Ether Keeps Beating Bitcoin, Dai Helps Skirt Currency Controls

Good morning defiers! Here’s what’s up in DeFi:

Savers hit by currency controls are paying a premium for Dai

All the ways in which ether is beating bitcoin

Savers Hit With Currency Controls are Turning to Dai

People in China and Argentina are paying a premium over MakerDao’s Dai stablecoin, which is pegged at 1-to-1 with the U.S. dollar, to skirt their countries’ currency controls and protect against inflation.

In Argentina, Dai is trading at around 71 pesos on local exchange Ripio, while the U.S. dollar rate is at 56. That means they’re paying an almost 30 percent premium to hold a dollar-based asset. In China, traders are paying between 4 and 2 percent premiums for Dai in over-the-counter desks, according to Lasse Clausen of crypto fund 1kx and developer Tina Zhen.

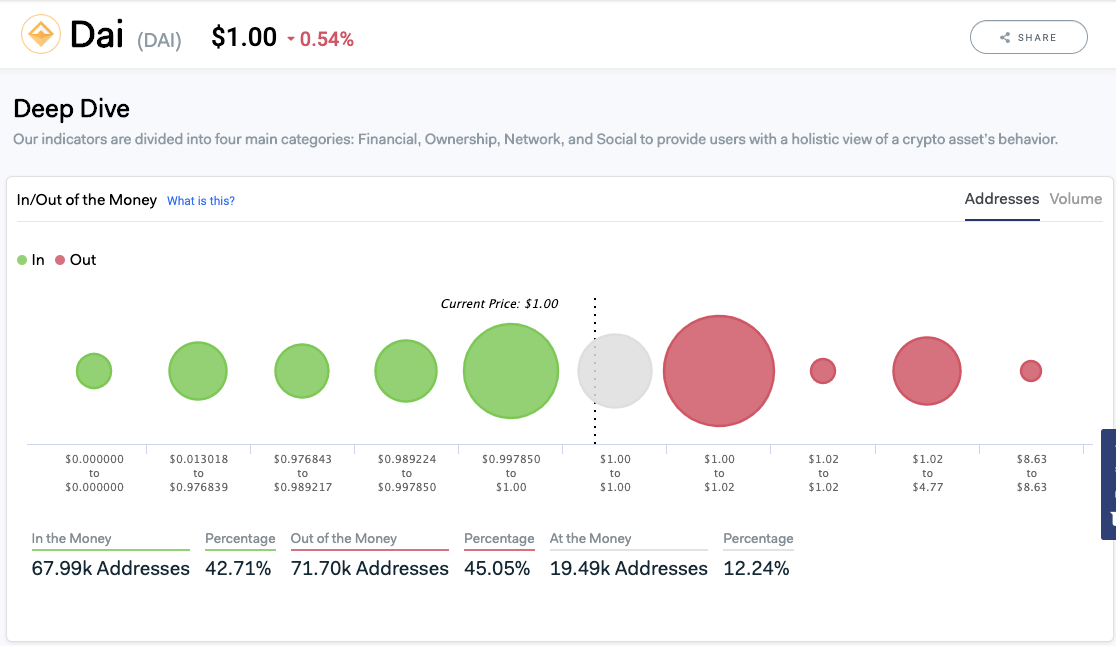

This could help explain why out of all the addresses which have bought Dai, 15 percent overpaid between $1.02 to $4.77, according to data by research firm IntoTheBlock (there’s one outlier that paid even higher at $8.6). The majority is probably a result of Dai’s fluctuations from its peg, but a portion could be because demand in some markets is creating a premium on local exchanges.

Image source: IntoTheBlock

Cryptocurrencies are made to be uncensorable money, meaning no government or third party can seize or control them. That’s key for people in countries like Argentina and China, where the government restricts the flow of capital and tries to force people into holding the local currency –a move that always backfires and causes the local currency to depreciate faster in the black market.

Traditionally, the dollar has been the favorite safe haven, and people living in countries with currency controls will do anything to get their hands on USD. Then, Bitcoin became an alternative. The next step is Dai, which combines the best things about dollars and bitcoin. Proof? The nearly 30 percent premium for Dai in Argentina compares with a 12 percent premium for bitcoin.

