Bancor Pledges to Fix AMMs Biggest Downfall as LPs Earn +300% Returns

Also, YFI's many flavors, BAL holders vote, $ALEX mining

Hello Defiers! Here’s what’s going on in decentralized finance:

Bancor’s V2 upgrade claims to fix AMMs biggest downfall

YFI’s many flavors

Balancer governance hitting its stride

Liquidity incentives for personal tokens

and more :)

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for 70 Dai/yr vs $100/yr).

🎙Listen to this week’s podcast episode with Olaf Carlson-Wee here:

🙌 Together with DeversiFi, a professional-grade, self-custodial exchange.

Bancor Shakes AMM Fees Up With V2 Pools

Bancor’s V2 launch is off to a strong start with its first pool, BNT/LINK, reaching its $500k cap within 48 hours.

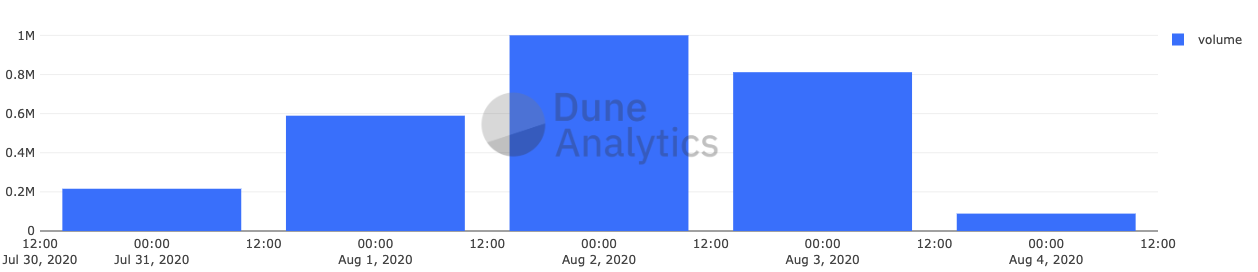

Bancor prides itself on being able to amplify liquidity by 20x so that a $1M V2 pool is said to act like a $20M pool in terms of slippage. This propelled volume on the LINK pool to climb to $1M in 24h on Sunday, giving the token the most competitive rate on the market, even before it was integrated with DEX aggregators like 1inch.

For liquidity providers, the first pool is offering 366% APR in trading fees- all without any liquidity mining schemas in place.

How Does it Work?

By segmenting liquidity through a dynamic design based on automated market makers (AMMs), traders can enter pools with single-sided liquidity, meaning they can just deposit one of the tokens in a pool, while on Uniswap LPs need to provide 50/50 of each. Bancor V2 aims to attract more volume with less liquidity by using more flexible bonding curves, or the formulas used to calculate token pricing in many AMMs.

Backed by automated rebalances, V2 shifts pool weights according to market demand, ensuring LPs benefit from little to no impermanent loss even as token price increases. This design provides low-slippage across most assets, even volatile ERC20 tokens like LINK.

Optimized Trading Fees

While DEXs like Uniswap are positioned as being favorable to LP’s through its 0.3% trading fees, it’s become increasingly obvious that the impermanent loss incurred from a 50/50 token pair drastically outweighs the fees collected from pool swaps.

Now, Bancor V2’s design challenges this thesis by boasting triple-digit APR’s solely on trading fees and the lack of impermanent loss.

“We’ve only scratched the surface of what’s possible with AMMs” Head of Growth Nate Hindman told The Defiant “The volume generated by this first LINK pool is incredibly exciting as we prepare to deploy the next pools with gradually raised and ultimately removed caps.”

Next, Bancor is set to roll out V2 pools for LEND, REN, renBTC and SNX - all of which will feature a $500k liquidity cap while the upgrade is in beta. This comes in lieu of a BancorDAO which will offer BNT staking in a few weeks’ time.

Contention

Bancor is no stranger to contention, enduring constant criticism after its $153M 2017 ICO. The token sale drama is behind it, but it still got some flak for its upgrade, with Uniswap developers suggesting Bancor had copied their interface code. Bancor’s Hindman denied they had “forked” the code, while admitting they had been “inspired” by their design.

“You guys can be inspired by our formulas, smart contract code and invention of AMMs and we can be inspired by your front-end,” Hindman tweeted.

What’s DeFi without a little drama. Regardless, it’s worth keeping an eye on as new pools roll out in the coming weeks.

YFI Clones: When One Wifey Is Not Enough

The success of yEarn’s YFI token is rapidly spurring a crop of copycats, with varying degrees of legitimacy. Some of them have turned to be outright scams, others have already gone inactive, while one is being celebrated as the first successful Chinese DeFi token.

Since many DeFiprotocols are forkable and the barrier to entry for competitors is low, it wouldn’t be surprising if, as the market enters a new stage, more copycats show up to get a piece of the $4.3B of total value locked (TVL) DeFi pie.

YFII, From China With Love

yfii.finance launched the YFII token on July 26 as a fork of YFI, yEarn’s token. The fork includes the upgrade proposal YIP 8, which didn’t pass YFI’s governance. The update doubles the total supply up to 60K and adds a halving mechanism similar to Bitcoin.

The Chinese DeFi token instantly faced headwinds as part of the community went vocal about the project being a scam and Balancer decided to blacklist it. With $20M in its liquidity pools, the move raised questions about how decentralized DeFi is and whether all of the DeFi platform’s components should be fully trustless or not.

The pool was relisted and yearn.finance deployed a strategy to farm YFII using Curve’s y pool.

