Compound Kicks the Game Board With Plans to Launch its Own Chain

Also Warp Finance suffers flash loan attack, Coinbase files to go public, Tornado Cash announces TORN token.

Hello Defiers and happy Friday! Here’s what we’re covering today

Compound Finance releases a white paper for the launch of an independent blockchain called Compound Chain

Warp Finance loses $8M in flash loan attack

Coinbase files to go public

Tornado Cash proposes decentralized governance and TORN token

and more :)

📺 Watch the latest drop of The Defiant’s DeFi 101 Series on YouTube!

🎙Listen to this week’s podcast episode with Bloq’s Jeff Garzik here:

🎁 Merry DeFi! Get The Defiant’s $100 annual subscription for $80. Offer expires Dec. 31s. Get full access to Defiant content and community as a gift for yourself or for others.🎄

🙌 Together with Zerion, a simple interface to access and use decentralized finance, Neutrino, an algorithmic price-stable protocol that enables the creation of stablecoins tied to real-world assets, and DeversiFi's Nectar Beehive V1, which allows traders to provide liquidity & earn Nectar ($NEC) tokens.

Compound Chain Foreshadows Cross-Chain DeFi Lending

Compound Finance is entering uncharted DeFi territory with an independent blockchain called Compound Chain.

Underpinned by a native unit of account called CASH, Compound Chain is a “reimagination of the Compound Protocol” that is “proactively preparing for the rapid adoption of digital assets, both on Eth2 and central bank digital currency ledgers,” according to compound.cash. $3.7B worth of assets are being supplied on Compound today, making it the largest US-based DeFi lending protocol.

CASH Pays for Transactions

Compound Chain will allow users to lend governance-approved assets from any blockchain and borrow against them to mint CASH, according to a primer published Thursday. CASH is used to pay for all transaction fees and accrues a continuously compounding interest rate to holders.

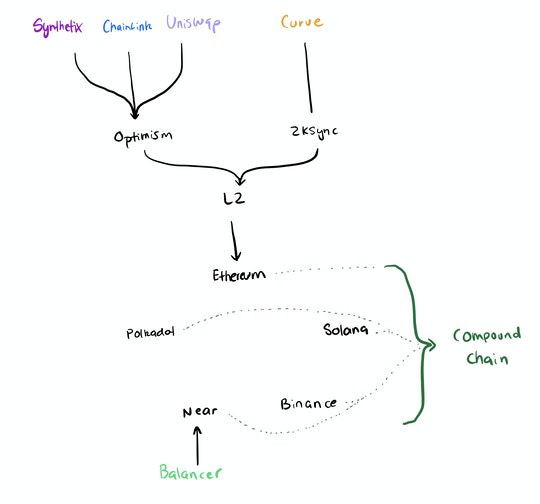

Compound Chain will be used to lock and account for balances on other chains using smart contracts called Starports. These assets are represented as balances on Compound Chain that live on their ‘peer blockchain’ (i.e. Ethereum, Tezos, etc.) meaning that protocols could reference locked collateral from any other chain using Compound as the connective tissue.

“Any balance on Compound Chain can be sent to any other address, an Ethereum address can send Compound Chain ETH to a Tezos address, or a Tezos address can send Compound Chain WBTC to Solana”.

Different from a Layer 2

This inherent structure makes it marginally different from a layer two solution, as Compound can now direct and aggregate value from many blockchains, including Ethereum and any layer two networks it supports.

Mixed Community Sentiment

The decision to become protocol agnostic has received mixed feelings from the DeFi community. Those in favor see Compound Chain as the natural extension of a growing DeFi market that will soon include chains outside of Ethereum. Critics say that Compound Chain’s consensus mechanism, which operates with governance-approved validators, would be a more centralized solution than Ethereum. Governance of Compound protocol on Ethereum, which is ruled by COMP holders, controls Compound Chain. .

This attempt at a vertical-specific chain (i.e. DeFi lending) is one of the first of its kind, and an approach that has the potential to differentiate Compound from other Ethereum lending protocols like Aave.

“We're excited to have this whitepaper out in the world.” strategy lead Calvin Liu told The Defiant “It's an early phase of a huge vision, and just the tip of the iceberg.”

As suggested, Compound Chain will be rolled out gradually over the course of the next year, with this release offering a glimpse into what’s been going on under the hood since the release of COMP. Outlined in the end of the paper, all aspects of Compound Chain will continue to be governed by the Ethereum-based COMP token.

Flash Loan Attacker Drains $8M From Warp Finance

Investors are depositing millions into new DeFi protocols launched by anonymous developers, at times only to be wiped away in a hack.

The latest to suffer that unfortunate fate is Warp Finance.

Promising to be a money market where users can borrow and lend tokens and stablecoins representing liquidity in automated market makers, Warp rapidly saw its total locked value climb to $8 million in the week after its launch.

Yet on Dec. 17, Warp became the latest victim of a flash loan exploit.

What Happened?

Around 23:00 UTC, a suspicious transaction began making the rounds after a tweet from DeFi investor "CryptoCat." The user highlighted that an address had executed a transaction that allowed them to withdraw all $7.8 million in stablecoins from Warp's lending contracts.

For this to be possible, the user should have deposited collateral valued at more than the $7.8 million they withdrew. But this was not the case: through a series of flash loans and trades, the attacker managed to trick the platform to let it withdraw all capital from Warp's stablecoin pools without depositing a single dollar of their own capital.