That could be misleading though, because liquidity is probably playing a big factor (lower Dai liquidity is probably pushing the premium higher). Still, there are good reasons why someone in a country with 50 percent inflation in the case of Argentina would want to use Dai over bitcoin: A dollar-pegged digital asset is better at being a safe haven than a volatile one.

Dai is even better than black market dollars. Savers can buy the digital asset directly on their laptops, they can store it in their digital wallets, transfer it in seconds, and use it to gain interest in DeFi. The group of people buying Dai in Argentina is probably extremely small right now, but maybe there will be a day when dollar-obsessed Argentines buy more Dai than USD. That’s one “flippening” I’d like to watch.

Ether Keeps Beating Bitcoin

Ether is beating Bitcoin on a growing number of metrics. These feats highlight strengthening fundamentals for the second-largest cryptocurrency and the base layer for most of decentralized finance.

These are some important metrics where ether is beating bitcoin, or very close to (source for all the charts is CoinMetrics):

Daily transaction fees, which signals increasing use of the Ethereum blockchain:

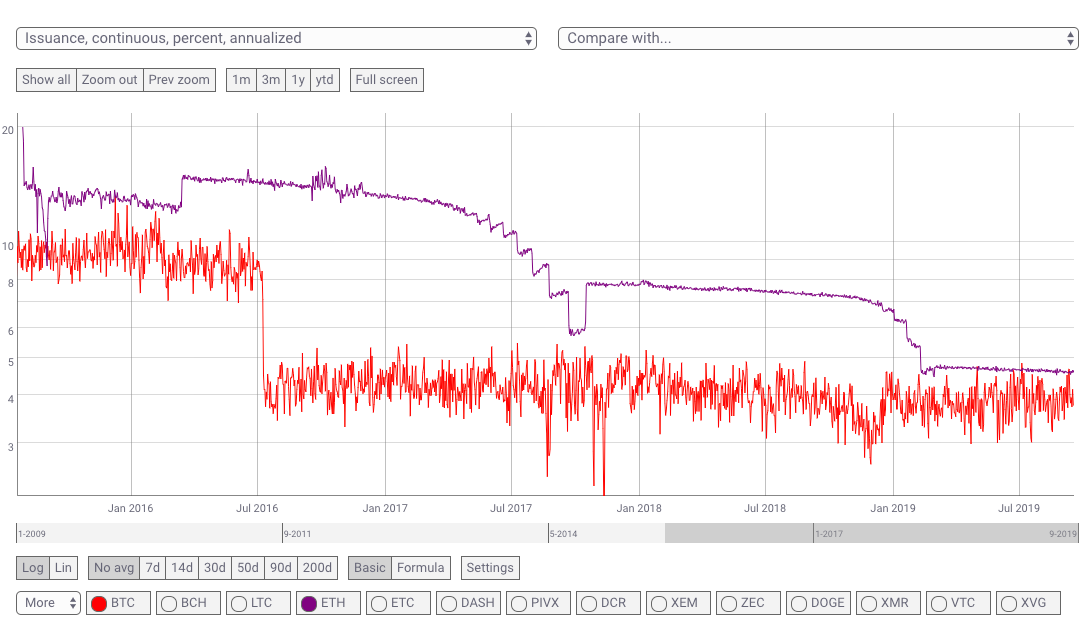

Issuance, which means that Ethereum now has the same inflation rate as Bitcoin:

Volatiliy, Ethereum about to become less volatile than bitcoin on a 180-day average:

Trading volume on Messari, which excludes exchanges suspect of inflating volume:

Bonus: Metrics where Ethereum beat bitcoin a long time ago and maybe you didn’t realize…

Check out the latest CoinMetrics report for all the ways the Ethereum version of Tether is beating USDT on Bitcoin-based Omni. Summarizing here: Transaction count, transfer value, addresses with balance of at least $10.

The Bitcoin metric Ethereum is very far surpassing is the one that created the original “flippening”; market capitalization.

Sign up to get the best and only daily newsletter focusing on decentralized finance news, complete with analysis, exclusive interviews, scoops, and a weekly recap. All content is free for now. Those who become paid subscribers now, before the paywall goes up, get a big discount :)

About the author: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.