Hello Defiers! This is a free sample of our latest DeFi Alpha Call. We hope you enjoy it. Please note that the stream starts at 02:08.

PS — If you find this recording and transcript helpful, please share it with a friend!

Anon: How's it going, everyone?

Vulcan: Doing well. How about yourself?

Anon: Very well, thank you.

yyctrader: Sorry. I haven't used this bot before, since Diego usually handles these. All right. I think we're good. Okay. So it's gonna track everyone. All right. So thanks for attending everyone and great to have you all here. So let's get started as we usually do with the markets. Okay. Bitcoin is still pretty weak, to be honest, like, yeah, we're making progress upwards, but it’s choppy. No big candles, like we saw in July.

This purple line right here is the hundred-day moving average. And it seems to be having trouble crossing above that for now. But, I mean, let's see, I mean, right now it seems like the narrative's all about Ethereum and the Merge.

Right. ETH did pretty much what I expected it to last week. So look at that. I didn't even have to move this little line that I drew last week. So yeah, so we saw a little more upside.

Anon: Are you sharing your screen?

yytrader: Oh, I'm so sorry guys.

anon: No, sorry to interrupt.

yyctrader: It's good you did. So sorry. All right. Can you see it now?

Anon: Yeah.

Market Overview (starts minute 02:08)

yyctrader: Okay. So fine. Since I clearly was just talking to myself, let's start again. So first I was looking at Bitcoin, so yeah, pretty much, the same. As we expected, we saw a little bit of upside.

It's still kind of struggling to close above the hundred-day MA, which is the purple line. I mean, above that, if we managed to clear it, we'd see, probably 28K would be the next area of interest, which was held as support a couple of times. And then we had the big breakdown. But yeah, overall, still pretty choppy.

This action is kind of the definition of what a dead cat bounce or bear market rally would look like. You know, it's just not really catching much upward momentum for now anyway, but, as I said last week, as long as we stay above this [yellow] trend line I don't see any real concerns for the bulls just yet.

I mean, there's many areas where we could find support. Let’s zoom in. Right now we're holding above the 8DMA, which is good. So it's just a sandwich between this longer timeframe 100DMA and the eight-day, which is like more, a lot more short term. So it's finding support here. If not, we have the 20 day, which is around 23 and a half, and then we have the big trend line, which is the test of this.

Now, if we were to break down, let's say we have the Fed minutes on Wednesday. That's the minutes of the last meeting. So that should be interesting and should give us some more clues as to how those guys are thinking.

But yeah, if we were to break down, I'd expect us to kind of bounce back to the trend line, which is where I'd probably look to short for, I don't know, a bear scenario, but, saying that, nothing to be too concerned about right now.

I mean, like, we've seen all the bad headlines and even right now, Tornado and privacy and stuff is kind of dominating the news cycle, but, behind the scenes, there has been some accumulation. I remain neutral at this stage, similar to last week.

ETH.

Pretty much followed the path that I laid out last week. So we saw a little bit more upside and now we're getting the pull back. How deep will it go? We'll have to wait and see, I think Wednesday should move the market one way or the other.

I would be a buyer in this area here [1700s]. I sold off most of my tactical longs over the weekend. So I'd be looking to buy back in probably around 1750 or so all the way down to 1700, because again, 1700 has been a very important level, right? 6, 7 times held as support and then finally broke down.

So as long as we stay above 1700, I think, the bulls are fine and we should make, either more choppy progress or at least, still have an upward bias as long as we stay above 1700. But again, for the time being just neutral, I think we are quite overbought on a short-term timeframe. I mean, we rallied a hundred percent in a month. So some pullback is definitely warranted at this stage, in my opinion. But, yeah, let's see how that plays out. For now, bulls are happy.

The merge is on track as far as we know, so, yep. That's good.

NFT Roundup

Let's move on to NFTs for the last week.

All right. So eight aliens or eight, I don't know. How do you pronounce that… aliens? Is a mint that is seeing some, decent volume, as you can see, in the past week, it's topped the chart and the floor price has been dropping, but, these are quite interesting and someone actually posted a thread about the origin story, which has something to do with Vitalik and a book that he read as a child and whatnot.

So I don't know, but, yeah, I mean, this is regular pixel art. I believe that, let me just verify this, but I believe this collection doesn't have royalties.

Yep. So it was a free mint and it has no royalty. So it's completely a kind of giveaway to the community, I guess, from the people who made it, who are, I don't remember the names, but they are, like notable NFT influencer types.

anon: How were you able to tell from Etherscan that it doesn't have royalties?

yyctrader: So you can see here that the NFT sold for 0.25 ETH, right? And usually, when there are royalties, you'll see three transactions in here. And here, this one only has two and you can see the split. So just doing some mental math, this looks like just the 2.5% that Opensea takes and the balance has been transferred to the seller. It's an interesting concept. So this is completely free. This is what punks are, essentially. That's how they launched with a free mint or free claim and no royalties. This one seems pretty interesting and yeah, I picked one up yesterday but I paid pretty much double of what the floor is now. Will be interesting to see how these things play out.

I just honestly got tired of not buying stuff that I come across and then seeing them like 10X and 20X the next week, like Goblins and another one we're gonna get to in a moment. So, this was just a FOMO buy, just to see what happens after I saw that Vitalik connection potential. I mean, who knows? But yeah, I think the concept of having no royalties is cool. It reduces friction for trading. It'll attract more liquidity, I think.

How's the activity? Yeah. Still pretty, pretty healthy. Even though the floor price hit half an ETH last week and yeah, it's just been kind of dying off ever since until, I don't know the next announcement or whatever they do, but yeah, let's see how that goes, but again, not a recommendation or anything. I just thought it was interesting so I picked one up.

Let's go back to the weekly charts.

All right. So then we have the usual suspects. This was a derivative of the apes that launched and, I mean, look at them, but 6,000 ETH in volume and half an ETH floor. I saw the Ape holders were shilling this pretty hard.

Another notable mint was a stealth mint that I wrote about in, oh actually I was going to write about in the Roundup, but I skipped it cause other stuff came up.

This was a stealth mint last week that really just rocketed off the floor. It's been made by these two guys, Gabriel and Halbert who are apparently world-famous game designers. I'm not familiar with them personally. So I can't speak to that. But, I mean, these things start getting swept as soon as they minted out, they minted out in minutes, maybe five minutes to mint out all 2000.

It was a free mint stealth drop. I saw them again around 0.1 when they just started trending. And I was like, what are these? And having been burned quite a bit with the whole anime NFT season a few months ago, I was like, okay, I'll pass. And yes, as is customary, we are 15X a week later.

