Ethereum Has a Popularity Problem: Fees Are Spiraling Higher

Also, bitcoin hodlers tired of just holding are coming to DeFi, ZRX on-chain metrics, Maradona's digital card.

Hello Defiers and happy Friday! Here’s what’s going on in DeFi:

Transaction fees are surging on Ethereum

Bitcoin in DeFi surged by 5x in one day

Over half of ZRX holders are making money after rally

“Hand of God” comes to Ethereum

and more :)

The open economy is taking over the old one. Subscribe to keep up with this revolution.

🎙Listen to this week’s podcast: Interview with the Winklevoss twins

🙌 Together with Eidoo, a cryptocurrency-powered debit card and platform for easy access to decentralized finance.

Ethereum’s Popularity Problem: Fees are Surging

There’s a common gripe among Ethereum users these days —gas is too damn high. Transaction fees are surging as Tether continues to move to the second-largest blockchain network.

Fees paid on the Ethereum network have surpassed 500 ETH every day since April 15, according to Etherscan. That’s the longest stretch since three months at the height of the latest crypto bubble, between December 2017 and March 2018. What’s more, total daily fees paid have breached 2,000 ETH three times in May, a level that’s been crossed a few dozen times in all of Ethereum’s five-year history. The average for the past week was at 1,700 ETH.

Image source: Etherscan

Tether (USDT) is the main culprit. Users have paid almost $1.4M in the past 30 days for using the stablecoin, according ETH Gas Station. Much of that activity is coming from exchange-to-exchange transfers, which signals arbitrage trading. There are also several ponzi scams that make up the top seven spots including noted pyramid scam MMM, which continues its long program of ponzi scheming.

Financial Layer

While frustrating for end-users, higher fees are a sign the network is getting used as a financial settlement layer. Dexes and stablecoins account for about half of the top 25 projects.

Another positive: high fees are a sign Ethereum’s transition to proof-of-stake will be sustainable. Fees are higher than expected rewards for PoS validators, Vitalik Buterin said earlier this week. Building an attractive staking yield is critical to maintaining decentralized and robust network security, according to a March report by Delphi Digital.

CryptoKitties Risk

Fees may be desirable for network security, but there’s the risk the network can become clogged and unusable, a key complaint in 2017 with CryptoKitties and ICOs. Many “ETH-killers” grew out of this poor user experience and are now attempting to gain market share with live mainnets and significant warchests. If Ethereum fees become significant barriers to entry for new DeFi users, other chains could see growth as traders look for the balance between fast, cheap transactions, and enough liquidity to make financial instruments worthwhile.

But there’s hope. Layer 2 scaling solutions, which take some of the computation and storage off chain, can help lower fees and transaction times. Loopring’s DEX is already using one of these solutions. With zk-rollups, users pay Ethereum network gas fees to enter into the ecosystem, but can then transact at lower costs off-chain.

Even Worse on Bitcoin

That said, compared to Bitcoin transaction fees, Ethereum fees are on average more than 10X less. So maybe there is even room to grow and maintain a strong user base. Or maybe the chains are starting to show real differences in use cases: Bitcoin as a store of value, and Ethereum as a place to put that value to work.

Bitcoin in DeFi Surges by 5X in One Day

It looks like bitcoin “hodlers” are getting tired of just holding. They’re increasingly locking up their coins in exchange for Ethereum tokens which can be used in DeFi.

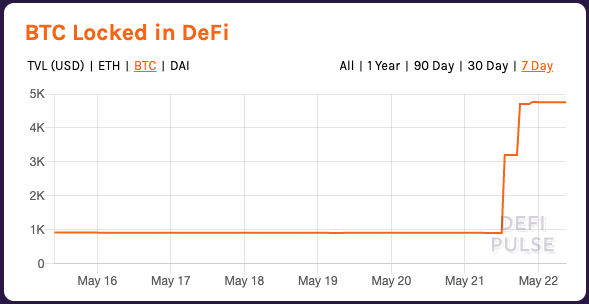

The amount of bitcoin locked in decentralized finance shot to 4.8K BTC (~$42M) on Thursday from just under 1K the day before, DeFi Pulse data show. Over 70% of all bitcoin on Ethereum comes from wBTC, an Ethereum token backed at 1-to-1 with BTC, according to btconethereum.com.

Image source: DeFi Pulse

Almost three fourths of that wBTC was added as collateral in MakerDAO. Almost 9.5 million Dai have been minted from wBTC, according to daistats.com, about half of which were issued in a single transaction. MakerDAO included wBTC as collateral in its system three weeks ago. While wBTC didn’t show signs of traction in the first weeks after launch, it’s now becoming clear there’s interest in borrowing against BTC.

Maker Cheers On

MakerDAO cofounder Rune Christensen is celebrating the wBTC flood. Maker dominance, measured as the share of its assets held versus the rest of DeFi, is down 10 percentage points since February. Adding more collateral options is part of an effort to increase locked dollars. Their strategy includes running tests with real-world assets, such as mortgages, in addition to crypto.

The increase of bitcoin on Ethereum helps consolidate three trends: increased liquidity for Ethereum applications, increased utility for BTC holders, and MakerDAO expanding its basket of collaterals to capture more market share in the increasingly competitive stablecoin space.

Custodial Vs. Trustless

Several custodial versions of wrapped BTC tokens have emerged, including imBTC, HBTC, and wBTC. The latter has a clear lead and currently accounts for approximately 4% of all value locked on DeFi. Others are working on linking the most liquid crypto asset with Ethereum’s network effects by providing trustless or non-custodial solutions. tBTC was the first one to launch but was paused just two days after its mainnet release due to a bug. With others such as Ren Project in the works, it remains to be seen whether a fully trustless representation of BTC on the Ethereum blockchain will overtake the more centralized options.

