Ethereum-ized Bitcoin Surges After MakerDAO Includes it in Collateral Family

Also, MakerDAO shuts down Sai, Chainlink launches verifiable randomness system.

Hello Defiers, here’s what’s going on in DeFi,

WBTC is surging after MakerDAO included the token as Dai collateral

MakerDAO’s Sai stablecoin was shutdown as purists call for crypto-only competitor

Chainlink launches verifiable randomness system

and more :)

🙌 Together with Eidoo, a cryptocurrency-powered debit card and platform for easy access to decentralized finance.

WBTC Surges into DeFi as Traders Snap Up Cheap Loans

Freshly minted WBTC is surging into decentralized finance after the MakerDAO community added the token as collateral last week.

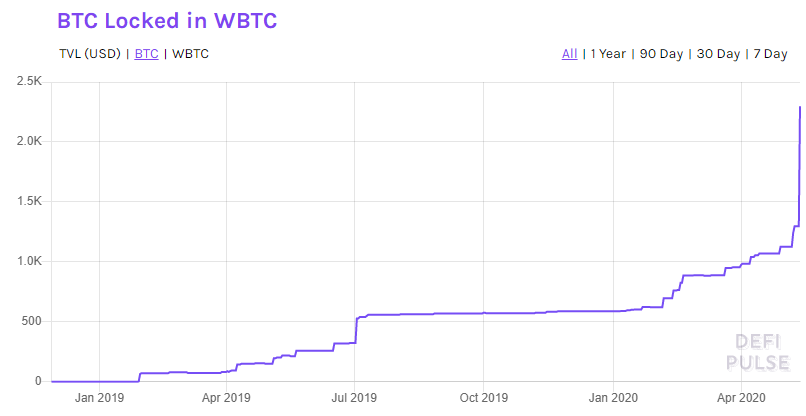

Circulating WBTC spiked 15% within the first week after passing MakerDAO’s executive vote on May 2. But yesterday another wave of $10M worth of BTC (~996 BTC) entered into circulation, nearly doubling the existing supply to over $20M. WBTC, or wrapped bitcoin, is an Ethereum ERC20 token backed at 1-to-1 with bitcoin.

There’s an increasingly important role for BTC in the Ethereum ecosystem. With more and more options for bringing BTC over to the leading smart contracts platform, BTC holders can now begin to capitalize on the diverse range of DeFi protocols available in the Ethereum economy.

Cheap Loans

The low borrowing rates on MakerDAO are a driving factor behind the attractiveness of BTC on Ethereum. The rate, known as the stability fee, users have to pay to borrow the Dai stablecoin against WBTC collateral on Maker is only 1% - the cheapest in the entire crypto ecosystem.

In terms of centralized providers, BlockFi allows users to deposit BTC and receive dollar-based loans for rates as high as 10%. While Ethereum lending protocols offer lower rates, at 4.78% APY on Aave and 1.39% on Compound, they’re still many percentage points higher than Maker’s.

Lightning Network

The recent spike in WBTC further extends its lead over Bitcoin’s Lightning Network in terms of value locked. For reference, Bitcoin’s leading scaling solution currently aggregates less than 1,000 BTC locked since launching in January 2018. Now with 2,300 WBTC circulating the Ethereum economy, Ethereum’s BTC alternative has cemented its lead with well-over twice as much value locked.

(Above) Total BTC Locked in WBTC. Graphic via DeFi Pulse

Despite the extended lead, WBTC stagnated for months after experiencing an initial rise to prominence in Spring of 2019. WBTC started to see a resurgence following the Aave rebrand in late January 2020 - likely as the money markets protocol offered under-the-radar cheap borrowing for keen BTC holders.

But now Maker - the biggest DeFi protocol in terms of value locked - is bringing WBTC back into the spotlight.

With the initial debt ceiling at 10M Dai and stability fee at 1%, Maker Governance may elect to change these parameters in the coming future. However, the two governance polls have MKR holders signaling to keep the current parameters as is. You can view the polls for changing the stability fee here and lowering the debt ceiling here. Until then, BTC holders still have the chance to collateralize their holdings and receive one of the cheapest loans on the market.

MakerDAO Sai Shutdown Spur Calls for “Pure” Stablecoin

MakerDAO shut down the first version of its Dai stablecoin yesterday, further spurring calls for a more “pure” competitor.

The system controlling Sai, short for Single-Collateral Dai, as it came to be known after it was succeeded by the new version, was deactivated, as planned. Most Sai holders had migrated their holdings into the new system. Those who still had Sai loans outstanding were liquidated without suffering a penalty.

While Sai was backed by only ether, the new system introduced in November, allowed for different types of collateral. Multi-Collateral-Dai, better known as just Dai, is now backed by ETH, BAT, USDC and WBTC. USDC is a stablecoin that’s backed at 1-to-1 with US dollars, while WBTC is backed by BTC under BitGo custody.

Purist Competitors

Purists in the Ethereum ecosystem have criticized adding USDC and WBTC as collateral for Dai, arguing it introduces the need to trust centralized third parties, and have called for a stablecoin that’s backed and run entirely on-chain. The goal is to have a fully decentralized system, which can’t be unilaterally shut down or censored.

Synthetix founder Kain Warwick has been one of the loudest proponents of such a system, writing an opinion piece in The Defiant Monday, where he said he has “zero intention of supporting a path towards permissioned assets and a dilution of trustlessness.” The Synthetix platform enables the issuance of sUSD, a derivative pegged to the US dollar that’s backed by SNX tokens.

Developers at Reflexer Labs are also getting to work in building another fully decentralized MakerDAO alternative with MetaCoin. And today prominent crypto researcher Hasu said there’s “room for a purist competitor to emerge.”

Liquidity is King

MakerDAO is adding different collateral types to ensure that there’s enough liquidity to back its Dai stablecoin so that its supply can continue to grow and isn’t limited by the market size of its collateral. The Maker team and community are also betting diversification will make the system more resistant against sharp volatility common in crypto assets.

Meanwhile Tether continues to be by far the most widely used stablecoin, even after admitting only about 70% of USDT tokens are backed by USD, not 100% as they originally claimed. This shows that for now, calls for a more decentralized version than Dai are coming from a niche sector of crypto as most are willing to accept Tether’s lack of transparency and centralization, in exchange for high liquidity.

Chainlink Launches “Verifiable Randomness” for Dapps

The decentralized oracle provider is launching Chainlink VRF, which allows applications to prove they can generate values in a random way. Its first integration is PoolTogether, a blockchain-based lottery, whose users count on it being able to produce verifiably random numbers to pick winners. Chainlink says its system can guarantee randomness is provably fair and equally uncertain to all contract participants with cryptographic proofs, while also reducing the risk of exploits.

JPMorgan Extends Banking Services to Bitcoin Exchanges: WSJ

Gemini, Coinbase are JPMorgan’s first clients from the cryptocurrency industry, the WSJ reported citing people familiar.

dYdX’s Antonio Juliano provides a good overview of DeFi liquidity.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

Click here to pay with DAI.There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the founder: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.