So yeah, this is interesting. It's a small collection, but still not that many owners, I mean, it's pretty concentrated, right? You have almost three NFTs per owner, which is not ideal, but, I mean, the whales are sweeping these up, so it's possible that they know something that's coming or there might actually be something to, to this project, but yeah, another one to keep an eye on, I guess.

Vulcan: One of those sold for like 22 ETH I think I saw.

yyctrader: Oh, yes, yes, it did.

Vulcan: Wild

yyctrader: This one.

Vulcan: There's gotta be some sort of, something planned for that. People know something. You wouldn't just drop 22 ETH randomly.

yyctrader: Exactly. Right. I guess this must be a one-of-one in the collection because it has, or do they all have names or was that the only one? Oh no, they all do. Pretty decent sales. That one's sold for 22 ETH but the rest have not hit that level yet, right? Yeah. It's like three, two, but it's just like a few days old. Something to watch.

I really want to thank you guys for voting in the newsletter that we sent out with the recording of last week's call. I'm glad to hear that at least 46 of you enjoyed the recording. So, yeah, so we'll continue to send that out. I think we can do it earlier this week, so we'll probably, as soon as the recording is ready, I believe Fran is recording it right now, so we can send that out.

What else?

Webaverse is not really doing too well. I mean, it minted it out as expected because it was really hyped, Pablo and I bid on the NFTs and I believe it closed at 0.45 ETH. So we're down a bit at the moment, but, this is apparently some super open metaverse stuff that they're building.

I'm in so many projects, honestly, that I don't even have time sometimes to know what the project does. So it's just because I follow the volume and trade based on that usually. So for me, it could be, I mean, there are some obviously that I collect because I want to hold those, but when it comes to these new drops and things, it's mainly just momentum.

Potatoz is still holding up. This was the one that I wrote about a couple of weeks ago. It's the 9gag metaverse entry ticket for lack of a better term. So this was again a free mint that's holding up. That's been holding up above 1 ETH quite well.

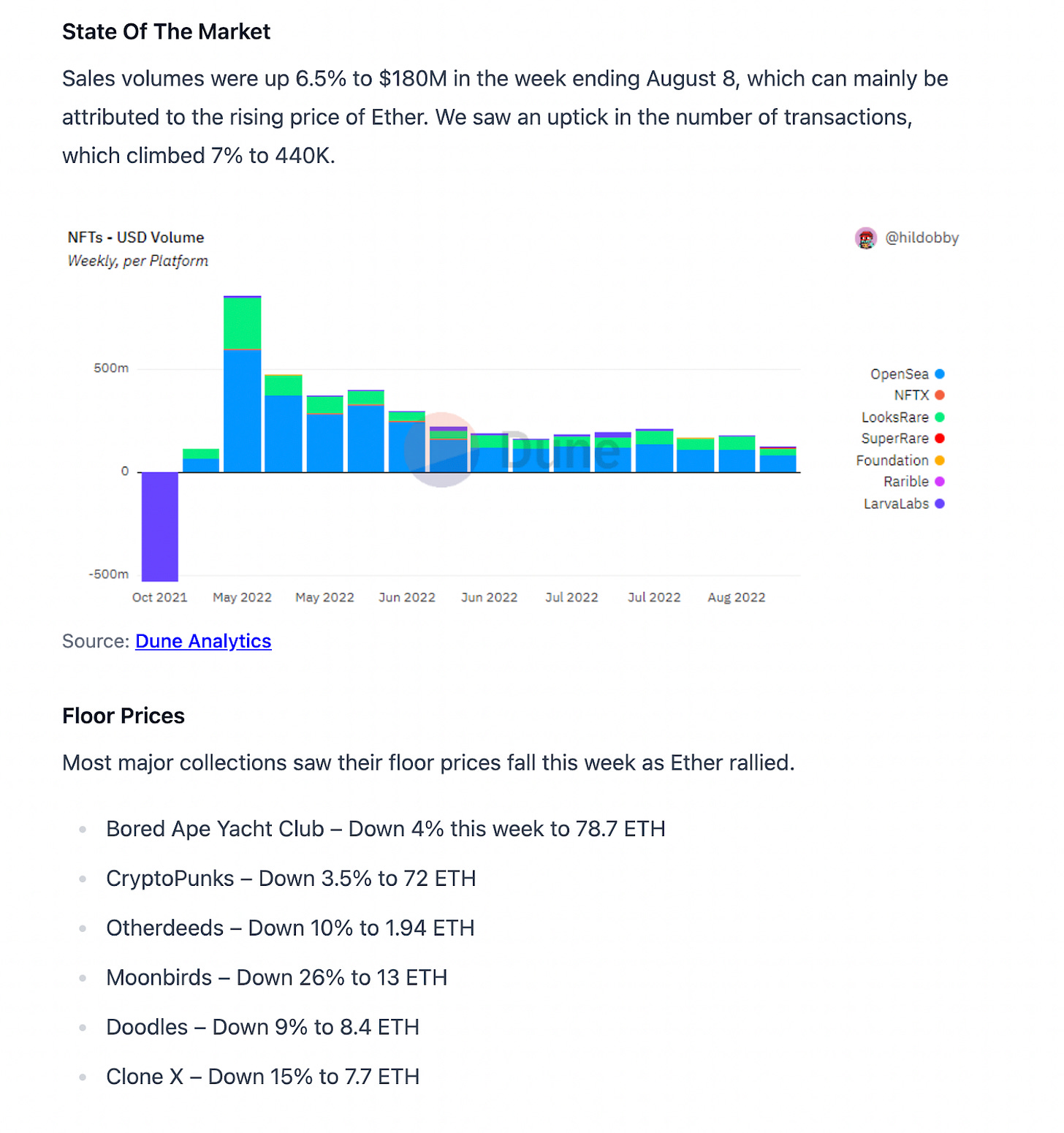

Penguins were the success story of last week. Pretty much every floor was down. Pretty much carnage across the board. We had Apes down 4%, Punks 4%, and Moonbirds. Wow. They've just been destroyed after that surprise switch to CC0 licensing. I think the holders are just annoyed that they didn't get a say in the matter right? More than the actual switch itself.

I did hear some cases of people who were working on licensing deals with their birds, which fell through after this happened. I'm not sure how much stock to put in that meaning I can't verify the sources. They could be just making something up just, you know, to get engagement as we see often. But if that is the case, that is really sad to hear though.

I mean, in this market, I'm sure negotiating licensing deals for JPEGs is not the easiest thing. So if someone actually managed to do it and then saw that deal killed that really sucks.

Coming back to, Penguins. These things, I mean, they're like the Energizer bunny, to be honest. So last year everyone had almost written them off because, you know, the founder Cole he's, well, let's just say he's a well-known, questionable personality in the space and the community wasn't happy with how they were running things.

