Can DeFi Compete With Banks if Rates Keep Dropping?

The answer is yes :) Also, ETH locked in MakerDAO climbs after rate cut, and dYdX loan liquidators are making a killing

Hello defiers! This is what’s going on in DeFi,

Dai borrowers taking their ETH to MakerDAO after rate cut

This is how DeFi can compete with fintech as rates keep sliding

dYdX loan liquidators made $400,000 of profit in one month

If you’re getting this, that means you’re on the free signups list, where you get partial access to the content. Remember the beta period, where early supporters get a discounted subscription, ends in four weeks!

MakerDAO is Eating Up All the ETH!

Okay, obviously not, but borrowers are increasingly pulling ether from other platforms and putting it as collateral on MakerDAO instead.

That’s a result from last week’s stability fee cut to 5.5 percent from as high as 20.5 percent in July. The 5.5 percent rate to borrow Dai, using 150 percent of ETH as collateral, on MakerDAO compares with rates of 9.9 percent on Compound Finance and 6.9 percent on dYdX, according to LoanScan.

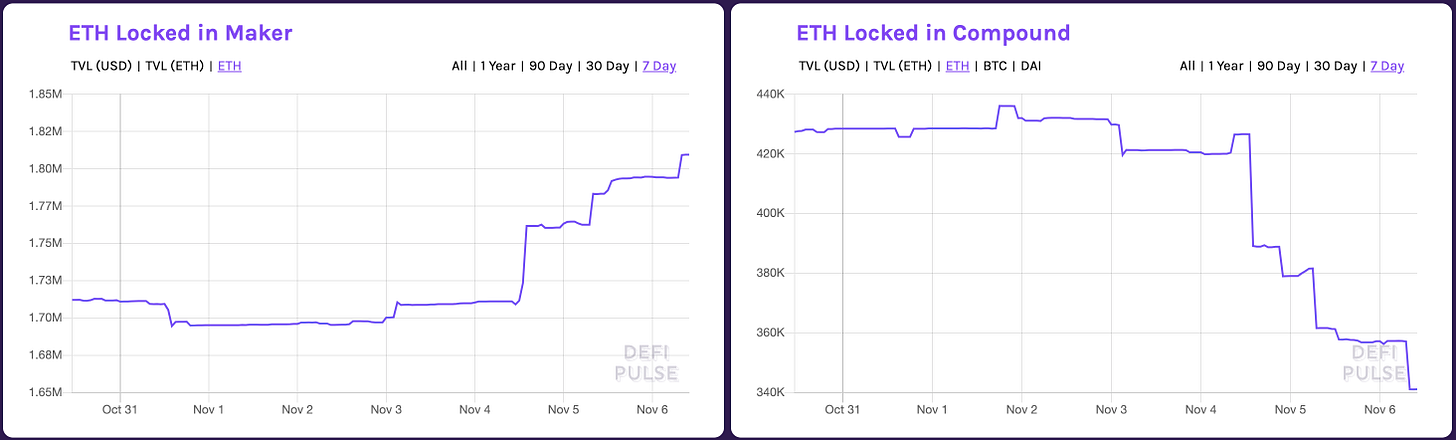

That difference is causing ETH locked in Compound and dYdX to drop almost 20 percent and 5 percent this week, respectively, while ETH locked in MakerDAO contracts rose 6 percent, according to DeFi Pulse.

Image source: DeFi Pulse

Another consequence of cheaper borrowing costs is that Dai supply is now at a record high of almost 98 million.

Interesting to note that while ETH locked in Compound and dYdX is sliding, other assets, like Dai and BTC, are rising. That means users are still going to these platforms to deposit their assets, just not ETH as much.

But it’s only a matter of time until interest rates converge. Dai borrowing rates on Compound and dYdX are already sliding. Also, increasing Dai supply may start to push the price lower, in which case, a rate hike will be in order.

What Happens to DeFi Value Prop When Rates Drop?

The sliding interest rates in decentralized finance are a result of increasing liquidity. If DeFi continues to grow, borrowing and lending rates should tend to slide.

This year, the big selling point of DeFi has been: Earn double-digit interest on a dollar-linked asset, no matter where you are. That’s compelling to both developed-world users with near-zero returns on their savings accounts, and developing-world users with devaluing currencies and restricted access to dollars.

So what happens when DeFi can’t offer double-digit returns any more?

It’s been surprising to see how far rates have already slid. Lending rates for Dai have halved from over 10 percent in July to around 4 percent now. That’s still more than double what fintech apps like Betterment and SoFi are offering on dollar deposits, but the risk of holding Dai in DeFi is at least that much higher.

Image source: LoanScan

The answer to that question has two parts. The first is that DeFi rates will probably be at least marginally higher than those in traditional finance for a years to come, to reflect the higher risk of these platforms.

The second is that DeFi will have to compete on offering users both an experience and functionality that traditional finance just can’t. Being able to interact with an app without having to hand out a shred of personal information, accessing any type of securities regardless of your location or wealth, automating complicated investment strategies, earning interest or even your salary in real time.

Doing all this and more with minimum friction and cost, and being able to dig into the apps’ code and make a new one if you don’t like how it’s working.

Traditional banking apps will start to feel clunky, limiting, and hard to use. And that’s what will keep people coming back to DeFi. Marginally higher rates will be the cherry on top.

Traders Made $400,000 in One Month on dYdX

Sign up to get the best and only daily newsletter focusing on decentralized finance news, complete with analysis, exclusive interviews, scoops, and a weekly recap. Those who become paying subscribers in the current 60-day beta period which started Oct. 1 get an early supporter discount :)

About the author: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.