TVL rankings began popping up, for a project able to grow its liquidity quickly, TVL became a sort of marketing instrument. A high TVL instilled (sometimes false) confidence that a project was solid because others believed in it and were using it.

The original TVL caught on partly due to its simplicity, but it is that simplicity that made it so deceiving. For one, calculating growth in USD introduced price-driven volatility. TVL may change not because assets are locked or withdrawn, but because the prices of the locked assets changed.

At different times during the year, it fueled excessive optimism and unwarranted panic. TVL would appear often in the headlines, without always revealing the true nature of market dynamics.

To remove the price effect, DappRadar developed adjusted TVL (aTVL), which more accurately depicted the flow of assets.

Others also found that classical TVL double-counted synthetic assets like cTokens. So DeBank created its own metric True TVL in order to remove them from the calculations.

Still, basic TVL appears to be the most quoted metric in DeFi, which may, from time to time, obscure reality.

The Stack Deepens

With liquidity approaching useful levels, developers were now free to experiment and expand functionality. The efforts fit broadly along three vectors: composability, new features, and retail.

One of the key benefits of DeFi is that protocols are easy to integrate with one another. Teams began to incorporate multi-project incentive models, and developers began to develop platforms that optimized yield farming.

Source: yearn.finance

Yield optimization efforts led to the emergence of Yearn, a project started by Andre Cronje, whose governance he passed to the community with one of the most radical token distribution schemes to date.

As synergies began to emerge projects began to integrate, both at an aggregator and basic protocol levels.

As part of that, flash loans began to play an important role. This particular type of instrument enabled users to borrow enormous amounts of capital as long as the loan was repaid within the same transaction. This has reduced capital restriction on a lot of inter-dapp operations.

Further extension of the stack came with Aave’s delegated loans, which enabled greater flexibility for capital deployment.

With trading volume growing, new market needs materialized. For instance, teams began working on derivatives products. While CeFi had exchanges that offered futures and options markets, DeFi had few options for hedging and thus controlling risk.

Over the course of the year the emergence of Hegic and projects such as Auctus and Deriswap laid the foundation for such markets.

On the retail front, it became possible to offer users simple, friendly UX that offered attractive yields, but abstracted away much of the complexity of DeFi. Projects such as Dharma and Idle offered fixed revenue streams for users by utilizing various DeFi protocols.

The appearance of liquidity enabled the sector to grow both horizontally and vertically.

The Price of Growth

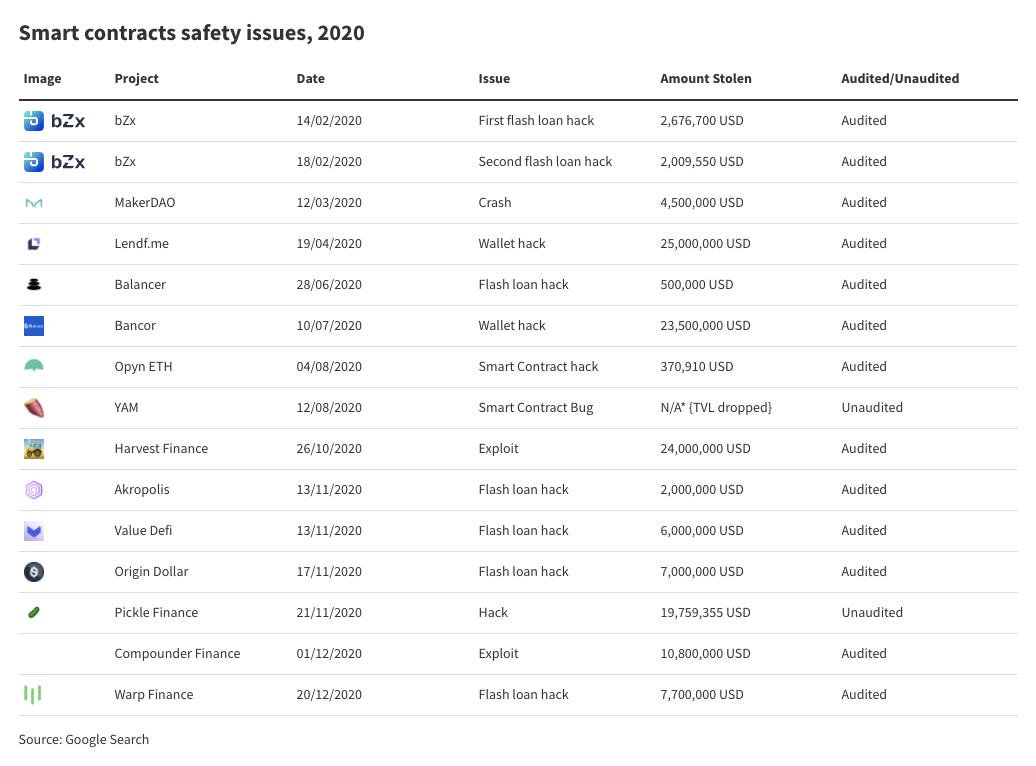

While DeFi has seen tremendous growth it has come at the cost of quality and security in the industry.