The team was just raking in money, and they dropped these, Pudgy Presents, which just had like these fishing rods in them and that after teasing a bunch of utility for a while. And then I think because so many serious collectors and influencers got into the collection and I mean, they're all over Twitter, right?

Like the chief of Nansen has a penguin as his profile picture. There was enough momentum in the community with like heavyweights in terms of holders that they just managed to stage a coup and kind of get rid of the founding team. And the project was sold for, I believe it was 750 ETH. What was his name? Luca Netz. So he's based in LA and has a bunch of businesses and stuff like that. And since then they've been building. This happened in Jan or Feb, so it's been six months of pretty tepid action.

So this was the initial hype, right? So these things pumped and then pretty much slid. They hit almost half an ETH back in December when the FUD was at its peak. And then there's this big spike when the acquisition was announced. And then another one, I'm not sure what led this off, but, yeah, it's been, new collectors coming in and it's been challenging this two and a half to three ETH floor quite a few times.

If they can keep the momentum going this might be the breakout assuming that they're gonna do something substantial going forward, but last week they basically rolled out pudgy toys. So these are gonna be physical toys and real-life based on a few of the signature penguins from the collection. Looking forward to those… if they're reasonably priced and available around me, I'm sure my kids would love some.

So far, the penguins have been doing really well. And it's been great to see the comeback. I haven't owned any since…I had a few when they first minted, but I sold them in the initial hype phase and I never really got back in and now I think they’ve become pricey again.

I feel I should have picked one up around one ETH but never did. So, since I don't have one, it's quite likely that these things will keep running.

I think that wraps it up for NFTs.

Any questions, anything to share? Have you guys seen anything interesting in the NFT market?

Vulcan: Yeah. The sudo ponzi season is kind of interesting. It feels like a new meta is kind of starting here.

yyctrader: Oh yeah, for sure. That's why I have Sudoswap up on the screen. We did the tutorial on it on Friday. It feels like a new, like you said, a new meta or new shitcoin season, but with JPEGs, because if you look at these things, the Sudo Inu. I'm not sure whether these things actually have a reveal plan.

So is it just gonna be 10,000 of the same picture in which case these are just fungible NFTs, right? Because what makes NFTs non-fungible is the fact that they're all unique. So hence can't be priced in the same way, but in this case, not only do you have the images being the same, but you also have the platform Sudoswap that doesn't charge royalties, like it doesn't support royalties at this point.

There's no friction when it comes to buying and selling. That's quite interesting and you know this, the spread here was a lot narrower yesterday when I was looking at it or even this morning for that matter, it was like if the floor for buying was 0.49, the bid was 0.47.

So I think It's possible that a bunch of people have just exited. Taken up some of the buy-side liquidity. Let's have a look. Yep, a bunch of sales.

Vulcan: Some of the teams, I'm not sure about Sudo Inu, I missed that one, but some of the teams are trying to provide their own liquidity. Like they allocate some of the team NFTs to the pool to try and keep the pool balanced. But yeah, I think Cobie was saying on Twitter that they're trying to make, or no, he was like, what's the difference between an NFT and an altcoin? And it's literally the same thing, but just with pictures. I think people are, are kind of like trying to, I don't know, bring like this shit oin game into the NFT market.

yyctrader: I mean, yeah. We need a new Ponzi.

Vulcan: yeah, exactly.

yyctrader: This is awesome. It combines shitcoins with JPEGs. So you get pictures as well. So, yeah.

Vulcan: I was just gonna ask like, is there like less slippage? I know it's due to the pool, weight, and everything, but like, maybe like, cuz I know if you're trading like super new coins, like shit coins, meme coins, that kind of stuff. Before they have decent liquidity, you're going to suffer a lot of slippage, like sometimes up to like 49% slippage if you're in something really early. So I wonder if these solve that problem of getting liquidity early on for new projects. It's gonna be interesting to see.

yyctrader: It's quite similar honestly, because, if you look at the collections, right, you can see based on the TVL of the pool, the spreads are really massive, right? Let's see. All right. Let's say this is a new project that launches for example. So you'll see very few because the only way that you get liquidity on Sudoswap is that people add it. And people, and, I'll get to creating the pools in a minute, but, people need to add their NFTs to the pool for you to be able to buy and sell, right?

So you have, this is one person who has put in his NFTs, and you can see his pricing as well. Currently, the pricing is at 0.43, and the delta is exponential, which means that each, and every time an NFT sells from this pool, the next NFT will cost 14% more and there's a swap fee of 10%.

This guy has set up quite the cash cow of a pool if someone comes and buys up these NFTs or like sweeps them. He'd hit the lottery pretty much.

Vulcan: Wow. I see.

yyctrader: Yeah. So, this is why I wanted to do a tutorial on this before this whole sudo season goes crazy and people just start apeing in. I want you guys to know exactly how the thing works so that you don't get caught unaware and, you know, fomo into something and end up spending way more than you should.

All right. So I think since we're looking at Sudo anyway. I'll run through the tutorial real quick.

Sudoswap Tutorial

What is sudo essentially? It's like Uniswap for NFTs. So, instead of using, like a traditional marketplace, like OpenSea or LooksRare where, you know, when you list your NFT, you're either waiting for somebody to come and pay your listed price, or the offers in most cases are quite like you guys must have seen them, right. They're usually way under the floor price.

There's no way to get instant liquidity at the floor price. You need to list and wait for someone to buy it. You might list it at the floor, or even slightly under the floor, but you still have to wait for someone to pick it up. And in the case of illiquid collections, which only see like a few sales a day or week, for example, I mean, that's pretty much impossible to get if you need liquidity quickly, not possible at all.

What Sudoswap does is it brings the AMM of Uniswap into NFT. So there's no waiting required. There's always a bid at a particular price. And usually, that's a lot closer to the floor price than it would be say on OpenSea in most cases. So let's just take an example, right?

So if we look at the collections they have, all right, so we have CloneX right, which is one of the most popular PFP collections. They've all dropped a lot. I mean, at an attractive price point, I guess if, someone's bullish on the whole Nike NFT ecosystem, but, personally, I've found that whenever I spend more than let's say one or two ETH on something on the secondary market, I usually end up buying the top and it doesn't work out, profit wise.

So unless it's something that you really want and wanna hold and, you know, make it your, go-to PFP or something, buying secondary is like a really, really risky game. Or at least I found it to be that way. Most of my major profits have come from either minting early, either minting obviously or being really early.

So let's say I just missed the mint and was able to grab something off the floor. Let's say, in the 0.1, 0.2 range, and then that runs to one, two ETH, yeah, those kinds of trades have been the most profitable for me. I mean, of course, there are people who flip these things. Like they buy rares for 20 and flip it for a hundred and stuff like that. That's of course another way to go, but it hasn't worked out for me personally.

