ETH Crossed $500 in a Most Quiet Rally

Also, IntoTheBlock analyzes the on-chain impact of ending UNI rewards.

Hello Defiers and happy Friday :) Here’s what’s happening

We’re in a very quiet crypto rally

IntoTheBlock reports on the on-chain impact of the end of Uniswap’s UNI mining: LPs are fickle, UNI holders not so much

Check out the new Defiant video on flash loans

👩💻 Also, a reminder that Harmony’s Hack the Horizon hackathon is live until Jan 17. There is $50,000 in Harmony’s ONE tokens for developers building on Horizon, a bi-directional bridge that connects Ethereum and Harmony. The first prize also includes an annual subscription to The Defiant!

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($10/mo, $100/yr).

📺 Watch The Defiant’s New YouTube Video on Flash Loans

Video producer Robin Schmidt dives into flash loans in the latest Defiant video, produced in partnership with Harmony Protocol.

🎙Listen to the interview in this week’s podcast episode here:

🙌 Together with Zerion, a simple interface to access and use decentralized finance, and 1inch.exchange v2, which aims to provide the best rates by discovering the most efficient swapping routes across all leading DEXes.

Shh! Cryptocurrencies are Rallying

We are in the middle of a crypto bull market but you wouldn’t know it from social media trends, news headlines and anchors, and just all-around hype.

If it feels a lot quieter this time around, it’s because it is. The gap between BTC and ETH prices and mainstream interest, measured by Google search, is at the widest ever in a run-up.

Bitcoin at $18k

Bitcoin yesterday crossed $18k, just about 10% away from its record of almost $20k. When the largest cryptocurrency was last trading at these levels Google search trends were near a record, or almost 7 times higher than it is now.

Up until the 2017 rally, the Google search score had closely tracked the Bitcoin price. But after that boom, the metrics started to decouple, with the divergence intensifying since October.

Ether at $500

ETH crossed $500 for the first time since July 2018. Google search interest, while climbing, has been near these levels many times this year. When ETH crossed $500 for the first time in 2017, Google search interest was more than 5 times higher than where it is now.

In the case of Ethereum’s cryptocurrency ether, it still has a long way to go before it can come close to its previous record of over $1k, which explains why the difference between the ETH price and the Google search score isn’t as wide as it is for Bitcoin —ETH hasn’t climbed as high relative to historical prices.

No-hype Rally

One explanation for this divergence between price and interest is that, at least in this stage of the current cryptocurrency bull-run, it’s not so-called “retail” demand driving prices. Instead, it could be that larger investors and institutions are loading up.

Data points to support this: Public companies including Microstrategy and Square adding Bitcoin to their treasuries, digital assets investment firm Grayscale crossing $10B in AUM, BlackRock CIO today saying Bitcoin could replace gold.

Unlike in the 2017 bubble, this time around it’s easier for professional investors to get cryptocurrency exposure: There are institutional-grade custody solutions, with clearer regulation, and liquid, US-regulated derivates.

Easier Access

It may also be possible that it’s simply easier for individuals to buy cryptocurrencies, reducing the need to ask Google how to do it. Robinhood, Cash App, and most recently, PayPal, have put crypto at the fingertips of millions.

Or it could be that we’re at the earlier stages of a rally and mainstream interest is bound to follow the recent price run-up. So when your friends start asking how to buy BTC, this time around you’ll also be able to show them to how they can put their crypto to work in DeFi.

On-Chain Markets Update by Lucas Outumuro IntoTheBlock

This Week: On-Chain Impact of the End of UNI Mining

Uniswap’s UNI release had major effects on the DeFi space. Just hours after the UNI airdrop, Ethereum hourly fees and gas costs reached a yearly high. Similarly, UNI’s liquidity mining program led Uniswap to become the DeFi protocol with the highest TVL, increasing its liquidity supplied by 4x to a high of over $3 billion.

Since UNI’s liquidity mining ended on November 16, Uniswap’s liquidity dropped by over 50% in a matter of days. At the time of writing, Uniswap has $1.32 billion in liquidity supplied, which is still 76% higher than the liquidity locked on September 16 prior to the announcement of UNI’s yield farming. However, the $1.7 billion+ that left Uniswap as soon as the rewards stopped point to the unloyal yield-seeking behavior incentivized by yield farming.

While the migration of liquidity may not come as a surprise to many readers, Uniswap’s liquidity mining program also showcases other interesting patterns. By analyzing on-chain data provided by IntoTheBlock, we are able to better understand the implications of UNI’s liquidity mining on Uniswap and the broader DeFi space.

Here are three key insights of UNI’s liquidity mining and general lessons learned:

1. Uniswap Liquidity Shifts to Competing DEXes

The main benefactors of Uniswap’s liquidity mining expiring were other decentralized exchanges. In terms of TVL, it is clear that LPs quickly migrated in search of high rewards. This is observed in the contrast between the liquidity supplied to Uniswap and its competitors as soon as UNI rewards ceased.

Source: IntoTheBlock’s DEXes Insights

In particular, SushiSwap has gained the most in terms of liquidity as can be seen in the graph in the right. Month over month, SushiSwap has seen an increase of 257% in liquidity supplied, while Bancor, Balancer and Curve grew by 193%, 17% and 6%, respectively. This demonstrates that liquidity providers (LPs) favored direct Uniswap AMM competitors with 50-50 pools over DEXes with slightly different models or scopes such as Balancer and Curve.