The food-meme introduced a quick-launch model by which projects went to production without a full audit. This shifted the risks to the users of the application.

Moreover, many of the projects were launched by pseudo-anonymous teams, which significantly reduced options for recourse in the event of malicious behavior or oversight.

Expectedly, the industry saw a number of costly bugs, hacks and “rug pulls”. While the damage varied by protocol, the threat of a major negative event continues to hang over the sector. With the protocols taking advantage of composability the danger of a domino effect event only increases.

Furthermore, with flash loans affording attackers access to an enormous amount of capital exploits have become lucrative and cheap to execute.

Source: https://public.flourish.studio/visualisation/3396454/

Even more alarming is the growth of the number of algorithmic exploits. The exploits don’t use a backdoor, or try to break the protocol, but rather manipulate protocol inputs to a favorable outcome. Often these rely on oracle inefficiency and use flashloans to create imbalances and then capitalize on them.

However, algorithmic events may not always be intentional. In fact, in March MakerDAO nearly collapsed because of an algorithmic event that was set off by price volatility and unfortunately coincided with network congestion.

Algorithmic events are hard to test for. In fact, recently many of the projects under attack were previously audited. The issue is not relegated to small startups and has put even major projects such as Compound and Aave at risk.

This further increases the risk of a potential domino effect moment.

The sector has tried to address the issue with a growing number of decentralized insurance solutions, but going forward testing and quality standards will need to be addressed in order avoid painful setbacks.

Source: https://public.flourish.studio/visualisation/4741633/,yinsure and Nexus Mutual

The other key issue has been transaction costs and congestion. As transaction activity on Ethereum grew so did gas costs. This was tolerable for whale farmers, whose transaction volumes make any fees appear negligible, but it pushed out small retail users and decimated sectors reliant on small transactions such as gaming.

Source: Etherscan.io Gas Price

This has shined a spotlight on layer 2 solutions such as Plasma (Matic Network) and Rollups (StarkWare and Optimism), but these still require integration, introduce complexity and reduce composability.

The sector and the industry will need to address these issues, or continued growth will start to undermine the structural integrity of the space.

The Currency Question

While BTC and ETH maximalists have continued to argue whose asset deserves to be considered a digital currency, stablecoins have been expanding their presence to fill that void.

Source: https://public.flourish.studio/visualisation/4752301/

Stablecoins offer a chance to denominate, transact and settle with much less volatility than any of the major cryptocurrencies. That is why they have become the lifeblood of the DeFi ecosystem.

Still, as with almost everything else in the industry there are custodial and DeFi solutions. For now custodial leads, with Tether USDT being far and away the dominant stable coin on the market. However, with counterparty risk being a concern and the ability of centralized players to freeze assets by blacklisting wallets, these solutions may eventually lose their appeal.

Source: https://public.flourish.studio/visualisation/4741746/

MakerDAO’s DAI is the clear leader among algorithmic stablecoins, and its attempts to integrate with the gaming sector show a vision that goes beyond DeFi.

However, with the stablecoin space becoming lucrative, enterprises and government players are looking to enter. With Diem (formerly Libra) and CBDC (China currently leading the effort) coins, these projects aim to reassert the dominance of traditional powerhouses.