All right. So if we compare this to OpenSea. So let's see.

We have the floor price of seven, whereas here it is 6.64, right? And there are a bunch of them for sale. So on the buy side, you're gonna save money. If you buy stuff that's listed on Sudoswap. Let's see what's the best offer here. When OpenSea shows you this best offer, this is the collection offer, that they finally rolled out after months, months, and months after, LooksRare did it. And it's a really helpful feature because if you just want a bid under the floor on something you don't care which particular NFT you get. It's amazing. Otherwise, you'd have to go to the floor-listed stuff and then put offers on each of them individually. That's what we had to do before but with the addition of collection offers, it's getting a lot easier to do that.

I'm just waiting for aggregators, like Gem, to also start having collection offers because I generally just use Gem these days because it pulls listings from all the exchanges. So that gives you the most variety when it comes to picking and maybe even the best price in some cases.

But yeah. Anyway, the best offer here is 6.3 ETH. This means that any Clonex can be sold to this offer for this price 6.3 and on Sudoswap, what's the offer? 6.24, so pretty comparable.

But since there are no royalties on Sudoswap you'd definitely come out ahead selling it here to the offer. If you're just looking for the floor price, or rather, collection offer. So that's a huge selling point for Sudo and also a big source of debate, going on right now in the NFT community, because, I mean, is cutting out the creators’ royalties, really the right move or not?

What do you guys think?

anon: I was going to ask you these questions because I believe you trade a lot of NFTs. Do you care about the royalties if you wanna make a profit?

yyctrader: Personally, for me? No. But then, it depends on the collection too. Like if I'm trading something, if it's gonna be a flip, then I don't care because I want to maximize my profit. But if it's a collection, let's say where, you know, I'm minting something because I want to support the artist, then it's a different story. Because again, that's stuff that I want to collect and hold, but yeah, from a trading standpoint. Yeah, obviously I would prefer not to pay the royalties because, I mean, it was okay when most collections used to be two and a half or 5% was like a lot, but now you see collections with seven and a half, 10%, 12 and a half percent, which is ridiculous.

anon: But what’s the percentage of let's say collections that you feel emotionally connected to and where you care about the royalty fee compared to the ones that you just flip? or 50/50?

yyctrader: Probably 90/10.

anon: I guess so I guess the math for the majority's gonna be like that.

yyctrader: Yeah. I mean, again, it depends, right? Like I would say most of the DeFi crowd who just got into NFTs for the money would be like a hundred percent, like, forget the royalties. We just want to, you know, flip these things.

But from the NFT side of things where people, you know, their first introduction was into NFTs and they joined the space because maybe they followed an artist or someone introduced them to the space. I mean, it could be different, but honestly, for most people, I think they would say, you know what, give me the money.

anon: I guess

Vulcan: I think that it's good to have the option. Like, it's gonna be nice for people to have the option, but I think that you're really gonna wanna support teams, cuz if a team's not getting the royalties, then they might have limited funding for future growth. And if they're promising big things like metaverse games and all these kinds of things, they definitely need funding to come to life. So if you, you wanna be careful not to cripple the team. I think like the fact that you can get around paying royalties. Now if enough people do that, I could see that damaging the long-term prospects of some projects. So I think it's important to recognize like, I don't think a PFP project with no real roadmap really needs 7% royalties or anything like that. But if a team's trying to grow and, and build like a product, then it might be more important to fund that.

yyctrader: Oh, absolutely. I think I agree with that.

anon: I was just gonna say, I completely agree with that. I think, you know, the NFTs are here to support the artists and if we're, if we're going around that, I mean, it definitely converts the space.

yyctrader: Yeah. I think there's also a distinction between how the project minted, right? Like there are a lot of projects that minted at extremely ridiculous prices in the bull market. Like 0.3 0.5 ETH, one ETH two ETH. So those guys have loaded up the treasury and are well funded. So I have no issue selling those or trading those without paying the royalties because you know, it's fine.

But for like projects, which let's say started out with a free mint and are completely dependent on royalties. I would be more inclined to say, okay, you know what, it's fine. I'm gonna trade this on LooksRare or x2y2 or something instead.

Vulcan: Yeah, exactly. I think the rise of the free mint meta kind of changed the royalties too. We started seeing higher royalties after Goblin Town, for example, I think they have pretty high royalties there. Maybe even teams should move towards not relying on the royalties, but even if having a public address where people are encouraged to kind of help pitch in if it's needed, if they're not raising anything for mint and that kind of stuff, then maybe we'll look at different ways of funding these projects.

yyctrader: Yeah. I mean, I think having the option is nice. It's something new and you know, it'll be interesting to see how the space adapts to it like right now, if you see like on socials and stuff, it's mainly traders who are saying “yes, it's good” and NFT creators or people whose bags are being negatively affected saying “no, no, how can you do this?”. It's primarily like the NFT influencers who are like, “hell no, like how can you do this? you're completely ruining the space.”

Vulcan: I think, everything was bound to move fully on-chain. Like anyway if the royalties aren't enforceable on-chain, then someone was gonna work around it. So there, there definitely needs to be some sort of further developments that can't just rely on like centralized services.

anon: I just gonna say. Some communities they'll blacklist a person that I know of on a future whitelist. If they set the commission to zero, cause like in another chain I use to like you could set the commission rate. So if they see some wallet putting it at zero or less than 5%, they just block the person from the next white list for like a V2 version that they have, or for some other release that they have. So the community takes their revenge out on the person for doing that.

yyctrader: That's pretty cool.

vulcan: Yeah. I think we saw something similar with The Wizards mint. They just burned people's wizards that were listed at floor price or something like that. Like this kind of funny, but also kind of sucks as well.

yyctrader: Oh yeah. That was awesome. That was great to see. I mean, not so much if you held one of those and you were trying to sell it. And that's interesting that you're saying communities are blacklisting, but so if we take that to the next level and think of you know, how that could evolve, you could potentially have projects sharing this data, right? There could be like a database of freeloaders, let's call them, and NFT projects could just kind of keep adding addresses to it and maybe it would be like informally shared and those addresses would continue to be blacklisted.

anon: That's a good idea. It's like an NFT FATCA list, you know like you just shared.

anon 2: Yes, it doesn't work when you just make up an address.

yyctrader: We have ours too. We could add all the Fed people and, you know, Gary and his SEC people. Add them all to the list. So when they want to enter the space, we're like, no, no, you are blacklisted now.

Vulcan: I saw it on Twitter. Somebody was suggesting the use of zero-knowledge proofs for this exact use case. Like basically if you can prove that your address is not associated with some of these other addresses on the list then you should be able to interact privately and, and freely. So it's kind of a cool use case that could come from it.

yyctrader: That sounds really interesting.