On-Chain Markets Update by IntoTheBlock

This Week: 0x (ZRX) Price Surge from an On-Chain Perspective

0x (ZRX) has gained about 70% in the past three weeks. The price surge comes after the project approves weekly staking payouts, and Vitalik Buterin’s fortuitous endorsement at the Ethereal Summit, when he said it was one of the projects he wanted to try.

0x is an open protocol for decentralized exchanges on the Ethereum blockchain, meant to serve as a building block that may be combined with other protocols to drive increasingly sophisticated dApps.

According to the 0x team, the most important role of its native token is to future-proof the protocol, while transferring value to “Relayers” through transactions fees, updating the protocols’ decentralized governance system on a continuous manner, and to partner with dApps to provide an incentive for adoption. Let's dive into ZRX from an on-chain perspective.

1. ZRX Price Surged 143% in One Day

May 8 was a great day for the ZRX token. Price surged 70% after the community voted to shorten the length of staking epochs (epochs serve as the basis for all other timeframes within the system, which provides a more stable and consistent scheduling metric than blocks or block timestamps), and Vitalik gave the project a stamp of approval during a virtual conference. YTD, ZRX is up 97%, reaching a yearly high of $0.43 on May 8.

2. On-Chain Transactions Went Through the Roof

In line with the price rally of May 8, on-chain transactions increased by 610% compared to the previous day. There were almost 10.9K transactions with a total volume of 110.44 ZRX tokens, the highest number since October 2018.

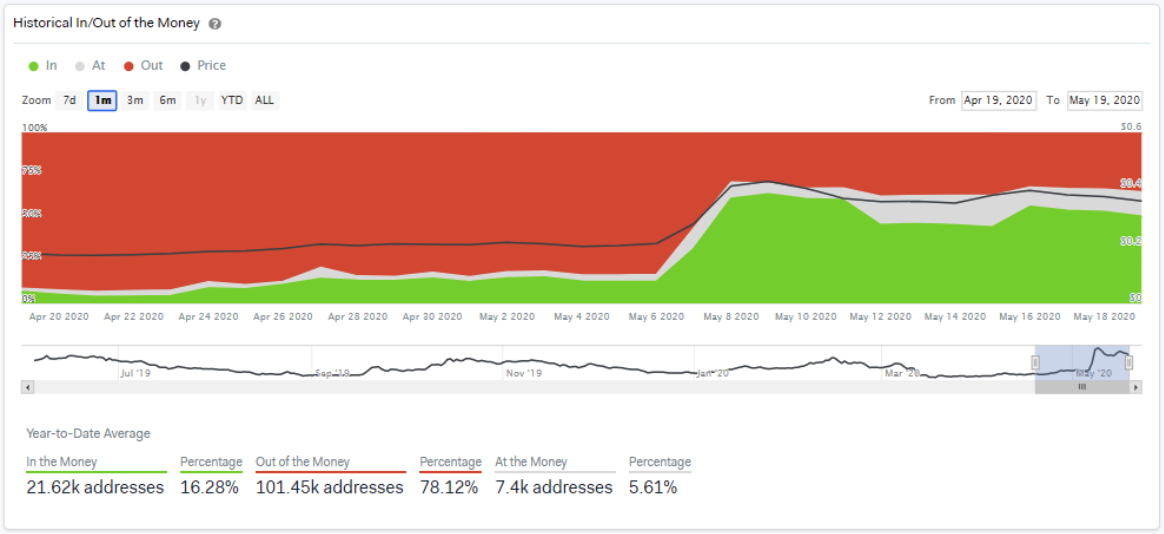

3. Over Half of ZRX Holders Are Making Money After Rally

IntoTheBlock’s machine learning algorithm identifies the average cost at which each address purchased a token. The In/Out of The Money chart compares current price of a cryptoasset to the average purchasing costs to determine what percentage of holders are making money, breaking even and losing money on their positions.

May has been a particularly good month for ZRX. 50.87% of all holders acquired ZRX at a price higher than $0.3597. Therefore, if all ZRX holders would sell today, over 50% would make a profit. This also means that about 46% of ZRX owners are breaking even. This current number of addresses In the Money is 34% higher than the Year-To-Date average of only 16.28%

The “Hand of God” Comes to Ethereum

Sorare inked a licensing partnership with Argentine soccer club Gimnasia La Plata, giving the fantasy football game the rights to issue digital cards tied to the teams’ players, according to a press release. Diego Maradona will be the first coach card issued on Sorare. Players and coaches are represented by limited-edition digital cards linked to Ethereum tokens under the ERC721 standard, which guarantee the authenticity, traceability, and digital scarcity. Some Sorare cards have been sold for more than $2K and Maradona's first card is heating up, with more than 20 bidders pricing it at over 3 ETH.

Tokensoft Distributes $4M to Investors Using Ethereum: Coindesk

Tokensoft, a digital securities platform for enterprises and financial institutions, has used blockchain tech to distribute equity to investors in a $4 million funding round, Coindesk reported. Investors receive a digital representation of their investments on the Ethereum blockchain using the ERC-1404 tokens to ensure the SAFE agreements will be enforced on-chain.

How to make DeFinancial products work for you: TokenBrice

TokenBrice of Monolith writes a blog post walking readers through “6 base strategies and their variants that harness the most relevant DeFinancial services.” He starts with “the “set and forget” strategies and progressively move down the stack towards the more complex but also lucrative ones,” including stablecoins yield, tokenized real estate with RealT, automated trading strategies with TokenSets, and staking on Synthetix.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

Click here to pay with DAI.There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the founder: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.