🥶 Compound ETH Market Frozen Due to Upgrade Bug

Hello Defiers! Here’s what we’re covering today:

News

👀 Defiant Premium Story for Paid Subscribers (📜Scroll to the end!)

NFT Roundup

Podcast

🎙Listen to the exclusive interview with Jake Chervinsky in this week’s podcast episode:

DeFi Explainers

Elsewhere

Arbitrum Nitro Launch with Steven Goldfeder & Harry Kalodner: Bankless

District of Columbia Suing MicroStrategy Founder Michael Saylor for Tax Fraud: CoinDesk

Crypto Lawyer Kyle Roche Pulls Out of Lawsuits Against Tether, Binance and Others: Decrypt

Trending in The Defiant

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Nexo’s fundamentals-first model helps you secure your assets and grow your wealth. The company now provides an increased insurance on custodial assets of $775 million. Learn More!

Zetachain is the first public L1 blockchain that natively connects with any chain and layer including Bitcoin and Dogecoin without wrapping or bridging assets. Dive into the docs to start building the future of multichain.

Bring your NFT product to market in hours with NFTPort's APIs. Mint NFTs as scale, deploy fully owned contracts & access high quality NFT data - all with simple REST APIs every developer knows. It's time to build.

Join Klaytn’s global flagship hackathon and hack your way to over US$1 million in prizes, grant funding, and incubation opportunities. Register now

DeFi Lending

🥶 Compound ETH Market Frozen Due to Upgrade Bug

Withdrawals and Liquidations in cETH Will Remain Frozen For A Week

FREEZING Despite three separate audits, an update to crypto lending protocol Compound contained a software bug, freezing the protocol’s $800M Ether market when it took effect Tuesday.

TVL Compound’s ether market, cETH, is its second-largest, after its market for dollar-pegged stablecoin USD Coin (USDC). Compound is the ninth-largest DeFi protocol with $2.68B in total value locked (TVL), according to The Defiant Terminal.

SOLUTION Withdrawals and liquidations in cETH will remain frozen for about a week, while the proposed solution – to undo the problematic upgrade – makes its way through Compound’s rigid governance process. Deposits remain unaffected, according to the protocol.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Bitcoin Market Action