All right. So, oh, we're like 40, almost 45 minutes in, and I havn't even started the tutorial yet, so, okay. I'm gonna just run through how you use Sudoswap.

Sudoswap Tutorial

yyctrader: So the first case is obviously just buying and selling, right? So that's pretty straightforward. So you just click on a collection that has some NFTs listed and if you have any in your wallet you'd see the zero would actually show you the number you have. So let's say you want to buy a few floor NFTs right? It's pretty simple. Just click on the ones you want. You get this, checkout screen and oh, what happened? So maybe the prices have changed.

anon: Someone just swept them.

yyctrader: Someone did. Right. All right. So let's try,

anon: I think so.

yyctrader: So if we would take these. Hmm. Or maybe these guys pulled liquidity and we can't see it yet. All right. Let's just look at these since we know these things are trading quickly. All right. So let's say we wanna buy some of these. Get rid of those. Why did they keep coming back? All right. There we go.

That's pretty much it, it's not too much in gas too. It's comparable to buying something on OpenSea or Gem or something. What's gas right now, like 22, 24? So yeah, 12 bucks for two NFTs is not too bad, so yeah, that's, that's how you would do it to buy. And similarly, if you had any of these to sell you'd be able to sell it at this price, 0.439, instantly. And that's it. Your swap is done so you don't have to list it or wait, or do any of that. And now when it comes to actually using the AMM, it's quite straightforward.

When you click on create pool, you get these three options.

One is if you want to set a limit, if you want to buy some NFTs of some collection, this is the option you'd pick. So you'll say I want to deposit ETH, so right now it's just ETH that's supported, but I'm sure they'll add more tokens as things go on. Probably APE would be next? And then you need to select the NFT that you want to buy. So let's say we want… but the search doesn't seem to be working.

Let's pick, let's find our ETH movie NFT, right? So we need to get to the details, get the contract, copy it, and go back to Sudo. So this search is pretty much similar to Uniswap. When we want to trade a random coin, we go find the address, paste it into the Uni token explorer, and it finds the token for you to add. And that's it.

So you want to deposit ETH and receive Infinite NFT in the next step. So now this is the pricing screen where you can set all the parameters of the curve. Right? So the floor price is…Oh, we already have a pool here. I had no idea. We do. Just one listed, but there is one. All right. That's nice to see.

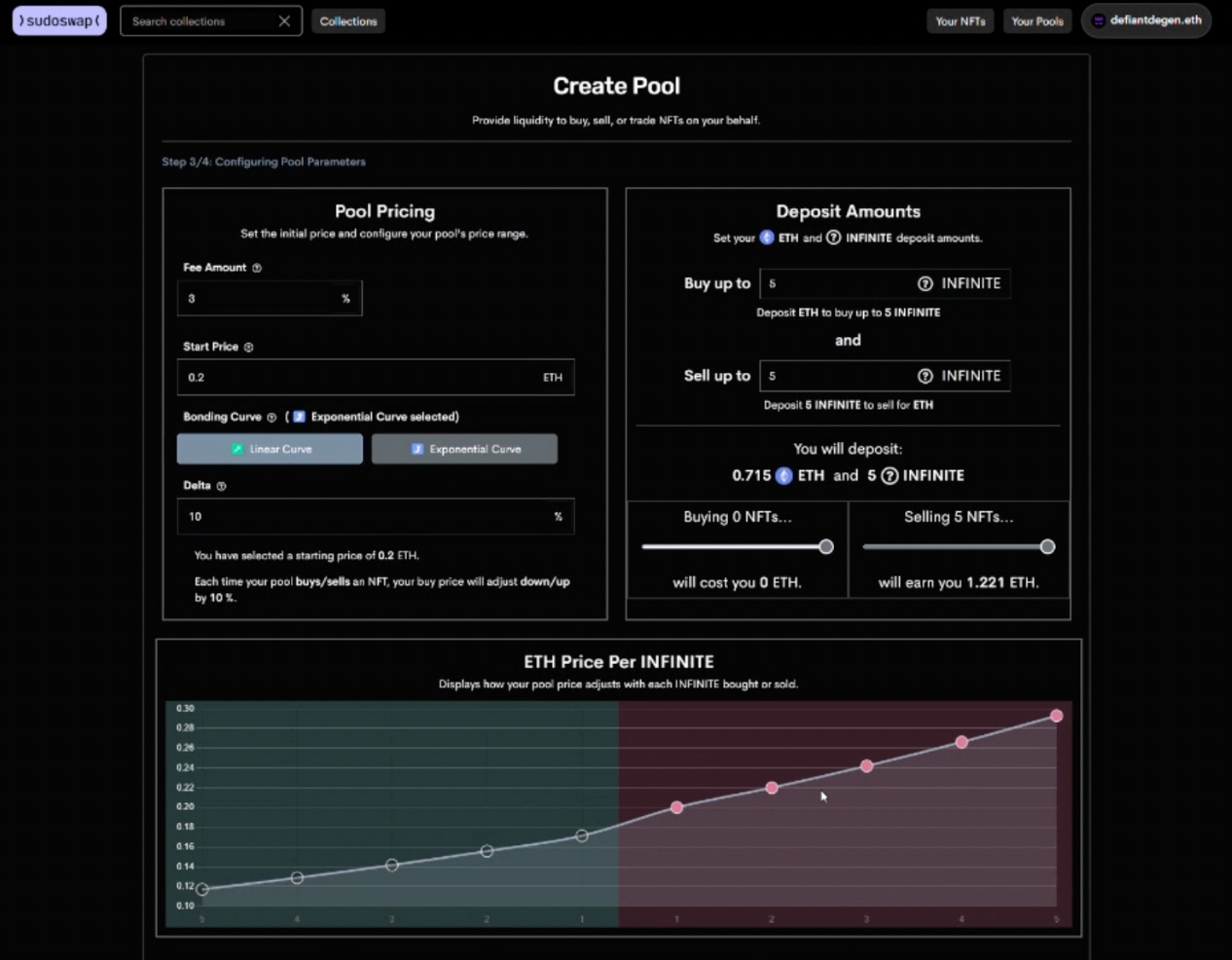

All right. So if we're creating the new pool, we go here to the next step. So now it depends on how many NFTs you wanna sell. If it's just a single one, then you would just set your price. Let's say it is 0.2 ETH and you don't need to touch any of these buttons, but if you're, let's say you're selling five NFTs, right?

