"Be Greedy in Private," Urges DeFi Investor Riding Fair Launch Trend

Also, Zerion's Uniswap integration, Kraken banking license, YFI cap

Hello Defiers, here’s what’s happening,

SAFE shows DeFi hunger for righteous founders can backfire

Zerion integrates with Uniswap

Kraken becomes first US regulated crypto bank

YFI holders want to cap supply at 30k

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for 70 Dai/yr vs $100/yr).

🎙Listen to this week’s podcast episode with musician RAC here:

📺 Watch New Video on The Defiant’s YouTube Channel and Subscribe

Check out the just-released video on The Defiant’s YouTube channel! The amazing story of SushiSwap. The video was produced in partnership with Robin Schmidt of Harmony Protocol.

🙌 Together with Zerion, a simple interface to access and use decentralized finance, Perpetual Protocol, which provides decentralized perpetual contracts for any asset, and HackAtom V, a two-week virtual hackathon organized by Cosmos.

SAFE Shows Toxic Undercurrent to Fair Launch Trend

In the latest DeFi drama a developer and investor behind a token called SAFE made a mistake when deploying a piece of code and now they’re both calling each other out and publishing their private chats, as the token tanks.

But this petty squabble points at a bigger problem: the latest DeFi trend of community-owned projects and fair launches has raised the bar to a level of virtuosity that most can’t or won’t reach.

Greed is good, Gordon Gekko said. But just… quietly.

Setting the Stage

Projects will do everything possible to look like they’re abiding by the new unwritten DeFi rules (no pre-mine, no VC money, 100% community-owned “valueless” token, decentralized governance). Once they’ve set the stage, they’ll look for ways to make a quick profit as soon as the project gains steam. Chef Nomi is one example with SushiSwap, Chef Insurance of SAFE is another.

YieldFarming.Insure launched with the commendable stated goal to incentivize DeFi traders to protect their investments with insurance instruments. Yield farmers who buy cover on their assets on Yearn Finance’s yinsure.finance, can stake the yNFTs tokens they get in exchange, on YieldFarming.Insure. Stakers would then receive $SAFE tokens in return.

The first three token pools added were for yNFT-ETH, yNFT-DAI and yNFT-WNXM. WNXM is insurance provider Nexus Mutual’s token.

The project had good initial traction with SAFE soaring by more than 10x to over $4k in just one day.

Raking in Millions

In the very early days of the project, Chef Insurance, who also goes by the name Alan, was approached by Azeem Ahmed, an investor who had been one of the first to farm SAFE thanks to an “accidental degen bet on NFTs,” and made “millions” by selling near the top, according to a leaked chat.

The problems started with the deployment of the fourth liquidity pool, a DAI-SAFE liquidity pool on Balancer. The pool would provide additional incentives for SAFE liquidity providers.

Chef Insurance asked Ahmed if he could help to deploy the pool by adding SAFE tokens. Ahmed, who was staking in all pools and earning SAFE, agreed, according to Chef’s and Ahmed’s leaked chats.

Rushing to Deploy

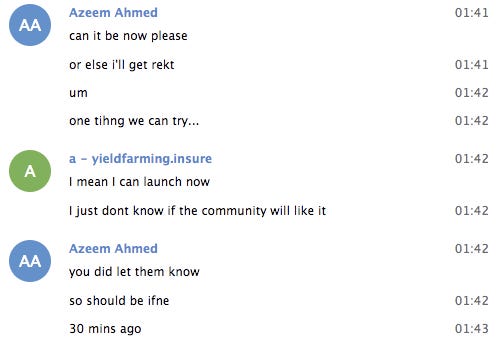

Ahmed started pushing the developer to start offering incentives for the fourth pool immediately. Ahmed’s concern was that if there were no incentives to stake SAFE, traders would “farm and dump” the token, and he’d be stuck holding SAFE in the pool. Chef Insurance was reticent as he didn’t want to blind-side other investors, but he finally agreed.

Amid the flurry of messages, Ahmed ended up opening the Balancer pool ahead of time, and in a panicked move, immediately removed the liquidity he had added. When he removed tokens, the pool locked up and left 10k SAFE inside.

Blame Game

Next, the blame game started between Ahmed and Chef, with both criticizing the other publicly and privately. The messages leaked are not a good look for either.

Beyond the pool deployment mess, it also transpired that the developer had been asking Ahmed for a $500k salary to take a gap year to develop the project, which would cover his living expenses and student debt payments.

Ahmed had agreed to this payment but was concerned that the agreement stays between them: publicly he should say he’s taking a $9k/month salary in line with what Yearn’s Andre Cronje is paid.

Be Greedy

“Be greedy privately,” Ahmed said. “You must look like a saint. Privately I’ll make sure you cash in hard.”

“Ok that’s a good idea,” the developer said.

If this expectation that open source developers and teams need to work for free, this private scheming will continue. There need to be better and transparent incentives for DeFi builders, or else they’ll either find some backhanded way to get paid market rates or go to another industry.

Zerion Integrates Uniswap for Seamless Token Trading

Zerion unveiled a new Uniswap integration, allowing users to buy and sell 170+ tokens directly from a sleek asset management dashboard.

Outside of adjusting gas prices and executing orders, Zerion’s portfolio tracks token performance and trade history in USD value, an aspect not currently displayed on Uniswap’s trade history. There will be no additional fees to trade on Zerion.

The integration marks the first of many native trading and yield farming opportunities set to make its way to Zerion, offering a trusted platform (also supported on mobile) to track holdings with native onramps to DeFi’s top yield opportunities. It’s also a sign of DeFi portfolio managers’ efforts to start to become a one-stop-shop to track and also execute investments.

As hinted in the Tweet, Uniswap is the first of many DEXs to be integrated into the platform with SushiSwap and Matcha being next on the docket.

Kraken Wins Bank Charter Approval

The State of Wyoming approved Kraken’s application to become the world’s first Special Purpose Depository Institution (SPDI). The new banking model allows Kraken to maintain custody and transact in both fiat and digital assets.

“Kraken Financial is the first digital asset company in U.S. history to receive a bank charter recognized under federal and state law, and will be the first regulated, U.S. bank to provide comprehensive deposit-taking, custody and fiduciary services for digital assets,” the release said.

The entity, tentatively called Kraken Financial, will enable clients to bank seamlessly between digital assets and national currencies, including paying bills and receiving salaries in crypto, as well as incorporate digital assets into investment and trading portfolios.

YFI Holders Vote to Make Sure No More Tokens Are Minted

Almost 92% of poll participants want to eliminate Yearn Finance’s ability to issue more of its YFI governance token so that total supply is capped at the current 30k.

“Burn the timelock on the YFI token so that no minting can ever take place again,” the proposal says.

The proposal could become the first governance decision that’s enforced when Yearn’s on-chain governance is deployed in the next two weeks, pending audits.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

About the founder: I’m Camila Russo, author of The Infinite Machine, the first book on the history of Ethereum. I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.