📉 Bitcoin Dominance Drops Under 40% For The First Time Since January

ETH Miner Balances At All-Time Highs Ahead Of The Merge

By Owen Fernau

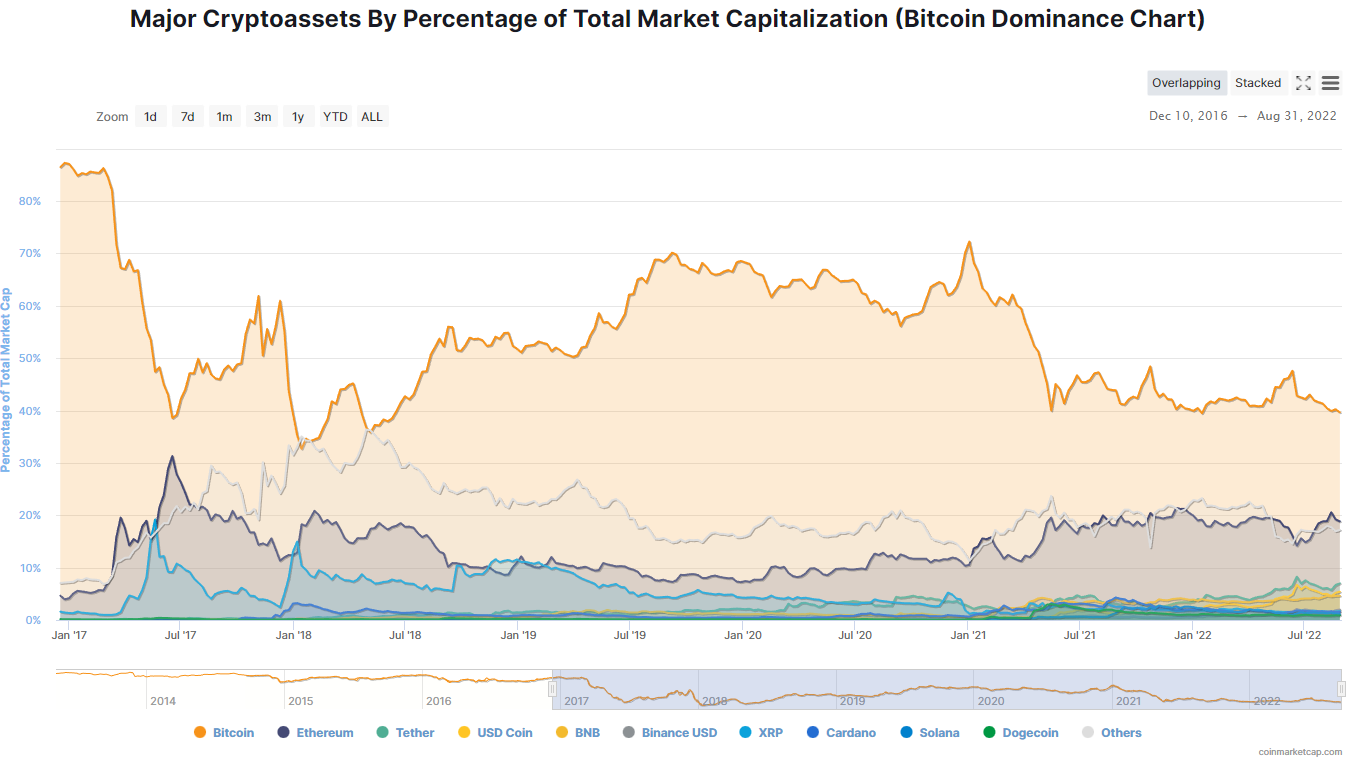

FALLEN Bitcoin dominance (BTC.D), which is the market capitalization of BTC relative to that of all digital assets, has fallen below 40% for just the second time since 2018 and stands at an eight-month low, according to data from CoinMarketCap.

CONTRAST The move stands in contrast to the last crypto bear market which kicked off in 2018 and saw BTC.D rise throughout the carnage to above 70% in September 2019 as alternative crypto assets collapsed in price.

FORCE Perhaps predictably, Ether has emerged as a primary force driving BTC.D close to all-time lows. ETH dominance (ETH.D) stands at 20% as of Aug. 30 after crawling upwards from a low of below 8% during the last quarter of 2019.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

🚀 Build your NFT app in hours instead of months

Ever wanted to deploy your own contracts or build NFT products and apps without having to learn the complex Web3 stack?

NFTPort lets you do exactly that with simple-to-use APIs and SDKs built for developers. NFTPort takes care of all the complicated NFT infrastructure so you can build your NFT project in just a few hours instead of months.

The APIs cover everything you need for NFT development:

Mint NFTs at scale and easily integrate them with your existing product

Deploy and monetize your fully owned NFT contracts

Get the highest quality NFT data (metadata, assets, ownership, transactions) from Ethereum, Polygon, and Solana (launching soon)

You can create an endless variety of innovative NFT products by combining these building blocks from NFTPort. Launch NFT collections, build your own dd NFT user portfolios to your existing app, etc.

Excited to build your NFT app? Grab your free API key

NFT Roundup

🌜 Moonbirds Fly High On $50M Round and New Collections

Proof Collective Bags a16z Cash and Phantom Offer Scam Roils NFT Market

By yyctrader

NEWS Institutional investors continue to place bullish bets on NFTs despite the current bear market in digital assets.

FUNDING Proof Collective, the company behind the popular Moonbirds collection, said on Aug. 30 that it had raised $50M in a Series A funding round led by venture capital behemoth a16z. Other investors include Seven Seven Six, True Ventures, and Collab+Currency.

GAMES The news came just a day after Limit Break revealed that it had raised an eye-popping $200M to build Web3 games. The company’s DigiDaigaku NFT collection commands a floor price of 12.3 ETH ($19,000) at the time of writing.

COLLECTION In a livestream on Tuesday, Proof CEO Kevin Rose outlined the company’s plans, which include a third NFT collection of 20,000 profile pictures (PFPs), called Moonbird Mythics, and a $PROOF token. Both are expected to launch in 2023.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Explainers

🧐 What is The Merge?

A Step-by-Step Guide to Ethereum’s Historic Upgrade

STAKING In 2014, Ethereum launched Beacon Chain, a Proof-of-Stake (PoS) network that differed from the original. Up until that time, Ethereum has used the same type of consensus mechanism to maintain its blockchain as Bitcoin — Proof-of-Work. Beacon introduced a new way to add blocks of data to the chain — staking.