So then you have two choices. The linear curve lets you increase your price by a fixed amount of ETH so let's say if we put 0.05. What's going on here? Oh, we are creating this pool to buy. That's why I was wondering why this curve looks this way. All right. So your first buy would happen, let's say you're looking to buy two, two NFTs. Your first buy would happen at 0.2 and then you can set the delta. So your second one would look to buy at 0.15. So this is the linear curve that you can use another option is to use the exponential curve, which is a percentage. So let's say you started bidding at 0.2 and you want to set 10%. So in this case, you can see, you would buy, let's make it five. So it's easier to see. So you can see the price changes by 10% each time.

Vulcan: It's almost like dollar cost averaging?

yyctrader: Exactly. So this is, it's kind of like Uniswap V3 if you guys remember, we covered DCA using V3 single-sided pools. So this is quite similar to that when you're doing the single-sided pool for buying or selling. So you set your starting price and the rate of change of your options. So you, off the orders as they go down. So yeah, exactly what you said, you're DCAing into your NFTs.

So let’s say you're happy with this and you want to buy five of these NFTs. You go to the next step and yeah. It would give you your confirmation. So you're depositing 0.8 ETH to buy up to five tokens. And this is the total, assuming that all your orders get filled by 10% each time. Then you hit create pool and it'll be sending your ETH to Sudoswap. And it's pretty cheap too, right? Just seven bucks to create your pool and have everything set and then that's all you need to do because there's no more action you need to take because your pool is there. People just need to fill your bids, essentially. So as people sell into your pool your ETH will be swapped for the NFTs.

This is how you limit orders for buying. And now let's have a look at selling. So we did this one. Now we look at the second option where we deposit just NFTs and receive ETH. The pricing screen is pretty much the same, except the curve is inverted because you're selling. So if you're selling five NFTs at a starting price of 0.2 and you set an exponential delta of 10%, there you go. So it would be 0.2, 0.22, and then 0.242, etc. So selling your five NFTs, you would earn 1.22 ETH and you can simulate how much you're gonna get and everything. I mean, it's quite intuitive and straightforward, honestly, and in the same way you can, also pick a linear curve. So let's say you set it at 0.05, in that case, obviously, you'd earn more because it's a fixed increment each time, which is more than 10%.

So these three cases, in which case, okay… First, instant buying and selling that's right on the main screen and then limiting orders for buying and selling is quite straightforward too. Now, where it gets a little bit more complicated is when you want to do both to earn fees. So let's try one of those. Let's just walk through the tutorial here. So in this case, we put in ETH and Infinite NFTs. So here we go. So now this is as an LP, you get to set your pool pricing. So it's totally customizable. So let's say we can set, we don't need to be greedy, so we can set say a 3% fee. One thing to note is that Sudoswap does charge a 0.5% fee of their own. So that will be added to this fee amount. So if you set 3%, the actual trading fee would be three and a half. All right.

So this is pretty similar to creating a pool on Uniswap where you set your starting price and the range where you want to buy and sell your NFTs. So let's say you wanna buy and sell up to five, right? So we start in the middle right here. So let's say we wanna start at clear point 2 ETH right with the delta of we can go for the same 10%. So yeah, you can see, this looks pretty much like your traditional, LP pair. So what would happen here is you'd start off in the middle of the curve and let's say people start buying up your NFTs.

So you'd start with the 0.7 ETH and five infinite tokens right here. Let's say there's demand for it. People start buying. So one by one, your NFTs would be swapped for more ETH. So at this point, when you are, when all your NFTs have been sold, you would have, 1.22, if in addition to the 0.71, you deposited since, I mean there were no sales into your pool and it just went up.

And in addition, you'd also earn 3% of each of those five trades that happen for your pool to be emptied. Now, again, this doesn't mean that you are out of the game, so to speak because if the price starts dropping again, people will start swapping back along this curve. So people will put in, let's say one NFT. So your next one will be priced at 0.266. So they'll start selling NFTs back to you along the curve, right? And if the price keeps dropping you'd then have, at this point, you'd be back to five NFTs and your original ETH but as the price keeps dropping below, your ETH would be used to buy up the NFTs as they go down.

As long as, the price stays in this range and there are trades happening in your pool, you'll be earning fees, 3% as you've said. So this is another great way to kind of monetize some of your dead NFTs as long as you don't mind them being sold off or, you know, being swapped for different NFTs because that's also a potential possibility, right?

Cause let's say you deposit five floor NFTs of some collection along with an ETH right? And then you have price fluctuations, people trade in and out. So it's possible that the NFTs that you are left with even if it comes back to the same price might be different due to trades that happen in the pool. So that's something to be aware of. So when you get to the next stage here, you need to actually select your NFTs. Now, this wallet doesn't actually have any NFTs. So I can't select any, but if you're creating a pool, you'd have the NFTs in the wallet. So you'd select those particular NFTs, approve them for trading, and then create the pool, which would be a couple of transactions. And then you're done.

I'll show you guys what a couple of pools look like, because I've been experimenting with this a bit.

So, all right. So these are some worthless junk NFTs that I just wanted out of my wallet. So I thought I'd just put them into a pool and just leave them there. So I put these raccoons into the pool willing to sell them for like peanuts, essentially, just to get rid of them. Obviously, no buyers yet, because this is a really dead collection. So, but who knows? And the same with these. What are these? I think this was marketed very heavily as you know, honestly, I can't even remember. It was so far back, maybe a year ago. This is how your pool would look like. I dumped 20 NFTs or 17 NFTs into this pool along this curve. So if I was to sell all of them, I would get half an ETH trading along this curve. So that's how Sudoswap works.

Any questions?

anon: Ah, yes. I was wondering if impermanent loss is not an issue in Sudoswap.

yyctrader: it is, but, again, like I was showing you on the chart, right? When you create a pool, which has both NFTs and ETH right. I'm just repopulating these so we can see the curve.

So it depends on what you're trying to accomplish. Right? So, if you, if you just wanna earn fees and retain your NFTs, this might not be the right play because let's say the NFTs take off. At this point, you would've at this point here, all your NFTs would be gone and you'd just, just be left with the ETH and let's say price keeps rising beyond 0.9. You'd never get your NFTs back. And you're essentially out of the position and you won't be earning any fees because like the price has moved out of your range. So, yeah, there is, impermanent loss in terms of NFTs is a bit of a nebulous concept to grasp, because it's so illiquid, right? So it's not like you have continuous pricing data for them, but yeah, the concept is the same. So you might be better off just holding your NFTs.

