Blue Kirby Signs Off as Anon Coins Sink

This video game-based character is making traders question DeFi's latest trend. Also, Uniswap's first governance vote, RAC breaking records.

Hello Defiers! here’s what’s going on in decentralized finance,

The fallout from Blue Kirby drama (and everything you need to know in case you have no idea who Blue Kirby is)

Uniswap’s community-led governance system has officially started

RAC breaks digital marketplace SuperRare records

and more :)

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI.

📺 Watch the latest video on The Defiant’s YouTube Channel:

🎙Listen to this week’s podcast episode with Simon Taylor of 11:FS:

🙌 Together with Zerion, a simple interface to access and use decentralized finance, Perpetual Protocol, which provides decentralized perpetual contracts for any asset, and HackAtom V, a two-week virtual hackathon organized by Cosmos.

Blue Kirby Sign Off Stains Anon DeFi Projects

Here’s the fable of Blue Kirby, the anonymous, video-game based character, who rode the explosive rise of the most popular DeFi token to the top and crashed back to earth along with it.

Blue Kirby’s Twitter account emerged in the space at the end of July, right as Yearn Finance was gaining traction from its ground-breaking 100% community-owned, supposedly “valueless,” governance token. YFI turned out to be anything but valueless and quickly soared to as high as ~$42k. Blue Kirby positioned itself at the center of the YFI boom, producing educational material, churning out bullish tweets, and meme-ing itself to crypto Twitter fame.

But the DeFi hype man got too, big too fast.

Off Blue Emerges

The once-beloved character’s downfall sucked up the industry’s attention this weekend as his latest endeavor Off Blue, a decentralized auction house with its own governance token called BLUE, which raised nearly 2,500 ETH by selling NFTs. Sales earned it the top slot on Rarible’s sellers’ list by many times over.

Spurring those sales, was that the project’s manifesto said NFT holders were eligible for BLUE airdrops or to stake tokens and receive governance weight plus future issuance.

Red Flags

The rate at which NFTs were being sold quickly raised red flags, leaving many to wonder what was being done with the funds that were loosely allocated to different buckets, and question whether Blue Kirby was simply keeping it all.

Amid rising concern about the use of funds from NFT sales, Rarible suspended the Off Blue account and the team behind the project created a refund portal to honor anyone who was not comfortable with the sale. That portal can be found here.

Had the crypto market not been on a downturn, the DeFi community might have not looked twice at the hundreds of thousands in digital assets being thrown at a days old project, but YFI was in free-fall and Blue Kirby’s reputation had already been tarnished.

The anonymous account had shilled Eminence, a project that was being developed by Yearn founder Andre Cronje, before it was live. Eminence got attacked causing those who had followed Kirby into the project’s smart contracts to lose their funds. In a further perceived betrayal to the community, Blue Kirby apparently sold YFI for ETH as it started to plunge from its peak —the anon character said it was to move their cash to a private account, but the damage was done.

