Blueprint for Economic Jailbreak in Zimbabwe Using Dai

Also, Dai vs. Sai, DappRadar report, first ZK-Rollup exchange

Good morning defiers! Here’s what’s going on in DeFi:

Project to bring Dai to Zimbabwe gets at the core of crypto

Dai rates surpass Sai

Ethereum is undeniably the ruling smart contract platform

First exchange using ZK-Rollup scaling technology launches

And, don’t forget to tune in to:

🎄Also: The Defiant holiday schedule:

This week: There will be no newsletter on the 25th, 26th, but will be back on the 27th with my Year in DeFi review.

Next week: No Defiant except for a recap on Sunday. This will be the first time since I started the newsletter in June that I take a full break. I’ll be back fully recharged after a family trip on Jan. 5!

Dives

Zimbabwe Needs Dai, and Crypto Needs This to Work

A project aiming to do what crypto should do best, yet hasn’t come close to — offering a viable alternative to those in oppressive banking regimes— landed on Reddit yesterday.

Team Toast, the developers of crypto-to-fiat onramp DAIHard, wants to help Zimbabweans buy and transfer Dai. It seems simple, but the 19 page whitepaper makes it clear how far cryptocurrency infrastructure still is from helping those who need it most.

Zimbabweans are dealing with inflation, withdrawals limits of about $20 per week, banks simply running out of cash, and a ban on buying foreign currency. Some turn to buying dollars in the black market , which is cumbersome and risky. While there’s some bitcoin trading even after authorities shut down the only local exchange last year, Dai would be better suited for Zimbabweans who want to protect their savings and make transfers to and from the country.

But there are many roadblocks for Zimbabweans to actually get their hands on Dai, which are the same those in many developing nations face:

Lack of local crypto exchanges allowing fiat-to-crypto on-ramp

Difficult user interface of decentralized fiat-to-crypto exchanges

Weak internet connection

Even if users overcome the UX and internet roadblocks in decentralized on-ramps like Bisq and DAIHard, they will find there is low liquidity of their local currency in the exchange

The project, called ZimDai, proposes having a group of people on the ground who are familiar with crypto, can buy Dai and transfer it in and out of the country. These agents would take a small fee for the transaction, which would be far less than the steep rates charged by local banks and mobile apps.

Because there’s very little Dai liquidity, ZimDai agents would use the relatively more active bitcoin market to cash out their Dai. This would have the added benefit of reducing the 5-10 percent premium in BTC trading.

ZimDai is far from the sophisticated, smart-contract-driven solutions often seen in the Ethereum ecosystem, and agents are far from the decentralized ideals many dapps strive to reach, —they are actual intermediaries!— but they may come closer to the people cryptocurrencies should be helping the most. The project is focusing on what’s practical and actually doable right now. If this solution works, it could be implemented in the many other nations with similar onboarding issues.

The next step would be to fund a decentralized autonomous organization to get the agent training and marketing effort started.

Decentralized finance so far has evolved with the premise that these solutions will eventually be used by those in oppressive regimes and devaluing currencies, once A, B or C issues are solved. Team Toast is starting from the end user and working their way back to figure out the fastest way to get to them. This time, maybe decentralization and more cutting-edge tech can come second.