Let's say, okay. In this case for example, right here, we're assuming that the current floor is 0.5e and you have five NFTs and you think, okay, I'm gonna put them in this pool and they're gonna be in this graduated price range and you know, I'm gonna earn fees and everything, but let's say, I don't know, Gmoney tweets about this collection tomorrow and the floor jumps to two ETH. In this case, you would've sold all your NFTs up to 0.9, right? So you'd obviously be better off if you had just held the NFTs by themselves because you'd have 10 ETH. So that's the impermanent loss as it applies to this particular situation.

anon: And since you mentioned, it's possible to earn on the trading fees. In this case, I would only be able to earn the trading fees five times, right?

yyctrader: Yes. That's assuming that the price keeps going up now let's say the price goes up and these four are sold and then the price starts dropping. So it starts coming back. As long as the price keeps oscillating within this range. So ideally to LP, it's the same concept as in DeFi, right? You want tokens that are kind of stable in relation to each other, which means that you want the collection with a relatively stable floor price, and you need NFTs that are floor NFTs. You don't wanna be putting rare ones in these pools because you'd get no premium whatsoever, but yeah, there are a lot of options and collections like that, which have kind of stayed at the relatively stable floor for a while. So that would be the ones that you would target for this particular purpose.

Overall, I think we'll see more liquidity coming in as more people you know, list and add collections. I mean, generally, as trading activity picks up. I think Sudoswap crossed a thousand daily unique users for the first time yesterday. So it's tiny, it's brand new.

I'm creating these pools from my various wallets, just in the hopes of an airdrop. And if you do it on the weekends, it costs you less than $10 in gas to do all the transactions, which is to approve the NFT collection, create the pool and you're done.

anon: And if I don't wanna risk any of mine NFTs, can I provide single-sided or ETH for instance?

yyctrader: You can, but then if the price drops you'd end up buying more of those NFTs.

anon: Okay.

yyctrader: It's not like a DeFi protocol where you supply ETH and get fees. You are providing liquidity, you could end up with the worst performing token of the pair, just like, in DeFi yeah.

anon: ok. Thank you

Vulcan: You can make a pool with just some free mints or something, some stuff that kind of what you did YYC. Just some stuff that you don't want in your wallet, but just for that airdrop potential.

yyctrader: Yeah. Exactly. Or passes, like you said, right? Like if all the NFTs are identical, then it doesn't really matter. So if it's a pre-mint pass or one of those webaverse, these things, these passes they're all the same. Right? So until they're revealed, I don't even know if these things actually reveal or they're gonna be just passes. But if you have collections like these, this is the perfect use for these to add liquidity, which is why you can see the spread also is quite tight in this case. So that's an ideal collection to put in.

So, as I said, in the beginning, Sudoswap is basically making NFTs well, non-fungible tokens fungible. So we're kind of coming full circle. So we went from like coins, which were liquid, but boring to JPEGs, which were super interesting, but illiquid. So now we're kind of finding the middle ground.

Benji: One question I have is like, what happens? So when, when you supply NFT on Sudoswap right? So if you get airdrop based on holding that NFT, do you still get airdrop? Are you eligible for airdrop or you wouldn't be?

yyctrader: No, as soon as the NFTs leave your wallet and they sit in the smart contract of your pool, like on Sudoswap each pool is its own contract owned by the creator. So let's say when I created those random pools, I created two smart contracts in which those NFTs are now placed. So on my OpenSea, I can see that the NFTs were transferred out. So yeah, when it comes to airdrops based on holdings, it is a concern.

Benji: Okay. Got it.

Vulcan: Technically could like a project that include those smart contract addresses and still, they would obviously have to do it separately from the wallets, but maybe if it's possible, I don't know. They could include those smart contracts, like people providing liquidity on Sudoswap as well.

yyctrader: I'm sure someone will come up with a way to do that. Or Sudoswap themselves might come up with, I don't know, like an API or something that lets you, because they need to consolidate all the pools to display it on their UI. That's how you get to see everything that's listed. So I'm sure there must be some way to kind of scrape out the addresses that are providing liquidity for a particular collection and you know, make that data available because yeah, otherwise this is like a huge pain point, you know... Benji, thank you so much because I actually didn't even think of this. So I will be kind of more wary about which NFTs I deposit in here.

anon: Yeah. I have a couple of Infinite Machine too, so if I supply it, then I was thinking to myself, you know, would I would probably not be eligible for airdrops.

yyctrader: Yeah. Don't put your Infinite NFTs in here. Otherwise, you won't get the fortnightly drops.

So that's Sudoswap pretty much in a nutshell. Any questions on Sudoswap before we move on to the second tutorial because we've already crossed an hour? I mean, I love these calls so I could keep chatting all day, but, you know, gotta get back to work.

Hermes Tutorial

yyctrader: All right. So. The second tutorial we did this week was, Hermes Protocol on Metis. How do you pronounce the chain?

Vulcan: I call it Metis, but probably, I guess we're Canadian cause yeah, it’s like a Native American tribe or something. That's what I associated with.

yyctrader: Yeah. Same because, and I assume because Vitalik is Canadian, the connection and all that and his mom. This is a pretty straightforward yield farm that we've covered this week.

What is this protocol? It's quite a complicated AMM. Let's just put it that way. It combines elements of Uniswap V3 with concentrated liquidity. It combines some bits from Curves, stable swap for its stable pools, and it does cross-chain liquidity, which means that these pools can be accessed from multiple chains.

So rather than having liquidity on every chain for XYZ token, like these, common pools can be accessed from all the chains that these guys work on. So if you guys want to read more about it's extremely detailed. So we can go down and so this is what I was saying. It's a unified liquidity pool, so it's one big pool and the users from different chains can use it. They have a lot of stuff that I didn't really have time to go through completely. It’s very well explained. This is the usual XYK and V2, balancer curve, all the protocols essentially, and this is what they do, which is like they're trying to find a more efficient formula, I guess, for the most efficient way to provide liquidity.

So, yeah, there's a lot of stuff to dive into when it comes to this protocol. So I'm gonna drop this link in the chat so you guys can read all about it in that Medium post. But now for the time being the pool that we covered this week was this one, which is a stable swap pool with the USDC and Mai. Mai is the over-collateralized Stablecoin issued by Qi DAO which is Qi. We had actually covered this a few weeks ago, but on a different AMM, it might have been Velodrome on Optimism.

Coming back to the pool, currently yielding 20% APR and that's quite good for a Stablecoin pool. I mean, that's anchor level yields. There are a bunch of options if you don't want to touch Mai there's also DAI USDC at 18%.

What is this? DAI USDC at 3%? Nah, not really. And yeah, the rest of them are not really that effective but these two polls look pretty decent.

Vulcan: Where is that? Are there incentives running right now? Like where's the yield coming from? Is 20% sustainable in your opinion?

yyctrader: This is a plain vanilla yield farm giving you governance tokens. So you get Hermes tokens.

Vulcan: Oh, I see. I see.

yyctrader: So this is one of them, it's a farm and dump kind of yield.

