Crypto Whales on Twitter All Day Can Now Trade With Actual Tweets

Also, ETH locked in DeFi is rebounding, Ledger data breach shows it's tough to stay safe in crypto, and sentiment on Ripple is shifting after SEC news.

Hello Defiers! Here’s what we’re covering today,

Crypto markets recap; bitcoin and ether correct on Monday, while ETH locked in DeFi rebounds

Tweets are being sold as NFTs

Ledger hack highlights the delicate balancing act of crypto storage

Crypto sentiment on Ripple shifts after news of looming SEC action

** BTW, a heads up that it’s a weird week for The Defiant: The podcast will be published tomorrow and we’ll be taking Dec. 25 off. **

📺 Watch the latest video on The Defiant’s YouTube Channel & Subscribe!

🎙Listen to this week’s podcast episode with Bloq’s Jeff Garzik here:

🎁 Merry DeFi! Get The Defiant’s $100 annual subscription for $80. Offer expires Dec. 31s. Get full access to Defiant content and community as a gift for yourself or for others.🎄

🙌 Together with Zerion, a simple interface to access and use decentralized finance, Neutrino, an algorithmic price-stable protocol that enables the creation of stablecoins tied to real-world assets, and DeversiFi's Nectar Beehive V1, which allows traders to provide liquidity & earn Nectar ($NEC) tokens.

Bitcoin Corrects as ETH Locked in DeFi Rebounds

After a week of record volumes for 2020, bitcoin’s price dropped on decreasing trading volumes. Meanwhile, assets locked in DeFi are recovering since the November dip - said to be due to the Ethereum 2.0 network upgrade.

Bitcoin is trading around $22,770 (Bitfinex) at the time of writing, reclaiming some of the losses from the 10% slump to as low as $21,900 on Monday.

The flagship cryptocurrency has bounced from the 12-hour 21 exponential moving average as it attempts to find its feet for market technicians to analyse further.

BTC/USD Corrects After All-Time-High

After a strong run to $24,000 on Monday, the longest-standing crypto dropped to as low as $21,886 (Biftinex) on Monday amid lower-than-average trading volumes on various exchanges, per data from Coinalyze.

The slump was quickly cut-short though when buyers stepped in at a historically significant technical indicator - the 12-hour 20-exponential moving average (EMA). The white line above is a lagging indicator and averages-out price-action within a given time-frame.

As price fell, order books grew thinner, which is normal since traders are more inclined to sit on the sidelines during Christmas week. In fact, combined volumes fell from $79.91 billion on Dec. 17 to $48.1 billion on the 21st - the day of the sell-off.

ETH Locked in DeFi Recovers from November Lows

At the same time, the world’s second-largest cryptocurrency by market capitalization, ether (ETH) also slipped on Monday trading, correcting 7% in 24 hours.

However, the mild correction didn’t deter Ethereum’s DeFi sector from its recovery. The amount of ether ‘locked’ in decentralized finance for yield continued to climb to 7.2M, the highest in almost two weeks.

TVL hit a high of 9.4M on Oct. 22, according to DeFi Pulse. Since then, the amount of locked ether fell to as low as 6.7M before rebounding in December.

.

ETH/USD Falls Short of Expectations; Holds Above $600

Ethereum is trading at just over $626 at the time of writing as the cryptocurrency licks its wounds and relatively modest performance in comparison to bitcoin.

The runner’s up cryptocurrency platform took an 8.9% drawdown on Monday, more or less mirroring bitcoin’s price-action as it holds above the 20-daily exponential moving average.

The question on every Etherean’s mind is not ‘whether’ Ethereum will perform, but ‘when’.

The ball is in your court, Ethereans.

Tweets Are For Sale in a Sign the Future Will be Tokenized

Ethereum-based social network Cent has caught Twitter by storm through its new Valuables feature, allowing users to buy Tweets, minted as scarce, digital assets.

“The creator of this tweet decides whether to turn their work into a limited edition, one-of-one NFT,” states the website. “Prior to them deciding, anyone can make an offer for them to consider on this page. Think of the tweet like it's a baseball card, and its creator is giving it to you with their autograph.”

Over $40,000 of offers have been made as of 48 hours ago, according to NFT podcast host who goes by the Twitter handle @niftytime.

Tradable tweets launched as the space for non-fungible tokens heats up, with $35M in digital art recently sold over a weekend, while the amount of NFTs sold climbs to the highest since CryptoKitties days, according to NonFungible, which tracks the data. It’s another sign users see value in owning provably scarce and unique digital assets.

Elon Musk Tweets

Bidders are now hoping Cent will catch the eye of top accounts like Elon Musk, with prominent NFT collector illestrator sitting atop the leaderboard with a 12ETH bid to buy a tweet about Doge.