In total, the attacker received 1,462 ether from the transaction, valued just under $1,000,000.

The cost, $134 in transaction fees.

The main tool the attacker utilized is flash loans—decentralized loans that are valid for only one block and require no collateral to be opened. If the taker of a flash loan returns the funds they borrowed and the fee within the same transaction, they can do what they please with the funds.

In Warp's case, the attacker used capital from the flash loan to create Uniswap liquidity provider tokens, manipulate how Warp perceives the price of the LP tokens via a large trade, then use the inflated collateral to withdraw stablecoins from Warp.

While the attacker drained $7.8 million from the Warp pools, they only made approximately $950,000.

Approximately $1.05 million worth of the funds withdrawn were distributed to Uniswap and SushiSwap liquidity providers, which facilitated the trades involved in this exploit. Then, another ~$5.8 million worth of LP tokens were in Warp's lending contracts.

Peckshield, an auditing company, broke down the details of the exploit here.

The Recovery Process

Because $5.8 million worth of LP tokens was left in the contract after the attack, many were quick to ask if there was any chance of recovery.

But because the value of most user deposits was $0, no one could feasibly withdraw the LP tokens without depositing more collateral. Further, Yam co-founder Brock Elmore pointed out that the LP tokens were still ultimately owned by the attacker.

After a "war room' effort with white-hat hackers like Paradigm's "Samczsun" and Yearn.finance's "Banteg", a potential solution was identified.

Work is currently being done to extract the LP shares from the smart contract to be distributed to affected users.

Tornado Cash Proposes TORN Governance Token

Tornado Cash presented a governance proposal to incentivize use of the Ethereum-based privacy tool via a new token called TORN.

Tornado Cash allows users to deposit a fixed amount of supported assets (ETH, USDC, DAI) and “wash it” through an anonymity pool. That deposited value can be redeemed by the receiving address using a note so that the sender and the receiver can not be linked.

Anonymity Mining

With TORN, users who deposit assets to the mixer are able to participate in so-called Anonymity Mining, allowing them to accrue a balance in Anonymity Points (AP) that can be redeemed for TORN governance tokens via a new privacy-focused AMM.

In typical DeFi fashion, all those who have deposited assets on Tornado Cash before Dec. 7 stand to share 5% of the initial supply, distributed as non-transferable vouchers (vTORN) to be used in governance, redeemable 1:1 for transferable TORN tokens one year after deployment.

TORN Airdrop

The earlier a deposit was made and the greater in aggregate deposits an account performed, the larger portion of the vTORN airdrop that address earned.

The proposal adds a proxy layer on top of Tornado Cash’s immutable smart contracts, allowing for Anonymity Mining and governance to occur without altering the underlying structure of the protocol that has thrived to date.

Rather than pushing the changes live, the Tornado Cash team has left all the suggestions up to the community to deploy.

Users in Control

“We don’t control Tornado.Cash” states the blog post “It’s users do, so if the community adopts this proposal, then it will become the way forward for privacy on Ethereum.”

The source code and a convenient deploy link are now live at initiation.tornado.cash, meaning it's only a matter of time before an unsung DeFi developer comes along to do what they do best - deploy contracts without the core team’s permission.

Coinbase Files to Go Public

The rumors are confirmed: Coinbase is going public. The largest US-based cryptocurrency exchange filed a draft S-1 registration statement with the SEC, a sign it’s planning to do an initial public offering. The crypto unicorn has raised more than $500 million was valued at $8 billion on its latest round.

The public listing of Coinbase means retail investors will now be able to have exposure to one of crytpo’s most successful companies. It also means that we’ll now get regular access to its financials and other key information.

Coinbase has 35 million customers, for whom it custodies $25B of funds, according to the latest public information. Based on those numbers and on other disclosures Messari estimates the company could be valued at $28B in the offering. Anthony Pompliano in today’s newsletter said he “wouldn't be surprised” if its able to price the IPO between $20B and $30B.

Uniswap Grants Program Proposal is Up for a Vote

A proposal to fund Uniswap ecosystem development with grants from the UNI Community Treasury is being voted on via the DEX’s governance system, with 10.5M UNI in favor and 7.4k against.

The program would start with an initial cap of $750k per quarter, with a committee of 6 members —1 lead and 5 reviewers — managing the grants. UNI holders who were self delegated or delegated to another address before block 11473815 are eligible for voting, which can be done until Dec. 24. If this proposal is successfully approved, UGP will start accepting applications on a rolling basis beginning at the start of 2021.

Reuben Bramanathan Joins IDEO CoLab Ventures

IDEO today announced that early Coinbase employee Reuben Bramanathan is joining IDEO CoLab Ventures as an investor, after collaborating with the design firm on fair launch capital and shared investments.

“We believe ‘Crypto Social’ is the next area where crypto will take off, and we’re excited for Reuben to help lead our team’s thinking, work, and investments there in addition to DeFi, Web 3.0, and more,” IDEO wrote in a blog post.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Get The Defiant’s $100 annual subscription for $80. Offer expires Dec. 31s.

About the founder and editor: Camila Russo is the author of The Infinite Machine, the first book on the history of Ethereum, and was previously a Bloomberg News markets reporter based in New York, Madrid and Buenos Aires. She has extensively covered crypto and finance, and now is diving into DeFi, the intersection of the two.