Basis Cash Revives Algorithmic Stablecoin With DeFi-Summer-Like Yields

Also, Rari Capital migrating to Melon, SuperRare introduces permissionless auctions.

Hello Defiers! here’s what’s happening today in DeFi,

Basis Cash is reviving shuttered algorithmic stablecoin project with DeFi-summer-like yields

Rari Capital is migrating to Melon Protocol

SuperRare introduces permissionless auctions

💗 You Can Contribute to The Defiant’s Gitcoin Grant Here: Huge thanks to the 75 contributors so far. Your support for DeFi-focused journalism makes a difference.

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($10/mo, $100/yr).

📺 Be ready to get your mind blown by the latest Defiant video on Pickle

The Defiant’s video mastermind Robin Schmidt already did the first DeFi ballad. You’ll have to see the first-ever DeFi rap, ft. Simon Wan and Cooper Turley.

🎙Listen to this week’s podcast episode with Gnosis’ Stefan George:

🙌 Together with Zerion, a simple interface to access and use decentralized finance, 1inch.exchange v2, which aims to provide the best rates by discovering the most efficient swapping routes across all leading DEXes, and DeversiFi's Nectar Beehive V1, which allows traders to provide liquidity & earn Nectar ($NEC) tokens.

Basis Revives Algorithmic Stablecoin With 10,000% Yields

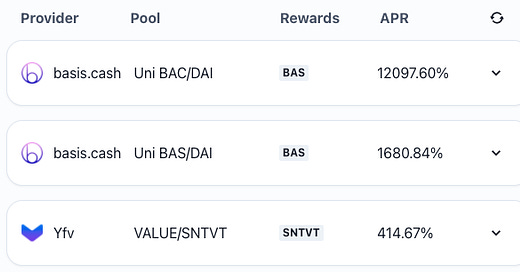

Basis Cash, a fork of shuttered algorithmic cryptocurrency Basis, is touting DeFi-summer-like APYs as the newly launched stablecoin - BAC - trades at $57 despite targeting a $1 peg.

With ~10,000% APYs on the BAC stablecoin liquidity pools, DeFi traders rushed to provide liquidity to the project which seeks to revive Basis without the SEC, VCs, or Bullshit, the anonymous founders wrote in the project’s Twitter bio. Peaking at nearly $200M in TVL, liquidity has since dropped to $2.5M according to DeFi Llama.

What is Basis?

Basis.io, the original project, launched “with the ambitious goal of creating a better monetary system: one that would be resistant to hyperinflation, free from centralized control, and more stable and robust than the monetary systems that came before it.”

Despite raising $133M the project closed its doors, citing US securities laws and transfer restrictions as major blockers to execute on their vision. Basis returned all capital to investors before shutting down in December of 2018.

Enter Basis Cash

Now, Basis is seeing a second life on the back of a completely anonymous team, presenting an MVP stablecoin called Basis Cash (BAC) and a governance token called Basis Shares (BAS). To maintain its peg, a third token called Basis Bonds (BAB) is issued whenever the price of BAC drops below a dollar. Users can claim BAB’s should BAC trade below a dollar, and redeem them when BAC trades above a dollar. In its current form, users are incentivized to sell BAC down to its target peg of $1.

However, the hype around the fair launch instead led BAC to trade at above $900 on Nov. 30 the day of the launch, before quickly plunging and hovering between $80 and $150 since, according to TradingView.

While things cooled off, farmers have been riding home with profits reminiscent of the early days of SUSHI and YAM.

Now, Basis is gearing up for the launch of its governance ‘Boardroom’ this Friday, using BAS earned from staking LP tokens for voting. There are two active proposals live on the project’s Github. Basis Cash shows that a 2017 project with $130M in funding that was unable to overcome legal risk, can now roam free in the land of DeFi - at least for now.

While it’s unclear whether the experiment will amount to anything meaningful, the excitement shows that the days of 10,000% yields are far from over for those willing to take on unprecedented amounts of risk. Stay safe out there!

Rari Capital Plans to Run DeFi Robo-Advisor on Melon

Rari Capital is planning to migrate its $57M of assets to Melon Protocol following the release of Melon v2 (to be rebranded as Enzyme Finance).

The DeFi robo advisor will leverage Melon infrastructure to continue building its automated investment strategies. 1,500 MLN will be distributed across all RGT token holders, and 50,000 RGT will be distributed across all MLN token holders.

SuperRare Introduces Permissionless Auctions

SuperRare, a marketplace for digital assets, is introducing an automated auction system built on Ethereum.

The system will initially support two styles of auctions: Scheduled auctions, which lets artists program artwork sales ahead of time, and Reserve auctions, where artists can set a reserve price that triggers a scheduled timed auction.

France is on the verge of imposing mandatory KYC rules for all crypto transactions, industry sources say: The Block

The French Finance Ministry is preparing to not only harden know-your-customer (KYC) rules for crypto firms but also regulate crypto-to-crypto transactions, according to Simon Polrot, president of French crypto association ADAN, The Block reported.

Fidelity Digital to Hold Bitcoin as Collateral for Cash Loans: Bloomberg

Fidelity Digital Assets will allow its institutional customers to pledge Bitcoin as collateral against cash loans in a partnership with blockchain startup BlockFi, Bloomberg reported. The target is Bitcoin investors who want to turn their digital stash into cash without selling, and potential customers include hedge funds, crypto miners and over-the-counter trading desks, Jessop said.

Coinbase-Backed Bitso Raises $62M to Expand Crypto Footprint in Brazil: CoinDesk

Latin American crypto exchange Bitso has raised a whopping $62 million funding round, the largest in the region for a digital asset firm, CoinDesk reported. Mexico City-based Bitso’s Series B also heralded the first investment in crypto by renowned fintech VC firms QED Investors and Kaszek Ventures, which led the fundraise. Also involved in the round were existing shareholders Coinbase and Pantera Capital.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($10/mo, $100/yr).

About the founder and editor: Camila Russo is the author of The Infinite Machine, the first book on the history of Ethereum, and was previously a Bloomberg News markets reporter based in New York, Madrid and Buenos Aires. She has extensively covered crypto and finance, and now is diving into DeFi, the intersection of the two.