DeFi Exchange Meets CeFi Liquidity But it Comes at a Cost

Also, The LAO explores ways to include unaccredited investors, ConsenSys KYC, The Graph integration with Chainlink.

Hello Defiers! Here’s what’s going on in decentralized finance:

zk-Stark Layer 2 solution increases throughput but decreases composability

The LAO explores how to bring in unaccredited investors to for-profit DAOs

MakerDAO community poll signals at least five potential new collateral types

ConsenSys launches a DeFi-focused compliance service

The Graph integrates with Chainlink

and more :)

🎙Listen to this week’s podcast episode here:

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for 70 Dai/yr vs $100/yr).

🙌 Together with Status, a secure messaging app, crypto wallet, and Web3 browser, & Quantstamp, a leading blockchain security firm keeping your money legos safe.

DeFi Exchange Meets CeFi Liquidity —at a Cost

We all thought Binance would be the first centralized exchange to pull it off: bring a massive exchange to the DeFi world smoothly, allowing users to enjoy everything they love about DEXs while enjoying razor thin bid/offer spreads and deep order books.

In the end, Bitfinex beat them to the punch. Formerly known as Ethfinex, DeversiFi was imagined in Bitfinex’s offices back in 2017 and incubated through to 2019 before spinning out to a stand-alone exchange in 2020. The concept is simple: DeversiFi aggregates centralized and decentralized liquidity, solving one of the main pain points faced by DeFi traders looking for deep order books.

But it comes at a cost.

Hacking ETH’s Limitations

Readers of The Defiant are keenly aware of the limitations of the Ethereum blockchain when it comes to high throughput use cases. This is addressed by DEXs in a myriad of ways: off-chain order books, batch matching, AMMs —we could go on.

DeversiFi decided to innovate by integrating a zk-Stark Layer 2 solution, allowing their platform to scale transactions per second dramatically while obfuscating the trading footprints left by the users of the exchange.

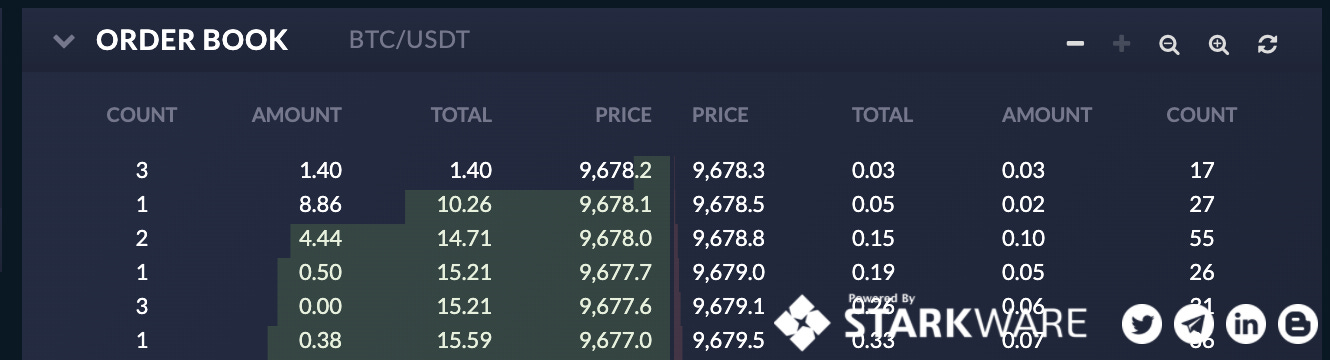

But the zk route means there is no composability to the main Ethereum chain. In layman’s terms, this means that DeversiFi’s order book is not readable by other smart contracts.

This might not sound like a big deal, but consider this: DeversiFi’s order books will not show up in DEX aggregators such as 1inch or Paraswap, even if chances are they provide some of DeFi’s tightest bid/offer spreads and depth.

DeversiFi’s WBTC/USDT order book

There are workarounds to this limitation, which the DeversiFi team is working to deploy in the near future. Composability is a key focus for the team, as well as being able to enable instant withdrawals from the exchange (instead of having to wait for each batch to settle on the Ethereum blockchain).