Network Effects and Competition

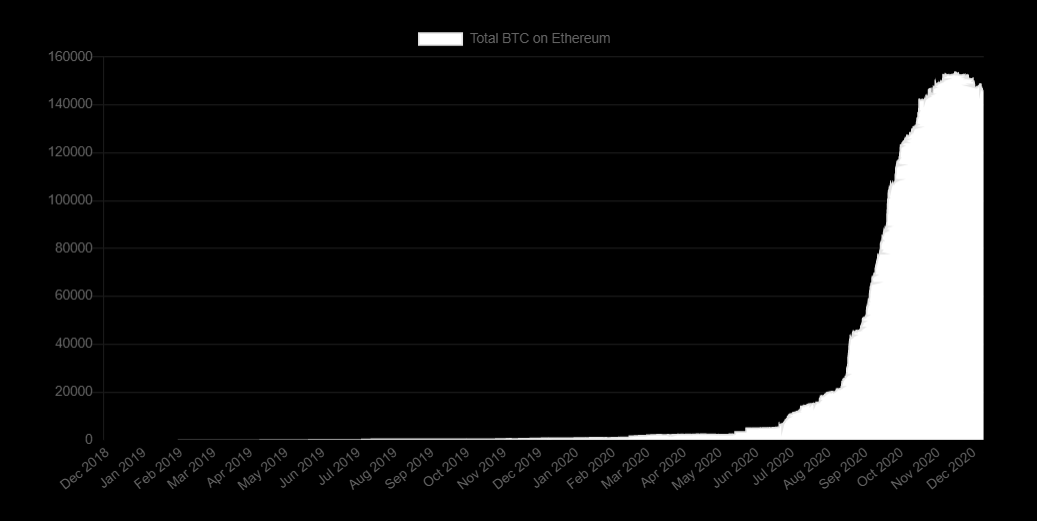

DeFi allowed Ethereum to reassert itself as the dominant blockchain for dapps. The sector provided yield that enticed other communities. The biggest inflow of capital came from Bitcoin. For those not wanting to sell, but still desiring the capital to work, wrapping BTC and putting it on Ethereum offered a door to a lot of opportunities.

As more and more dapps began to accept wrapped forms of BTC, its value on Ethereum, as well as the number of centralized and decentralized bridges, skyrocketed. This in turn, enticed other communities to cross over into Ethereum, with Zcash, Dash, Ethereum Classic and Filecoin being among those with wrapped versions of their native currency launching on Ethereum.

Source: btconethereum.com

If capital proves sticky, this may become a moat for Ethereum as its rivals try to wrestle away its crown.

The line of projects wanting to do so has grown long. As DeFi proved that the market for decentralized services is real and expanding, rivals began to race for a chance to grab a piece of the pie.

With Ethereum’s scalability woes painfully on display, rival ecosystems highlighted their scalability benefits to try to entice away developing teams. Since Ethereum has, by far, the largest development community in crypto it became vital to offer EVM compatibility in order to be competitive. Furthermore, a number of projects launched programs to try to financially incentivize development, Binance’s $100M being one of the biggest.

Projects tried to follow Ethereum’s blueprint and so a number of MakerDAO, Uniswap and Compound alternatives launched on rival networks.

Still, so far, very few platforms have been able to establish organic developer interest. In fact, for many the DeFi boom has realigned the ranking of projects behind Ethereum. EOS and even Tron (despite its DeFi efforts) have fallen behind, while Polkadot, NEAR Protocol, Cosmos and Solana have stepped up. Polkadot in particular has generated a lot of buzz with its growing DeFi ecosystem, despite not having launched its parachains yet.

Source: https://public.flourish.studio/visualisation/4025241/

Source: https://public.flourish.studio/visualisation/4750516/

Source: https://public.flourish.studio/visualisation/4750519/

With interoperability, becoming key it will be important if rivals are able to attract capital away from Ethereum. With Ethereum 2.0 Phase 0 launch complete, the window of opportunity appears to be closing, but time remains.

Source: Beacon Chart

Looking Ahead

As DeFi continues to grow and expand it should catalyze growth in other sectors. DeFi provides infrastructure for transacting value, and now that it is in place that should help value creating segments take steps forward.

The arts and collectibles sector is already starting to integrate into the stack, with projects like Aavegotchi and NFTfi combining collectibles and decentralized finance. NFT art pieces are attracting increasing sums at auctions, making it feel as if it is only a matter of time before these assets are accepted as collateral within DeFi.

Source: NFTfi.com

Moreover, there appears to be growing momentum to tokenize real world items. As real estate finds its way to the blockchain it should also appear within the DeFi space.

As the market grows in value, competition should only increase both at layer 1 and layer 2 levels. With the recent merger spree by Yearn it is already possible to see DeFi camps forming. Competition should be good for the end user, as it will hopefully address quality and security issues as well as increase feature scope.

In 2020 DeFi proved that it belongs, but it must continue to move forward in order to drive the bigger web3 vision.

The information provided here is for informational purposes only. This is not investment advice and should not be treated as such. Strategic Round Capital has invested in the Umbrella Network. Strategic Round Capital and/or the author of this report holds a position in BTC, ETH, HEGIC, YFI, USDT, USDC.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Get The Defiant’s $100 annual subscription for $80. Offer expires Dec. 31s.

About the founder and editor: Camila Russo is the author of The Infinite Machine, the first book on the history of Ethereum, and was previously a Bloomberg News markets reporter based in New York, Madrid and Buenos Aires. She has extensively covered crypto and finance, and now is diving into DeFi, the intersection of the two.