Vulcan: Yeah. Yeah. So there's still emissions going on though?

yyctrader: Well, clearly. You can see the left, right? I mean, there are a lot of interesting pools and most of these farm tokens have all been beaten down almost to zero. With the bear market. We might see a bounce too, because this, as I said, this AMM is not just a plain Uniswap fork. It's got quite a lot of nuance to it. And it seems really interesting what they're trying to do.

The question is, is the ecosystem gonna survive? Cause that's the main question, right? Like with all these side chains and alts and everything, right now we've been seeing the layer 2s kind of gaining some momentum. Optimism, Arbitrum have kind of started to attract TVL as they start, in the case of Optimism, at least they've started incentive programs, right?

Optimism is one of the biggest in terms of TVL and I think it was at five, 600 million when we covered it last week. So yeah, coming back to this farm, it's a simple, V1 yield farm as far as it concerns us for the tutorial. So we can add, again, that this is not a constant AMM, right? So before depositing liquidity, you need to check how much of each token you need, because it's not 50-50. So as you can see here, yeah, we need, for every thousand USDC, we need to have 1300 Mai as well. So the process to get into these is pretty simple. In this case, Synapse is the cheapest bridge.

Yeah, so bridge USDC to Metis and you've got, It's gonna give you a little bit of gas so you can get started with your first swap at least, and there's a $2 transaction fee and it's the same process as we usually follow. So we approve the token and then bridge it. And then once it's received, we'd need to add liquidity here. And of course, since you won't have, if you're bridging just USDC you'd need to swap for the right proportion of the two assets and then add them to the pool. And once you, once you add your liquidity, you'll get your LP tokens and in this case, let’s switch.

All right. So once you have your LP tokens of whichever pool it is that you choose, you can click this button and will essentially switch to stake. Then you can stake your tokens and then you start getting your rewards. This is a pretty decent yield on ETH USDC as well, 38%. But again, it depends on your view of the market.

I mean, I think at this point is quite a decent play I'd say, because if we're gonna range around 2000 for a few months it's a good opportunity to capture some yield, but it's a lot better to LP ETH at 2000 than it was at 1100 and 1200 at which point you would have been completely killed by impermanent loss and missed a good chunk of this rally that we've seen.

Now in this kind of neutral posture that the market's in, or at least I'm in, I would consider aping in these pools as well, because it's basically taking some risk off the table because you're earning some fees since your position is no longer completely ETH it's less sensitive to market movements, so, yep, that's how this protocol works.

Any questions about this?

Vulcan: It looks cool. I'm gonna take a look at it.

yyctrader: Yeah. I mean, go through this Medium post. It's long, it's detailed. It tells you everything you need to know about what these guys are trying to do. I started reading this morning and I was like, whoa, these guys are actually doing something different from everyone else trying to adapt the LP model itself.

Most DEXs that you see are either forks of Uni or, if they're doing stable swap, they take like the curve invariant and then just kind of tack on a couple of things to it. Maybe play with the parameters a bit, but these guys are actually trying to do something new and combine cross-chain as well. But, again, at the same time, we should always be aware that, you know, bridges haven't been the safest places to be lately. I don't think this particular protocol should have a bridge risk because they use these combined pools. They can be traded into from any chain, but there's no like actual bridging of assets off-chain. So, yeah. It's interesting. I'm gonna go through this in more detail when I have some more time.

Vulcan: Cool. Sounds interesting. I've never bridged to Metis or anything, so maybe it might be time.

yyctrader: Yeah, I got into one during the Om fork season when we had all the rebates points going on. So there was a couple on Meti that I got into, but, yeah, they all went to zero really quickly more even, and that's saying something for those because at least they used to last like a few days… They were like a week long. You could get some, these things collapsed in two days. So it was like, I think toward the end of a rebate season.

Vulcan: That got pretty predatorial very quickly with the three, three, once people figured out the three, three mechanics. So working the other way was kind of a race to the bottom.

yyctrader: Yep, absolutely.

An update on the GMX position

yyctrader: Just to give you guys an update on the GMX position that we took, was it last week or the week before that? We went in with a thousand USDC and we're up about 5% on the underlying LP. And we've got about 0.07% of rewards as well. So not bad. I think the yield when we placed the LP was somewhere in the 27, 28% range. So I think, yeah, we're keeping up with that. So we should be making like 2% a month.

Vulcan: I know GMX has been, been like outperforming, is it outperforming the, just holding the token or slightly underperforming that?

yyctrader: Well, GLP is a mix of assets, right? It's like Bitcoin, ETH, and Stablecoins. So it's more, it has no GMX tokens in it, actually speaking, but GMX has been going up. Like it was, it hit 15 bucks at the lows and it hit 45 last week. So it's been doing quite well. It's part of this whole real yield. I think that's the new narrative for DeFi and we're actually gonna be putting out a story on that either today or tomorrow, Owen's working on it. I think it's healthy for the ecosystem for people to be moving away from the inflationary Ponzi to more sustainable, or we hope sustainable based on actual on-chain user activity. But again, it's dependent on user activity. So the users disappear or we see like a protracted bear market. You'd have the same kind of effect of reducing revenue on these protocols too. And they would be more sensitive in my opinion, to drop off an activity because they don't have inflationary tokens to kind of hand out to keep people happy while the market is bad.

Vulcan: Yeah. Yeah. Makes sense.

yyctrader: Yeah, but from a user perspective, it's great because you get paid your yield in ETH or Stablecoins, right? So you don't have this additional step of needing to claim and dump your tokens and, you know, watch the price of that token and make sure you kind of maximize by trying to time the market and sell at a good price.

Vulcan: Yeah. That's a cool feature.

yyctrader: All right. I think that pretty much wraps it up for this week.

The DeFi Alpha Call takes place every Monday at 2pm ET in Discord.

If you've made it this far, many thanks! We really do appreciate people reading The Defiant.

By clicking the button below, you can start a free trial, right now, 100% risk-free. Get the 5-minute newsletter keeping 73K+ crypto innovators in the loop.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. We curate, digest, and analyze all the major developments in DeFi, so that you can stay informed and knowledgeable about the most cutting-edge and fastest-changing corner of crypto and finance.

Free signups to the newsletter get:

Daily news briefings

Sunday Weekly recap

General chat on The Defiant’s Discord server

Premium Subscribers get:

Full transcript of exclusive podcast interviews

DeFi Alpha weekly newsletter on how to put your money to work in DeFi by yyctrader and DeFi Dad

Inbox Dump edition of The Defiant newsletter every Saturday with all the PR that didn’t make it to our content channels

Exclusive community calls with the team

Subscriber-only chats on The Defiant Discord server

Full access to The Defiant’s content archive

Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).