But for now, throughput is coming by compromising on composability. DeversiFi won’t be able to play with other Money Legos yet.

The LAO Wants to Open For-Profit DAOs to Everyone

The LAO, a venture fund powered by MolochDAO and OpenLaw, is exploring ways to open up for-profit decentralized organization, such as theirs, to unaccredited investors. This would being The LAO’s goal of decentralizing Silicon Valley closer to reality as today, while the fund is more open and transparent than most VCs, it can still only accept accredited investors in the US.

The way to do it is through an extension to the Moloch v2 smart contracts called Minion. A Minion can receive funds from a DAO and transfer those funds to another Ethereum address after it has been authorized by DAO members. Through Minions, Moloch-based DAOs will be able to create sub-groups of DAOs —which The LAO team calls “Baby DAOs.” These Baby DAOs can be used to raise funding for specific projects or initiative, similar to an SPV.

The controlled setting for Baby DAOs, where only DAO members can create them, and the ability for investors to pull their capital at multiple points during the process, or “rage quit,” has the potential to increase investor protections.

Because of these characteristics, a DAO-plus-Baby architecture, “opens up the possibility of creating DAOs where unaccredited and accredited investors could work together, potentially decreasing — if not dramatically decreasing — the risk of fraud that underpins most of the global securities law regulations,” The LAO team wrote in a blog post.

ConsenSys Launches DeFi-Focused Compliance Service

ConsenSys “is rolling out a product focused on the know-your-customer regulatory compliance requirements that have proved to be a headache for many cryptocurrency firms,” Bloomberg reported. The move raised some eyebrows in the DeFi community, as to some, a big piece f open finance is the ability to offer access to anyone, a goal that could be dampened if dapps require KYC.

ConsenSys replied on Twitter saying that the service “provides AML/CFT checks through know your transaction (KYT), which does not obtain any personally identifiable information,” to help companies comply with regulations and prevent money laundering, fraud, and funding of terrorism.

Maker Community Votes on Potential New Collateral Types

The MakerDAO community this week voted for at least five tokens they’d like to add as collateral types in the system. The projects for which more community members voted in favor of adding than against are Centrifuge’s DROP tokens, 0x’s ZRX, Decentraland’s MANA, Keep Project’s tBTC, and Uniswap’s v1 Dai liquidity token.

Image source: David Gogel, Twitter

But that doesn’t mean their addition is imminent. MakerDAO’s head of community development Richard Brown tweeted, “these polls gather level of interest in having other ratified teams start deeper evaluations. They don't signify an immediate addition of new collateral into the protocol. New assets can take months to eval.”

The Graph Announces Integration With Chainlink

The Graph is integrating with Chainlink to allow indexed data from The Graph’s APIs, called subgraphs, to be relayed to smart contracts via Chainlink oracles, according to The Graph’s blog post announcement. As part of the integration, The Graph will index DEX liquidity data that Chainlink oracles can bridge to DEX UIs as reference data for calculating slippage based on a user’s trade size. The Graph will also track gas prices paid per transaction and plans to develop a universal API to allow smart contracts access to any subgraph using a Chainlink decentralized oracle network.

Rari Capital is the Latest DeFi Yield Robot

Rari Capital is the latest “yield robot,” a popular DeFi application which rebalances users stablecoin deposits into the highest-yielding opportunities. In addition to rebalancing among lending protocols, Rari Capital plans to rebalance deposits between stablecoins too, to maximize returns. The platform isn’t live yet and there’s a waitlist available.

Baseline Integrates Microsoft & Google Spreadsheets: CoinTelegraph

The Baseline Protocol has released integrations for Google Sheets and Microsoft 365, allowing multiple entities to privately verify that their databases share the same records, CoinTelegraph reported.

Marc Zeller from Aave highlights this incredible transaction where an Ethereum user paid $2.5M to move $133.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

Click here to pay with DAI.There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the founder: Camila Russo, is a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.