MINERS From Sept. 15 to 16 2022, Ethereum will become a PoS network when Beacon merges with its mainnet. The move will ditch miners and computational work in favor of economic staking and validators. Here’s a primer explaining what this means for decentralized finance:

NEXT MOVE While Bitcoin legitimized the concept of peer-to-peer (P2P) digital money, it was Ethereum that spearheaded the blockchain’s next move — smart contracts that deploy decentralized applications (dApps). Bitcoin accounts for about 40% of the total market capitalization in crypto. Ethereum broadened smart contracts for many uses — borrowing, lending, predictive markets, NFT marketplaces, exchanges, gaming, governance, wallets, storage, and even gambling.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Explainers

🧹 What Is a Sweep-the-Floor NFT Trading Strategy?

Understanding a Key Investing Practice in Nonfungible Tokens

RISKIER As speculative assets go, NFTs are at the riskier end of the spectrum. And they’ve fetched astonishing sums in the marketplace. From Yuga Labs’ Bored Ape Yacht Club to Chiru Labs’ Azuki, a dozen NFT collections recorded $400M in total sales. Even after May’s market crash in 2022, the floor price of top collections remained at around 70 ETH.

STRATEGY New traders are searching for the next hit collection. This is where the “sweep the floor” NFT trading strategy comes into play.

TRACTION The floor price is the fundamental metric in the NFT market. The NFT market behaves much like the commodities market, with one big difference: the former is decentralized. The price determination in the NFT market is organic. As the project gains public traction, more people rush to buy items from an NFT collection, typically composed of 10,000 NFTs. And the more they buy, the more the minimum price rises.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Elsewhere

🔗 Arbitrum Nitro Launch with Steven Goldfeder & Harry Kalodner: Bankless

On today's episode, we welcome back Steven Goldfeder and Harry Kalodner for their second appearance on Bankless. Both times for huge Arbitrum launches!

🔗 District of Columbia Suing MicroStrategy Founder Michael Saylor for Tax Fraud: CoinDesk

The District of Columbia is suing MicroStrategy (MSTR) founder and Executive Chairman Michael Saylor for allegedly never paying any income taxes in the district in the more than 10 years he has lived there, Attorney General Karl A. Racine announced in a tweet on Wednesday.

🔗 Crypto Lawyer Kyle Roche Pulls Out of Lawsuits Against Tether, Binance and Others: Decrypt

High-profile crypto attorney Kyle Roche has withdrawn from several class action suits against Binance and other major crypto companies, just days after the release of leaked videos in which he discussed his relationships with crypto clients over drinks.

Trending in The Defiant

Christensen Calls For MakerDAO to Float Stablecoin In what would mark a dramatic strategic reversal, Rune Christensen, the founder of MakerDAO, is calling for the DeFi stalwart to reduce its exposure to real-world assets and freely float the value of its stablecoin, DAI, against the dollar.

SushiSwap Members Rejoice as Whale Bails from Token Arca, a crypto-focused asset manager, appears to have sold its $3.1M position in SushiSwap’s token. And many of the crypto exchange’s community members couldn’t be happier.

Why The Merge Might Fail Yes, hard as it is to believe, after all the setbacks, breakthroughs, delays, two steps forward, one step back…

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Aleksandar Gilbert, Samuel Haig, and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

Free subscribers to the newsletter get:

Daily news briefings

Sunday Weekly recap

General chat on The Defiant’s Discord server

👑Prime defiers get:

Full transcript of exclusive podcast interviews

DeFi Alpha weekly newsletter on how to put your money to work in DeFi by yyctrader and DeFi Dad

Weekly live DeFi Alpha call with yyctrader

Inbox Dump edition of The Defiant newsletter every Saturday with all the PR that didn’t make it to our content channels

Exclusive community calls with the team

Subscriber-only chats on The Defiant Discord server

Full access to The Defiant’s content archive

Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

You can start a prime membership for free right now with this link. You’ll get full access for 7 days. It’s 100% risk-free.

Defiant Premier for Paid Subscribers

🌋 Mt. Gox Trustee Repayment Announcement Triggers Fear in Bitcoin Market

Outstanding Claims by Ripped Off Customers Worth $2.8B

By Samuel Haig

FLOOD Is Mt. Gox, the notorious exchange that crashed spectacularly in 2014, about to rise from the dead and flood the market with Bitcoin? Or is an arcane legal document that surfaced on Wednesday being widely misunderstood?

RUMORS Those are the questions roiling crypto after the announcement was published to Mt. Gox’s moribund website on Aug. 31. Straight away, rumors flew that Mt. Gox was poised to release $2.8B worth of BTC it held n mid-September.

To read the full story subscribe to The Defiant newsletter.

Keep reading with a 7-day free trial

Subscribe to WE'VE MOVED TO thedefiant.io to keep reading this post and get 7 days of free access to the full post archives.