Pressing Delete

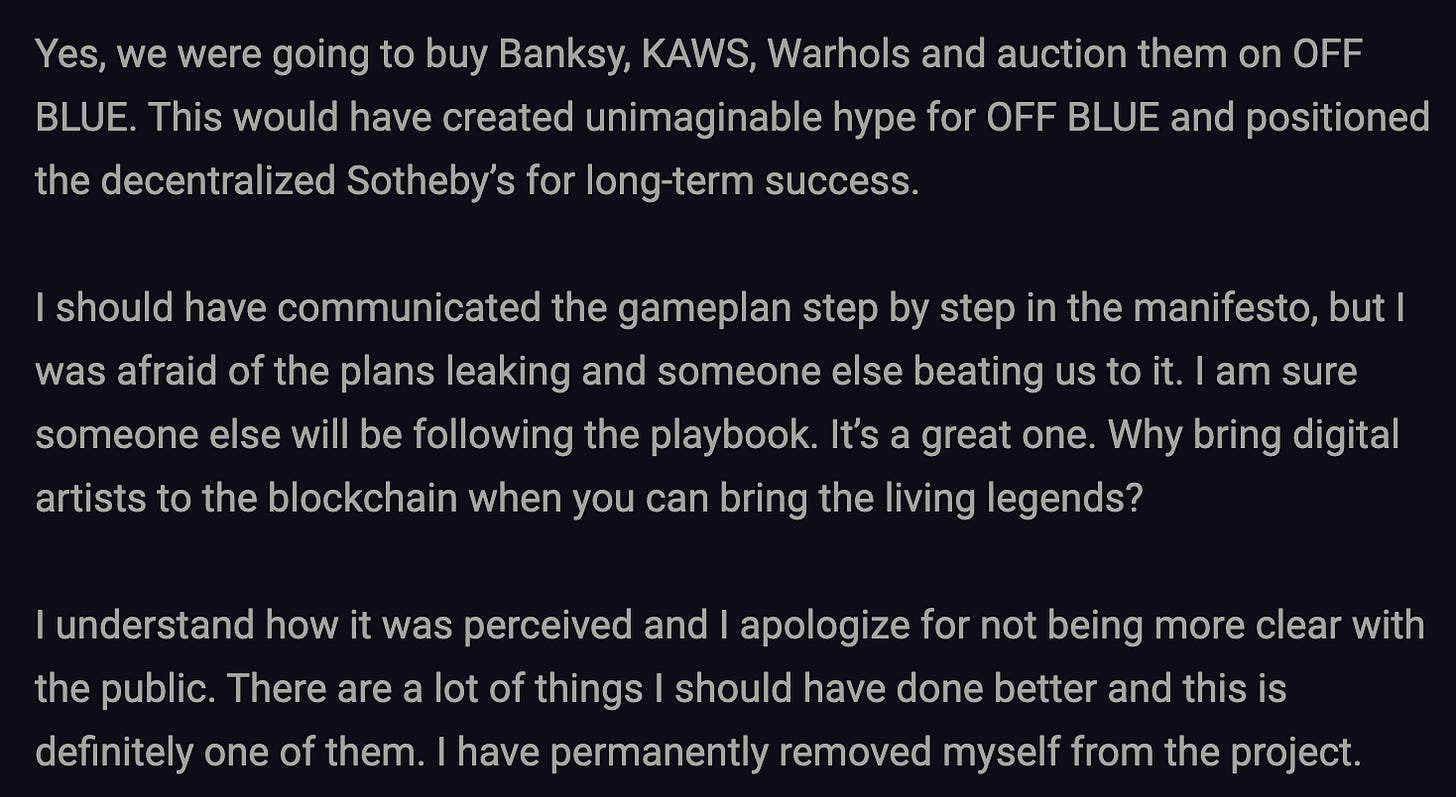

When Off Blue started to unravel, Blue Kirby deleted his 20k follower Twitter account and said he was removing himself from the Off Blue project via a post-mortem closure post. He was able to leave as quickly as he came, except with earnings from his Yearn and NFT work.

While there were many reasons behind the account’s termination, perhaps the worst was the public doxxing and threats angry members threw at the main person behind Blue Kirby.

No Reputational Damage

The fable of Blue Kirby shows that when sentiment and prices turn on anonymous founders holding a big enough stash, the lure of pressing delete without suffering reputational damage is proving to be too hard to resist.

And the market is taking note as coins backed by anonymous founders like SUSHI and SWRV are underperforming ETH and other DeFi tokens, though the bigger driver is likely that the projects were forks that didn’t add enough value relative to the original protocols, not that the founders were anonymous.

Tokens of Ethereum platforms which didn’t add massive yield farming incentives like MKR and UNI are outperforming.

Onwards Without Blue Kirby

So what happens with Off Blue now? As illustrated in the now-removed manifesto, the goal of the project is to create a decentralized Sotheby’s, leveraging Web3 primitives like token-permissioned gates to restrict auction access to those holding a predefined amount of tokens. Off Blue will continue on without Kirby.

It remains to be seen whether Off Blue can survive the fall of Blue Kirby, and whether the community is as quick as it once was to “ape” into anonymously founded projects.

Let this also serve as a reminder that the exponential growth of public profiles comes with positive and negative side effects. In this case the community saw those play out firsthand over the course of a week through the rise and fall of DeFi’s most memorable meme account to date.

Uniswap Governance Kicks Off

Uniswap’s first UNI governance proposal is now live for voting thanks to the mobile wallet Dharma.

The proposal seeks to lower the barriers to participate in governance by lowering the quorum, or the total amount of tokens needed for a vote to pass, from 4M UNI (4% of the supply) to 3M UNI (3% of the supply) and reducing the proposal threshold, or the amount of UNI needed to create a proposal, from 1M UNI (1% of the supply) to 0.3M UNI (0.3% of the supply).

The changes come prior to any onchain voting regarding UNI rewards, a signal that the governance parameters set forth by Compound should be further democratized to allow more proposals to be created and passed by the Uniswap community.

The adjusted parameters come after Yearn lowered its quorum, a sign that governance still needs to become more accessible to deal with low voter turnout and ensure that key proposals pass.

With ongoing discussions to propose that mobile wallets and aggregators like Dharma be eligible for extra UNI retroactive rewards, it’s likely that governance is about to heat up for the leading DeFi DEX responsible for over $250M in volume in the past 24 hours.

As a project leveraging Uniswap to offer permissionless DEX trading in app, Dharma is the first of many contenders for the emerging protocol politicians fighting for UNI delegation.

RAC Breaks SuperRare Primary Sale Record

Grammy-winning musician RAC set a record for the highest primary sale price on an NFT sold through SuperRare over the weekend.

The audio-video fusion, Elephant Dreams, sold at auction for 70ETH following a last minute bidding war between two avid NFT collectors and a subsequent tweetstorm from RAC himself.

The highly acclaimed NFT came with a kicker of 1000 $RAC tokens, the first of many prizes to be earned by those participating in the RAC ecosystem and his newly launched community token.

While this is the continuation of a strong commitment to Web3 for RAC, other musicians are taking note.

Festival headlining producer 3LAU sold his audio-visual rendition Star Crossed for 33ETH yesterday afternoon, giving the winner a choice of backstage tickets to any show or festival of their choosing.

The rising trend of musicians combining visual and audio experiences marks the start of a creative explosion for NFTs, just one of the many testaments to why the digital art sector has been receiving so much attention in recent weeks.

Aave Raises $25 Million to Bring DeFi to Institutions: Decrypt

Decentralized lending and borrowing protocol Aave today announced a $25 million investment from Blockchain Capital, Standard Crypto, and Blockchain.com ventures, among others, Decrypt reported.

“Aave raised funds from strategic investors to bring DeFi closer to institutional use and to expand the team size to serve the growth in Asian markets,” CEO Stani Kulechov said, adding that the new stakeholders will participate in the protocol’s governance and staking.

Grayscale’s Ethereum Trust Granted SEC Reporting Company Status: CoinDesk

Grayscale Investments’ Ethereum Trust on Monday became a Securities and Exchange Commission (SEC) reporting company, a move that increases the trust’s transparency – and potentially its liquidity too, CoinDesk reported.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

About the founder: Camila Russo is the author of The Infinite Machine, the first book on the history of Ethereum, and was previously a Bloomberg News markets reporter based in New York, Madrid and Buenos Aires. She has extensively covered crypto and finance, and now is diving into DeFi, the intersection of the two.