Sums

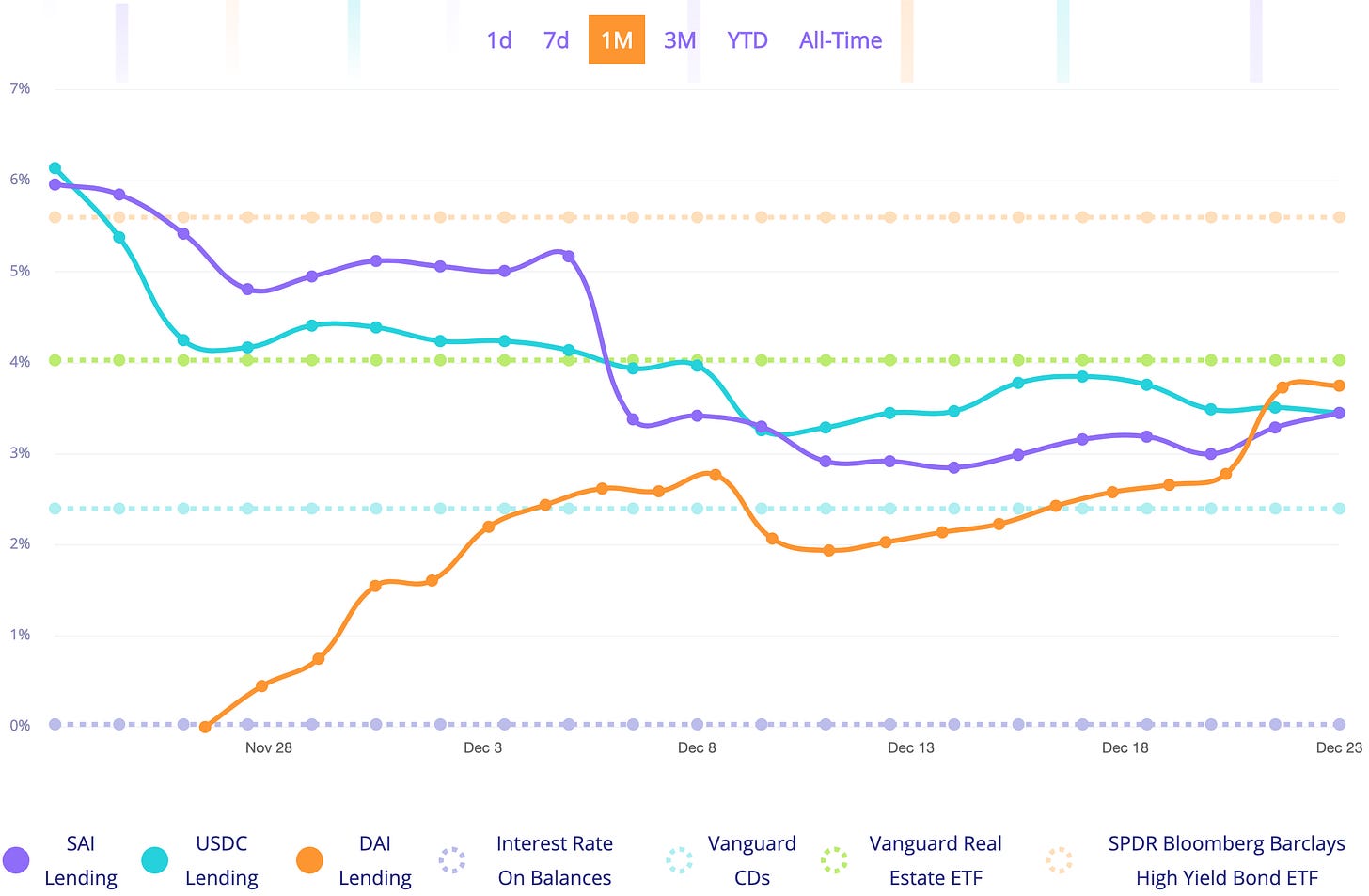

Dai Now Gets You a Better Return Than Sai

The Dai lending rate overtook Sai’s over the weekend.

MakerDAO’s Dai now yields 3.75 percent of interest, compared with the platform’s Sai rate at 3.45 percent.

Image source: defiprime.com

💡Reminder that: Dai is backed by different types of collateral and is the stablecoin implemented by MakerDAO last month to enable the platform to scale and bring more stability to the system. Sai is the stablecoin which was used in the previous Maker system, and uses only ETH as collateral.

The higher-yielding Dai should accelerate the switch from Sai and make the current Maker stablecoin the undisputed ruler of DeFi.

Ethereum is the Ruling Smart Contract Platform

Ethereum remains the most significant smart contract blockchain, and decentralized finance had the most explosive growth out of all dapps categories this year, according to a DappRadar report.

Daily active unique wallets across the Ethereum dapp ecosystem rose 118 percent to over 19,000, while daily value in terms of US dollars up 166 percent at well over $10 billion. So-called “Ethereum Killers” Tron and EOS struggled to grow their user base and value captured by their dapps, the Dec. 18 report said.

Gaming was the biggest contributor to dapp activity, while DeFi had the biggest increase:

Games and Marketplaces: 50% of activity, up 195%

Gambling and High-Risk: 22% of activity, up 78%

Exchanges: 20% of activity, rising 26%

DeFi: 6% of daily activity, rising 529%

DeFi also had the biggest increase in terms of value transacted, and was only marginally beat by exchanges in terms of biggest contributor to overall volume. While gaming accounted for most daily activity, it had the smallest impact in terms of value:

Exchanges: 50% of total value, down 40%

DeFi: 45% of total value, up almost 1,990%

Gambling and High-Risk: 3% of total value, down 71%

Games and Marketplaces: less than 1% of total value, up 87%

To be sure, DeFi is far from mainstream and still has a tiny user base: DeFi dapps exceeded 1,000 users only on two days in 2019 — Nov. 18 and 19, when MakerDAO upgraded to its new multi-collateral contract. MakerDAO averaged around 250 daily uniques, Compound around 400 and dYdX around 175.

New Scaling Tech for Decentralized Exchanges Goes Live

WeDEX_io, the first DEX built on the Loopring v3 protocol and using ZK-Rollup scaling technology, is live on mainnet, though only for a reduced number of beta users.

WeDEX processed 24,461 trades and 2,301 ETH in volume, compared with Uniswap’s 2,517 and 0x’s 3,471. While not apples to apples as WeDEX incentivizing beta with rewards, “it nonetheless shows what's possible w/ ZK! To our knowledge, this is the first working DEX on Ethereum mainnet scaled with zkRollup,” a Loopring tweet said.

Tweet of the Day: Controversial ETH2 Thread

This thread claiming Ethereum 2.0 shouldn’t try to be a continuation of the current Ethereum chain, because ETH1 already found a product-market-fit with DeFi, and by the time ETH2 launches, it will be too difficult to migrate all the activity and dapps to the new chain. It ruffled some feathers. Judge for yourself:

Chart of the Day: DeFi Goes Parabolic on Google Trends

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.

Click here to pay with DAI.There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the author: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.