2. Uniswap Continues to Dominate in Volume, Proving it’s Stickier

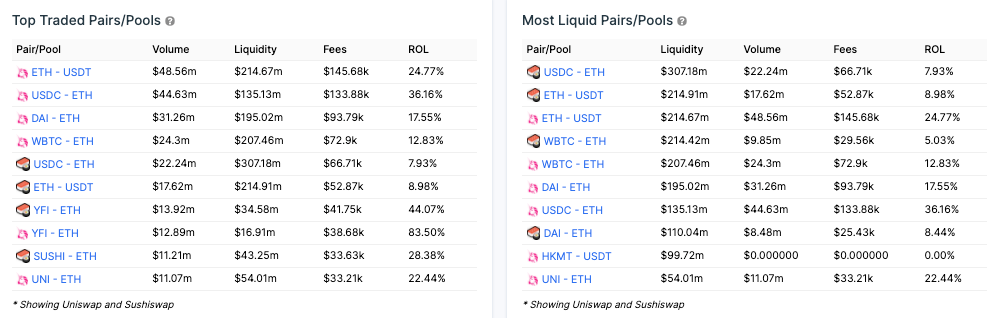

While Uniswap continues to have higher liquidity overall than SushiSwap, the latter has dethroned the former with the most liquid trading pair out of all DEXes. At the time of writing, the USDC-ETH pair in Sushiswap has the highest liquidity. Note that the charts below do not consider liquidity mining rewards for the values shown for return on liquidity (ROL).

Source: IntoTheBlock’s DEXes Insights

The chart above also shows that while LPs quickly reallocate capital based on expected yields, traders do not switch as easily. The most traded pairs across DEXes were still in Uniswap, even for the less liquid USDC-ETH pair and ETH-USDT pairs. In aggregate, Uniswap traded a total of $419 million on November 17, which is five times greater than the $73 million settled by Sushiswap.

While in theory higher liquidity benefits traders protecting them from slippage, traders still opted to trade at Uniswap. It is unclear if these traders effectively incurred higher costs by trading these pairs in Uniswap instead of in SushiSwap. Although the higher volumes persist in the meantime, it is also uncertain whether traders will eventually migrate as well, or if they will be more loyal to Uniswap than their liquidity provider counterparts.

3. Money Flows into UNI as Holders Continue to Grow

Some have pointed to a potential sell-off in UNI to occur as liquidity providers claim their rewards upon the ending of liquidity mining rewards. UNI prices have indeed dropped approximately 10% since these ended, but have done so in the midst of a broader sell-off in crypto. By analyzing Uniswap flows data, we observe that swaps in the UNI-ETH pair have actually been more inclined towards UNI in November.

Source: IntoTheBlock’s Free Uniswap Protocol Metrics

Uniswap Pair flows show whether the liquidity taken from traders is from swapping UNI for ETH or vice versa. If there is a greater inflow than outflow into a token, then its net flow would result positive. Throughout November, the UNI-ETH pair has seen negative net flows for UNI of -816k UNI, meaning that is the net amount withdrawn from traders swapping ETH for UNI so far this month.

Similarly, in centralized exchanges UNI has left more exchanges than entered them in November. The net flow for UNI to centralized exchanges has also been negative, pointing to 715k more UNI leaving centralized exchanges than entering them throughout the month. This is generally seen as an indication of positions being taken and traders opting to hold their own tokens.

Source: IntoTheBlock’s Uniswap UNI Analytics

This trend suggests that both CEX and DEX traders continue to trade into UNI in spite of its liquidity mining rewards coming to an end (at least for now). This pattern is echoed in the total number of addresses holding the UNI token. The total number of addresses holding UNI has been increasing steadily since late September, approaching 100k holders.

Source: IntoTheBlock’s Uniswap UNI Analytics

Overall, the end of UNI’s liquidity mining has had strong effects on Uniswap and the broader DeFi space. It proved the fickle nature of liquidity providers and how these rewards may not sustainably improve supply-side metrics by themselves. At the same time, it demonstrated that traders do not switch platforms as easily and continue to acquire UNI despite the 50% decrease in Uniswap’s liquidity. It will be interesting to see how Uniswap adapts future UNI incentives to mitigate short-term-minded LPs and continue to engage traders.

Circle Partners with Venezuela Opposition Leader to Deliver Aid

Circle is collaborating with opposition leader Juan Guaido and Airtm, together with coordination and licensing with the US government, to use USDC in an aid disbursement pipeline that bypasses currency controls imposed by Maduro.

The US Treasury and Federal Reserve release seized funds to Guaido’s account at a US bank. Guaido uses those funds to mint USDC and sent it to Airtm. Airtm’s network of forex agents enables withdrawals to local currency in Latam bank accounts at free-market rates., and is dispersed to accounts of Venezuelan healthcare workers as AirUSD stablecoin. The healthcare workers are then able to withdraw to their local bank accounts as bolivars at free-market rates.

BlackRock’s chief investment officer made the bull case for Bitcoin on CNBC.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

About the founder and editor: Camila Russo is the author of The Infinite Machine, the first book on the history of Ethereum, and was previously a Bloomberg News markets reporter based in New York, Madrid and Buenos Aires. She has extensively covered crypto and finance, and now is diving into DeFi, the intersection of the two.