Screenshots Aren’t Ownership

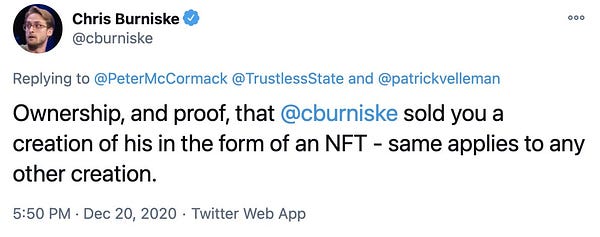

The trend has led some to question what makes digital assets valuable, with prominent Bitcoin content creator Peter McCormack challenging the notion of provenance by claiming ‘he now owns this NFT’ by taking a screenshot of a Tweet from crypto investor Chris Burninske.

Other web3 thought leaders like Grammy-winning musician RAC are fully leaning into the trend, posting a tweet with the attachment of an unreleased track that he said won’t be uploaded anywhere else. The tweet currently has a high offer of over $400. Other use-cases emerging is for creators to airdrop other digital assets to buyers of their tweets, according to @niftytime.

Even accounts outside of crypto showed interest in the feature, with web3 power users offering up offers to buy tweets within seconds.

The trend is one in the growing wave of social tools in crypto, showing that Ethereum’s vibrant ecosystem is now expanding into use-cases that are catching mainstream eyes.

Ledger Data Hack Shows Crypto Storage is a Catch 22

Crypto hardware wallet provider Ledger had thousands of its users’ sensitive information leaked to the public this weekend.

The data breach that occurred in June was brought to light after a public hacker shared the stolen data on leaking site Raidforum, after months of it supposedly ‘selling for six figures’ on dark marketplaces. The proprietary documents contained physical addresses, emails and phone numbers of 270k+ Ledger customers.

Apologies

While personal information was leaked, Ledger said “payment information, credentials (passwords), or crypto funds were not impacted. This data breach has no link nor impact on our hardware wallets and the Ledger Live application. Your crypto assets are safe and are not in peril.”

Ledger is now scrambling to keep users’ trust by releasing a suit of apologies, including in most notably an email to those affected and a series of Tweets.

The hack highlights crypto users’ are in a catch-22 type of situation where decentralized wallets which don’t require disclosing any information, are easier to breach as they are online. Meanwhile, hardware wallets like Ledger provide “cold” or offline storage, but because it’s a physical object that needs to be delivered, a centralized company will store client’s information.

Not a Laughing Matter

In typical crypto twitter fashion, many accounts are now memeing the leak, posting all sorts of plays on crypto security.

But for those getting emails with threats of having their house broken into if they don’t send over money, it’s no laughing matter. Ledger CEO Paul Gauthier said in an interview with Decrypt those threats are “just an online scam to scare you with these tactics.” He added users with leaked data will not be reimbursed as that would “kill the company.”

The leak goes to show that even a company that’s focused on security can still suffer from major vulnerabilities and highlights just how crucial it is for crypto users to protect their sensitive information.

Sentiment Turning on Ripple After SEC Action

Ripple said Monday that the SEC is planning to file a lawsuit against the company on claims that it sold unregistered securities. And while the initial reaction of many crypto enthusiasts was to side with the US regulator, the tide has begun to change.

The most notabe about-face came from Messari CEO Ryan Selkis, who yesterday said “In before Ripple PR’s ‘we’re in this together’ nonesense. No. We’re not.” But today Messari’s Unqualified Opinions newsletter included an analysis on why Selkis hopes Ripple wins.

Ripple is Not the Enemy

In general, the change in sentiment from Selkis and others seen in crypto Twitter can be summarized like this: Ripple may or may not be a good digital settlement layer, but that doesn’t mean it should be regulated away.

Crypto enthusiasts are suspicious of Ripple because it’s run on a permissioned network, and token supply isn’t determined by miners or validators. Instead, 100B XRP was issued all at once, with a chunk of it held in a reserve to be sold in scheduled installments. On top of this more centralized system, there’s the “XRP Army” which is known to flood the mentions of anyone who dares criticize the token.

So at first, XRP critics felt vindicated.

Clear Path Needed

But then, it started to become clear that if there was a "bad guy" in the story, it was more likely to be regulators trying to clamp down on an emerging industry. Rather than focus on calling XRP a security, which doesn’t help anyone, regulators should provide better ways for investors to trade, hold and use digital assets.

If they don’t, investors will be forced to pay the exorbitant premiums of Grayscale’s products, while DeFi innovators go to Europe and Asia, and sketchy exchanges continue concentrating much of the trading volume.

Cryptocurrencies aren’t going anywhere. Regulators should accept that and provide clarity for teams who will keep on building, and investors who will find a way to buy them anyway.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Get The Defiant’s $100 annual subscription for $80. Offer expires Dec. 31s.

About the founder and editor: Camila Russo is the author of The Infinite Machine, the first book on the history of Ethereum, and was previously a Bloomberg News markets reporter based in New York, Madrid and Buenos Aires. She has extensively covered crypto and finance, and now is diving into DeFi, the intersection of the two.