YYFI, First DeFi Exit Scam

YYFI was launched July 29 as yet another YFI token copycat but was quickly identified as a scam. Once the fork got enough liquidity, the owner minted 1M YYFI and started draining the Balancer Pool.

The risk of YFI creator Andre Cronje minting an unlimited number of tokens since he was the sole owner of the contract was raised within hours after its launch. But Cronje handed control to community members to protect from that risk.

YFFI, Another Scam

Other copycats, such as YFFI seemed to have been launched as a scam from the ground up. After an initial liquidity raise, the team burned a handful of tokens that had been pre-mined to drive community confidence. Later on, they began withdrawing the remaining pre-mined tokens without burning them to exit the investment. The token is down from $619 to $2.62 in four days.

C.R.E.A.M & WIFEY

Wifey.finance, which announced its WIFEY token on Monday as a “YFI clone that gives you the most,” joined forces with the C.R.E.A.M protocol for the distribution of the token —“wifey” is a play on the way some pronounce YFI. C.R.E.A.M is the first project that forked Compound’s lending protocol specifically to leverage the yield farming trend.

Here’s how WIFEY distribution works: Users stake funds to the Curve yCRV pool and receive yCRV tokens in exchange. Then they supply their yCRV to C.R.E.A.M and receive crYCRV tokens in exchange. Finally, users stake their crYCRV tokens at Pool 1 in wifey.finance and, well, get WIFEY rewards for providing liquidity.

As DeFi keeps attracting capital and yields remain attractive, more protocols are bound to get forked. The impact is already being felt across governance systems, incentive mechanisms designs, and even in the political decisions that have to be made when choosing whether a given project can leverage other Ethereum protocols to gain traction. DeFi is getting riskier, and investors must be cautious when interacting with forked protocols that promise to deliver high yields. Even the best talents in the space can get “rekd.”

Luckily, these kinds of experiments will push DeFi harder and help it evolve towards a more stable and reliable system that can gain mass adoption.

Balancer Votes to Adjust Liquidity Mining Factors

As Balancer crossed the $500M total liquidity milestone across its automated asset management platform, BAL token holders are making changes to the way governance tokens are distributed.

In the latest round of BAL-based voting, the community passed a vote to reduce the wrapFactor on soft-pegged pools from 0.7 to 0.2. In essence, pools which feature soft-pegged pairs like sETH/wETH, USDC/mUSD and renBTC/WBTC had their BAL reward allocation drastically diminished.

The thesis of promoting useful liquidity suggests soft-pegged pools take on less risk from an impermanent loss standpoint while bringing little to no volume to the platform.

While the vote originally saw some contention, the final results of 94% Yes votes goes to show BAL holders were drastically in favor of the new wrapFactor.

BAL voters also chose to include a 1.5x multiplier on BAL-based liquidity and an adjusted feeFactor to award BAL to high-fee pools, which previously were receiving little to no token incentives.

Balancer is starting to find its stride with its snapshot-based governance polls bringing about significant changes to the BAL distribution in its few weeks of being live.

Personal Token Yield Farming

With liquidity mining campaigns heating up, entrepreneur Alex Masmej is joining the movement through the advent of an $ALEX Yield Round.

Starting this Friday, LP’s who provide liquidity to the ALEX/ETH Uniswap pair over the course of the next month stand to earn a pro-rata share of 100,000 ALEX.

Citing illiquidity as a common issue for those seeking to join his ecosystem, a 2.5 ETH trade was said to incur 5% of slippage at the time of writing. Now, less than 24 hours after launch, more than $10k worth of new liquidity has entered the pool, representing a 30% increase in capital.

The launch of a liquidity mining campaign falls perfectly in line with Masmej’s tendency to spin up innovative experiments regarding his personal token - most notably a “Control My Life” governance poll in which $ALEX holders voted to have the Frenchman run 5 kilometers per day for the month of July.

“To sustain excitement around $ALEX, I keep experimenting every month or so, adapting to new market trends.” Masmej told The Defiant “Liquidity mining has always been on my mind since personal tokens are known to be particularly illiquid— so this incoming DeFi bull run felt like the right time to do it.”

While the initial program is only set to run for one month, Alex has hinted at subsequent rewards pools to follow - both for Uniswap and rising contenders like Balancer.

To learn more about the program, token holders with more than 1 $ALEX can join this permissioned chat group to discuss all things Masmej.

DeFi-Focused Derivatives Platform Hedget Raises $500K in Seed Funding: CoinDesk

According to a press release issued Monday, the round was led by FBG Capital and NGC Ventures, both Asia-based venture firms, CoinDesk reported. Hedget is a new Ethereum layer 2 solution for decentralized options trading, allowing users to buy and sell derivatives using collateral to hedge risk when holding crypto.

Coca-Cola’s bottlers are testing out DeFi on Ethereum: Decrypt

CONA Services (Coke One North America,) the tech partner of the largest Coca-Cola bottlers in the region, will establish a “Coca-Cola Bottling Harbor” to reduce technical barriers for suppliers, Decrypt reported. The project is enabled by The Baseline Protocol, a middleware solution for large companies. It enables them not only to communicate and transact privately on the Ethereum public blockchain, but also to access DeFi applications, and tokenize assets.

ETH2 Medalla testnet launched successfully!

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

Click here to pay with DAI. There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the founder: I’m Camila Russo, author of The Infinite Machine, the first book on the history of Ethereum. I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.